Video Conferencing Market Share, Size, Trends, Industry Analysis Report

By Component (Hardware, Software, Service); By Deployment; By Application; By End Use; By Region; Segment Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 123

- Format: PDF

- Report ID: PM2038

- Base Year: 2024

- Historical Data: 2020 - 2023

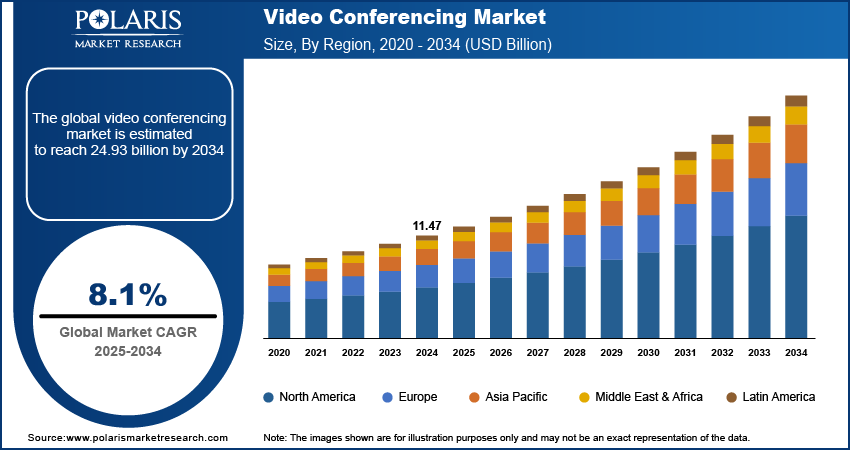

The global video conferencing market size was valued at USD 11.47 billion in 2024, growing at a CAGR of 7.35% from 2025–2034. Key factors driving the demand includes surge in innovations in the field of video conferencing, coupled with the robust market growth in penetration of video conferencing solutions in the education and telemedicine sectors, which is now required to optimize the utilization of the collaboration platform and increase the efficiency of meetings by integrating virtual assistant technology.

Key Insights

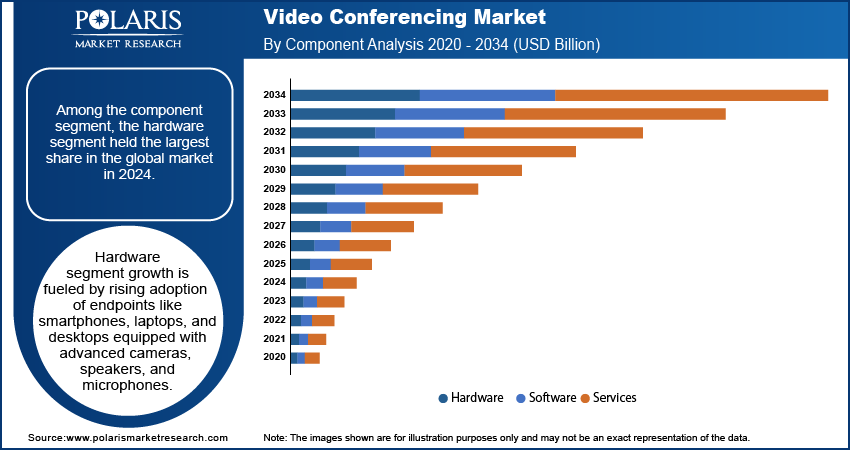

- In 2024, the hardware segment dominated the global market. The growth is attributed to the rapid development and adoption of smartphones, laptops, and desktops with high-resolution cameras, speakers, and microphones.

- The corporate segment is expected to witness rapid growth during the forecast period, driven by the rapid development of the cloud-based collaboration and communication software industry.

