Protein Bar Market Share, Size, Trends, Industry Analysis Report

By Source (Plant-Based, Animal-Based); By Type; By Region; Segment Forecast, 2025-2034

- Published Date:Sep-2025

- Pages: 118

- Format: PDF

- Report ID: PM2765

- Base Year: 2024

- Historical Data: 2020-2023

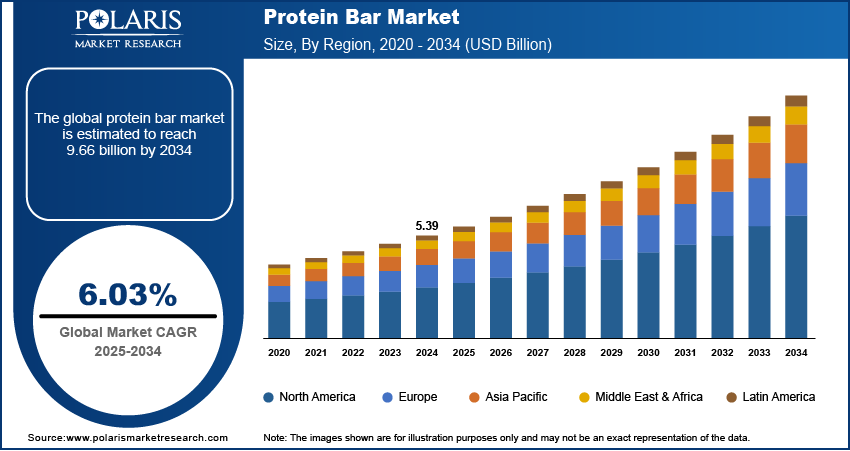

The global protein bar market was valued at USD 5.39 billion in 2024 and is expected to grow at a CAGR of 6.03% during the forecast period. Consumer preference is shifting in favor of wholesome and practical snacking options like protein bars as consumers' awareness of their health increases. This is one of the primary drivers of worldwide market expansion. The growing awareness of the benefits of taking protein bars also boosts total sales. Nutrient-rich food items called protein bars provide the body with the extra protein required.

Key Insights

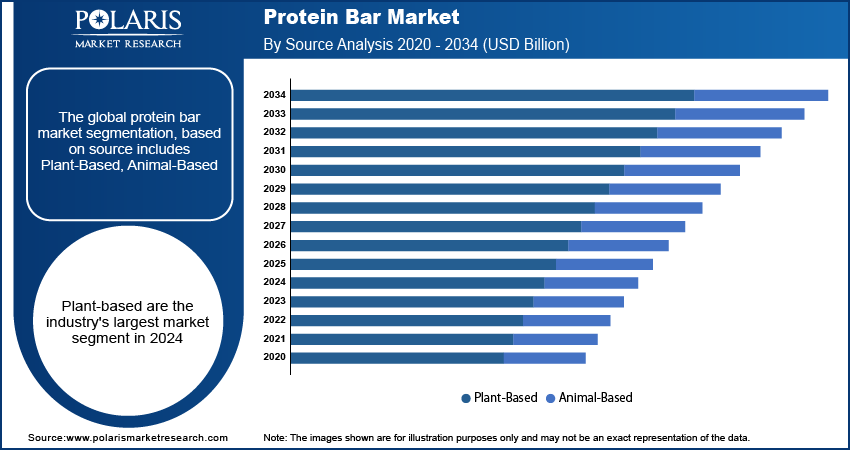

- In 2024, the Plant-based protein bars market led the market owing to the increasing preferences for vegan, sustainable, and clean-label products.

- The growing popularity of fitness trends and the rise of consumer demand for convenient, protein-rich snacks drives the sports nutrition bars segment in the Protein Bar market.

- North America is expected to have significant growth due to increasing retail availability and on-the-go and functional protein bar offerings consumption.

