Substation Market Size, Share, Trends, Industry Analysis Report

: By Voltage, Component, Technology, Application (Transmission and Distribution), End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM3164

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

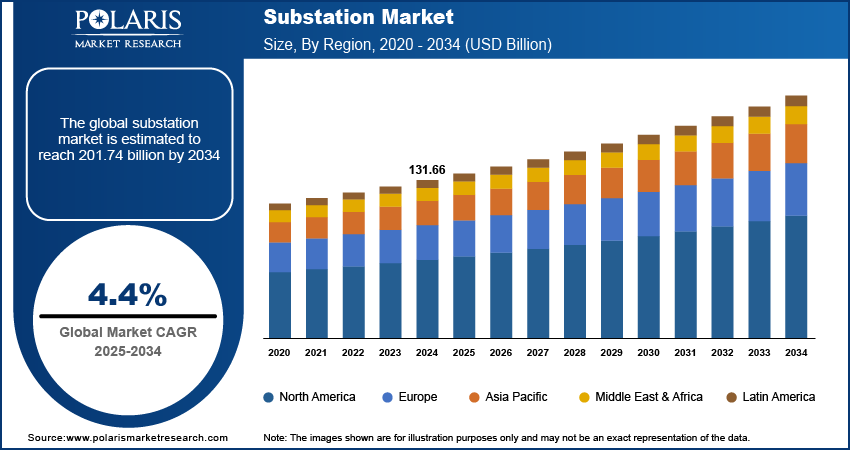

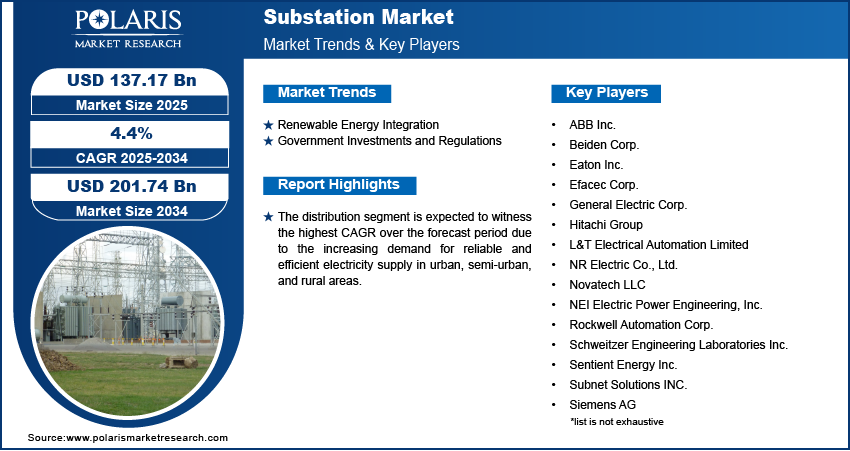

The substation market size was valued at USD 131.66 billion in 2024, growing at a CAGR of 4.4% during the forecast period. The market demand is driven by the rapid development of infrastructure in cities and the growing number of manufacturing plants requiring reliable power sources.

Key Insights

- The distribution segment is anticipated to register the highest CAGR during the projection period. The segment’s growth is fueled by the growing demand for efficient and reliable power supply.

- The industrial segment led the market in 2024, owing to the rapid expansion of energy-intensive industries like manufacturing and data centers.

- Asia Pacific dominated the global market in 2024. This is primarily due to rapid industrialization and urbanization across major economies such as India and China.

- North America is projected to register significant growth during the projection period, owing to the growing adoption of renewable energy in the region.

Industry Dynamics

- The shift towards renewable energy sources such as solar, wind, and hydroelectric power is fueling the demand for advanced substations.

- The rising investments by governments globally in advanced energy infrastructure drives the market growth.

- The growing need for grid modernization is expected to provide several market opportunities during the projection period.

- High initial capital investment associated with substations may present market challenges.

Market Statistics

2024 Market Size: USD 131.66 billion

2034 Projected Market Size: USD 201.74 billion

CAGR (2025-2034): 4.4%

Asia Pacific: Largest Market in 2024

AI Impact on Substation Market

- AI monitors equipment performance and environmental conditions in real time to prevent faults and improve reliability.

- Machine learning models predict transformer and switchgear failures. These models enable proactive maintenance and reduce outages.

- AI-driven load forecasting optimizes power distribution, balancing demand and minimizing energy losses.

- Advanced analytics support automated fault detection and recovery. The automated detection and recovery improve grid resilience and operational efficiency.

