Global Strapping Machine Market Share, Size, & Industry Analysis Report

: Information By Product, By Material (Polypropylene, Polyester, Steel, Others), By Application, By End Use And By Region – Market Forecast, 2025 - 2034

- Published Date:May-2025

- Pages: 147

- Format: PDF

- Report ID: PM1045

- Base Year: 2024

- Historical Data: 2020-2023

The global strapping machine market was valued at USD 5.2 billion in 2024 and is projected to grow at a CAGR of 5.8% from 2025 to 2034. The market expansion is attributed to the rising demand for efficient packaging solutions across industries such as connected logistics, food & beverage, and e-commerce, aiming to enhance product safety during transportation. The strapping machine market assessment is sustained by increasing demand for efficient packaging solutions across various industries. Factors such as rapid urbanization, expanding populations, and heightened global trade contribute to this demand. Industries seek reliable strapping machines to secure goods during transportation, ensuring product integrity and meeting stringent biodegradable packaging standards amid evolving industry dynamics.

To Understand More About this Research:Request a Free Sample Report

Automated strapping machines play a crucial role in ensuring consistent and secure packaging, effectively minimizing product damage during transportation. By reducing damage, these machines contribute to fewer returns, replacements, and customer complaints, safeguarding the company's reputation and enhancing overall customer satisfaction.

Market Trends:

The Rise Of E-Commerce And Advances In Logistics Technology Are Driving The Market Growth

The industry CAGR is propelled by the expansion of e-commerce and advancements in logistics technology. The surge in online shopping has significantly increased the volume of goods shipped directly to consumers. Both large online retail giants and smaller e-commerce ventures require efficient packaging solutions to manage this heightened demand driving the industry estimates.

Moreover, automated strapping machines boost packaging efficiency and consistency, enabling C2C (consumer-to-consumer) e-commerce businesses to maintain smooth delivery operations and uphold high levels of customer satisfaction. This integration of technology in packaging processes boost market penetration for the pivotal role of strapping machines in supporting the growth and efficiency of the e-commerce sector.

For instance, according to the United States Census Bureau, Annual retail trade sales for the years 2022 and 2021 were USD 7041 billion and USD 6519.8 billion, respectively, which shows more than 8% growth in the market; this results in increasing packaging and services and hence the use of the these machine are expected to grow in the forecast period.

Industrialization And Manufacturing Growth Drives The Market Outlook

The rise in manufacturing plants and production facilities necessitates secure packaging for goods during transportation and distribution. These machines play a crucial role by bundling products securely for shipment, ensuring they reach their destination intact. As industrialization progresses, there is simultaneous development of infrastructure such as improved transportation networks and logistics hubs. This growth emphasizes the need for robust packaging solutions capable of handling increased movement of goods, thereby boosting demand for strapping machines.

For instance, according to International Yearbook of Industrial Statistics highlights significant post-pandemic recovery in global industrial sectors. Manufacturing, electricity, mining, waste management, water supply, and utilities collectively grew by 2.3%, with manufacturing leading the recovery at 3.2%. This growth trajectory underlines the increasing adoption of these machines in manufacturing industries for packaging and delivery requirements.

Moreover, expanding populations and urbanization are driving heightened demand for e-commerce and bolstering the packaging industry. This trend further amplifies the revenue potential of the industry, as industries seek efficient solutions to meet growing consumer and logistical demands.

Segment Insights:

Application Insights:

The market segmentation, based on application includes bundling, binding, packaging, others. In 2024, the packaging segment claimed the largest market share. This segment caters to diverse industries such as food and beverages, pharmaceuticals, electronics, and consumer goods. Each industry demands reliable packaging solutions for product protection during transit and storage, thereby boosting the demand for strapping machines.

Further, the rapid expansion of e-commerce has notably escalated the need for secure packaging, amplifying the volume of goods requiring robust handling. For instance, according to Amazon's annual report, their net sales increased by 12% to USD 74.8 billion in 2023, compared with USD 66.0 billion in 2022. Amazon is the largest e-commerce platform, which uses packaging machines to package products for safety and distribution.

