Surimi Market Share, Size, Trends, Industry Analysis Report

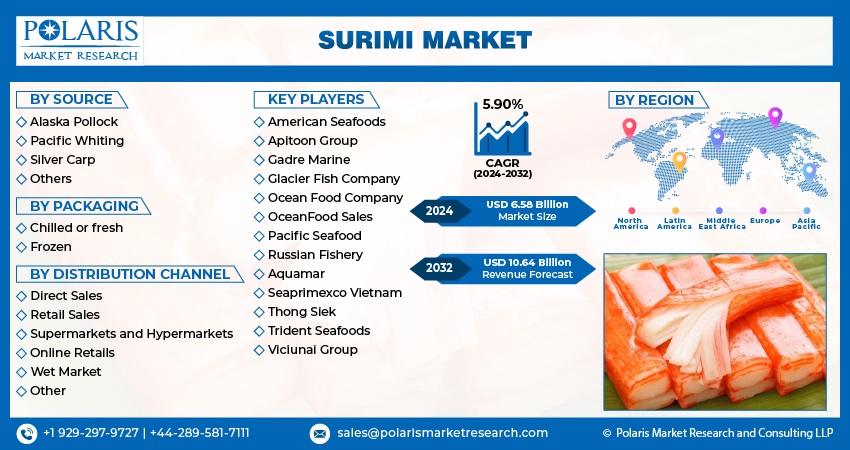

By Source (Alaska Pollock, Pacific Whiting, Silver Carp, Others; By Packaging; By Distribution Channel; By Region; Segment Forecast, 2024-2032

- Published Date:Jan-2024

- Pages: 119

- Format: PDF

- Report ID: PM3424

- Base Year: 2023

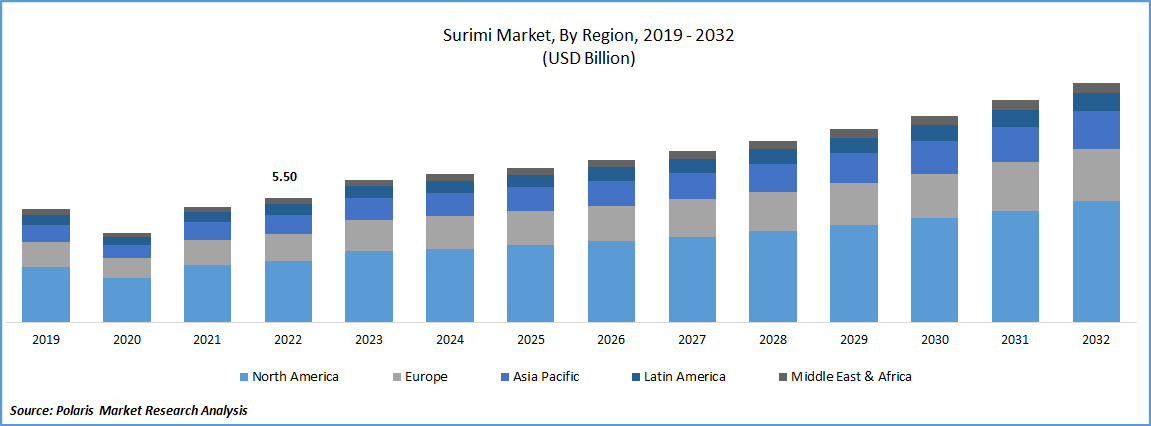

- Historical Data: 2019-2022

Report Outlook

The global surimi market was valued at USD 6.34 billion in 2023 and is expected to grow at a CAGR of 5.90% during the forecast period. Escalating the popularity of the surimi across the various countries worldwide is one of the foremost factors improving the global revenue. The popularity of surimi has been increasing for several reasons such as low-cost and versatility. It is considered to be a healthier alternative to other processed meats due to its lower fat and calorie content. Many countries are opting for surimi due to its health benefits. For example, in February 2022, In order to compete with the United States on the worldwide market, Russia aims to further grow its fish processing industry by increasing the production of surimi, notwithstanding the current military confrontation with Ukraine. As a result, rising popularity of surimi is majorly contributing got the market’s growth.

To Understand More About this Research: Request a Free Sample Report

The COVID-19 pandemic has caused a shift in consumer demand, with many people opting for shelf-stable, long-lasting foods like surimi. As a result, the demand for surimi has increased in some markets. However, it has also led to the closure of restaurants and other food service establishments, reducing the demand for surimi in these channels. The lockdown has led the uncertainty in the global market, with many manufacturers and distributors unsure of what the future holds. This has led to cautious business decisions and a focus on cost-cutting measures. As a result, COVID-19 pandemic has had a mixed impact on the surimi market, with disruptions in supply and changes in consumer demand being the main drivers of change.

Industry Dynamics

Growth Drivers

Augmenting consumption of fish-based food or sea food across many countries is one of the primary factors likely to bolster the growth of global market. For instance, as per the UN Food and Agriculture Organization, around the world, fish and other marine animals are crucial for nutrition and food security. Fish enthusiasts include Portugal, South Korea, and Japan, whereas landlocked nations like Afghanistan, Ethiopia, and Tajikistan are at the opposite end of the spectrum with annual per capita intake of less than 1 kilogramme. As a result, increasing demand for sea food is apparently intensifying the growth of global market

Enhancing the market strategies executed by the various players is another major factor supporting the global market. Many consumers are seeking for surimi due to its excellent health benefits. To tap the huge consumer base across the world, businesses are focusing on expanding their revenue stream by implementing market strategies. For example, in December 2022, to decrease the amount of plastic and increase recyclability, Mondi has given Angulas Aguinaga supplementary packaging made of recyclable paper for its Krissia brand chilled surimi sticks. Likewise, many other businesses are also engaging in the research and development of the surimi market. This is dramatically heightening the growth of the global market.