Industry Dynamics

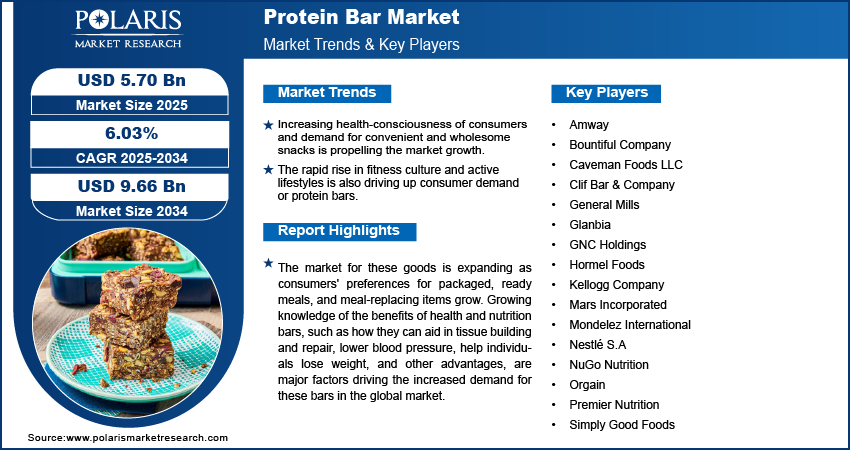

- Increasing health-consciousness of consumers and demand for convenient and wholesome snacks is propelling the market growth.

- Increasing consumer demand for plant-based diets is generating a demand for more vegan and allergen-friendly options for protein bars.

- The rapid rise in fitness culture and active lifestyles is also driving up consumer demand for protein bars.

- Innovation in flavors, ingredients and packaging are expanding the attractiveness of a product while introducing diversity to the consumer base.

Market Statistics

- 2024 Market Size: USD 5.39 Billion

- 2034 Projected Market Size: USD 9.66 Billion

- CAGR (2025-2034): 6.03%

- North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

AI Impact on Protein Bar Market

- AI enhances the speed and efficiency of product development by analyzing consumer preferences and nutrition data.

- AI develops supply chain speed and efficiency channel by predicting future demand and managing supplies; thus, developing product availability, while minimizing cost in production.

- AI improves quality assurance and mitigation through technology with AI powered real-time monitoring of production systems to tackle productive inefficiencies and mitigate potential risk while ensuring product consistency.

- AI uses consumer feedback data on purchasing behavior to provide insights to brands to do effective targeting to consumers with product variation.

The market for these goods is expanding as consumers' preferences for packaged, ready meals, and meal-replacing items grow. Growing knowledge of the benefits of health and nutrition bars, such as how they can aid in tissue building and repair, lower blood pressure, help individuals lose weight, and other advantages, are major factors driving the increased demand for these bars in the global market.

For instance, according to the Viby-based company, Arla Foods Ingredients has developed an energy bar idea that enables businesses to increase the protein content in every component of their protein bars, including the mass, filling, and coating, without sacrificing taste or texture. The milk chocolate mass from Arla's Lacprodan line is made with whey protein and milk protein ingredients to maintain its flavor and softness throughout the shelf life and provides 30% protein per bar.

Despite the fact that protein bars are becoming more and more popular, businesses are increasingly focused on reducing the amount of sugar and artificial ingredients in their goods, which is a trend that is predicted to drive the growth of the nutrition bars market over the coming years. Furthermore, it is projected that the consumption of nutrition bars by athletes and sportspeople will increase.

Customers purchase protein bars for various reasons, including energy boosts, muscular growth, and weight management. Additionally, the sales of these items have risen because of fitness clubs' marketing initiatives promoting energy bars as an alternative to meal replacements. The market is anticipated to experience an increase in demand during the projected period due to the rising popularity of protein bars and the rising number of fitness clubs.

The uncertain situation across the world compelled consumers to boost their nutritional intake and eat safer and healthier meals as their interest in items that promote the overall maintenance of health and wellness grew. For instance, to complement its original energy bar range, which includes crispy and decadent bars with less sugar and carbs, Quest Nutrition, introduced the Quest snack bar in 2020. Additionally, as people started working from home or staying at home more frequently, the need for protein bars increased.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Protein is a crucial component that encourages fitness growth. To stay fit and healthy, customers are choosing energy and weight-management goods like protein bars. The popularity of protein bars among consumers who are health-conscious is growing as a result of their high nutritional content. Furthermore, these healthy foods can offer the precise protein balance needed for a healthy lifestyle.

Furthermore, incorporating bars into meals is expected to increase protein intake without adding extra calories or carbs. It is projected that these fitness trends will raise demand for protein bars because of how crucial energy bars are for giving essential minerals and proteins, boosting energy levels, and promoting muscle building. Athletes, gym goers, and people with physically demanding jobs are all encouraged to eat it as a post-workout snack. Weight lifters and athletes require adequate protein to sustain energy levels and improve performance.