To Understand More About this Research: Request a Free Sample Report

The substation market refers to the industry focused on the design, manufacturing, and installation of substations, which are critical components of electrical power systems. Substations function as facilities that transform voltage from high to low or vice versa, enabling the efficient transmission and distribution of electricity from power plants to consumers. These facilities include transformers, circuit breakers, switches, and other electrical equipment to control and regulate the flow of electricity.

Urbanization and the rapid development of infrastructure in cities and industrial hubs are fueling the demand for substations to support new residential, commercial, and industrial developments. Additionally, the construction of new substations is necessary to improve energy distribution in densely populated areas, further fueling the market growth. Moreover, many countries are investing heavily in modernizing their electrical grids to improve efficiency, reliability, and security.

Innovations such as gas-insulated substations (GIS), mobile substations, and automation are expanding the capabilities of substations. These advanced technologies reduce space requirements and increase operational efficiency, reliability, and safety, attracting investment from utilities and private sector players. Furthermore, the growing number of manufacturing plants, data centers, and commercial facilities that require reliable power sources is contributing to the substation market expansion.

Market Dynamics

Renewable Energy Integration

The shift towards renewable energy sources such as wind, solar, and hydroelectric power is driving the need for advanced substations. For instance, according to the International Energy Agency, global renewable electricity generation is expected to exceed 17,000 terawatt-hours (TWh) by 2030, reflecting a nearly 90% increase from 2023. Renewable energy generation often occurs in remote areas, requiring substations to efficiently transmit and distribute electricity to urban and industrial centers. Moreover, smart substations equipped with renewable energy integration features are also in high demand, which is contributing to the substation market growth.

Government Investments and Regulations

Governments worldwide are increasing investments in energy infrastructure as part of their commitment to sustainable growth and energy security. For instance, In December 2024, according to the US Department of Agriculture, the Electric Department of the US invested USD 6 million in developing small hydroelectric and solar facilities, along with a battery energy storage system, to provide renewable energy for approximately 115 local households. This includes upgrading and expanding substation networks, particularly in emerging economies, where rapid industrialization and urbanization are creating new electricity demand.

Segment Insights

Assessment by Application Outlook

The global substation market segmentation, based on application, includes transmission and distribution. The distribution segment is expected to witness the highest substation market CAGR over the forecast period. This growth is due to the increasing demand for reliable and efficient electricity supply in urban, semi-urban, and rural areas. The expansion of residential housing projects, commercial complexes, and small-scale industries is driving the need for modernized distribution networks that handle fluctuating electricity demands. Furthermore, the push for electrification in remote areas and the integration of renewable energy sources, such as rooftop solar systems, has emphasized the importance of advanced distribution substations. These substations play a critical role in minimizing power losses, ensuring voltage stability, and enabling effective load management, which is essential for addressing the growing energy requirements of rapidly developing regions.

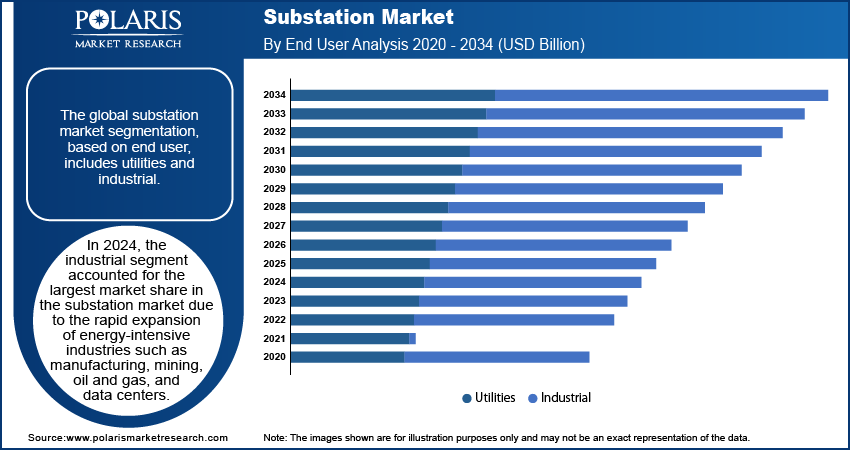

Evaluation by End User Outlook

The global substation market segmentation, based on end user, includes utilities and industrial. In 2024, the industrial segment accounted for the largest market share due to the rapid expansion of energy-intensive industries such as manufacturing, mining, oil and gas, and data centers. These sectors rely heavily on uninterrupted, high-capacity power supply to maintain operational efficiency and meet production targets. Substations tailored for industrial applications are designed to handle large power loads, ensuring minimal downtime and enhanced performance. The increasing automation of industrial processes and the adoption of advanced technologies such as robotics and IoT are further driving the demand for robust and reliable substation infrastructure. Additionally, the ongoing development of industrial parks and zones in emerging economies has further contributed to the growth of the industrial segment.

