Substation Automation Market Share, Size, Trends, & Industry Analysis Report

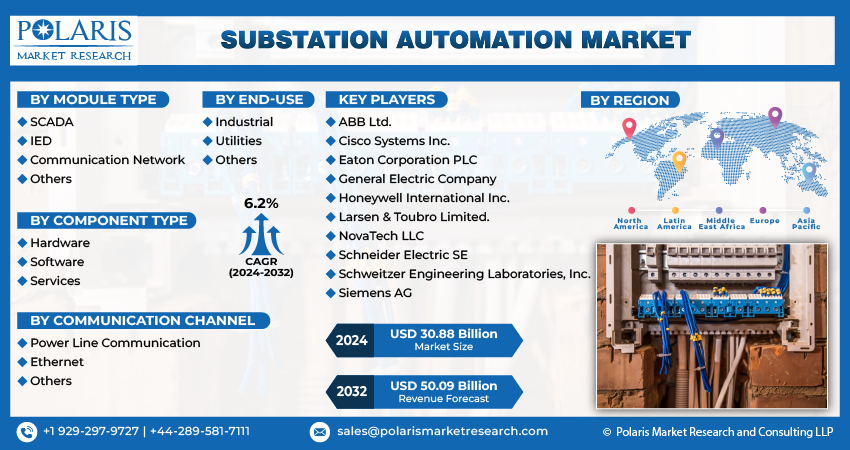

By Module Type (SCADA, IED, Communication Network, Others); By Component Type; By Communication Channel; By End-Use; By Region; Segment Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 118

- Format: PDF

- Report ID: PM1433

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

The global substation automation market was valued at USD 45.7 billion in 2024 and is expected to grow at a CAGR of 8.10% from 2025 to 2034. The market is fueled by modernization of aging infrastructure and the integration of renewable energy sources.

Key Insights

- The SCADA segment dominated with the highest revenue share in 2024, as it enables the central control and real-time monitoring of substation operations.

- The hardware segment had the largest market share, backed by the prevalence of intelligent electronic devices, digital relays, and PLCs.

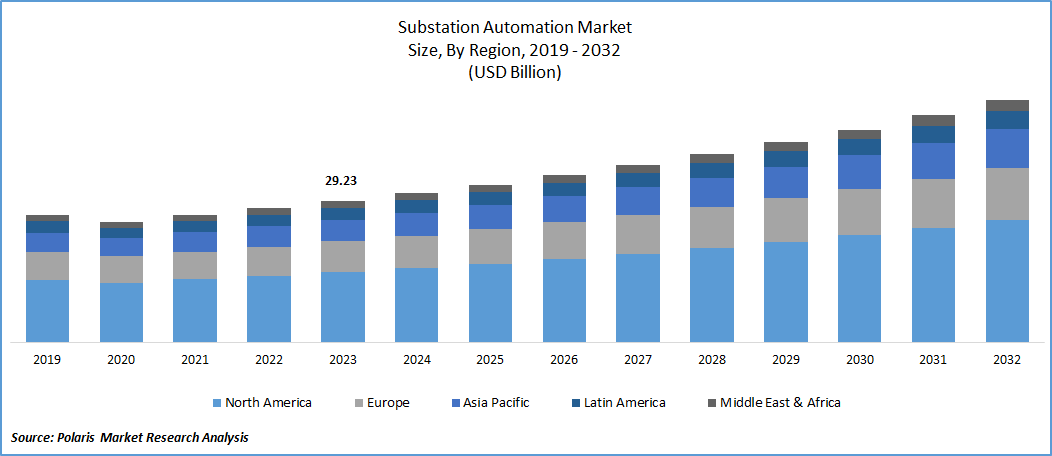

- North America led the market in 2024, fueled by increased investments in grid modernization and the use of renewable energy sources.

- The Asia Pacific is likely to be the fastest-growing regional market over the forecast period, driven by increasing power demand and the expansion of smart grids in countries such as China and India.

Industry Dynamics

- Rising investments in grid infrastructure schemes and smart cities are driving the market.

- The transition to renewable energy sources demands smarter grid management, increasing the demand for automation technologies.

- Advances in communication technologies, IoT, and AI are facilitating real-time data analysis, predictive maintenance, and effective grid management.

- One of the major findings in the substation automation market is the high initial cost and intricacy of integrating automation systems with existing legacy platforms.

