Student Information System Market Size, Share, Trends, Industry Analysis Report

By Component (Software, Service), By Deployment, By Application, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 128

- Format: PDF

- Report ID: PM2006

- Base Year: 2024

- Historical Data: 2020-2023

Overview

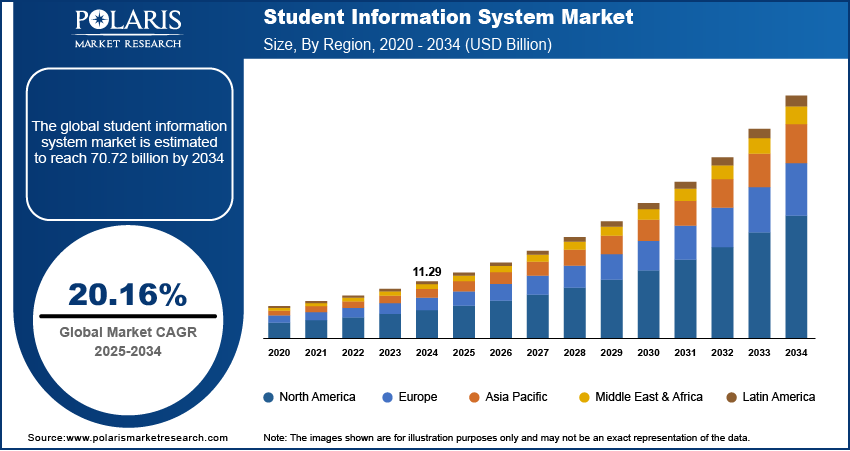

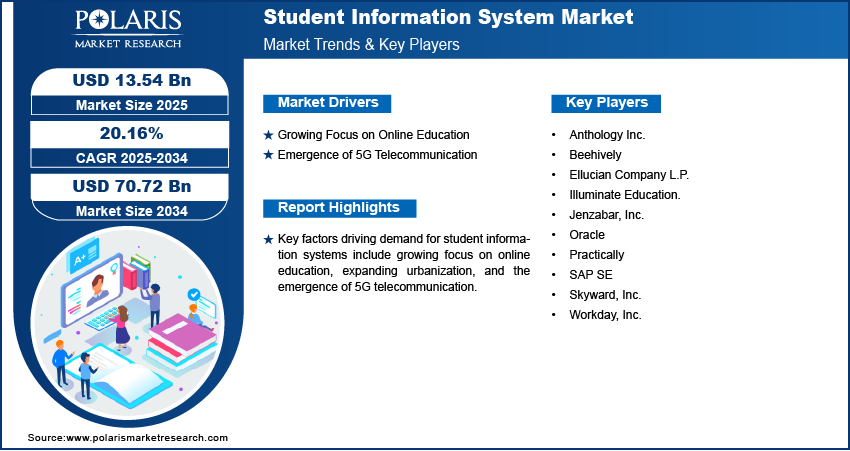

The global student information system market size was valued at USD 11.29 billion in 2024, growing at a CAGR of 20.16% from 2025 to 2034. A few key factors driving demand for student information systems include growing focus on online education, expanding urbanization, and the emergence of 5G telecommunication.

Key Insights

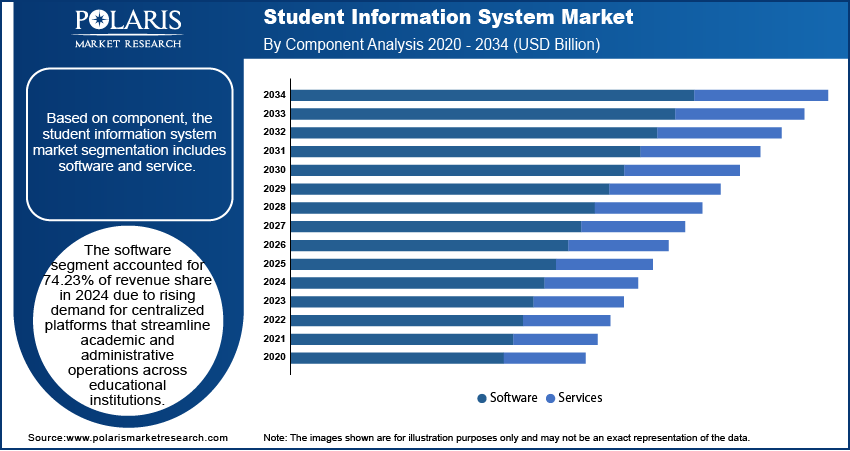

- The software segment accounted for 74.23% of revenue share in 2024 due to rising demand for digital solutions to streamline academic and administrative operations.

- The cloud segment held 61.43% of revenue share in 2024 due to a widespread shift toward cost-efficient digital infrastructure.

