Sterilization Container Systems Market Size, Share, Industry Analysis Report

By Product (Sterilization Container, Accessories), By Type, By Technology, By Material, By End User, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM1952

- Base Year: 2024

- Historical Data: 2020-2023

Overview

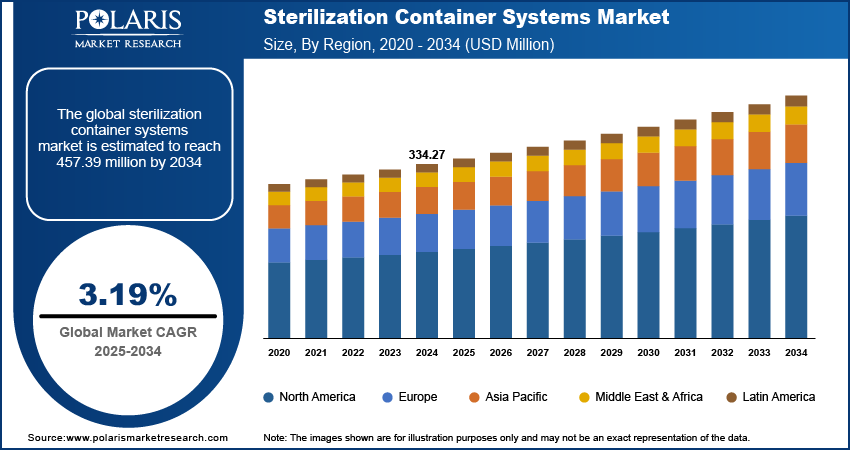

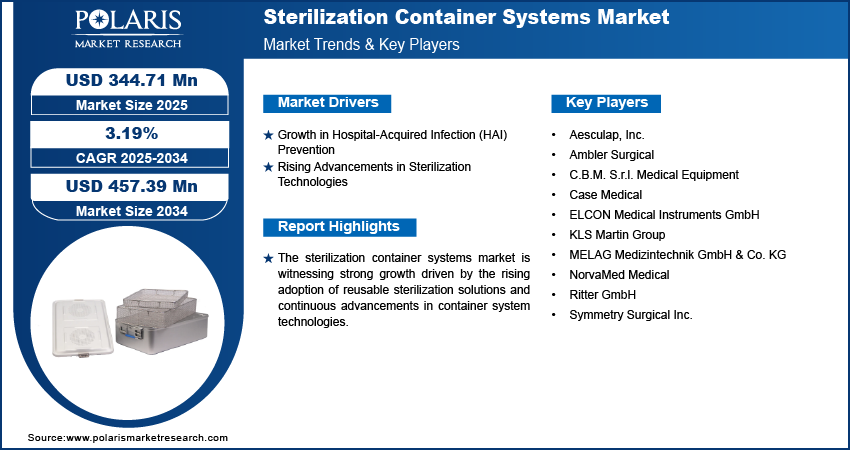

The global sterilization container systems market size was valued at USD 334.27 million in 2024, growing at a CAGR of 3.19% from 2025 to 2034. Key factors driving demand include the increasing surgical procedures, rising demand for reusable containers, growing focus on hospital-acquired infection (HAI) prevention, and rising advancements in sterilization technologies

Key Insights

- The sterilization containers led the revenue share in 2024. The containers are favored by healthcare facilities for reliable surgical instrument sterilization.

- The stainless steel containers segment is projected to grow fastest during the forecast period, owing to durability, corrosion resistance, and reusability in high-frequency sterilization.