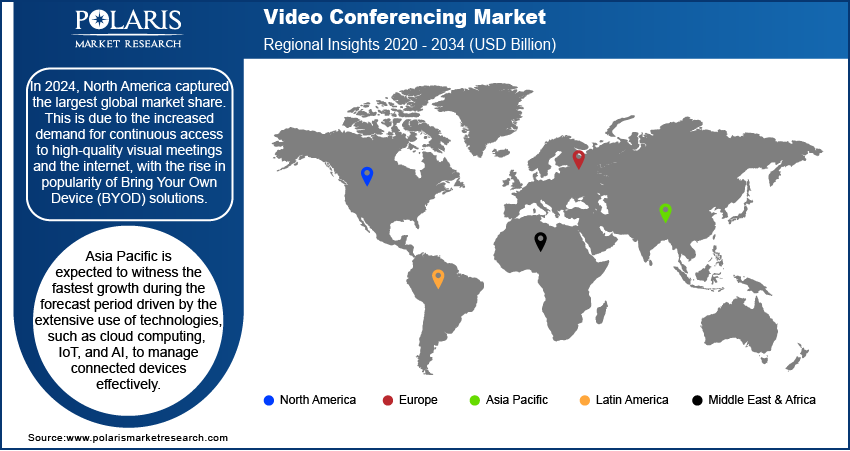

- In 2024, North America captured the largest global market share. This is due to the increased demand for continuous access to high-quality visual meetings and the internet, with the rise in popularity of Bring Your Own Device (BYOD) solutions.

- Asia Pacific is expected to witness the fastest growth during the forecast period driven by the extensive use of technologies, such as cloud computing, IoT, and AI, to manage connected devices effectively.

Industry Dynamics

- The rise of hybrid and remote working arrangements has led to an increased demand for video conference tools to support daily collaboration as opposed to in-person meetings.

- The rise in telehealth options for consultations and patient monitoring, offered by healthcare providers, has contributed to demand for video conferencing platforms.

- Increased competition from free platforms puts pressure on pricing. This makes profitability and differentiation of core products difficult.

- Opportunity for premium services and new revenue streams to offer distinct value beyond a basic video call is done through the integration of AI features such as meeting summaries and automated transcription.

Market Statistics

- 2024 Market Size: USD 11.47 billion

- 2034 Projected Market Size: USD 24.93 billion

- CAGR (2025-2034): 8.1%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

AI Impact on Video Conferencing Market

- Dynamic enhancement of audio and video quality, removal of background noise, and adjusting for lighting, AI enhances the professionalism and ease for all participants.

- AI enhances the effectiveness and accessibility of meetings, with real-time transcription, translation, and automatic summarization, which capture important discussions and action items.

- AI-powered characteristics like advanced virtual backgrounds, gesture recognition, and automatic framing automate back-end tasks that ensure meetings are more seamless and intelligent.

- Vendors attempt to monetize these features in different ways to create alternative sources of revenue to reduce customer churn.

It is a live visual connection between two or more people for communication who are in different locations. The rising need for operational enterprise communication along with large-scale investment by several organizations for modernizing and simplifying communication networks is further expanding the implementation of video conferencing globally.

The technology is often considered convenient for business users in several countries as it saves expenses, time, and aggravations regarding business travel. Furthermore, the use of video conferencing, such as to conduct routine meetings, assign business deals, and hold job interviews of candidates, eventually paving the way for higher market growth during the forecast period.

Industry Dynamics

Growth Drivers

The proliferation of the video conferencing market is rising at a significant pace rate considering the global scenario. With the rapid shift in preference for video conferencing interviews in the recruitment process, video conferencing technology has become a viable option to strengthen its brand by hiring candidates with exceptional professional skills. Conferencing enables business organizations to gain insights regarding the aspects, including the ideal meeting length, the optimal number of participants, and more.

Conferencing is also helping organizations to find and analyze better content of meeting at a faster pace and with more ease and effectiveness by modernizing and simplifying the business process. Hence, video conferencing is becoming the standard practice and appeals a comparative analysis among meetings in an organization, which, in turn, strengthens the trend for video conferencing in developed and emerging markets.

This accelerating demand for cloud technology on the back of the digital age has insisted enterprises replace to deploy cloud-based solutions by replacing traditional systems of the business management process. Thus, global companies are looking forward to integrating cloud-based video conferencing solutions and services and playing a critical role in changing the dynamics of the video conferencing market during the forecast period.