End-Use Insights:

The market segmentation, based on end-use, includes consumer goods, food and beverage, newspaper and publishing, postal, others. In 2024, the food and beverage category emerged as the fastest-growing market segment. This sector deals predominantly with consumable goods that necessitate dependable packaging to preserve freshness and prevent spoilage during transit and storage. Strapping machines play a vital role in ensuring that packaging remains consistently tight and secure, which is critical for maintaining the quality of these products. Globally, the demand for food and beverage products continues to escalate due to population growth and evolving consumer preferences. This heightened demand underscores the need for efficient and reliable packaging solutions, ensuring timely delivery of goods in optimal condition.

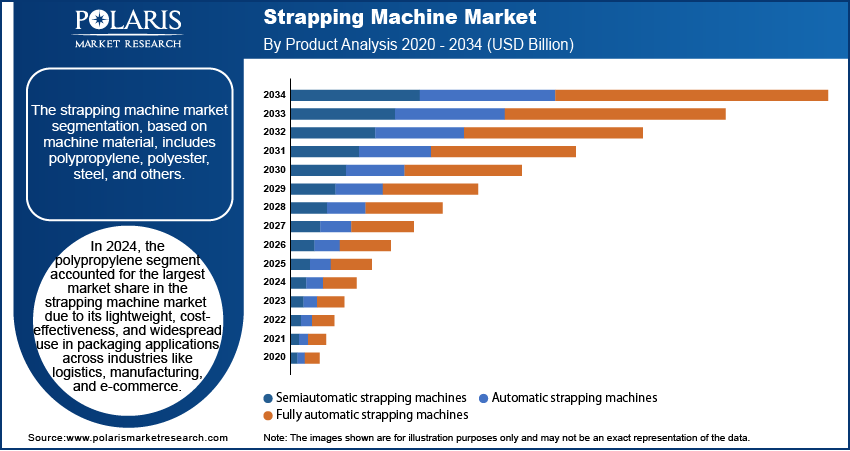

Global Strapping Machine Market, Segmental Coverage, 2020 - 2034 (USD Billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