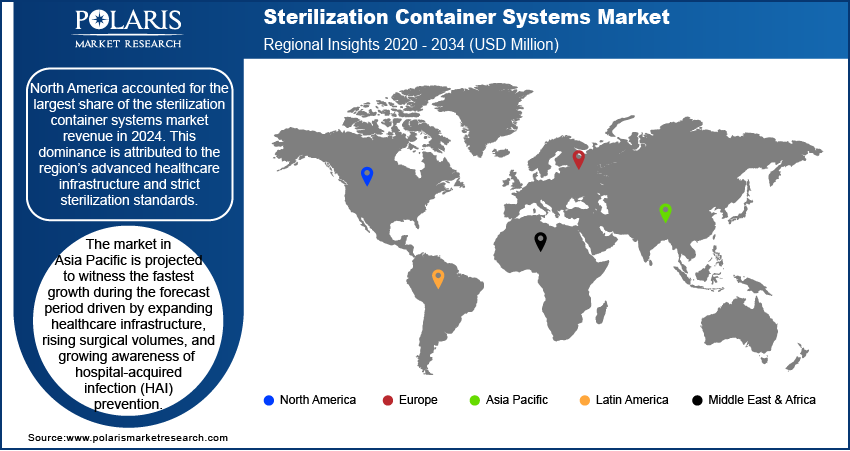

- North America dominated the global market revenue in 2024, supported by advanced healthcare systems and stringent sterilization protocols.

- The U.S. was the largest regional market in 2024, driven by robust surgical infrastructure, regulatory compliance, and infection control standards.

- The market in Asia Pacific is anticipated to grow at the highest rate during the forecast period, fueled by healthcare expansion, rising surgeries, and HAI prevention initiatives.

- The industry in India showed significant growth, attributed to healthcare modernization and rising infection control measures in hospitals.

Industry Dynamics

- Rising focus on infection control boosts sterilization container adoption, as hospitals prioritize secure systems to prevent cross-contamination during surgeries.

- Innovations such as low-temperature sterilization and smart filtration enhance container performance, aligning with modern healthcare sterilization needs.

- High upfront costs of advanced sterilization containers limit adoption, especially in budget-constrained hospitals and emerging markets, slowing market penetration.

- Growing demand for reusable, eco-friendly containers in sustainable healthcare creates a revenue opportunity for manufacturers by 2030.

Market Statistics

- 2024 Market Size: USD 334.27 million

- 2034 Projected Market Size: USD 457.39 million

- CAGR (2025–2034): 3.19%

- North America: Largest market in 2024

AI Impact on Sterilization Container Systems

- AI-powered RFID/sensors track sterilization cycles, instrument usage, and maintenance needs, reducing human errors and improving efficiency.

- AI analyzes data from sterilization containers to predict wear-and-tear, preventing failures and extending product lifespan.

- AI algorithms monitor sterilization compliance in real-time, flagging deviations to lower hospital-acquired infection (HAI) risks.

- AI forecasts demand for sterilization containers, helping manufacturers and hospitals manage inventory and reduce costs.

Sterilization container systems are durable, reusable, rigid boxes designed to securely store, transport, and sterilize surgical instruments while maintaining their sterility. The market for sterilization container systems is witnessing robust growth, driven by the increasing focus on infection control and surgical safety. The demand for reliable, secure, and efficient sterilization solutions has surged as healthcare facilities prioritize sterile processing to meet strict regulatory standards. These systems offer enhanced protection compared to wraps and pouches, ensuring reduced contamination risks and prolonged instrument usability. Their structured design supports improved workflow efficiency within central sterile supply departments (CSSDs), promoting standardized procedures and compliance with hospital sterilization protocols.

The adoption of these containers is contributing to the rising demand for reusable containers across healthcare environments. Hospitals and surgical centers are increasingly shifting toward reusable sterilization solutions to minimize waste and reduce long-term operational expenses, with the growing focus on cost-effective and sustainable medical practices. Reusable containers offer a longer lifespan and better return on investment, and also align with global initiatives to reduce the environmental impact of single-use medical products. This shift supports the broader healthcare industry's movement toward greener practices, reinforcing the value of sterilization container systems as both economically and environmentally advantageous.