Market Statistics

2024 Market Size: USD 45.7 billion

2034 Projected Market Size: USD 99.1 billion

CAGR (2025–2034): 8.10%

orth America: Largest Market Share

AI Influence on Substation Automation Market

- AI facilitates predictive maintenance by analyzing equipment data to identify faults before they lead to failure.

- It promotes grid stability by enhancing load balancing and real-time fault detection.

- AI analytics enhance decision-making by processing enormous amounts of sensor and operational data.

- Smart algorithms help automate control systems, minimizing human error and intervention.

- AI provides cybersecurity by detecting and preventing threats in substation networks.

To Understand More About this Research:Request a Free Sample Report

Substation automation is a system that integrates protection, control, automation, monitoring, and communication features within a substation. This system is designed to be flexible and customizable, allowing users to configure the input/output settings of Intelligent Electronic Devices (IEDs) based on their preferences. Modern substation layouts are organized in a way that enables users to remove or resize counters as needed.

The integration of advanced technology in substation automation, utilizing data from smart electrical equipment to automate tasks and enable remote equipment control, is driving significant growth in the substation automation market. This sector relies on specialized tools such as sensors, devices, and software for seamless two-way communication, alongside intelligent electronics like programmable logic controllers, digital sensors, and protection relays that enhance monitoring and regulation of substation equipment. As a result, the market is propelled forward by these innovations, promising enhanced efficiency and reliability in electrical infrastructure management.

Furthermore, the power supply industry is experiencing a rise in demand for reliable and efficient energy due to the increasing use of renewable energy sources. In response, manufacturers are creating advanced substation automation systems that are energy-efficient and cost-effective. These systems assist in monitoring and controlling power transmission and distribution, ultimately improving the efficiency, reliability, and safety of the power grid.

For instance, in September 2022, Siemens Smart Infrastructure and Shell Global Solutions International BV entered into a MoU to collaborate on the development of low-carbon and highly efficient energy solutions that align with the goals of the ongoing energy transition. This collaborative effort will specifically target projects aimed at generating green hydrogen for industrial applications, benefiting both Shell and its clients.

The substation automation market has been significantly affected by the COVID-19 pandemic. The pandemic has caused widespread lockdowns, disruptions in supply chains, and limitations on workforce mobility, leading to project delays and hindering the deployment of substation automation systems. The economic uncertainties started by the pandemic have also caused some utilities to reassess their capital expenditure, affecting investment decisions in automation technologies. However, the pandemic has also accelerated the digital transformation in the power sector, highlighting the importance of resilient and remotely operable infrastructure. As utilities aim to improve grid reliability, reduce operational costs, and ensure the continuity of critical services, there is a growing emphasis on adopting advanced substation automation solutions. The need for real-time monitoring, control, and diagnostics has become more pronounced in ensuring a reliable power supply amidst dynamic challenges.

Furthermore, the increasing adoption of smart grids and renewable energy sources has further fueled the demand for substation automation technologies. The integration of these systems enables utilities to efficiently manage the complexities associated with renewable energy generation and distribution, contributing to a more sustainable and resilient power grid.

Moreover, the increasing adoption of substation automation systems, providing real-time monitoring and control capabilities for power transmission and distribution, is anticipated to contribute significantly to the growth of market revenue in the forecast period. Utilities are leveraging advanced sensors, communication technologies, and data analytics integration to enhance the efficiency of power grids, thereby improving the reliability and safety of the power supply.

Industry Dynamics

Growth Drivers

Rising Investments in Smart Cities and Grid Infrastructure Projects

The increasing investments in smart cities and smart grid infrastructure are driving significant growth in the substation automation market. As cities worldwide aim to enhance efficiency, sustainability, and quality of life, the implementation of smart technologies becomes imperative. Smart grids, enabled by advanced substation automation systems, play a crucial role in optimizing energy distribution, managing demand, and integrating renewable energy sources. This heightened focus on modernizing energy infrastructure is propelled by various factors, including the growing urban population, rising energy consumption, and the need to mitigate environmental impacts. Thus, the aforementioned

Consequently, substantial investments are being directed towards the deployment of intelligent substations equipped with advanced automation, monitoring, and control capabilities. These systems enable real-time data collection, analysis, and decision-making, facilitating proactive maintenance and optimizing asset utilization. Furthermore, the integration of digital communication technologies, IoT devices, and analytics platforms enhances grid intelligence and enables predictive maintenance strategies. Overall, the convergence of urbanization, energy transition, and digitalization fuels the expansion of the substation automation market, offering opportunities for industry players to innovate and address the evolving needs of modern energy infrastructure.

