Surgical Blade Market Size, Share, Trends, Industry Analysis Report

: By Product (Stainless Steel, High-Grade Carbon Steel, and Others), Material, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 128

- Format: PDF

- Report ID: PM4070

- Base Year: 2024

- Historical Data: 2020-2023

Surgical Blade Market Overview

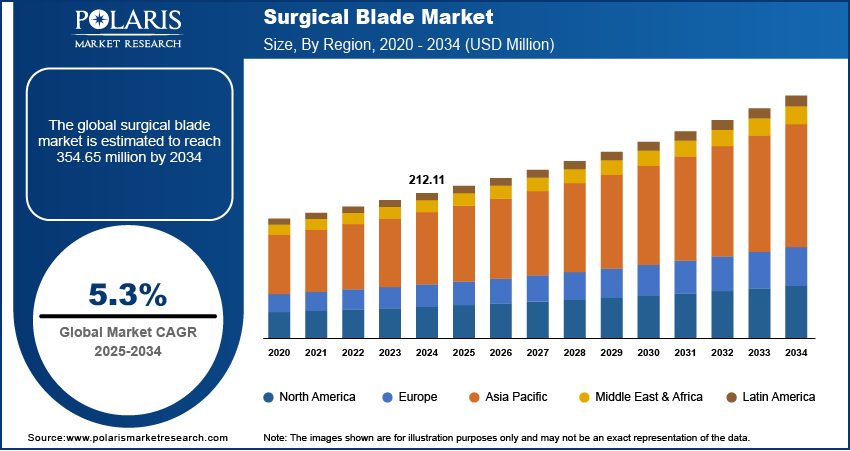

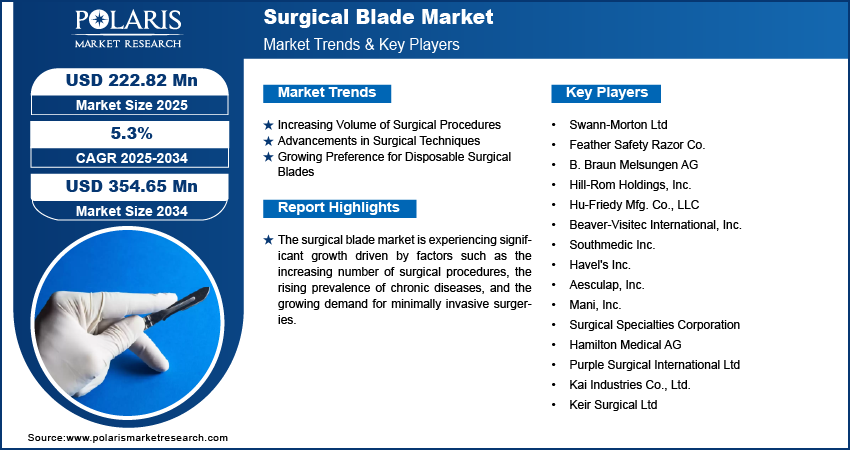

The surgical blade market size was valued at USD 212.11 million in 2024. The market is projected to grow from USD 222.82 million in 2025 to USD 354.65 million by 2034, exhibiting a CAGR of 5.3% during 2025–2034.

The surgical blade market encompasses the production, distribution, and utilization of blades used in various surgical procedures. These blades are essential tools for making precise incisions and are widely used in hospitals, clinics, and ambulatory surgical centers. The market is driven by factors such as the increasing volume of surgeries due to the rising prevalence of chronic diseases, advancements in surgical techniques, and the growing demand for minimally invasive surgeries. Additionally, there is a notable trend towards the adoption of disposable surgical blades to prevent cross-contamination and enhance patient safety. The market is further influenced by ongoing innovations in blade materials and designs to improve cutting efficiency and durability.

To Understand More About this Research: Request a Free Sample Report

Surgical Blade Market Dynamics

Increasing Volume of Surgical Procedures

The rise in the number of surgical procedures is a significant driver of the surgical blade market. This growth is largely attributed to the increasing prevalence of chronic diseases such as cardiovascular conditions, diabetes, and cancer, which often require surgical intervention. According to the World Health Organization (WHO), cardiovascular diseases are the leading cause of death globally, contributing to approximately 17.9 million deaths each year. The rising incidence of such diseases has led to a higher demand for surgical procedures, thereby boosting the demand for surgical blades.