Drivers & Opportunities

Growth in Hospital-Acquired Infection (HAI) Prevention: The growing focus on hospital-acquired infection (HAI) prevention is fueling the demand for these systems. The need for secure and reliable sterilization methods has become essential as healthcare facilities aim to mitigate the risk of cross-contamination and infection transmission, particularly during surgical procedures. A November 2024 CDC report revealed that 3.2% of hospitalized patients, 1 in 31, contract at least one HAI during treatment. These infections risk patient safety and create effective healthcare system burdens, driving increased adoption of rigorous sterilization measures in medical facilities. Sterilization container greatly reduces the risk of external contamination compared to soft-wrap alternatives, thereby supporting hospitals’ infection control protocols. This has positioned sterilization container systems as essential tools in achieving higher standards of patient safety and minimizing HAI-related complications.

Rising Advancements in Sterilization Technologies: Rising advancements in sterilization technologies are also driving the growth opportunities, as healthcare providers aim for compatibility with modern, high-efficiency sterilization methods. Innovations such as low-temperature sterilization, improved filtration mechanisms, and integration with automated reprocessing equipment have expanded the performance capabilities of container systems. In November 2024, W&H launched the Lexa Mini, a compact Class B rapid sterilizer for North America. Designed for dental practices, it ensures fast, reliable sterilization of handpieces with freshwater cycles and closed-door drying, complementing existing workflows while maintaining safety and efficiency. These advancements enable better sterilization outcomes while ensuring the integrity of delicate and complex surgical instruments. Additionally, modern container systems are being designed to accommodate emerging sterilization cycles, enhancing their adaptability across various medical environments. Therefore, as technology continues to evolve, sterilization containers are increasingly aligned with the operational and safety requirements of advanced healthcare environments.

Segmental Insights

Product Analysis

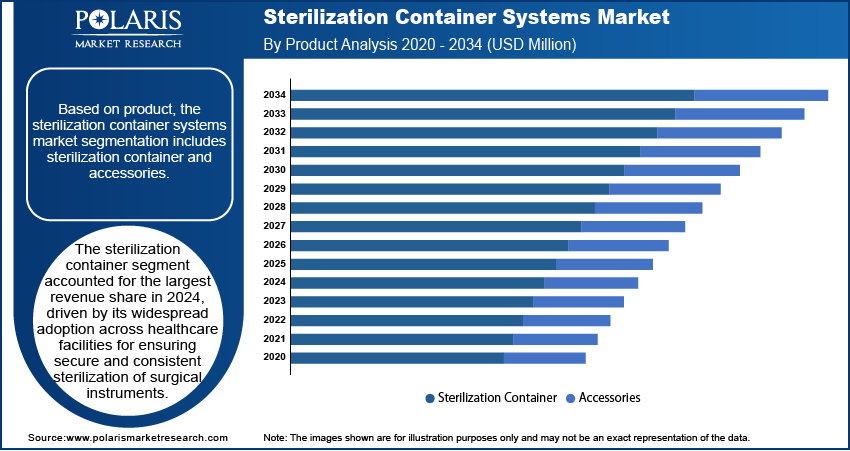

Based on product, the segmentation includes sterilization container and accessories. The sterilization container segment accounted for the largest revenue share in 2024. The containers are widely adopted across healthcare facilities to ensure secure and consistent sterilization of surgical instruments. These rigid containers offer superior protection against contamination, enhance storage efficiency, and maintain sterility over extended periods. Their durability and reusability further contribute to cost savings and reduced medical waste, making them a preferred choice over traditional wraps. The growing focus on infection control and compliance with sterilization standards has further strengthened demand for sterilization containers in hospitals and surgical centers.

Type Analysis

In terms of type, the segmentation includes perforated and non-perforated. The non-perforated segment is expected to witness significant growth during the forecast period owing to its ability to provide a completely sealed barrier against external contaminants. These containers are particularly beneficial in sensitive medical environments that require maximum protection of instruments post-sterilization. The absence of perforations reduces exposure to ambient conditions, thereby improving sterility maintenance. Their design also supports compatibility with advanced sterilization techniques, making them suitable for delicate and complex surgical tools, which further drives their adoption in modern healthcare facilities.