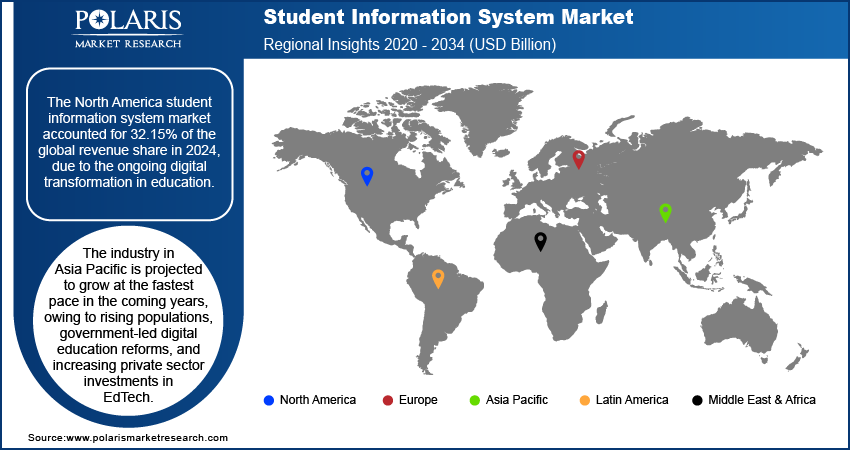

- North America accounted for a 32.15% share of the global student information system market revenue in 2024, owing to the ongoing digital transformation in education.

- The U.S. held the largest revenue share in the North America student information system landscape in 2024, due to educational institutions seeking automation solutions for administrative tasks.

- The industry in Asia Pacific is projected to grow at the fastest pace in the coming years, owing to expanding populations and growing investments in the digitalization of the education sector.

Industry Dynamics

- The growing focus on online education is fueling the demand for student information systems as they manage student data, track progress, and facilitate remote learning.

- The emergence of 5G telecommunication is propelling the adoption of student information systems as enhanced bandwidth allows SIS platforms to integrate advanced features such as AI-driven analytics, virtual classrooms, and mobile app functionality.

- The growing investments in the digitalization of the education sector in emerging regions such as India are expected to create a lucrative market opportunity in the future.

- Lack of awareness and high cost of student information systems hinder the market growth.

Market Statistics

- 2024 Market Size: USD 11.29 Billion

- 2034 Projected Market Size: USD 70.72 Billion

- CAGR (2025–2034): 20.16%

- North America: Largest Market Share

AI Impact on Student Information System Market

- Artificial intelligence (AI) is rapidly transforming the market. The technology is turning traditional administrative systems into intelligent ecosystems. It enhances learning, engagement, and operational efficiency.

- From enrollment process to transcript generation, AI tools streamline repetitive tasks, freeing up staff time and reducing human error.

- SIS vendors are prioritizing mobile-friendly designs, enabling students and staff to access schedules, grades, and academic tools on the go.

- Virtual assistants and chatbots integrated into SIS platforms avail instant responses to student queries, which improves communication and satisfaction.

- Higher education organizations lead in AI adoption, whereas K–12 is catching up fast, especially with demand for remote learning and data-driven instructions.

Student information system (SIS) is a digital platform designed to manage student-related data efficiently. It serves as a centralized database for storing academic records, attendance, grades, schedules, and personal details. Schools, colleges, and universities use SIS to streamline administrative tasks, enhance communication between teachers, students, and parents, and ensure data accuracy. It automates processes like enrollment, grading, and reporting, reducing manual workload. SIS also supports online learning by providing access to course materials and progress tracking, improving overall educational management.

The benefits of a student information system include improved efficiency, data security, and accessibility. It reduces paperwork, minimizes errors, and saves time for educators and administrators. Real-time updates enable parents and students to track academic progress, attendance, and deadlines. SIS enhances communication through notifications and portals, fostering collaboration. Additionally, it supports data-driven decision-making with visual analytics and reporting tools. SIS ensures compliance with regulations and simplifies audits by digitizing records.

The global student information system market demand is driven by the expanding urbanization. World Economic Forum, in its 2022 report, stated that the share of the world’s population living in cities is expected to rise to 80% by 2050. This is forcing institutions to adopt scalable digital solutions such as student information systems (SIS) to manage enrollment, attendance, and academic records efficiently. Urbanization is further expanding competition among schools, pushing them to leverage SIS platforms for data-driven decision-making, personalized learning, and streamlined communication with parents. Additionally, government initiatives in urban areas are mandating digital transformation in education, further accelerating SIS adoption to ensure compliance and improve administrative workflows. Hence, as cities expand, the demand for robust SIS solutions grows, helping institutions handle larger student volumes while maintaining operational efficiency.

