Specialty Food Ingredients Market Size, Share, Trends, Industry Analysis Report

By Nature (Organic, Conventional); By Type (Antioxidants, Colorants, Emulsifiers, Enzymes, Minerals, Flavors, Sweetener, Acidulants, Preservatives, Specialty Oils); By Application; By Distribution Channel; By Region – Market Forecast 2025–2034

- Published Date:Oct-2025

- Pages: 128

- Format: PDF

- Report ID: PM1088

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

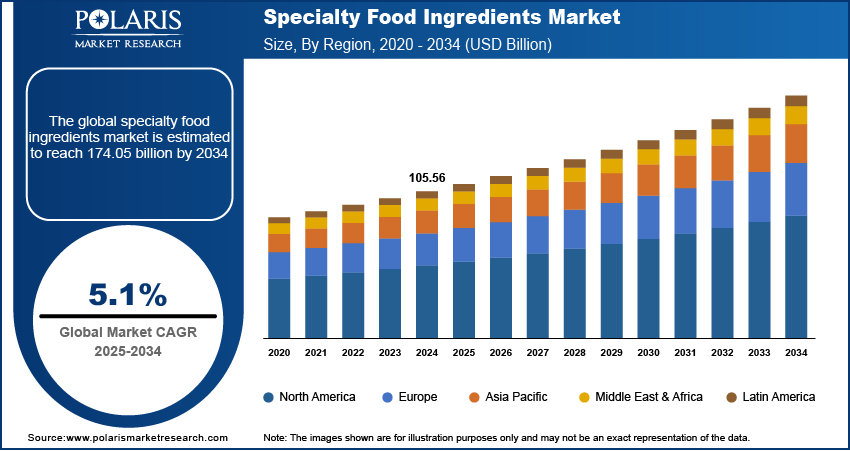

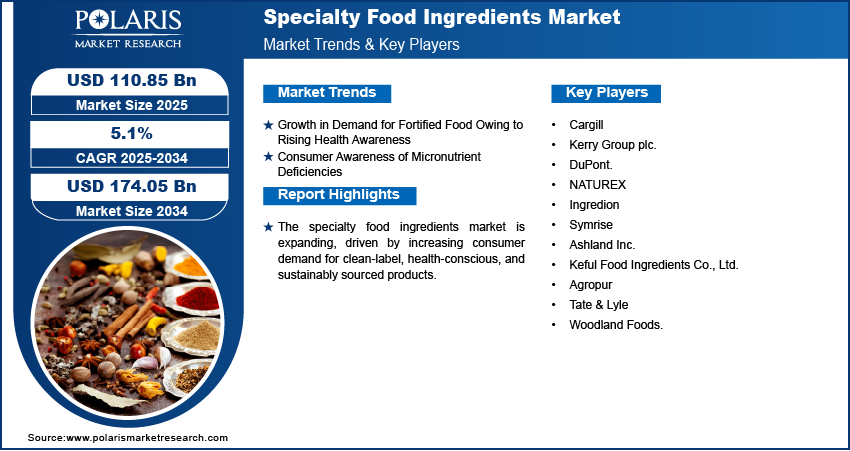

The specialty food ingredients market was valued at USD 105.56 billion in 2024; it is projected to record a CAGR of 5.1% from 2025 to 2034. Specialty food ingredients are used to refine taste, texture, visual appeal, nutritional value, or shelf life of products. The market is driven by rising demand for convenience and processed food, growing focus on health trends, and a surging preference for clean-label ingredients.