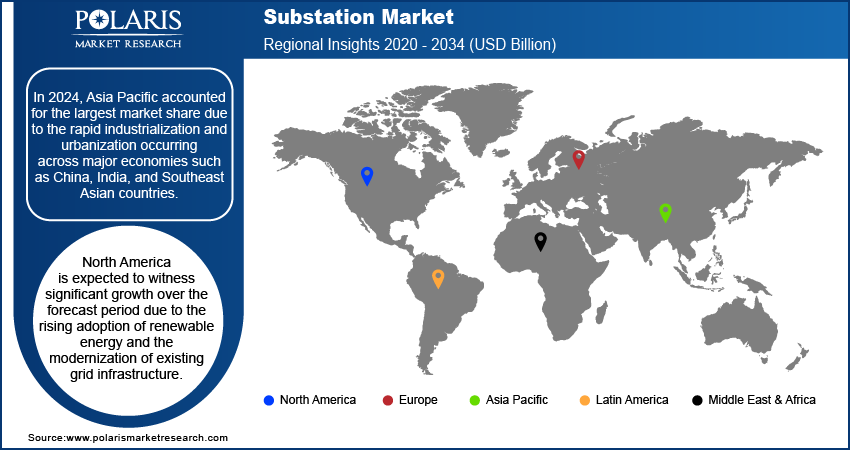

Regional Analysis

By region, the study provides substation market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific accounted for the largest market share due to the rapid industrialization and urbanization occurring across major economies such as China, India, and Southeast Asian countries. The increasing demand for electricity to support large-scale infrastructure projects, manufacturing expansion, and residential developments has driven significant investments in substation construction and grid modernization. Additionally, government initiatives aimed at improving electrification in rural and remote areas, coupled with the integration of renewable energy sources such as solar and wind into regional grids, have further boosted the deployment of advanced substations. For instance, in 2022, solar and wind energy accounted for 92% of the incremental power generation capacity in India, highlighting a strong focus on renewable energy sources. The region’s focus on upgrading aging grid infrastructure to meet growing electricity demand and ensure reliability also contributes to its dominant market position.

North America is expected to witness significant substation market growth over the forecast period due to the rising adoption of renewable energy and the modernization of existing grid infrastructure. For instance, in 2023, the US generated around 4,178 billion kilowatt-hours (kWh) of electricity from utility-scale facilities. Fossil fuels accounted for roughly 60% of this generation, with nuclear energy contributing about 19% and renewable sources providing the remaining 21%. The US and Canada are investing heavily in the development of smart grids and digital substations to enhance grid efficiency, reduce transmission losses, and accommodate the growing share of renewable energy in the power mix. Furthermore, the increasing frequency of extreme weather events in the region has highlighted the need for resilient and reliable grid systems, prompting utilities to upgrade and expand substation capacity. The proliferation of electric vehicles and energy storage systems has also accelerated the need for advanced substations to support higher power loads and manage grid stability effectively.

Substation Key Market Players & Competitive Analysis Report

The substation market is highly competitive, with key players focusing on technological advancements, strategic partnerships, and infrastructure modernization. Major companies such as ABB, Siemens, Schneider Electric, and Eaton dominate the market, offering innovative substation solutions, including digital substations and smart grid integration. Growing investments in renewable energy and grid expansion projects are driving competition among established and emerging players. Additionally, regional and local manufacturers are enhancing their product offerings to meet rising demand in developing economies.

The market is witnessing increased mergers, acquisitions, and collaborations as companies seek to expand their geographical reach and technological capabilities. Governments worldwide are investing in grid modernization and smart substations, intensifying competition. Furthermore, advancements in automation, IoT, and AI-powered monitoring systems are reshaping the industry, pushing players to innovate continuously. As the demand for reliable and efficient power transmission grows, the substation market remains dynamic and competitive, with companies striving for differentiation through efficiency and innovation.

ABB Group is a global technology and automation company, providing solutions across industries such as power generation, electrification, automation, and robotics. ABB has grown into a multinational corporation with a presence in over 100 countries. The company's mission is to deliver advanced technology that enables sustainable growth while addressing the world's energy and industrial challenges. ABB plays a significant role in the ocean economy through its wide array of technologies that support the maritime industry, offshore energy production, and renewable energy projects. The company's expertise spans automation, electrical systems, and digitalization, which are critical for improving efficiency, sustainability, and safety in ocean-based industries.