Advancements in Surgical Techniques

Advancements in surgical techniques, such as minimally invasive procedures, robotic-assisted surgeries, and precision medicine, are driving the demand for surgical blade market. As surgeons increasingly adopt techniques that require finer, more precise incisions, there is a growing need for blades with enhanced sharpness, durability, and specialized designs. Innovations like laser-cut and coated blades improve performance, reducing tissue damage and promoting faster patient recovery. Additionally, the rise of robotic surgery necessitates ultra-sharp, micro-sized blades that enhance accuracy. These technological improvements are expanding the surgical blade market, as hospitals and healthcare providers seek advanced tools to support evolving surgical practices.

Growing Preference for Disposable Surgical Blades

The growing preference for disposable surgical blades is another key driver. Disposable blades are increasingly favored due to their ability to reduce the risk of cross-contamination and hospital-acquired infections. The Centers for Disease Control and Prevention (CDC) estimates that approximately 1 in 31 hospital patients has at least one healthcare-associated infection on any given day. To mitigate this risk, healthcare facilities are adopting single-use surgical blades, which offer a safer and more hygienic alternative. This trend is expected to continue, further propelling the demand for disposable surgical blades.

Surgical Blade Market Segment Insights

Surgical Blade Market Assessment by Product

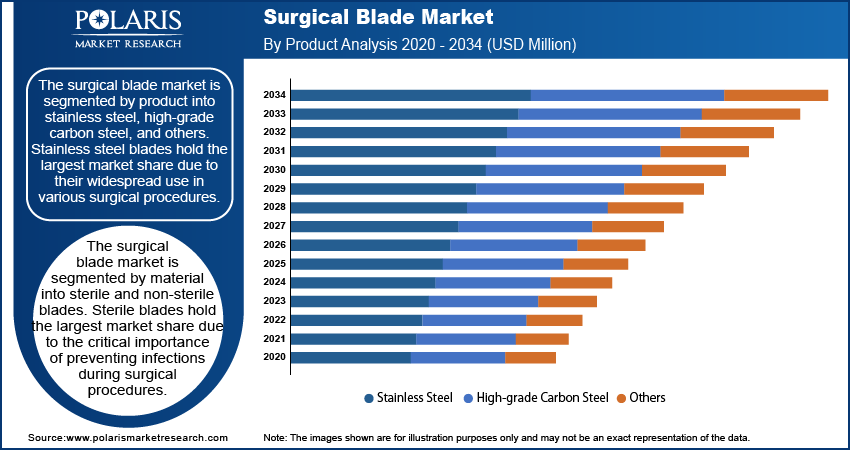

The surgical blade market is segmented by product into stainless steel, high-grade carbon steel, and others. Stainless steel blades hold the largest surgical blade market share due to their widespread use in various surgical procedures. Their popularity is driven by their durability, corrosion resistance, and cost-effectiveness, making them a preferred choice in many healthcare settings. Stainless steel blades are particularly valued for their ability to maintain sharpness over multiple uses, which is essential in procedures requiring precision.

High-grade carbon steel blades are also registering the fastest growth rate in the market. This growth is attributed to their superior sharpness and edge retention, which are critical for complex surgeries that demand high precision. The adoption of high-grade carbon steel blades is also influenced by the increasing number of minimally invasive surgeries, where precision and reduced tissue damage are crucial. Additionally, the others category, which includes ceramic and diamond-coated blades, is gaining attention for specialized applications, although they currently occupy a smaller market share.

Surgical Blade Market Evaluation by Material

The surgical blade market is segmented by material into sterile and non-sterile blades. Sterile blades hold the largest market share due to the critical importance of preventing infections during surgical procedures. Moreover, it is also the segment to witness the highest growing rate. The demand for sterile blades is driven by stringent regulatory standards and protocols in healthcare facilities aimed at ensuring patient safety. Their single-use nature further enhances their appeal, as it eliminates the risk of cross-contamination, making them the preferred choice in most surgical settings.

Surgical Blade Market Outlook by End Use

The surgical blade market segmentation, based on end use, includes hospitals, clinics, and ambulatory surgical centers (ASCs). Hospital segment holds the largest market share. Hospitals are the primary consumers of surgical blades due to the high volume of surgical procedures performed in these settings. The comprehensive range of surgeries conducted in hospitals, from routine to complex procedures, necessitates a constant supply of high-quality surgical blades. Additionally, the availability of advanced medical infrastructure and skilled healthcare professionals further supports the dominant position of hospitals in this market segment.

Ambulatory surgical centers (ASCs) are registering the highest CAGR in the market. This rapid growth can be attributed to the increasing preference for outpatient surgeries that offer cost-effective solutions and reduced hospital stays. ASCs provide specialized surgical care with shorter recovery times, leading to a rising demand for surgical blades tailored for minimally invasive procedures. The shift towards these centers is driven by patient convenience, lower costs, and advancements in surgical technology, contributing to the robust growth of this segment.