Market Insights

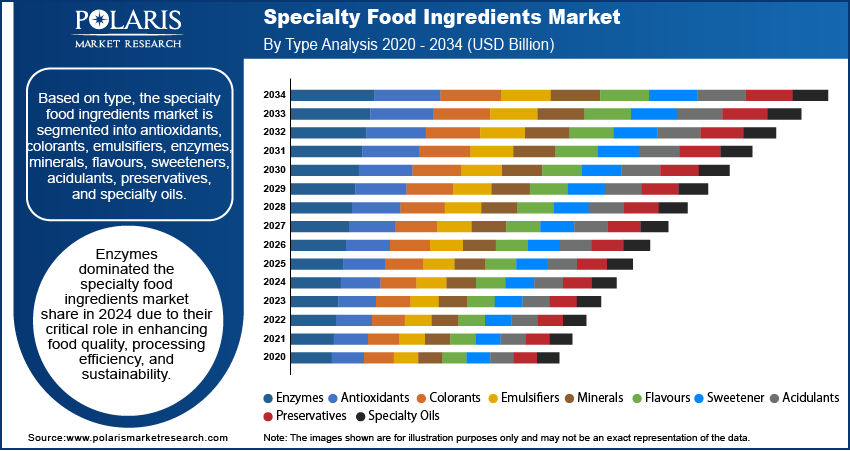

- Based on type, the enzyme segment dominated the market in 2024. Enzymes play a crucial role in enhancing food quality, improving processing efficiency, and promoting sustainability. They are also known to improve texture, extend shelf life, and reduce processing time.

- In terms of nature, the organic segment is expected to record a higher CAGR from 2025 to 2034. Segment’s growth is attributed to the rising awareness of the health risks of synthetic additives, coupled with the increasing preference for sustainably sourced products.

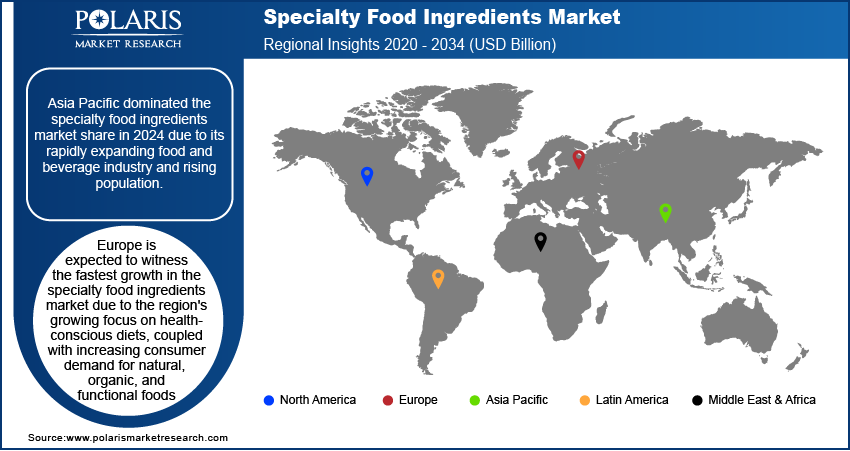

- Asia Pacific was the largest market for specialty food ingredients in 2024. Its dominance can be primarily attributed to the vast food and beverage sector in the region. Rising middle-class population, increasing disposable incomes, and changing dietary preferences contribute significantly to this sector.

- Europe is expected to witness the fastest CAGR from 2025 to 2034. The projected growth can be attributed to the increasing demand for functional food products with organic ingredients.

Industry Dynamics

- The growing demand for fortified meal options, coupled with the increasing awareness regarding the lack of micronutrients in regular diets, is driving the specialty food ingredients market growth.

- Governments’ emphasis on food fortification programs to combat the large-scale issue of malnutrition propels the demand for specialty food ingredients worldwide.

- Organic and sustainably sourced ingredients are gaining traction, which serves as attractive growth prospects for specialty food ingredient manufacturers.

- Limited shelf life and structural stability of ingredients may hinder their use in food and beverage applications.

Market Statistics

Market Size, 2024: USD 105.56 billion

Projected Market Size, 2034: USD 174.05 billion

CAGR (2025–2034): 5.1%

Largest Market in 2024: Asia Pacific

AI Impact on Specialty Food Ingredient Market

- AI assistance can ease R&D by accelerating the process of identification of novel specialty ingredients through refined bioinformatics approaches.

- AI tools can be employed to analyze health data, dietary patterns, and lifestyle trends to support targeted development of specialty ingredients based on major concerns.

- AI-based predictive models can heighten the efficiency of fermentation and downstream processes, improving yield and purity of high-value ingredients.