Drivers & Opportunities

Growing Focus on Online Education: Online education is increasing the need for centralized digital platforms such as student information systems to manage student data, track progress, and facilitate remote learning. Schools and universities adopting hybrid or fully online models require student information systems (SIS) to handle virtual enrollment, digital attendance, and online gradebooks efficiently. Additionally, regulatory requirements for online education are also mandating secure data management, further driving SIS adoption to ensure compliance and streamline administrative tasks in digital learning environments. Therefore, as educators rely on online education, they tend to adopt SIS to provide seamless access to coursework, assessments, and student analytics.

Emergence of 5G Telecommunication: Schools and universities are extensively leveraging 5G’s high-speed connectivity to support real-time data updates, seamless video conferencing, and instant collaboration between teachers, students, and parents. Enhanced bandwidth allows SIS platforms to integrate advanced features such as AI-driven analytics, virtual classrooms, and mobile app functionality without latency issues, encouraging more institutions to adopt SIS solutions to support remote and hybrid learning models, ensuring smooth access to attendance records, grades, and coursework on mobile devices. Additionally, 5G’s low latency improves the scalability of SIS deployments, helping educational institutions manage growing data volumes and deliver a more responsive digital learning experience. Therefore, as 5G telecommunication advances in the future, the demand for student information systems rises correspondingly.

Segmental Insights

Component Analysis

Based on component, the segmentation includes software and service. The software segment accounted for 74.23% of revenue share in 2024 due to rising demand for centralized platforms that streamline academic and administrative operations across educational institutions. Schools, colleges, and universities increasingly adopted software solutions to manage core functions such as enrollment, attendance, grading, and scheduling. The shift toward digital learning environments and the growing need for real-time data access significantly boosted the demand for integrated platforms. Moreover, the rise in government and institutional investments in education technology supported the widespread deployment of these systems. Customizable features, compatibility with mobile devices, and cloud-based deployment options of software enhanced user engagement and drove adoption rates among both academic administrators and IT decision-makers.

Deployment Analysis

In terms of deployment, the segmentation includes cloud and on-premise. The cloud segment held 61.43% of revenue share in 2024 due to a widespread shift toward scalable, cost-efficient digital infrastructure across educational institutions. Schools and universities preferred cloud-based platforms as they offered greater flexibility, easier remote access, and reduced dependency on internal IT resources. Cloud deployment also enabled seamless software updates, real-time data synchronization, and improved collaboration among faculty, students, and administrators. The growing emphasis on data security, backup, and disaster recovery further encouraged institutions to migrate to cloud environments. Additionally, cloud solutions supported hybrid learning models, which gained attraction post-pandemic, accelerating adoption across both developed and emerging regions.

Application Analysis

In terms of application, the segmentation includes financial management, student management, admission & recruitment, student engagement & support, and others. The admission & recruitment segment accounted for 29.81% of revenue share in 2024 due to rising competition among schools and universities to attract and retain students. Institutions invested heavily in digital tools that automate application workflows, manage applicant communications, and provide data-driven insights for admissions strategies. The growing trend of online and international applications further fueled the need for advanced recruitment platforms, such as student information systems, that offer real-time tracking, analytics, and seamless integration with other administrative systems. These platforms also supported outreach campaigns and enabled institutions to personalize engagement with prospective students, enhancing conversion rates and reducing administrative burden.

The financial management segment is projected to grow at a robust pace in the coming years, owing to the increasing complexity of managing tuition fees, scholarships, grants, and institutional budgeting. Schools are adopting digital financial solutions that provide accurate, real-time tracking of revenues and expenditures. Student information system support automated billing, financial aid distribution, and multi-currency processing, which are especially valuable for institutions with international students. Moreover, growing demand for accountability in financial planning and resource allocation continues to drive adoption.

End Use Analysis

In terms of end use, the segmentation includes K-12 and higher education. The K-12 segment is expected to register a higher CAGR from 2025 to 2034, owing to the increasing digitalization of primary and secondary education systems worldwide. Public and private schools are adopting student information systems to improve administrative efficiency and enhance student support. Student information systems integrating financial management tools are also witnessing rising demand, as schools seek to automate fee collection, manage budgets, and ensure accountability in resource utilization. Government initiatives promoting digital infrastructure in education, especially in emerging economies, are fueling the adoption of student information systems in K–12.

Regional Analysis

The North America student information system market accounted for 32.15% of the global revenue share in 2024. This dominance is attributed to ongoing digital transformation in education, government mandates for data transparency, and the need for streamlined administrative processes. Schools and universities in the region invested heavily in cloud-based SIS solutions to improve student data management, attendance tracking, and academic reporting. Additionally, the growing emphasis on personalized learning and integration with learning management systems (LMS) fueled SIS adoption in North America.