Surgical Blade Market Regional Insights

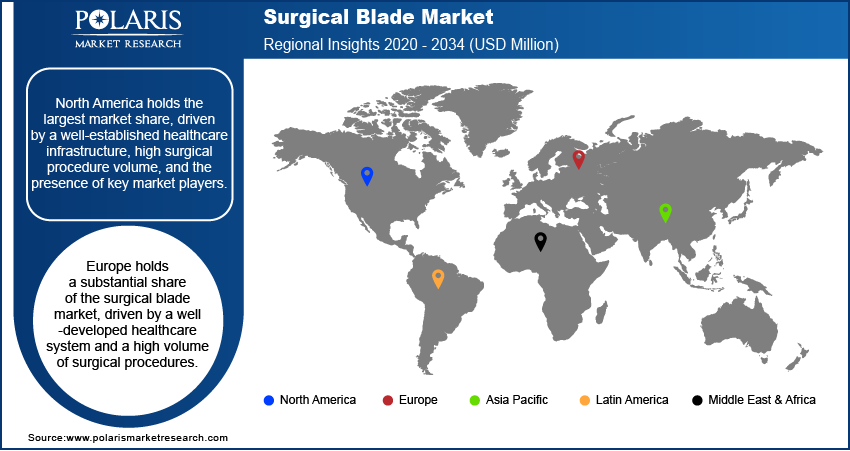

By region, the study provides surgical blade market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share, driven by a well-established healthcare infrastructure, high surgical procedure volume, and the presence of key market players. The region's advanced medical technology and stringent healthcare regulations further support the demand for high-quality surgical blades. Additionally, the increasing prevalence of chronic diseases and the rising number of ambulatory surgical centers contribute to the region's dominance. Europe follows closely due to its robust healthcare system, while Asia Pacific is witnessing significant growth, fueled by rising healthcare investments and an expanding patient population.

Europe holds a substantial share of the surgical blade market, driven by a well-developed healthcare system and a high volume of surgical procedures. The region benefits from strong government support for healthcare infrastructure and the presence of leading medical device manufacturers. Countries such as Germany, the UK, and France are major contributors, with a focus on adopting advanced surgical techniques and ensuring compliance with stringent regulatory standards. The growing elderly population and the rising prevalence of chronic diseases further boost the demand for surgical blades in Europe.

Asia Pacific is experiencing rapid growth in the surgical blade market, attributed to increasing healthcare expenditure and the expansion of healthcare facilities. Emerging economies such as China and India are driving this growth due to their large populations, rising middle class, and improving access to healthcare services. Additionally, the growing prevalence of chronic diseases and the rising number of surgical procedures in the region are fueling demand. Government initiatives to improve healthcare infrastructure and the growing trend of medical tourism also contribute to the strong market expansion in Asia Pacific.

Surgical Blade Market Key Players and Competitive Insights

The surgical blade market features several key players actively contributing to the industry. These include companies such as Swann-Morton Ltd; Feather Safety Razor Co.; B. Braun Melsungen AG; Hill-Rom Holdings, Inc.; and Hu-Friedy Mfg. Co., LLC. Other prominent names include Beaver-Visitec International, Inc.; Southmedic Inc.; Havel's Inc.; and Aesculap, Inc. Additionally, companies such as Mani, Inc.; Surgical Specialties Corporation; and Hamilton Medical AG play a crucial role in the market. Further notable players include Purple Surgical International Ltd; Kai Industries Co., Ltd.; and Keir Surgical Ltd.

The competitive landscape of the surgical blade industry is characterized by a mix of well-established companies and emerging players focusing on innovation and product development. Many companies are investing in research and development to improve blade materials and designs, aiming for higher precision and reduced patient recovery time. The market is also witnessing strategic partnerships and collaborations to enhance product portfolios and expand geographic reach. Additionally, the growing emphasis on patient safety has led to increased adoption of disposable surgical blades, prompting companies to innovate and meet the evolving needs of healthcare providers.

Insights into the competitive dynamics reveal that companies are leveraging technological advancements and focusing on quality assurance to maintain their market positions. The increasing number of surgical procedures globally and the rising demand for minimally invasive techniques are driving competition among players to offer superior products. Market participants are also exploring opportunities in emerging markets, where healthcare infrastructure is rapidly developing, to capitalize on the growing demand for surgical instruments. This competitive environment is expected to foster continued innovation and expansion in the surgical blade market.

Swann-Morton Ltd is a prominent manufacturer of surgical blades and handles. It is known for its wide range of precision blades used in various medical fields. The company is based in the UK and has a strong global presence, supplying to hospitals, clinics, and other healthcare facilities.

