Global Specialty Super Absorbent Polymer Market Size, Share & Industry Analysis Report

: By Type, By Material, By End Use Industry, and By Region – Market Forecast, 2025 - 2034

- Published Date:Aug-2025

- Pages: 120

- Format: PDF

- Report ID: PM5015

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

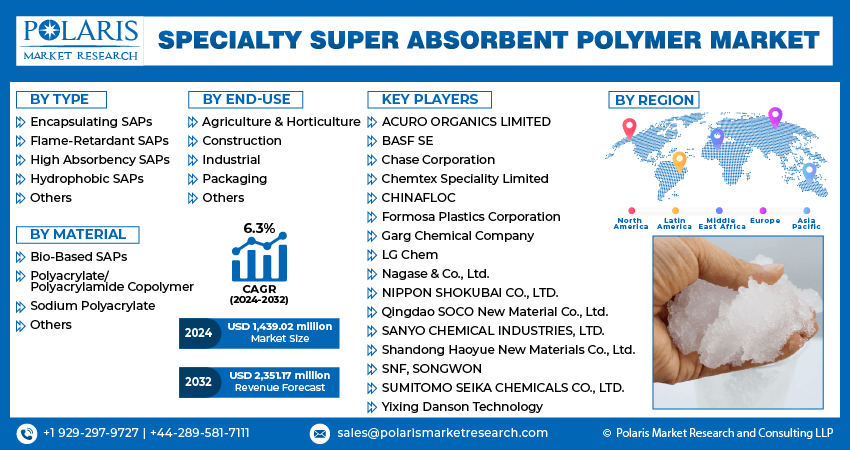

The specialty super absorbent polymer market size was valued at USD 1,439.02 million in 2024, growing at a CAGR of 6.4% during the forecast period. The growing demand for special hygiene products among older adults and rising packaging consumption across industries are a few of the key factors driving market demand.

Key Insights

- The sodium polyacrylate segment accounted for the largest market share in 2024. The cost-effectiveness and excellent absorption capabilities of sodium polyacrylate contribute to the segment’s leading market share.

- The agriculture segment is projected to witness a significant CAGR, owing to the growing adoption of these materials in improving water efficiency and crop yield.

- North America accounted for the largest market share, primarily driven by the increased demand for advanced medical products and solutions in the region.

- Asia Pacific is projected to witness significant growth. The presence of several leading market participants is driving the regional market growth.

Industry Dynamics

- The introduction of innovative products by market participants to cater to evolving industry needs is fueling market expansion.

- Rising investments in infrastructure development are driving the demand for specialty super absorbent polymers in concrete mixtures for their ability to regulate moisture content.

- Growing awareness about hygiene products is expected to create several market opportunities in the coming years.

- Raw material price volatility may present market challenges.

Market Statistics

2024 Market Size: USD 1,439.02 million

2034 Projected Market Size: USD 2,664.46 million

CAGR (2025-2034): 6.4%

North America: Largest Market in 2024

To Understand More About this Research:Request a Free Sample Report

The demand is growing due to rising number of the elderly population who require special hygiene products, such as adult diapers, which use specialty super absorbent polymers to manage incontinence issues. The number of elderly people is increasing in major regions such as Japan, the US, and parts of Europe. According to the Eurostat, as of 2024, 21.6% of the population of Europe is 65 years and above.

specialty super absorbent polymers are advanced materials designed for specific, high-performance applications beyond standard consumer products. SAPs offer comfort, help reduce skin irritation, and enhance overall quality of life. People need more daily living and healthcare support, which is driving demand for absorbent products. This growing need is pushing companies to create more advanced and effective SAP-based solutions, thereby driving the growth of the market.

The growth in the packaging industry is driving the specialty super absorbent polymer demand. The packaging industry has grown significantly across the globe due to increased consumption of different types of packaging in various industries. For instance, the India Brand Equity Foundation reported that the sector is experiencing a CAGR of 22% to 25%. This increased growth of the packaging industry has created the demand for specialty super absorbent polymers as they effectively absorb and retain liquids, such as moisture or fluids released by perishable goods. Therefore, the growing packaging industry and its adoption of innovative materials are driving the specialty super absorbent polymer demand.

