Subcutaneous Immunoglobulin Market Size, Share, Trends, & Industry Analysis Report

By Product (IgG, IgA, and IgM), By Application, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 130

- Format: PDF

- Report ID: PM4416

- Base Year: 2024

- Historical Data: 2020-2023

Overview

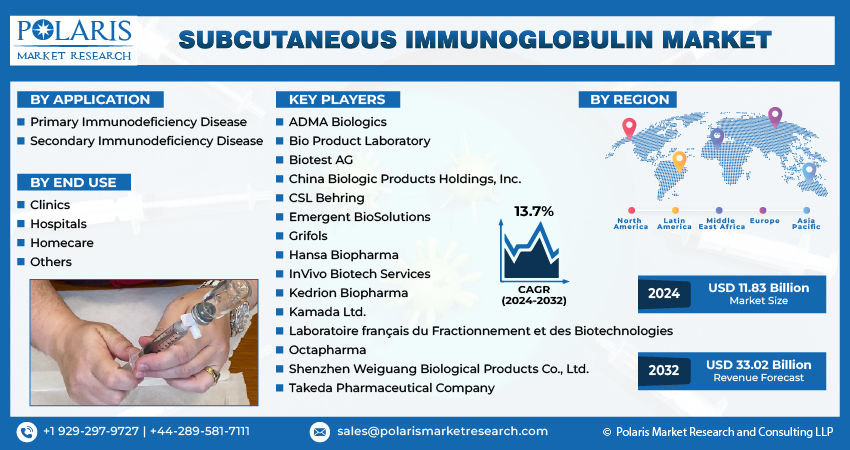

The global subcutaneous immunoglobulin market size was valued at USD 11.22 billion in 2024, growing at a CAGR of 9.11% from 2025–2034. Key factors driving demand include superior patient preference and improvement in quality of life, growth in the prevalence of immunodeficiency diseases, rising advancements in formulation technology, strong pipeline of therapies and the robust pace of product approvals.

Key Insights

- IgG dominated revenue in 2024, as it is the primary immunoglobulin isotype used to effectively treat a wide range of primary and secondary immunodeficiency disorders.

- Secondary immunodeficiency segment growth is driven by the increasing global incidence of conditions like cancer and autoimmune diseases, which can cause acquired immune deficiencies.

- Hospitals held the largest share in 2024, as initial SCig administration often requires specialized medical supervision and access to infusion facilities.

- North America led the global SCIG market in 2024, fueled by its refined healthcare systems and rapid integration of advanced therapeutic solutions.

- The U.S. dominated the North American region, a position driven by its robust clinical infrastructure and early, widespread adoption of novel immunotherapy products.

- The Asia Pacific region is anticipated to register the highest growth rate, propelled by major healthcare investments, greater disease awareness, and improved access to modern treatments.

- India's market is experiencing significant expansion, primarily due to improving diagnostic capabilities for immune disorders and increasing patient access to refined care.

Industry Dynamics

- The rising global incidence of immunodeficiency disorders is expanding the patient pool, creating growth opportunities for long-term immunoglobulin therapy demand.

- Innovations in high-concentration, low-volume formulations are enhancing treatment efficiency and patient convenience, further accelerating market adoption.

- Emerging markets represent a major untapped opportunity due to rising diagnosis rates and improving healthcare access, driving significant new patient volume.

- Extremely high treatment costs and complex reimbursement policies create substantial access barriers for patients and limit market expansion.