- AI-powered monitoring systems detect contaminants, ensure batchwise consistency, and enhance traceability, which are critical components of quality check and assurance processes.

- AI tools can help optimize raw material usage, reduce waste, and lower environmental impact in manufacturing operations, in turn contributing to ESG and regulatory compliance.

To Understand More About this Research: Request a Free Sample Report

Specialty food ingredients are unique, high-value additives or components used in food production to enhance taste, texture, appearance, nutritional value, or shelf life. The specialty food ingredients market is driven by the rising demand for convenience and processed foods, leading manufacturers to incorporate these ingredients widely. Increasing health awareness and the preference for natural, clean-label ingredients are expected to enhance market growth. Key industry players are actively acquiring other companies to diversify their product offerings. For instance, in June 2024, Tate & Lyle announced the acquisition of CP Kelco, a U.S.-based provider of pectin and specialty gums, for $1.8 billion. This strategic move aims to enhance Tate & Lyle's ability to meet the growing consumer demand for healthier food options by improving texture and taste profiles in their product offerings. These ingredients are utilized in various sectors, including bakery, snacks, beverages, confectionery, dairy, meat, and poultry. In bakery items such as bread and cookies, specialty flours and natural sweeteners enhance taste and texture. Similarly, natural sweeteners and colors are popular in confectionery products for flavor and visual appeal. The growing consumer desire for healthier, high-quality foods continues to boost the use of specialty food ingredients.

Market Dynamics

Growing Demand for Fortified Food

The growing demand for fortified foods, driven by rising health awareness, is driving the specialty food ingredients market growth. Consumers are increasingly prioritizing nutrient-rich diets to address specific health concerns and prevent deficiencies. This shift has led to a surge in demand for foods enriched with vitamins, minerals, and functional ingredients. Governments worldwide are actively promoting food fortification initiatives to combat malnutrition and support public health, further boosting the market's growth. For instance, in October 2024, Senegal and the World Food Programme launched a fortified rice program in schools, supported by DSM-Firmenich, to combat micronutrient deficiencies and improve child nutrition and education. The initiative distributes enriched rice to 61,000 students and strengthens local production capacities targeting 236 schools initially. This program aligns with efforts to enhance food sovereignty, nutrition, and economic development in West and Central Africa.

Consumer Awareness of Micronutrient Deficiencies

Consumer awareness of micronutrient deficiencies is driving the specialty food ingredients market demand. There is a growing need for foods that can help bridge nutritional gaps as people become more informed about the importance of essential vitamins and minerals in maintaining overall health. Specialty food ingredients, such as fortified vitamins, minerals, and functional additives, are increasingly used to enhance the nutritional profile of various food products. This awareness has led to the popularity of products aimed at addressing specific deficiencies, especially in areas such as bone health, immune function, and energy metabolism. Manufacturers are incorporating specialty food ingredients to meet the demand for more nutritionally balanced food, thus driving specialty food market growth. For instance, a November 2024 report by DSM-Firmenich highlighted that their Dry Vitamin A Palmitate NI manages global malnutrition by strengthening widely consumed staple foods such as flour with stable, clean-label vitamin A. This innovation combats hidden hunger, supports immune health, and aligns with UN Sustainable Development Goal 2- Zero Hunger.

Segment Analysis

Market Assessment by Type Outlook

The global specialty food ingredients market segmentation, based on type, includes antioxidants, colorants, emulsifiers, enzymes, minerals, flavours, sweetener, acidulants, preservatives, and specialty oils. Enzymes dominated the market share in 2024 due to their critical role in enhancing food quality, processing efficiency, and sustainability. They are widely used for applications such as improving texture, extending shelf life, and reducing processing time, meeting the growing demand for clean-label and natural food products. Advancements in enzyme technology have enabled tailored solutions for diverse food applications, further driving their adoption. Additionally, the rising focus on food waste management and optimizing production processes in the food industry has strengthened the demand for enzymes. Their multifunctional benefits and alignment with health-conscious and environmentally friendly trends make them a leading segment in the market.