U.S. Student Information System Market Insights

The U.S. held the largest revenue share in the North America student information system landscape in 2024, due to K-12 and higher education institutions seeking automation of administrative tasks, compliance with the Family Educational Rights and Privacy Act, and the need for real-time analytics. The shift toward hybrid and online learning post-pandemic in the U.S. also increased reliance on SIS for remote enrollment, grading, and communication. Furthermore, EdTech investments and federal funding for digital infrastructure further pushed schools to adopt advanced SIS platforms.

Europe Student Information System Market Trends

The market in Europe is projected to hold a substantial revenue share in 2034 due to government initiatives promoting digital education, such as the EU’s Digital Education Action Plan. Institutions in the region are adopting SIS to centralize student records, improve interoperability between systems, and comply with the General Data Protection Regulation (GDPR). The rise of cross-border student mobility programs also necessitated the use of SIS platforms to manage international student data efficiently. According to the European Union, there were 1.76 million students from abroad undertaking tertiary level studies across the EU in 2023.

Germany Student Information System Market Overview

The demand for student information systems in Germany is being driven by rising digitalization in education. Schools and universities in Germany are implementing SIS to modernize administrative workflows, enhance parent-teacher communication, and support vocational training programs. The need for secure data handling under strict German privacy laws and the integration of SIS with emerging AI and analytics tools are further accelerating demand.

Asia Pacific Student Information System Market Assessment

The industry in Asia Pacific is projected to grow at the fastest pace in the coming years, owing to rising populations, government-led digital education reforms, and increasing private sector investments in EdTech. Population Reference Bureau stated that Asia’s population is projected to increase by 10% by 2050, to 5.3 billion, up from 4.8 billion in 2024. Countries such as India, China, and Australia are adopting SIS to automate admissions, streamline fee management, and improve student engagement. The expansion of online and hybrid learning models, along with the need for multilingual and scalable SIS solutions, is driving market growth in the region.

Key Players & Competitive Analysis

The student information system (SIS) market is highly competitive, with key players offering diverse solutions tailored to K-12, higher education, and corporate learning sectors. Vendors such as Oracle and SAP SE dominate with their enterprise-grade platforms, integrating SIS with broader ERP ecosystems for scalability and advanced analytics. Anthology Inc. and Workday, Inc. compete strongly in higher education, leveraging cloud-based solutions with AI-driven insights and seamless financial aid integration. Meanwhile, Jenzabar, Inc. and Ellucian specialize in academic-focused SIS platforms, catering to colleges and universities with modular, customizable features. In the K-12 space, Illuminate Education and Skyward, Inc. lead with data-driven tools for student performance tracking and state compliance reporting. Emerging players such as Beehively and Foradian Technologies target niche markets with cost-effective, user-friendly solutions for smaller institutions.

A few major companies operating in the student information system industry include Anthology Inc.; Beehively; Ellucian Company L.P.; Foradian Technologies; Illuminate Education; Jenzabar, Inc.; Oracle; SAP SE; Skyward, Inc.; and Workday, Inc.

Key Players

- Anthology Inc.

- Beehively

- Ellucian Company L.P.

- Illuminate Education

- Jenzabar, Inc.

- Oracle

- Practically

- SAP SE

- Skyward, Inc.

- Workday, Inc.

Student Information System Industry Developments

In May 2023, Monash University partnered with Oracle to offer a new, customized, hands-on learning program for Monash Business School undergraduate students to ensure they enter the workforce with the skills they need in the digital world.

In March 2022, Practically acquired Foradian Technologies Pvt Ltd, the world’s most widely used ERP, to offer a comprehensive end-to-end product suite for schools.

Student Information System Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Software

- Service

By Deployment Outlook (Revenue, USD Billion, 2020–2034)

- Cloud

- On-premise

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Financial Management

- Student Management

- Admission & Recruitment

- Student Engagement & Support

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- K-12

- Higher Education

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Student Information System Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 11.29 Billion |

|

Market Size in 2025 |

USD 13.54 Billion |

|

Revenue Forecast by 2034 |

USD 70.72 Billion |

|

CAGR |

20.16% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 11.29 billion in 2024 and is projected to grow to USD 70.72 billion by 2034.

The global market is projected to register a CAGR of 20.16% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are Anthology Inc.; Beehively; Ellucian Company L.P.; Foradian Technologies; Illuminate Education; Jenzabar, Inc.; Oracle; SAP SE; Skyward, Inc.; and Workday, Inc.

The software segment dominated the market revenue share in 2024.

The K-12 segment is projected to witness the fastest growth during the forecast period.