Market Statistics

- 2024 Market Size: USD 11.22 billion

- 2034 Projected Market Size: USD 26.78 billion

- CAGR (2025-2034): 9.11%

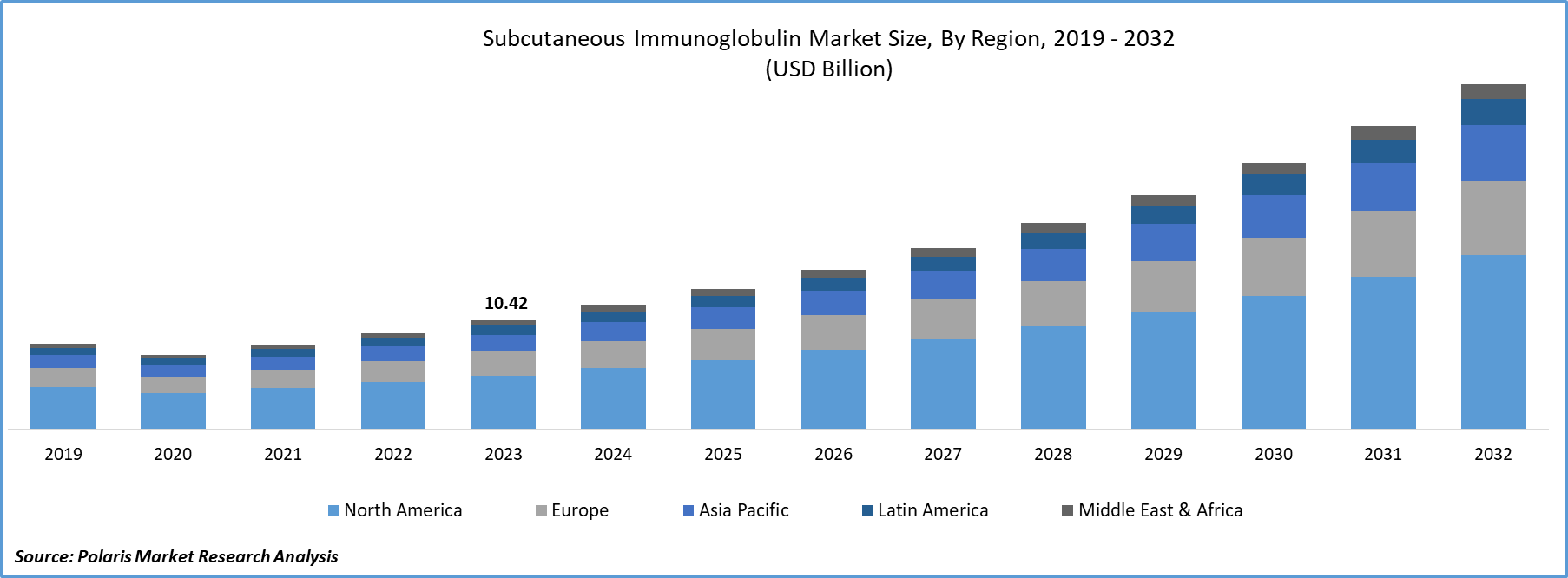

- North America: Largest market in 2024

Subcutaneous immunoglobulin (SCIg) is a therapeutic preparation of antibodies administered under the skin to treat primary and secondary immunodeficiency disorders. The market is driven by the superior patient preference and improvement in quality of life, as SCIg offers advantages over traditional intravenous administration. Patients benefit from greater autonomy, as SCIg can be self-administered at home, reducing dependency on healthcare facilities and frequent hospital visits. This autonomy enhances convenience and also minimizes treatment-related disruptions to daily life. Furthermore, SCIg is associated with fewer systemic adverse reactions and allows for steady immunoglobulin levels, contributing to improved disease management and better long-term adherence. Collectively, these factors make SCIg a preferred therapeutic choice, strengthening its demand across diverse patient populations.

The strong pipeline of therapies and the robust pace of product approvals further contribute to the expansion opportunities. Ongoing research and clinical development efforts are expanding the therapeutic potential of SCIg, leading to a steady stream of innovative formulations and delivery systems. Regulatory agencies have been granting approvals to new SCIg products that highlight improved safety profiles, flexible dosing schedules, and enhanced delivery devices. For instance, in April 2023, the FDA approved a new 50mL/10g prefilled syringe for CSL Behring's Hizentra. Providing more dosing options for patients with primary immunodeficiency or CIDP using subcutaneous immunoglobulin therapy. This continuous flow of advancements broadens the treatment landscape and also provides healthcare providers with more tailored options for patient-specific needs. Additionally, the collaboration between an active pipeline and regulatory support is expected to accelerate market adoption, ensuring SCIg remains a central part in the management of immunodeficiency conditions.

Drivers & Opportunities

Growth in Prevalence of Immunodeficiency Diseases: The growth in the prevalence of immunodeficiency diseases is boosting the expansion opportunities, as it directly increases the patient population requiring long-term immunoglobulin therapy. The demand for reliable and effective treatments continues to expand with a rising number of individuals diagnosed with primary and secondary immunodeficiency’s. A report from IDFNZ in April 2024 indicated that approximately 6 million people globally are affected by a primary immunodeficiency disorder. SCIg provides an essential therapeutic option that ensures consistent antibody levels to support immune function, thereby addressing the unmet medical needs of these patients. This growing prevalence creates sustained demand for SCIg and positions it as a critical component in the overall management of immunodeficiency disorders.