Market Evaluation by Nature Outlook

The global specialty food ingredients market segmentation, based on nature, includes organic and conventional. The organic segment is expected to witness the fastest growth rate in the market during the forecast period due to increasing consumer preference for clean-label, natural, and sustainably sourced products. Rising awareness about the health benefits of organic ingredients, associated with concerns over synthetic additives and chemical residues, is driving demand for organic options. Supportive government policies, certifications, and expanding sustainable farming practices further fuel this trend. Additionally, the growing availability of organic specialty food ingredients across various retail channels enhances consumer access and adoption. These factors establish the organic segment as a major driver for specialty food ingredients market demand.

Regional Insights

By region, the study provides specialty food ingredients market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the market in 2024 due to its rapidly expanding food and beverage industry and rising population. The region's growing middle-class population, increasing disposable incomes, and changing dietary preferences have driven demand for processed and convenience foods enriched with specialty ingredients. Additionally, advancements in food processing technologies and a robust presence of local and international manufacturers have supported specialty food ingredients market growth. Favorable government initiatives promoting food safety and innovation further boosted the adoption of specialty food ingredients. For instance, a report published in August 2023 highlighted that the Indian government launched several initiatives to support the food processing sector, such as the Production Linked Incentive Scheme for the Food Processing Industry (PLISFPI) with a budget of USD 130.8 million and the PLI Scheme for Millet-based Products (PLISMBP) in 2022-23. These schemes aim to enhance manufacturing capacity, promote innovative products, and improve branding abroad. Additionally, the Pradhan Mantri Kisan Sampada Yojana (PMKSY) and Pradhan Mantri Formalization of Micro Food Processing Enterprises (PMFME) provide support for infrastructure development, technology adoption, and food safety testing. These efforts focus on sustainability, increasing employment, and ensuring global competitiveness in the food processing industry. The region's dynamic economic growth and evolving consumer preferences solidify its leadership in the market.

Europe is expected to witness the fastest growth in the specialty food ingredients market due to the region's growing focus on health-conscious diets, coupled with increasing consumer demand for natural, organic, and functional foods. For instance, in November 2021, Martino Rossi launched M-NAT, a functional clean-label ingredient made from corn flour. Designed to reduce the use of starches, it serves as a thickener, stabilizer, and gelling agent. The product is gluten, allergen, and GMO-free, produced through a special physical treatment developed by the company's R&D department. Additionally, strict regulations and a high standard of food quality and safety in Europe are encouraging the adoption of advanced food fortification and enhancement technologies. Europe's strong food processing industry, alongside the rising popularity of plant-based meat and clean-label products, further supports the expansion of the market in the region.

Key Players and Competitive Analysis Report

The competitive landscape of the specialty food ingredients industry includes global leaders and regional players aiming to capture market share through innovation, strategic partnerships, and regional expansion. Global players such as Cargill, Kerry Group plc, Tate & Lyle, and others leverage strong R&D capabilities and extensive supply chains to deliver advanced ingredients, including functional, clean-label, and plant-based solutions. Market trends highlight the growing demand for natural and sustainable ingredients, reflecting changing consumer preferences and the rise of health-conscious eating. According to the specialty food ingredients market statistics, the market is set to witness robust growth, driven by increasing demand for convenience foods, clean-label products, and fortified nutrition. Regional companies focus on catering to localized preferences by offering cost-effective and culturally tailored ingredients, particularly in emerging markets are expected to grow at the highest CAGR. Competitive strategies include mergers and acquisitions, collaborations with food manufacturers, and the development of innovative, sustainable ingredient solutions to meet evolving consumer demands. These dynamics emphasize the importance of innovation, adaptability, and regional focus in propelling the market forward. A few key major players are Cargill; Kerry Group plc.; DuPont; NATUREX; Ingredion; Symrise; Ashland Inc.; Keful Food Ingredients Co., Ltd.; Agropur; Tate & Lyle; and Woodland Foods.