Technology Analysis

The segmentation, based on technology, includes filter and valves. The filter segment dominated the market in 2024, driven by its critical role in maintaining sterility while allowing efficient airflow during sterilization processes. Filters integrated into sterilization containers enable the penetration of sterilant gases or steam while acting as a barrier to microbes and particles, ensuring the sterility of contents throughout storage and transport. Their effectiveness in enhancing safety and compliance with sterilization protocols has led to widespread utilization. Additionally, advances in filter materials and designs have improved their performance, further solidifying their dominance in the market.

Material Analysis

Based on material, the segmentation includes aluminum, stainless steel, and other material. The stainless steel segment is expected to witness the fastest growth during the forecast period due to its superior durability, corrosion resistance, and suitability for repeated sterilization cycles. Stainless steel containers provide enhanced longevity and structural integrity, even under high-pressure or high-temperature sterilization processes. Their robust build minimizes wear and tear, ensuring consistent performance over time. Additionally, stainless steel’s compatibility with modern sterilization technologies and its ability to protect surgical instruments effectively have positioned it as a favorable choice for long-term use in hospital environments.

Regional Analysis

The North America sterilization container systems market accounted for the largest global revenue share in 2024. This dominance is attributed to the region’s advanced healthcare infrastructure and strict sterilization standards. The high volume of surgical procedures, combined with increased awareness of infection control and patient safety, has driven the adoption of advanced sterilization solutions. Additionally, the strong presence of manufacturers and ongoing investments in healthcare modernization have supported the region’s dominance in the market.

U.S. Sterilization Container Systems Market Insights

The U.S. held the largest share in North America sterilization container systems landscape in 2024 due to its advanced surgical infrastructure, strict regulatory standards, and high awareness regarding infection control. The country’s well-established hospital network and widespread adoption of reusable sterilization systems have reinforced market dominance. Additionally, continuous investments in healthcare innovation and focus on reducing hospital-acquired infections have contributed to the strong demand for sterilization container systems.

Asia Pacific Sterilization Container Systems Market Trends

The market in Asia Pacific is projected to witness the fastest growth during the forecast period, driven by expanding healthcare infrastructure, rising surgical volumes, and growing awareness of HAI prevention. The demand for effective and reusable sterilization solutions is gaining momentum as emerging economies in the region increase investments in healthcare facilities and regulatory compliance. According to a February 2025 report, the Ministry of Commerce and Industry stated that India allocated USD 11.50 million to healthcare in its 2025–26 budget, a 9.78% increase from the previous year's USD 10.47 million. The budget is allocated to strengthen healthcare infrastructure and services across the country. Furthermore, the region’s shift toward cost-efficient, sustainable medical practices is expected to accelerate the adoption of sterilization container systems across both public and private healthcare environments.

India Sterilization Container Systems Market Overview

The market in India is expanding due to rapid improvements in healthcare infrastructure and increasing focus on infection prevention in public and private hospitals. The country’s growing surgical volumes and rising demand for cost-effective, reusable medical devices are driving the adoption of sterilization container systems. Moreover, greater awareness around hygiene standards and hospital safety is pushing healthcare facilities to replace conventional sterilization methods with more advanced container systems.

Europe Sterilization Container Systems Market Outlook

Europe is projected to hold a substantial market share by 2034, due to the region’s strong regulatory focus on infection prevention and sustainability in healthcare. European healthcare providers are increasingly adopting reusable sterilization technologies to reduce environmental impact and ensure long-term cost efficiency. In addition, the presence of well-established healthcare infrastructure and a rising demand for high-quality surgical instruments are expected to support continued growth. This regional focus on quality assurance and standardization reinforces Europe’s solid position in the global market.