Market Dynamics

Innovative Product Launches

The specialty super absorbent polymer CAGR is driven by innovative product launches that cater to evolving industry needs. The market players are introducing specialty super absorbent polymers with improved functional properties. For instance, in July 2024, ZymoChem launched BAYSE, the super absorbent polymer that is scalable, entirely bio-based polymer, and biodegradable. It serves as an alternative to conventional superabsorbent polymers derived from fossil fuels. These innovations are expanding the biodegradable super absorbent polymers market scope and attracting new users. Thus, product launches promote competition among manufacturers and encourage continuous improvement in technology, thereby driving the market growth.

Increased Spending in the Construction Sector

The construction sector has experienced significant spending for infrastructure developments due to increased population and urbanization. For instance, in April 2024, the U.S. Census Bureau reported that construction spending reached an estimated USD 2,099.0 billion, indicating a 10.0% increase from the April 2023 estimate of USD 1,907.8 billion. The increased spending on construction has represented the rising necessity for cost-effective building materials that improve performance and sustainability. Thus, the demand for specialty super absorbent polymers is growing as they are utilized in concrete mixtures for their ability to regulate moisture content.

Segment Insights

Specialty Super Absorbent Polymer Material Insights

The global market segmentation, based on material, includes bio-based SAPs, polyacrylate/polyacrylamide copolymer, sodium polyacrylate, and others. In 2024, the sodium polyacrylate segment accounted for the largest revenue share in the market due to its superior absorption capabilities, cost-effectiveness, and versatility across various applications. Sodium polyacrylate is highly efficient at absorbing and retaining large amounts of liquid relative to its mass. For instance, according to Carnegie Mellon University, sodium polyacrylate can absorb 800 times its weight in purified water and 300 times its weight in tap water. This absorbing capability makes sodium polyacrylate an ideal choice for high-performance needs in industries such as agriculture and construction. Thus, the sodium polyacrylate segment dominated the market.

Specialty Super Absorbent Polymer End Use Industry Insights

The global market segmentation, based on end use industry, includes agriculture, construction, industrial, packaging, and others. The agriculture segment is expected to grow with a significant specialty super absorbent polymer CAGR due to the increasing adoption of these materials in enhancing water efficiency and crop yield. Specialty super absorbent polymers are highly effective in retaining soil moisture, reducing water evaporation, and improving the water-holding capacity of soils, which is important in arid and drought-prone regions. The capability of polymers assists farmers in optimizing irrigation, reducing water usage, and sustaining crop growth during dry periods. Consequently, these factors are expected to drive the significant growth of the agriculture segment over the forecast period.

