Subdermal Contraceptive Implants Market Share, Size, Trends & Industry Analysis Report

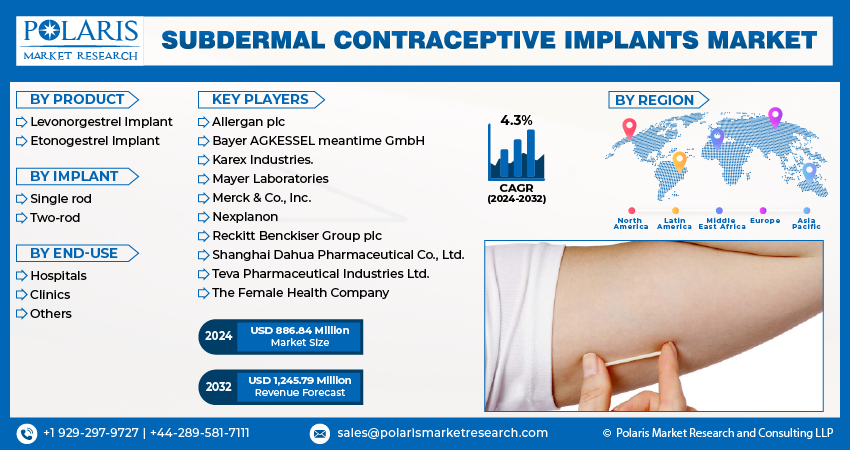

By Product (Levonorgestrel Implant, Etonogestrel Implant); By Implant; By End-Use; By Region; Segment Forecast, 2025 - 2034

- Published Date:May-2025

- Pages: 120

- Format: PDF

- Report ID: PM1844

- Base Year: 2024

- Historical Data: 2020-2023

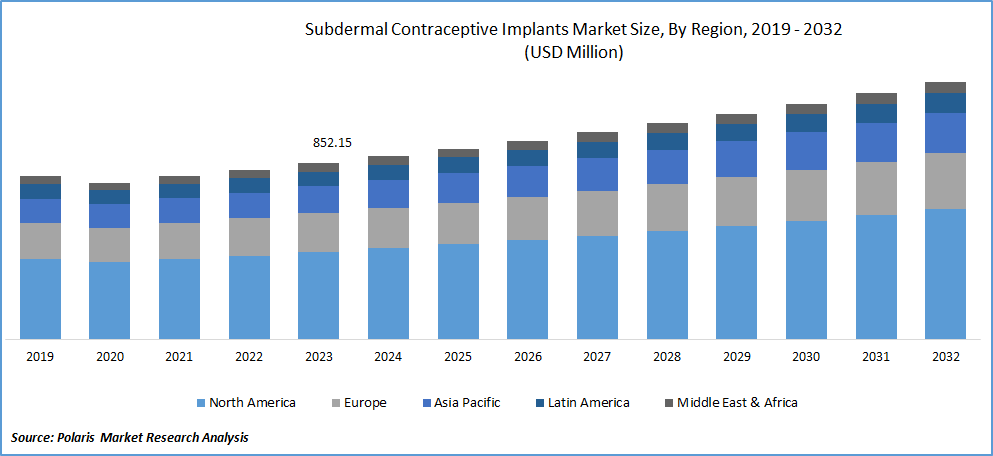

The global subdermal contraceptive implants market was valued at USD 1.1 billion in 2024 and is anticipated to grow at a CAGR of 3.90% from 2025 to 2034. The market is expanding due to growing awareness of long-acting reversible contraception methods.

Subdermal contraceptive implants, small rods inserted into the upper arm, steadily release hormones to prevent pregnancy for one to five years. These implants offer convenience, high effectiveness, and long-term birth control. The increasing demand for reliable and long-term contraceptive methods, coupled with investments in the healthcare sector, is driving the need for subdermal contraceptive implants. Technological advancements and research and development efforts support market growth due to key players' new product launches and acquisitions.

Governments worldwide are taking initiatives to improve access to subdermal implants, and insurance plans often cover FDA-approved birth control products. Countries such as Tanzania and the United States are implementing measures to increase availability and improve the supply chain of contraceptive devices and products. These factors contribute to the growing demand and scope of the subdermal contraceptive implant market.

To Understand More About this Research: Request a Free Sample Report

In collaboration with organizations like contraceptive manufacturers such as Bayer HealthCare's Jadelle, the UN has taken steps to address women's contraceptive needs in underdeveloped African economies by significantly reducing prices. This initiative aims to make contraceptives more affordable and accessible. Inexpensive subdermal contraceptive implants like the Sino-implant (II) are anticipated to acquire popularity in regions like Africa and Asia, contributing to subdermal contraceptive implants market development. Several factors are driving the demand for subdermal contraceptive implants. The increasing number of unwanted pregnancies globally has become a significant concern.

- For instance, according to the United Nations Population Fund, unintended pregnancies account for approximately half of all pregnancies worldwide, with 121 million occurring yearly. To address this issue, initiatives promoting contraceptive methods have gained traction.

Etonogestrel subdermal contraceptive implants witnessed high market demand in 2022. These implants offer a long-term contraceptive solution and are being adopted due to factors such as population growth, initiatives for population control, concerns regarding sexual health, and increased healthcare expenditure in developing countries. These factors contribute to the market's growing demand and scope for subdermal contraceptive implants.

Industry Dynamics

- Growth Driver

- Growidng Population and Rising Healthcare Expeniture

The need for subdermal contraceptive implants has risen due to their high effectiveness and affordability. Women prefer these implants because they are safe, effective for three years without intervention, and can be easily removed for a quick return to fertility. These implants work by modifying the endometrium, suppressing ovulation, and increasing the viscosity of cervical mucus.