Report Segmentation

The market is primarily segmented on the basis of component, deployment, application, end-use, and region.

|

By Component |

By Deployment |

By Application |

By End Use |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Segmental Analysis

Component Analysis

Among the component segment, the hardware segment held the largest share in the global market in 2024. The market growth of the hardware segment can be attributed to the growing development and acceptance of endpoints, including smartphones, laptops, and desktops fortified with high-resolution cameras, speakers, and microphones. In addition, the rise in adoption of the Internet of Things (IoT), enabling the robust incorporation of hardware with cloud-based software solutions and other key technologies, such as artificial intelligence and facial recognition, are the few factors that boost the market growth.

The service segment is likely to propagate at an effective rate during the foreseen period, owing to the escalating integration of augmented reality and other key technologies and cloud-based video conferencing services, such as Adobe Connect, LoopUp, and so on, which is likely to enhance customer experience. Moreover, a significant increase in mobility needs of remote workforce and workers has been witnessed, which would further complement the market growth of this segment worldwide.

End Use Analysis

The corporate segment is expected to see a large revenue in the global market, owing to the rapid development of the cloud-based collaboration and communication software industry, opening new opportunities for new players in the marketplace. Further, the continual growth in the frequency of geographically dispersed teams has promoted the massive utilization of cloud-based platforms to streamline business processes, enhance productivity, and manage projects of all extents, accelerating market growth.

On the flip side, the healthcare segment is expected to pave a high market share in terms of revenue by 2034. It helps healthcare providers in patient care and telemedicine, healthcare administration applications, and medical education to deliver improved patient care by offering them enhanced communication options. Thus, these factors are expected to contribute to the market growth fortune.

Regional Analysis

North America Video Conferencing Market Assessment

Geographically, North America dominated the global market in 2024 due to the robust growth and early adoption of advanced technologies and software associated with video conferencing in the region. Additionally, the escalating demand for continuous access to high-quality visual meetings and the internet, coupled with the increasing popularity of Bring Your Own Device (BYOD) solution, is further expanding the market growth at a rapid pace considering the global scenario.

Additionally, countries such as the U.S and Canada are further estimated to register the largest number of initiatives, and partnership agreements will prolong unified communication (UC) solutions and video conferencing collaboration portfolio to streamline businesses of several sizes across these countries.

Asia Pacific Video Conferencing Market Insights

Asia Pacific is expected to witness a high CAGR in the global market during the forecast period owing to the extensive usage of technologies, including cloud computing, IoT, and AI to manage connected devices effectively, coupled with the huge proliferation of 4G and 5G networks that present huge opportunities for the acceptance of video conferencing. The growth of this region is further boosted by the digital transformation across the BFSI, IT & Telecom, and education sectors, which has boosted the adoption of remote communication tools. A rise in initiatives for the promotion of digital infrastructure and the startup ecosystem has also created a wide path for market expansion. Moreover, the rise in remote and hybrid work, with the need for cost-effective communication solutions, especially after the pandemic, encouraged organizations to adopt advanced video conference systems into their operations.

How does the imposition of regulations on data protection and privacy impact the India video conferencing market?

The increasing adoption of hybrid work, digital learning, and telemedicine propels the demand for video conferencing in India. Also, government initiatives and the rising penetration of 5G networks boost the adoption of video conferencing platforms in the country. However, the rising use of these platforms leads to the requirements for data privacy, security, and regulatory compliance. The following table comprises comprehensive information on key regulatory and compliance areas in India.

|

Area |

Description |

Relevance to Video Conferencing |

|

Data Protection |

India’s DPDP Act 2023 |

Ensures personal and corporate data is securely stored and processed |

|

Telemedicine Practice Guidelines (MoHFW, India) |

Regulations for remote patient consultation and medication |

Requires secure end-to-end encrypted platforms for doctor-patient communication Emphasis on ensuring the privacy of patients in video consultation |

|

Corporate Security Standards |

ISO 27001, SOC 2, NIST frameworks |

ISO 27001 imposes the use of an Information Security Management System (ISMS). Ensures enterprise-grade security for internal meetings, board meetings, and sensitive information |

|

Sector-specific Compliance |

Financial (PCI DSS), Healthcare (HIPAA) |

Platforms used in the banking and healthcare sectors must have specialized security certifications. They focus on data protection from fraud and theft. |

The imposition of such regulations and rules clarifies that companies providing video conferencing products must maintain a balance between innovation and regulatory adherence. Many major global market players, including Cisco Webex, Microsoft Teams, and Zoom, focus on obtaining various certifications to expand their business in India. On the flip side, Indian vendors such as Airmeet, JioMeet, and Zoho Vani, are taking actions to comply with domestic and international regulations. These factors boost the adoption of video conferencing in the country.