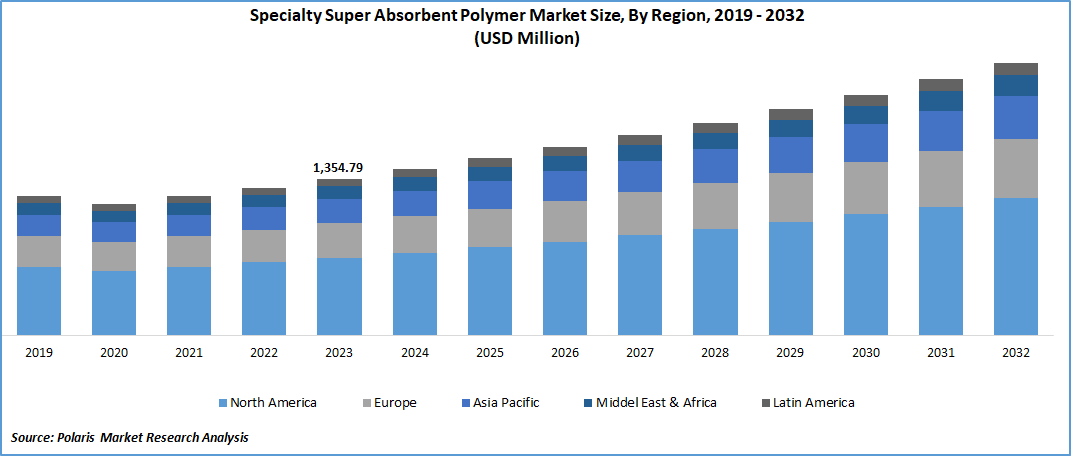

Specialty Super Absorbent Polymer Regional Insights

By region, the study provides industry insights into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. The North American held the highest revenue share due to the growing Medicare sector. For instance, according to the Centers for Medicare & Medicaid Services, Medicare spending increased by 5.9% to reach USD 928.3 billion in 2022, while Medicaid spending grew by 9.6% to reach USD 805.7 billion in the same year. This increased growth has created the demand for advanced medical products and solutions. Thus, a rising need for medical products for effective wound care and controlled drug delivery systems has initiated the utilization of specialty super absorbent polymers because of their superior absorbency and fluid management properties. Thus, the expanding Medicare in the region is contributing to the dominance of the region in the global market.

The Asia Pacific specialty super absorbent polymer market is anticipated to grow significantly due to the presence of several manufacturers, including SUMITOMO SEIKA CHEMICALS CO., LTD., NIPPON SHOKUBAI CO., LTD., LG Chem, SONGWON, and SANYO CHEMICAL INDUSTRIES, LTD. These manufacturers are bringing advanced technologies and innovative product offerings that enhance the variety of available superabsorbent polymers. Additionally, investments by manufacturers in expanding production capacities and establishing local supply chains ensure a steady and cost-effective supply of specialty super absorbent polymer materials. Thus, the Asia Pacific region is projected to grow with a significant specialty super absorbent polymers CAGR over the forecast period.

The China specialty super absorbent polymers market is anticipated to grow substantially due to the polymer's essential function in the rapidly expanding wastewater treatment sector within the country. China's wastewater treatment industry is growing as there is substantial demand for cleaning and recycling water technology. For instance, in 2021, the water treatment facilities in China processed wastewater for 98.1% of urban municipalities and 28% of rural areas. As a result, there is a heightened need for innovative solutions to assist the wastewater treatment process. Therefore, specialty super absorbent polymers are used in wastewater treatment processes as they enhance water retention capacity and improve the efficiency of solid-liquid separation, thereby aiding in the bulk filtration and purification of wastewater. This increased usage is expected to propel the growth of the specialty super absorbent polymers market in China.

Key Players & Competitive Insights

Leading players are investing heavily in research and development in order to expand their product types, which will help the industry grow even more. Players are also undertaking a variety of strategic activities to expand their global footprint, with important developments including innovative product launches, international collaborations, higher investments, and mergers and acquisitions between organizations. To expand and survive in a more competitive and rising environment, the specialty super absorbent polymer industry must offer cost-effective solutions.

The market is represented by a combination of global and regional players competing for market share. Major global companies are dominating due to their extensive R&D capabilities, broad product portfolios, and established presence. These companies focus on continuous innovation to develop specialty super absorbent polymers with enhanced properties. Major players include ACURO ORGANICS LIMITED, BASF SE, Chase Corporation, Chemtex Speciality Limited, CHINAFLOC, Formosa Plastics Corporation, Garg Chemical Company, LG Chem, Nagase & Co., Ltd., NIPPON SHOKUBAI CO., LTD., Qingdao SOCO New Material Co., Ltd., SANYO CHEMICAL INDUSTRIES, LTD., Shandong Haoyue New Materials Co., Ltd., SNF, SONGWON, SUMITOMO SEIKA CHEMICALS CO., LTD., and Yixing Danson Technology.

Sanyo Chemical Industries, Ltd. is a manufacturer of chemical products in Japan, specializing in industrial agents, superabsorbent polymers, and raw materials for various applications, including paints, latex, pulp and paper, advance ceramics, and electronics. The company has a business presence in several countries, including Thailand, Malaysia, China, South Korea, Taiwan, and the US In September 2022, the company's wholly-owned subsidiary, SDP Global Co., Ltd., developed an eco-friendly superabsorbent polymer that incorporates plant-based biomass as a key raw material.

Nagase & Co., Ltd. is a global company involved in the manufacturing, import/export, and sales of a wide range of chemicals and materials. The company was founded in 1832 and is headquartered in Osaka, Japan. Nagase & Co., Ltd. offers several products, including solvents, additives, resins, pigments, urethane and plastic materials, petrochemical products, release agents, and flame retardants. In February 2023, Nagase & Co., Ltd. and its subsidiary, Nagase ChemteX Corporation, in collaboration with Hayashibara Co., Ltd., developed a super absorbent polymer that exhibits absorption properties. The super absorbent polymer also boasts a high biomass content resulting from an elevated proportion of bio-based materials.