The global market for these implants is driven by increasing demand from countries like China, Japan, and India, as well as a growing population and rising healthcare expenditure. Increasing health concerns, enhancing healthcare infrastructure, and growing awareness of preventive healthcare have also contributed to the increased demand for these implants.

Factors such as increasing awareness of contraceptives, growing concerns about fuel health, and government initiatives for population control have influenced the subdermal contraceptive implants market. The market is further supported by factors like increasing changing lifestyles, disposable income, and the introduction of reasonable contraceptives by market performers.

The rising number of abortions and unwanted pregnancies and technical advances in the field also promote the adoption of these markets. Global players are expanding their presence in developing countries to tap into the potential market, thereby driving the growth of these markets.

Report Segmentation

The market is primarily segmented based on product, implant, end-use, and region.

|

By Product |

By Implant |

By End-Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

- The levonorgestrel implant segment held the largest market share in 2024

In 2023, the levonorgestrel implants segment held the largest market share, a form of long-acting reversible contraception (LARC) that consists of small, flexible rods containing the synthetic hormone levonorgestrel. They are inserted under the skin, usually in the upper arm, and release a steady, low hormone dose into the bloodstream over an extended period.

Levonorgestrel implants are highly effective at preventing pregnancy, with a very low failure rate due to their continuous hormone release. Depending on the specific product, these implants can provide contraceptive protection for several years (e.g., 3 to 5 years) before needing replacement.

Once inserted, there's nothing else the user needs to do to maintain contraceptive effectiveness, unlike daily pills or other methods requiring regular user action. The effects of Levonorgestrel implants are reversible, meaning fertility generally returns shortly after the implant is removed.

By End-Use Analysis

- The hospital segment expected to witness the fastest CAGR during forecast period.

The hospital segment expected to witness the fastest CAGR during forecast period, as hospitals being high-traffic environments where many patients seek various healthcare services. This high footfall gives hospitals a significant advantage in attracting patients seeking contraceptive services, including these contraceptive implants. The availability of a diverse patient population contributes to the higher adoption of subdermal implants in hospitals.

Also, hospitals are equipped with advanced healthcare infrastructure, including state-of-the-art medical equipment and facilities. It enables healthcare providers in hospitals to offer patients a wide range of contraceptive options, including subdermal implants. The availability of advanced medical equipment enhances the quality of care and increases patient confidence in choosing hospitals for contraceptive needs.

Moreover, hospitals typically have a comprehensive range of medical services and departments, allowing for integrated care. It means that women seeking subdermal contraceptive implants can also access other necessary healthcare services, such as gynecological examinations, counseling, and follow-up care, all under one roof. The convenience and continuity of care offered by hospitals contribute to the preference for this setting.

Regional Analysis

-

North America accounted for the largest market share in 2024

In 2023 North America accounted for the largest market share driven by established technological advancements, healthcare infrastructure, and growing research and development activities. The region has witnessed increasing abortions, contributing to market growth. Rising health concerns, a growing number of unwanted pregnancies, and rising awareness about efficient contraceptives, including affordable implants, have also fueled the demand in North America.

Factors such as high disposable income, government industries, and corroborating healthcare programs have further supported the region's market development for subdermal contraceptives. For example, data from the Guttmacher Institute indicated a significant number of pregnancies, unwanted pregnancies, and abortions in North America, emphasizing the need for effective contraceptive methods.

The Asia Pacific region is expected to experience the fastest growth during the forecast period, driven by heightened awareness and positive initiatives implemented by both governments and private organizations. These efforts aim to improve women's access to contraceptive methods. According to the World Health Organization (WHO), approximately 214 million women in developing economies like India who wish to prevent pregnancy do not currently utilize modern contraceptive methods, including subdermal implants. In contrast, in Indonesia, around 64.0% of married women use contraception, with approximately 57% relying on modern methods and about 7.0% opting for traditional methods.

Competitive Insight

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

The main market companies in the subdermal contraceptives industry include:

- Allergan plc

- Bayer AGKESSEL meantime GmbH

- Karex Industries.

- Mayer Laboratories

- Merck & Co., Inc.

- Nexplanon

- Reckitt Benckiser Group plc

- Shanghai Dahua Pharmaceutical Co., Ltd.

- Teva Pharmaceutical Industries Ltd.

- The Female Health Company

Recent Developments

- In October 2023, Health and Family Welfare Minister Dinesh Gundu Rao launched subdermal single rod implants and SC-MPA injectable contraceptives in Karnataka, introducing these effective birth spacing options at the State Family Planning Summit in Bengaluru across four pilot districts

- In April 2022, ProMed Pharma commenced a preclinical assessment of an innovative, fully resorbable contraceptive implant. This development was made possible by receiving Bill & Melinda Gates Foundation funding.

Subdermal Contraceptive Implants Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 1.14 billion |

|

Revenue forecast in 2034 |

USD 1.6 billion |

|

CAGR |

3.90% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2032 |

|

Segments Covered |

By Products, By Implant, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

Subdermal Contraceptive Implants Market Size Worth $ 1.6 Million By 2034

The main market companies in the subdermal contraceptives industry include Mayer Laboratories, Bayer AGKESSEL meantime GmbH

North America is region contribute notably towards the Subdermal contraceptive implants Market

The global subdermal contraceptive implants market is expected to grow at a CAGR of 3.90% during the forecast period.

Subdermal contraceptive implants Market report covering key segments are product, implant, end-use, and region.