Report Segmentation

The market is primarily segmented based source, packaging, distribution channel, and region.

|

By Source |

By Packaging |

By Distribution Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Alaska Pollock segment held largest share in the global market in 2022

In fiscal year 2022, the Alaska Pollock segment dominated the market with major share as it is an important seafood product that provides a healthy and sustainable source of protein, supports local economies, and offers a versatile ingredient for many different types of cuisine. Alaska Pollock is a major commercial fishery in the United States and is an important source of revenue for many fishing communities. The surimi industry provides jobs and income for many people involved in fishing, processing, and distribution. For instance, December 2021, in order to highlight the long-underrated benefits of Wild Caught Alaska Pollock, Aquamar, one of the top surimi producers in North America, is launching a brand makeover. Many companies are also contributing in the market by doing developments. As a result, the popularity Alaska Pollock is fruitfully enhancing across the world.

Chilled or fresh packaging is accounting largest market share in 2022

In packaging type, chilled and fresh type is dominating the market with major share in global market as it is processed and packaged immediately after the fish is caught, ensuring that the product retains its quality and freshness. Chilled or fresh surimi is convenient for consumers who want a quick and easy source of protein for meals or snacks. The product can be consumed as is or used as an ingredient in a variety of dishes. Fresh or chilled surimi is a healthier option compared to other processed meats. It is low in fat, calories, and carbohydrates, and high in protein, making it an ideal food for people who want to maintain a healthy diet.

Supermarkets/Hypermarkets segment is dominating the global market in 2022

In 2022, the supermarkets and hypermarkets segment held the largest global share in terms of volume and value. This is attributed to the benefits of this distribution channel such as the convenience, large product selection, and many other benefits. Large number of consumers are seeking to go supermarket and hypermarket to purchase surimi due to its promotional activities. These often have promotional activities, such as sales or discounts, to encourage consumers to purchase surimi products. This can increase consumer awareness and demand for surimi. Also, they offer a large selection of surimi products, including different brands, flavors, and packaging options.

Asia Pacific is accounting the largest share in the global market in 2022

In the fiscal year 2022, Asia Pacific is expected to lead the global market with major share as the region is the largest consumer of surimi in the world. The region has abundant supplies of raw materials for surimi production, including Alaska Pollock, which is the most commonly used fish for surimi production. Growing awareness of the surimi is one of the prime factors driving the growth of the market. For example, the first "surimi benefication project" in India was introduced by Keshav B. Koli, CMD-SMSSL, under the company's brand name nakhwa. Also, according to National Surimi Association, nearly 967 tonnes of frozen surimi were produced in Hokkaido in December 2022. This factor is augmenting the growth of market in the Asia Pacific region.

North America is accounting a significant share in the global market due to growing technological advancements in the region. For example, in October 2022, The Association of Genuine Alaska Pollock Producers (GAPP) Annual Meeting, which celebrated everything about Wild Alaska Pollock, unveiled fifteen new partners from three different nations and a range of distribution channels, including retail, convenience, out-of-home, and new product innovation. These new collaborations were the result of a concerted effort to find partners for the Programme who share the Program's enthusiasm for the limitless potential of wild Alaskan pollock and who are prepared to provide an equal or greater commitment of matching money to assure the success of the various programmes. As a result, this factor is broadening the market’s growth in North America.

Competitive Insight

The global market involves American Seafoods, Apitoon Group, Gadre Marine, Glacier Fish Company, Ocean Food Company, OceanFood Sales, Pacific Seafood, Russian Fishery, Aquamar, Seaprimexco Vietnam, Thong Siek, Trident Seafoods, and Viciunai Group.

Recent Developments

- In December 2021, Shining Ocean completed the acquisition of the True World Group by the Aquamar. True World Foods, a company owned by the TWG that distributes fish to food-service venues, has locations in the US, Canada, the UK, & Spain.

Surimi Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 6.58 billion |

|

Revenue forecast in 2032 |

USD 10.64 billion |

|

CAGR |

5.90% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019– 2022 |

|

Forecast period |

2024– 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Source, By Packaging, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

American Seafoods Group, Apitoon Group, Aquamar Inc (Lm Foods LLC), Gadre Marine Pvt. Ltd., Glacier Fish Company LLC, Ocean Food Company Ltd., OceanFood Sales Ltd., Pacific Seafood Group, Russian Fishery Company LLC, Seaprimexco Vietnam, Thong Siek Global, Trident Seafoods Corporation, Viciunai Group, etc. and others |

FAQ's

The surimi market report covering key segments are source, packaging, distribution channel, and region.

Surimi Market Size Worth $10.64 Billion By 2032.

The global surimi market is expected to grow at a CAGR of 5.92% during the forecast period.

Asia Pacific is leading the global market.

key driving factors in surimi market are augmenting consumption of fish-based food or sea food.