List Of Key companies:

- ACURO ORGANICS LIMITED

- BASF SE

- Chase Corporation

- Chemtex Speciality Limited

- CHINAFLOC

- Formosa Plastics Corporation

- Garg Chemical Company

- LG Chem

- Nagase & Co., Ltd.

- NIPPON SHOKUBAI CO., LTD.

- Qingdao SOCO New Material Co., Ltd.

- SANYO CHEMICAL INDUSTRIES, LTD.

- Shandong Haoyue New Materials Co., Ltd.

- SNF

- SONGWON

- SUMITOMO SEIKA CHEMICALS CO., LTD.

- Yixing Danson Technology

Specialty Super Absorbent Polymer Industry Developments

May 2025: Sumitomo Seika revealed the completion of an advanced SAP pilot plant at its Himeji Works. The company stated that the pilot facility is created to be a scale-down version of its full-scale production unit and will allow it to run medium-scale experimental production.

February 2025: ZymoChem announced the successful production of a key biopolymer ingredient at commercial scale. The company stated that the ingredient is used in its first major product. The announcement was made shortly after ZymoChem introduced its biodegradable super absorbent polymer, BAYSE.

May 2024: The Indonesia-based subsidiary of NIPPON SHOKUBAI CO., LTD., obtained ISCC PLUS certification for Acrylates, Acrylic Acid, and Superabsorbent polymers. This certification allowed the company to commence the production and sale of these products.

April 2023: HKRITA developed a superabsorbent polymer using cotton textile waste. The innovation had a significant impact on the apparel and textiles industry by stabilizing cotton yields and promoting textile recycling.

October 2023: Lummus Technology has made its Saplene super absorbent polymer technology commercially available. This innovative technology utilizes acrylic acid as the primary feedstock for super absorbent polymer production. Consumer goods manufacturers utilize the super absorbent polymer produced in the creation of liquid-absorbing personal hygiene products and other specialized applications.

Specialty Super Absorbent Polymer Segmentation:

By Type Outlook (Revenue USD Million, 2020–2034)

- Encapsulating SAPs

- Flame-Retardant SAPs

- High Absorbency SAPs

- Hydrophobic SAPs

- Others

By Material Outlook (Revenue USD Million, 2020–2034)

- Bio-Based SAPs

- Polyacrylate/Polyacrylamide Copolymer

- Sodium Polyacrylate

- Others

By End Use Industry Outlook (Revenue USD Million, 2020–2034)

- Agriculture & Horticulture

- Construction

- Industrial

- Packaging

- Others

By Regional Outlook (Revenue USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Specialty Super Absorbent Polymer Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,439.02 million |

|

Market Size Value in 2025 |

USD 1,528.83 million |

|

Revenue Forecast in 2034 |

USD 2,664.46 million |

|

CAGR |

6.4% from 2024 – 2032 |

|

Base Year |

2024 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Volume Kilotons, Revenue in USD million, and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global specialty super absorbent polymer market size was valued at USD 1,439.02 million in 2024 and is projected to grow to USD 2,664.46 million by 2034.

The global market is projected to grow at a CAGR of 6.4% during the forecast period, 2025-2034.

North America had the largest share of the global market.

The key players in the market are ACURO ORGANICS LIMITED, BASF SE, Chase Corporation, Chemtex Speciality Limited, CHINAFLOC, Formosa Plastics Corporation, Garg Chemical Company, LG Chem, Nagase & Co., Ltd., NIPPON SHOKUBAI CO., LTD., Qingdao SOCO New Material Co., Ltd., SANYO CHEMICAL INDUSTRIES, LTD., Shandong Haoyue New Materials Co., Ltd., SNF, SONGWON, SUMITOMO SEIKA CHEMICALS CO., LTD., and Yixing Danson Technology.

The sodium polyacrylate segment held the highest share in the specialty super absorbent polymer market in 2024.

The agriculture category had the highest CAGR in the global market.