General Electric is a global industrial company that operates in China, Europe, the Americas, the Middle East, Asia, and Africa. The compnay has four segments: renewable energy, aviation, power, and healthcare. The power segment offers gas and steam turbines, as well as software solutions for power generation, industrial, government, and other customers. It also provides upgrade and service solutions. The renewables segment supplies diverse solutions for its customers by combining blade manufacturing, offshore and onshore wind, grid solutions, hybrid renewables, hydro, storage, and digital services offerings.

List of Key Companies

- ABB Inc.

- Beiden Corp.

- Eaton Inc.

- Efacec Corp.

- General Electric Corp.

- Hitachi Group

- L&T Electrical Automation Limited

- NR Electric Co., Ltd.

- Novatech LLC

- NEI Electric Power Engineering, Inc.

- Rockwell Automation Corp.

- Schweitzer Engineering Laboratories Inc.

- Sentient Energy Inc.

- Subnet Solutions INC.

- Siemens AG

- Schneider Electric Limited

- Tesco Automation Inc.

- Texas Instruments Incorporated

- Tarigma Corporation

- Toshiba Corporation

Substation Market Developments

September 2025: Hitachi announced a USD 1 billion manufacturing investment in the U.S. The company stated that the investment will focus on expanding the production of key electrical grid infrastructure in the country.

March 2025: Siemens showcased its latest advancements in grid modernization at DISTRIBUTECH 2025. The new solutions make use of advanced protection relays and intelligent automation for improving the efficiency of grids.

December 2024: Munster Technological University, in collaboration with H&MV Engineering experts in high voltage design and construction and ABB, launched a Digital Substation at MTU's Power Academy Lab in Bishopstown. This facility showcases advanced digital solutions for enhanced efficiency and reliability in power management.

October 2024: DNV launched Phase 2 of its joint industry project on floating substations to enhance collaboration in the energy sector. This phase focuses on refining technical specifications and operational frameworks for these designs, promoting innovation and efficiency in offshore power integration.

August 2024: GE Vernova deliverd the world's first 245 kV SF6-free gas-insulated substation for Réseau de Transport d'Électricité. This innovative solution aims to reduce environmental impact by eliminating sulfur hexafluoride (SF6), a harmful greenhouse gas.

Substation Market Segmentation

By Voltage Outlook (Revenue, USD Billion, 2020 - 2034)

- Low

- Medium

- High

By Component Outlook (Revenue, USD Billion, 2020 - 2034)

- Substation Automation System

- Communication Network

- Electrical System

- Transformer

- Busbar

- Protection Devices

- Circuit Breaker

- Protective Relay

- Switchgear

- Monitoring & Control System

- Human Machine Interface

- Programmable Logic Controller

- Others

- Others

By Technology Outlook (Revenue, USD Billion, 2020 - 2034)

- Conventional

- Digital

By Application Outlook (Revenue, USD Billion, 2020 - 2034)

- Transmission

- Distribution

By End User Outlook (Revenue, USD Billion, 2020 - 2034)

- Utilities

- Industrial

By Regional Outlook (Revenue, USD Billion, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 131.66 billion |

|

Market Size Value in 2025 |

USD 137.17 billion |

|

Revenue Forecast in 2034 |

USD 201.74 billion |

|

CAGR |

4.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global substation market size was valued at USD 131.66 billion in 2024 and is projected to grow to USD 201.74 billion by 2034.

The global market is projected to register a CAGR of 4.4% during the forecast period.

In 2024, Asia Pacific substation market accounted for the largest share due to the rapid industrialization and urbanization occurring across major economies such as China, India, and Southeast Asian countries.

Some of the key players in the market are ABB Inc., Beiden Corp., Eaton Inc., Efacec Corp., General Electric Corp., Hitachi Group, L&T Electrical Automation Limited, NR Electric Co., Ltd., Novatech LLC, NEI Electric Power Engineering, Inc., Rockwell Automation Corp., Schweitzer Engineering Laboratories Inc., Sentient Energy Inc., Subnet Solutions INC., Siemens AG, Schneider Electric Limited, Tesco Automation Inc., Texas Instruments Incorporated, Tarigma Corporation, and Toshiba Corporation.

The distribution segment is expected to witness the highest CAGR over the forecast period due to the increasing demand for reliable and efficient electricity supply in urban, semi-urban, and rural areas.

In 2024, the industrial segment accounted for the largest market share in the substation market due to the rapid expansion of energy-intensive industries such as manufacturing, mining, oil and gas, and data centers.