Key Players & Competitive Analysis

The sterilization container systems industry is witnessing intense competition driven by emerging markets, technological advancements, and strategic investments. Key players such as Aesculap (B. Braun) and ELCON Medical Instruments GmbH are leveraging revenue growth opportunities through expansion strategies in both developed markets and high-growth regions. Competitive intelligence reveals a focus on sustainable value chains, with companies prioritizing innovations such as smart tracking and reusable designs to meet latent demand. Disruptions and trends, such as stricter sterilization regulations and rising surgical volumes, are reshaping vendor strategies. Revenue forecasts indicate steady growth, supported by macroeconomic trends and expert insights on healthcare infrastructure upgrades. Small and medium-sized businesses are gaining traction through niche offerings, while larger firms dominate via region-wise market size advantages. Supply chain disruptions and geopolitical shifts remain challenges, but future development strategies emphasize resilience. Pricing insights and product offerings are critical for competitive positioning, with mergers and acquisitions accelerating market consolidation. Industry trends suggest long-term potential, particularly in emerging market segments where healthcare investments are rising.

A few major companies operating in the sterilization container systems industry include Aesculap (B. Braun); ASP; C.B.M. S.r.l. Medical Equipement; ELCON Medical Instruments GmbH; Hermann Müller Medizintechnik Gmbh; Hu-Friedy Mfg. Co., LLC; KLS Martin Group; Medline Industries, LP; Melag; and Schülke & Mayr GmbH.

Key Players

- Aesculap, Inc.

- Ambler Surgical

- C.B.M. S.r.l. Medical Equipment

- Case Medical

- ELCON Medical Instruments GmbH

- KLS Martin Group

- MELAG Medizintechnik GmbH & Co. KG

- NorvaMed Medical

- Ritter GmbH

- Symmetry Surgical Inc.

Sterilization Container Systems Industry Developments

- April 2024: SIG introduced the SIG Prime 55 In-Line Aseptic, a spouted pouch filling system with integrated sterilization. The technology eliminates third-party pre-sterilization, simplifying supply chains and reducing production costs for aseptic spouted pouch packaging.

- March 2024: STERIS launched Verafit Sterilization Bags and Covers featuring a patent-pending viewing window. The design enables visual dryness confirmation of sterilized parts, helping biopharmaceutical manufacturers comply with EU GMP Annex 1 requirements for sterilization cycle validation.

Sterilization Container Systems Market Segmentation

By Product Outlook (Revenue, USD Million, 2020–2034)

- Sterilization Container

- Accessories

By Type Outlook (Revenue, USD Million, 2020–2034)

- Perforated

- Non-perforated

By Technology Outlook (Revenue, USD Million, 2020–2034)

- Filter

- Valves

By Material Outlook (Revenue, USD Million, 2020–2034)

- Aluminum

- Stainless Steel

- Other Material

By End User Outlook (Revenue, USD Million, 2020–2034)

- Hospitals

- Ambulatory Surgical Centers

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Sterilization Container Systems Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 334.27 Million |

|

Market Size in 2025 |

USD 344.71 Million |

|

Revenue Forecast by 2034 |

USD 457.39 Million |

|

CAGR |

3.19% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 334.27 million in 2024 and is projected to grow to USD 457.39 million by 2034.

The global market is projected to register a CAGR of 3.19% during the forecast period.

North America accounted for the largest global revenue share in 2024.

A few of the key players in the market are Aesculap (B. Braun); ASP; C.B.M. S.r.l. Medical Equipement; ELCON Medical Instruments GmbH; Hermann Müller Medizintechnik Gmbh; Hu-Friedy Mfg. Co., LLC; KLS Martin Group; Medline Industries, LP; Melag; and Schülke & Mayr GmbH.

The sterilization container segment accounted for the largest revenue share in 2024.

The stainless steel segment is expected to witness fastest growth during the forecast period