Feather Safety Razor Co., based in Japan, is a key player in the surgical blade market. It offers high-quality blades known for their sharpness and durability. The company serves both domestic and international markets, providing surgical blades that cater to a variety of medical applications.

List of Key Companies in Surgical Blade Market

- Swann-Morton Ltd

- Feather Safety Razor Co.

- B. Braun Melsungen AG

- Hill-Rom Holdings, Inc.

- Hu-Friedy Mfg. Co., LLC

- Beaver-Visitec International, Inc.

- Southmedic Inc.

- Havel's Inc.

- Aesculap, Inc.

- Mani, Inc.

- Surgical Specialties Corporation

- Hamilton Medical AG

- Purple Surgical International Ltd

- Kai Industries Co., Ltd.

- Keir Surgical Ltd

Surgical Blade Market Developments

- November 2024: Feather Safety Razor Co. introduced an updated version of their safety blade line, focusing on enhanced precision and safety features, which reflects their continuous efforts in product innovation.

- October 2024: Swann-Morton announced the launch of a new range of blades designed specifically for minimally invasive surgeries, highlighting their commitment to addressing evolving surgical needs.

Surgical Blade Market Segmentation

By Product Outlook (Revenue-USD Million, 2020–2034)

- Stainless Steel

- High-Grade Carbon Steel

- Others

By Material Outlook (Revenue-USD Million, 2020–2034)

- Sterile

- Non-Sterile

By End Use Outlook (Revenue-USD Million, 2020–2034)

- Hospitals

- Clinics

- Ambulatory Surgical Centers (ASCs)

By Regional Outlook (Revenue-USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Surgical Blade Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 212.11 Million |

|

Market Size Value in 2025 |

USD 222.82 Million |

|

Revenue Forecast by 2034 |

USD 354.65 Million |

|

CAGR |

5.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The surgical blade market has been segmented into detailed segments of product, material, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy: The growth and marketing strategies in the surgical blade market focus on innovation, product differentiation, and expanding geographic reach. Companies are investing in research and development to create advanced blade materials that offer greater precision and durability. Marketing efforts are increasingly targeted at educating healthcare providers about the benefits of high-quality, disposable blades to reduce infection risks. Strategic partnerships with hospitals and clinics, as well as collaborations with medical device distributors, help enhance market penetration. Additionally, companies are focusing on emerging markets where healthcare infrastructure is improving, aiming to capture new growth opportunities.

FAQ's

The surgical blade market size was valued at USD 212.11 million in 2024 and is projected to grow to USD 354.65 million by 2034.

The market is projected to register a CAGR of 5.3% during the forecast period, 2024-2034.

North America had the largest share of the market.

The surgical blade market features several key players actively contributing to the industry. These include companies like Swann-Morton Ltd, Feather Safety Razor Co., B. Braun Melsungen AG, Hill-Rom Holdings, Inc.,; Hu-Friedy Mfg. Co., LLC.; Beaver-Visitec International, Inc., Southmedic Inc., Havel's Inc., and Aesculap, Inc.

The stainless steel segment accounted for the larger share of the market in 2024.

A surgical blade is a small, sharp-edged instrument used in various medical procedures to make precise incisions in the skin and other tissues. It is typically made of stainless steel or high-grade carbon steel and is designed for single-use or multiple uses depending on the type. Surgical blades are used by healthcare professionals in surgeries, biopsies, and other medical interventions where accuracy and minimal tissue damage are essential. They are available in various sizes and shapes, each tailored for specific surgical needs.

A few key trends in the market are described below: Shift towards Disposable Blades: Increasing preference for single-use surgical blades to minimize the risk of cross-contamination and infection. Advancements in Blade Materials: Development of higher-quality, sharper, and more durable materials for improved precision and efficiency. Minimally Invasive Surgeries: Growing demand for surgical blades tailored for minimally invasive techniques, requiring smaller incisions. Technological Integration: Integration of advanced manufacturing technologies to enhance blade precision and consistency.

A new company entering the surgical blade market could focus on offering innovative, high-quality disposable blades that prioritize patient safety and minimize infection risks. Investing in research to develop advanced materials that enhance sharpness, durability, and precision for minimally invasive surgeries could give the company a competitive edge. Additionally, targeting emerging markets with expanding healthcare infrastructure and a growing demand for surgical instruments could be a strategic move. Building strong partnerships with hospitals and healthcare providers and emphasizing the benefits of their products through educational marketing campaigns could help establish a solid market presence.

Companies manufacturing, distributing, or purchasing Surgical Blade and related products, and other consulting firms must buy the report.