Rising Advancement in Formulation Technology: Rising advancements in formulation technology are also driving the SCIg market forward by enhancing treatment efficiency and patient convenience. Modern formulations are being developed with higher concentrations, reduced infusion volumes, and improved stability, which simplify the administration process. A 2023 report indicates Hyaluronidase-facilitated subcutaneous immunoglobulin (fSCIG) 10% is approved for primary and secondary immunodeficiency’s. However, its adoption in SID treatment remains limited due to less familiarity among hematologists and oncologists compared to established intravenous immunoglobulin therapy. These innovations reduce treatment burden, shorten infusion times, and minimize adverse effects, making SCIg more accessible and patient-friendly. Manufacturers are improving therapeutic outcomes and also driving broader acceptance of SCIg as a preferred treatment modality. This technological progress strengthens the overall value proposition of SCIg in the healthcare landscape.

Segmental Insights

Product Type Analysis

Based on product type, the segmentation includes IgG, IgA, and IgM. The IgG segment accounted for largest revenue share in 2024 primarily due to the wide therapeutic relevance of IgG in treating both primary and secondary immunodeficiency disorders. IgG formulations are widely prescribed because they provide broad-spectrum immune protection, helping patients maintain stable immunoglobulin levels over time. Their established clinical efficacy, safety profile, and availability in advanced subcutaneous formulations further strengthen their adoption. Additionally, continued innovation in IgG-based therapies and delivery methods ensures sustained preference, reinforcing the segment’s leadership in the market.

Application Analysis

In terms of application, the segmentation includes primary immunodeficiency disease and secondary immunodeficiency disease. The secondary immunodeficiency disease segment is expected to witness significant growth during the forecast period attributed to the rising incidence of conditions such as cancer, autoimmune disorders, and certain infections, which lead to secondary immune deficiencies. SCIg is increasingly recognized as an effective therapy to support immune function in these patients as treatment options evolve. Additionally, the flexibility of home healthcare administration and consistent antibody delivery make SCIg particularly beneficial for long-term secondary immunodeficiency management. This broadening therapeutic scope positions the segment as a major growth driver within the market.

End Use Analysis

The segmentation, based on end use, includes hospitals, homecare, clinics, and others. The hospitals held largest share in 2024 due to the requirement of specialized medical supervision and infusion infrastructure. They serve as the first line of treatment settings where patients are diagnosed, started on therapy, and monitored for adverse reactions. The presence of skilled healthcare professionals and access to advanced infusion facilities make hospitals the preferred choice for initial treatment. Hospitals continue to dominate as they provide comprehensive patient management and specialized care, while home care adoption is growing.

Regional Analysis

North America subcutaneous immunoglobulin market held the largest global market share in 2024. This dominance is attributed to its advanced healthcare infrastructure and high adoption of innovative immunotherapy solutions. The region benefits from strong clinical research activities, favorable reimbursement structures, and a high level of awareness among healthcare providers and patients. Collectively, these factors ensure strong growth of SCIg across both primary and secondary immunodeficiency treatments, consolidating the region’s leading position.

U.S. Subcutaneous Immunoglobulin Market Insight

U.S. held significant market share in North America subcutaneous immunoglobulin landscape in 2024 due to its advanced healthcare infrastructure and widespread availability of innovative immunotherapy solutions. Strong awareness among healthcare professionals, combined with favorable reimbursement frameworks, supports high adoption of SCIg treatments. Additionally, the presence of leading biopharmaceutical companies and ongoing clinical research enhances accessibility and accelerates the integration of advanced formulations into routine care.

Asia Pacific Subcutaneous Immunoglobulin Market

The market in Asia Pacific is projected to grow at a substantial CAGR from 2025-2034 owing to increasing healthcare investments, rising patient awareness, and expanding access to advanced treatment options. According to the Ministry of Commerce and Industry report from March 2025, India's healthcare and pharmaceutical sector received investments totaling USD 30 billion from 2022 to 2024. Rapid improvements in healthcare infrastructure, with a growing focus on personalized medicine, are driving adoption in the region. The expanding prevalence of immunodeficiency diseases further enhances the demand for SCIg, positioning the Asia Pacific as a major growth hub during the forecast period.