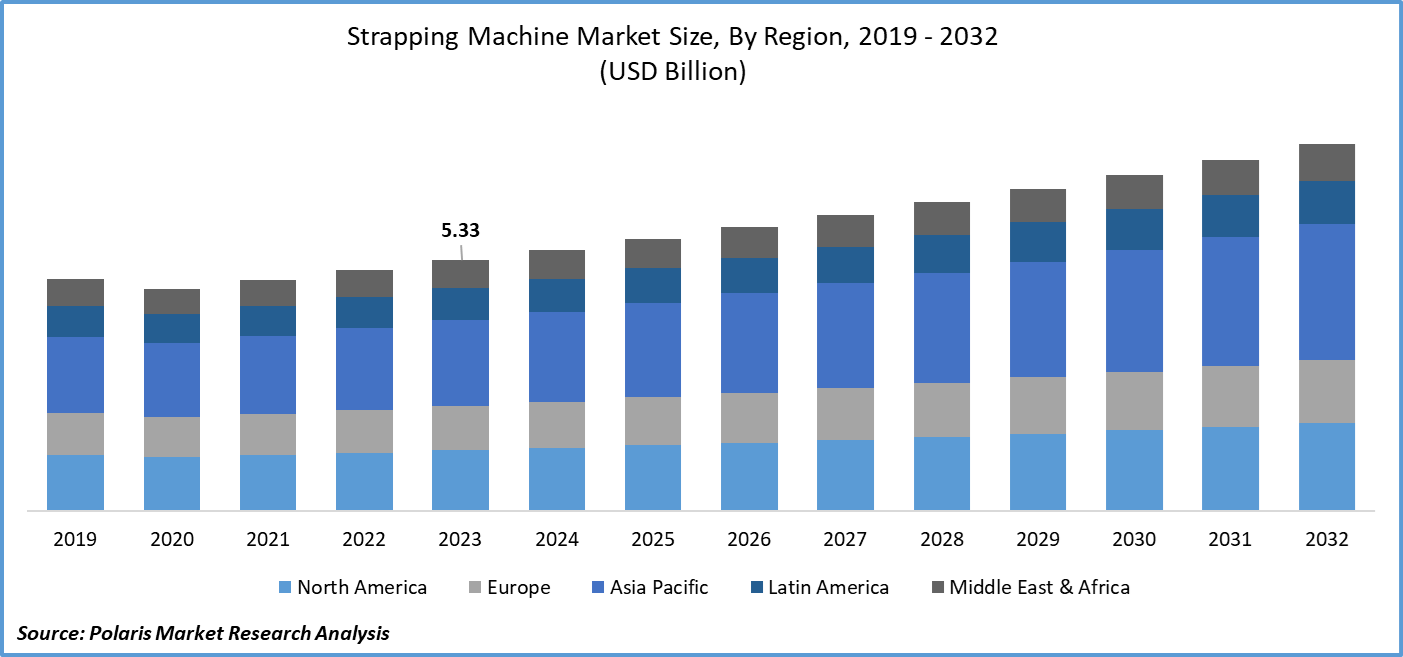

Regional Insights:

By region, the study provides the market insights into North America, Europe, Asia-Pacific, Latin America and Middle East & Africa. The Asia-Pacific strapping machine market is accounted to be the largest market in 2024. The increasing number of manufacturers, particularly in China and India, has created a higher demand for strapping machines, primarily for packaging purposes, thereby driving growth in the Asia Pacific strapping machine market.

India strapping machine market is expected to grow substantially during the anticipated years due to the rising exports manufacturing activities in India driving the demand for strapping machines, which are essential for securing goods during packaging and transportation. For instance, according to IBEF, India’s Manufacturing exports in fiscal year 2023 were USD 447.46 billion, compared to USD 422 billion in fiscal year 2022, which shows a 6.03% growth.

China is expected to grow at significant CAGR during the forecast period due to increasing investments in infrastructure development, including logistics and transportation networks, have enhanced the efficiency and scale of manufacturing and distribution. As goods movement increases and infrastructure improves, the demand for reliable packaging solutions is rising, further driving the industry revenue.

For instance, according to the State Council, the Peoples Republic of China, in 2022, the China Federation of Logistics and Purchasing reported a 3.4 percent year-on-year increase in social logistics, reaching USD 50.4 trillion. Therefore, the increase in logistics is attributed to the rising demand for e-commerce platforms in the China. This lead to an increasing demand for packaging and subsequently for strapping machines boosting the China strapping machine market.

GLOBAL STRAPPING MACHINE MARKET, REGIONAL COVERAGE, 2020 - 2034 (USD Billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

North America strapping machine market is expected to grow at fastest CAGR due to increasing consumer demand for a wide range of products, from electronics to food items, necessitates efficient and reliable packaging solutions. Strapping machines ensure that products are securely packaged, reducing the risk of damage during shipment and enhancing customer satisfaction.

North American industries are at the forefront of adopting automation and smart manufacturing technologies. Automated strapping machines enhance productivity, reduce labor costs, and improve packaging accuracy, making them an attractive investment for manufacturers seeking to modernize their operations. Leveraging advanced automation technologies and artificial intelligence can enhance machine performance, offering features like predictive maintenance, fault detection, and operational efficiency.

For instance, in March 2023, Signode has developed a cutting-edge, fully automatic twin head modular steel strapping machine with automatic paper feeding and application, which is being provided to a top brass and copper bar rod manufacturer in North America.