Kerry Group is a food and ingredients company that produces various food and beverage ingredients, flavors, and consumer foods. Headquartered in Ireland, Europe. The company's product line includes ingredients for the dairy, meat, bakery, beverage, and convenience food sectors. Kerry Group offers a variety of functional components, such as emulsifiers, stabilizers, and sweeteners, which are used to improve texture, flavor, and nutritional value in food products. The company also produces a range of natural and artificial flavors used in food and beverage applications. The company also offers a product portfolio that includes taste ingredients, nutrition ingredients, functional ingredients, food solutions, beverage products, food services, pharma and biotechnology, food and beverages applications, and animal applications. The company has a total of 147 manufacturing locations in 35 countries and offers about 18,000+ products around the globe.

DuPont is a global provider of purification and specialty-separation technologies, delivering advanced membrane science and ion exchange solutions. Its focus is on enhancing the safety and cleanliness of drinking water for households and communities, improving the operational efficiency and sustainability of industries and markets, and addressing water scarcity challenges worldwide. Within DuPont's Nutrition & Biosciences division, the company makes innovation and the development of enzyme products in the Fabric & Household Care sector. The company’s core product portfolio includes fabrics, construction materials, fibers & nonwovens, personal protective equipment, packaging materials & solutions, solar/photovoltaic materials, water solutions, medical devices & materials, electronics & industrial, and adhesives. The company also offers this product in various sectors, such as automotive, building & construction, military, water management, law enforcement & emergency response, energy, safety & protection, packaging & printing, and government & public sector. The firm also provides various technologies, including Nano filtration (NF), ultrafiltration (UF), reverse osmosis (RO), ion exchange (IX), biofouling prevention, electro-deionization (EDI), membrane bioreactor systems (MBR), closed-circuit reverse osmosis (CCRO), and membrane aerated biofilm reactor modules (MABR).

Key Companies

- Cargill

- Kerry Group plc.

- DuPont.

- NATUREX

- Ingredion

- Symrise

- Ashland Inc.

- Keful Food Ingredients Co., Ltd.

- Agropur

- Tate & Lyle

- Woodland Foods.

Specialty Food Ingredients Industry Development

February 2024: Ingredion introduced NOVATION Indulge 2940, a functional native starch designed for plant-based food applications. It offers gelling and enhanced mouthfeel.

January 2024: ofi launched a new commercial platform, ofi F&B Solutions, under its Ingredients & Solutions segment, streamlining its category solutions and innovation infrastructure to enhance customer support.

March 2023: ADM introduced the Knwble Grwn brand, offering sustainably sourced, plant-based ingredients produced by small and underrepresented farmers using regenerative agriculture practices.

Specialty Food Ingredients Market Segmentation

By Nature Outlook (Revenue, USD Billion, 2020–2034)

- Organic

- Conventional

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Antioxidants

- Colorants

- Emulsifiers

- Enzymes

- Minerals

- Flavours

- Sweetener

- Acidulants

- Preservatives

- Specialty Oils

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Food and Beverages

- Bakery & Confectionary

- Dietary Supplements

- Convenience Foods

- Functional Foods

- Personal Care

- Nutrition and Health

- Nutraceutical Ingredients

- Active Pharmaceutical Ingredients

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Online

- Offline

- Hypermarkets

- Supermarkets

- Convenience Stores

- Specialty Retail Stores

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Specialty Food Ingredients Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 105.56 billion |

|

Market Size Value in 2025 |

USD 110.85 billion |

|

Revenue Forecast by 2034 |

USD 174.05 billion |

|

CAGR |

5.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global specialty food ingredients market size was valued at USD 105.56 billion in 2024 and is projected to grow to USD 174.05 billion by 2034.

The global market is projected to register a CAGR of 5.1% during the forecast period.

Asia Pacific dominated the specialty food ingredients market share in 2024.

A few key players in the market are Cargill; Kerry Group plc.; DuPont; NATUREX; Ingredion; Symrise; Ashland Inc.; Keful Food Ingredients Co., Ltd.; Agropur; Tate & Lyle; and Woodland Foods.

Enzymes dominated the specialty food ingredients market share in 2024.

The organic segment is expected to witness the fastest growth rate in the specialty food ingredients market during the forecast period.