India Subcutaneous Immunoglobulin Market Overview

The market in India is expanding due to rising awareness of immunodeficiency disorders and growing access to advanced treatment options. Improvements in healthcare infrastructure, coupled with increased investments in specialized therapies, are driving wider adoption of SCIg. The shift toward patient-centric care, along with the rising prevalence of secondary immunodeficiency conditions, further fuels demand for subcutaneous immunoglobulin therapies in the country.

Europe Subcutaneous Immunoglobulin Market

The subcutaneous immunoglobulin landscape in Europe is projected to hold a substantial share in 2034 driven by robust regulatory support, well-established healthcare systems, and strong emphasis on patient-centric care. European healthcare policies often prioritize innovative therapies that improve patient quality of life, aligning with the advantages offered by SCIg. The region’s established network of specialized clinics and treatment centers further strengthens access and distribution. These factors, combined with high levels of clinical adoption, ensure Europe remains a major contributor to the global SCIg landscape.

Germany Subcutaneous Immunoglobulin Market

Germany market growth is driven by its strong regulatory environment, robust clinical adoption, and focus on high-quality healthcare delivery. The country benefits from a well-developed healthcare system that actively integrates innovative treatment modalities such as SCIg. Additionally, the focus on patient safety, coupled with the availability of specialized treatment centers, supports growing adoption. Germany’s commitment to advancing therapeutic options strengthens its role as an essential contributor to the European SCIg market.

Key Players & Competitive Analysis Report

The subcutaneous immunoglobulin (SCIg) competitive landscape is witnessing competition among established players such as CSL Behring, Takeda, and Grifols, who leverage strategic investments in high-concentration formulations and prefilled syringes to secure vendor share. Competitive intelligence and strategy are crucial as these leader’s target developed markets with revenue growth fueled by superior patient convenience. However, emerging markets present a substantial revenue opportunity, though market entry assessments must carefully evaluate economic and geopolitical shifts and local supply chain disruptions. The future relies on technological advancement, particularly hyaluronidase-facilitated products, which represent a major disruption and trend. Future development strategies should focus on niche emerging market segments or novel delivery systems to avoid the high barriers to entry dominated by large plasma fractionators for small and medium-sized businesses. Additionally, expert's insight confirms that sustainable value chains in plasma sourcing and manufacturing will be the ultimate determinant of long-term revenue growth and market leadership.

Major companies operating in the subcutaneous immunoglobulin industry include Baxter; Biotest; CSL Behring; GC Biopharma USA, Inc.; Grifols; Kamada Ltd.; LFB; Nufactor; Octapharma; and Takeda.

Key Players

- Baxter

- Biotest

- CSL Behring

- GC Biopharma USA, Inc.

- Grifols

- Kamada Ltd.

- LFB

- Nufactor

- Octapharma

- Takeda

Industry Developments

- July 2024: The FDA approved an expanded label for Grifols XEMBIFY to include treatment-naïve patients with primary immunodeficiencies. It is the first 20% subcutaneous immunoglobulin approved for initial therapy without requiring prior intravenous administration.

- January 2024: The FDA approved Takeda's HYQVIA for CIDP maintenance therapy in adults. This facilitated subcutaneous immunoglobulin allows for less frequent, at-home infusions, including self-administration after training, to prevent relapse.

Subcutaneous Immunoglobulin Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- IgG

- IgA

- IgM

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Primary Immunodeficiency Disease

- Secondary Immunodeficiency Disease

By End Use (Revenue, USD Billion, 2020–2034)

- Hospitals

- Homecare

- Clinics

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Subcutaneous Immunoglobulin Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 11.22 Billion |

|

Market Size in 2025 |

USD 12.22 Billion |

|

Revenue Forecast by 2034 |

USD 26.78 Billion |

|

CAGR |

9.11% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 11.22 billion in 2024 and is projected to grow to USD 26.78 billion by 2034.

The global market is projected to register a CAGR of 9.11% during the forecast period.

North America subcutaneous immunoglobulin market held the largest global market share in 2024.

A few of the key players in the market are Baxter; Biotest; CSL Behring; GC Biopharma USA, Inc.; Grifols; Kamada Ltd.; LFB; Nufactor; Octapharma; and Takeda.

The IgG segment accounted for largest revenue share in 2024.

The secondary immunodeficiency disease segment is expected to witness significant growth during the forecast period.