Key Market Players & Competitive Insights

Leading key players are investing heavily in research and development in order to expand their product lines. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, strapping machine industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global strapping machine industry to benefit clients and increase the market sector. In recent years, the strapping machine industry has offered some technological advancements. Major players in the industry, including Duplomatic MS Mechatronics BU, Dynaric Inc., Fromm Holdings AG, Messersi Packaging S.r.I., MJ Maillis S.A., Mosca GmbH, Polychem Corporation, Samuel Strapping Systems, StraPack Inc., Strapex Group, Transpak Equipment Corp., Signode Packaging Systems Corporation.

EAM-Mosca Corporation, established in 1982, provides automatic strapping systems for industrial packaging, bundling, and unitizing applications. The company is headquartered in Hazle Township, PA, with additional facilities in Canada and Mexico and a network of distributor partnerships across the Americas and Caribbean. In May 2024, The Mosca Group has inaugurated the expansion of its US facility in Hazle Township. The company has upgraded the headquarters of its subsidiary EAM-Mosca and added approximately 11,000 square meters to its Pennsylvania campus. This expansion will enable the headquarters to oversee the production of strapping machines, straps, spare parts, and related services for the USA, Latin America, and the Caribbean.

Signode was founded in 1913 and is headquartered in Tampa, Florida. The company produces strap, stretch, and protective packaging. It also manufactures packaging tools and equipment used to apply bulk packaging materials. In December 2022, Signode introduced a new BST battery-powered tool for sealless steel strapping.

Key Companies in the market include:

- EAM-Mosca Corporation

- Duplomatic MS Mechatronics BU

- Dynaric Inc.

- Fromm Holdings AG

- Messersi Packaging S.r.l.

- MJ Maillis S.A.

- Polychem Corporation

- Samuel Strapping Systems

- Signode Packaging Systems Corporation.

- StraPack Inc.

- Strapex Group

- Transpak Equipment Corp.

Industry Developments

In January 2025, a new fully automatic strapping machine was launched by Bremetz Machinery Co., Ltd, featuring advanced intelligent control and precision engineering. Developed by the company's R&D team, it was designed to enhance packaging efficiency, accuracy, and durability while reducing operational costs.

In June 2023, FROMM Packaging and Duplomatic MS Mechatronics BU a collaboration to develop an all-electric strapping machine for lumber packs.

In February 2022, Signode, a global manufacturer of automated packaging equipment, tools, and consumables, has launched its new BPT steel strapping tool. This battery-operated tool has a lightweight design and is well-suited for a broad range of steel strapping applications, including both heavy-duty stationary and mobile applications that demand high-tension force.

In July 2020, FROMM introduced its new Smart S-series, battery powered 3-IN-1, strapping tools for plastic straps, the P328S and P329S. They are equipped with an extensively tested heavy duty colour touchscreen, state-of-the-art software with various smart features, including a wireless option.

Market Segmentation:

Product Outlook

- Semiautomatic strapping machines

- Automatic strapping machines

- Fully automatic strapping machines

Material Outlook

- Polypropylene

- Polyester

- Steel

- Others

Application Outlook

- Bundling

- Binding

- Packaging

- Others

End Use Outlook

- Consumer goods

- Food and beverage

- Newspaper and publishing

- Postal

- Others

Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Strapping Machine Report Scope:

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 5.2 billion |

|

Market size value in 2025 |

USD 5.5 billion |

|

Revenue Forecast in 2034 |

USD 9.1 billion |

|

CAGR |

5.80% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global Strapping Machine market size was valued at USD 5.2 Billion in 2024

The global market is projected to grow at a CAGR of 5.80% during the forecast period, 2025-2034

Asia Pacific had the largest share in the global market

• The key players in the market are Duplomatic MS Mechatronics BU, Dynaric Inc., Fromm Holdings AG, Messersi Packaging S.r.I., MJ Maillis S.A., Mosca GmbH, Polychem Corporation, Samuel Strapping Systems, StraPack Inc., Strapex Group, Transpak Equipment Corp., Signode Packaging Systems Corporation

The packaging category dominated the market in 2024

The food and beverage had the largest share in the global market