Report Segmentation

The market is primarily segmented based module type, component type, communication channel, end-use, and region.

|

By Module Type |

By Component Type |

By Communication Channel |

By End-Use |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Module Type Analysis

The SCADA Segment Accounted For the Largest Revenue Share in 2024

In 2023, the SCADA segment accounted for the largest revenue share because it can oversee and control various substation automation tasks centrally. SCADA systems make possible the real-time monitoring of all processes and equipment in a substation. This allows for the quick identification and resolution of problems, reducing downtime and improving the overall effectiveness of the system. As a result, the substation automation market has seen a surge in demand for SCADA systems, leading to an increase in revenue.

On the other hand, the IED segment is anticipated to witness the fastest growth throughout the forecast period. The use of IEDs has become more frequent due to their ability to detect faults and provide protection against electrical problems such as overloads and overvoltage’s. Additionally, advancements in IED technology have enabled the integration of communication, control logic, and protective relays into a single unit, which has resulted in an increased demand for these devices in the substation automation industry.

By Component Type Analysis

The Hardware Segment Accounted For the Highest Market Share

The hardware segment accounted for the highest market share during the forecast period. Due to the increasing use of substation automation devices, such as digital relays, programmable logic controllers, and intelligent electronic devices, the power grid is becoming more efficient. These devices provide immediate monitoring and control of substation equipment, enhancing reliability and reducing downtime. They play a key role in providing the smooth and efficient operation of power transmission and distribution networks.

On the other hand, the software segment is anticipated to experience the fastest growth throughout the forecast period. The demand for advanced software solutions in substation automation, including energy management systems (EMS), distribution management systems (DMS), and supervisory control and data acquisition (SCADA), is increasing rapidly, leading to the growth of this market. These software solutions provide numerous benefits, such as improved efficiency, reduced energy consumption, increased reliability, and the ability to monitor and control substation equipment in real-time.

Regional Insights

North America Accounted For the Largest Market Share in 2024

In 2023, North America accounted for the largest market contributor in the substation automation market. The integration of advanced technologies such as IoT, AI, and cloud computing within the power sector significantly drives the growth of the substation automation market in North America. Additionally, increased investments in grid modernization projects and the implementation of government regulations promoting the adoption of renewable energy sources contribute to the expanding market for substation automation in this region.

The Asia Pacific region accounted for the fastest growth in the forecast period. The demand for reliable and efficient power supply is increasing in developing nations like China and India, which is expanding the market for substation automation in the region. Also, the Asia Pacific substation automation market is expected to grow due to the widespread adoption of smart grid technologies and advanced communication networks in the power sector.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global substation automation market include:

- ABB Ltd.

- Cisco Systems Inc.

- Eaton Corporation PLC

- General Electric Company

- Honeywell International Inc.

- Larsen & Toubro Limited.

- NovaTech LLC

- Schneider Electric SE

- Schweitzer Engineering Laboratories, Inc.

- Siemens AG

Recent Developments

- In January 2021, SEL launched a new product called the SEL-3350 Automation Controller. This controller is specifically designed for applications that require midlevel I/O and computational capabilities. The SEL-3350 has been engineered to endure challenging conditions, making it ideal for deployment in utility substations, industrial control systems, and automation systems.

- In December 2020, Hitachi ABB Power Grids introduced a new product called the Remote Terminal Unit (RTU) 530. This product aims to extend the lifespan of existing power distribution networks. The RTU 530 comes with advanced features such as secure communication, encryption, and security logging. These features make it easier to transition to modern technologies and ensure enhanced security.

Substation Automation Market Report Scope

|

FAQ's

The key companies in the substation automation market include ABB Ltd., Cisco Systems Inc., Eaton Corporation PLC, and General Electric Company.

The global substation automation market is expected to grow at a CAGR of 6.2% during the forecast period.

The key segments covered in the substation automation market report are module type, component type, communication channel, end-use and region.

The key driving factors in the substation automation market are the rise in the number of investments in smart cities and in smart grid infrastructure projects.

The substation automation market size is expected to reach $ 99.1 billion by 2034.