Key Players & Competitive Analysis Report

Video conferencing landscape is characterized by intense competition among established players and agile market entrants. Competitive intelligence and strategic assessments identify leading vendor strategies concentrated on innovation, primarily in the area of AI, to improve user experience and automate meetings. A large opportunity for revenue exists in small and medium businesses that are a new segment of the market with specific technology requirements for scalable, cost-efficient solutions. Planned product development is now largely shaped by socioeconomic and geopolitical factors, and supply chain disruption challenges that vendors must consider when regrouping their regional footprint. Performance will depend on vendor's use of expert's foresight of industry change, including hybrid work, that builds sustainable value ecosystems and provides strong competitive positioning with superior products. Some of the Major Players operating the global market include Amazon Web Services, Inc., AURA Presence, Avaya Inc., Barco NV, BlueJeans Network, Inc, Cisco Systems, Inc., Fuze, Inc., Google, Haivision, Inc., HighFive, Inc., Huawei Technologies Co. Ltd., Kaltura, Inc., Kollective Technology, Inc., Lifesize, Inc., Logitech International S.A., LogMeIn, Inc., Microsoft Corporation, Pexip, AS, Plantronics, Inc., Qumu Corporation, Sonic Foundry, Inc., StarLeaf Inc., Vidyo, Inc., and Zoom Video Communications, Inc.

Industry Developments

- June 2025: HP Inc. collaborated with Google Beam, an AI-powered, true-to-life 3D video communications solution designed to take virtual collaboration to the next level. It is designed to transform the future of workplace communications by combining 3D imaging, natural eye contact, spatial audio, and adaptive lighting into an elegant solution for small meeting spaces.

- March 2024: Zoom Workplace unveiled an AI-powered collaboration platform to reimagine teamwork. According to Zoom, this technology ensures a seamless AI deployed workforce in an economical way. Also, it provides a seamless way for colleagues and customers to connect and achieve their daily objectives more productively.

- March 2024: Microsoft and Oracle expanded their partnership to satisfy global demand for Oracle Database@Azure worldwide. For Microsoft, this merger with Oracle will make the migration of workloads streamlined and also empower business innovation.

Video Conferencing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 11.47 billion |

| Market size value in 2025 | USD 12.37 billion |

|

Revenue forecast in 2034 |

USD 24.93 billion |

|

CAGR |

8.1% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Component, By Deployment, By Application, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Amazon Web Services, Inc., AURA Presence, Avaya Inc., Barco NV, BlueJeans Network, Inc, Cisco Systems, Inc., Fuze, Inc., Google, Haivision, Inc., HighFive, Inc., Huawei Technologies Co. Ltd., Kaltura, Inc., Kollective Technology, Inc., Lifesize, Inc., Logitech International S.A., LogMeIn, Inc., Microsoft Corporation, Pexip, AS, Plantronics, Inc., Qumu Corporation, Sonic Foundry, Inc., StarLeaf Inc., Vidyo, Inc., and Zoom Video Communications, Inc. |

FAQ's

• The global market size was valued at USD 11.47 billion in 2024 and is projected to grow to USD 24.93 billion by 2034.

• The global market is projected to register a CAGR of 8.1% during the forecast period.

• North America dominated the global market share in 2024.

• A few key players are Amazon Web Services, Inc., AURA Presence, Avaya Inc., Barco NV, BlueJeans Network, Inc, Cisco Systems, Inc., Fuze, Inc., Google, Haivision, Inc., HighFive, Inc., Huawei Technologies Co. Ltd., Kaltura, Inc., Kollective Technology, Inc., Lifesize, Inc., Logitech International S.A., LogMeIn, Inc., Microsoft Corporation, Pexip, AS, Plantronics, Inc., Qumu Corporation, Sonic Foundry, Inc., StarLeaf Inc., Vidyo, Inc., and Zoom Video Communications, Inc.

• In 2024, the hardware segment dominated the global market.

• The corporate segment is expected to witness rapid growth during the forecast period.