The demand for the product is therefore anticipated to increase as fitness activities become increasingly popular worldwide. Furthermore, the major companies in the market, as well as other smaller competitors, have a strong propensity for product innovation to satisfy the unique needs of sportsmen.

How Regulations on Protein Products Drive the Protein Bar Market?

The imposition of regulations ensures consumer safety, accurate labeling, and truthful marketing. This is required due to the functional and nutritional claims often associated with protein products. In many regions, “high in protein” claims must be supported by data on protein quality, digestibility, and the product's full nutritional matrix. Market players must comply with these regulations to launch or operate a protein bar brand in India (or already doing so). Industry players must adhere to these regulations to gain a competitive advantage. The following table consists of regulatory information across different regions.

|

Region |

Regulatory Authority |

Key Compliance Focus |

|

India |

Food Safety and Standards Authority of India (FSSAI) |

Product safety, licensing, nutritional claims, HFSS restrictions, labeling accuracy, and GMP compliance |

|

U.S. |

Food and Drug Administration (FDA) |

Food classification, labeling, supplement claim substantiation, allergen disclosure, and CGMP compliance |

|

European Union (EU) |

European Food Safety Authority (EFSA) |

Nutrition and health claims, ingredient transparency, protein content verification, and additive limits |

|

Australia/Singapore/Japan |

FSANZ/SFA/CAA |

Allergen labeling, packaging transparency, marketing claims, and sugar and additive limits |

|

Global Trend |

— |

Growing focus on protein verification, clean-label, functional ingredient substantiation, and front-of-pack labeling |

Report Segmentation

The market is primarily segmented based on source, type, and region.

|

By Source |

By Type |

By Region |

|

|

|

Know more about this report: Request for sample pages

Plant-based are the industry's largest market segment in 2024

Plant-based protein bars are anticipated to dominate the industry in 2024. Considering that they are created using only organic foods like fruits, butter, seeds, and many others, which are rich in nutrients and defend the body against a variety of diseases. As more individuals choose to eat a plant-based diet to maintain a healthier lifestyle, there is an increase in the number of vegetarians around the world, which leads to an increase in product consumption.

For instance, according to data provided by the Vegan Society, over 629,000 people from 228 countries and territories signed up for the Veganuary campaign in 2022, which encourages people to go vegan for the entire month of January. In contrast, in 2021, there were 582,000 participants; in 2020 there were 400,000, in 2019 there were 250,000, in 2018 there were 168,500; in 2017 there were 59,500; in 2016 there were 12,800, and in 2015 there were 3,300.

Additionally, the growing number of health and fitness club members who are obsessed with preserving their bodily health drives up demand for the product, which produces greater outcomes than other types of bars.

Sports nutrition bars segment will account for a higher share of the market

In 2024, sports nutrition bars were anticipated to rule the market. Sports nutrition places a strong emphasis on the consumption of specific nutrients, including vitamins, minerals, dietary supplements, and organic compounds formed of proteins, lipids, and carbohydrates. Bodybuilders and athletes have always used sports nutrition items to improve their performance and promote muscle growth. Sports nutrition products have recently begun to gain widespread popularity among leisure and lifestyle consumers. The pattern shows a significant increase in the market's consumer demographic.

Market expansion will be fueled by the rise in the adoption of nutrition and energy bars as well as by the rising recognition of protein as a crucial constituent. Furthermore, the expanding number of people working in dangerous vocations such as tunnel building, mining, and other jobs that need eating high-protein diets to recuperate one's physical power is one factor driving the product's increased use.

The demand in North America is expected to witness significant growth during the forecast period

The increase in fitness enthusiasts and the number of gyms, fitness training facilities, and health clubs in North America are anticipated to drive market growth worldwide. Furthermore, Due to their active lifestyles and demanding work schedules, Americans are increasingly searching the market for healthier options. As a result, customers are turning to snack bars, notably energy bars, instead of traditional snacks. For instance, a deal was reached in 2021 to buy NxtBar, by GenTech Holdings., an up-and-coming leader in the high-end premium coffee and functional foods markets.

The optimum protein balance needed for a healthy lifestyle can also be found in these nutrient-dense products. In addition, including bars with meals is anticipated to boost protein intake without increasing calorie or carbohydrate intake. Protein bars play a significant role in supplying important minerals and proteins, boosting energy levels, and expanding muscle growth, all of which contribute to increased fitness awareness and demand for protein bars.

Competitive Insight

Some of the major players operating in the global market include General Mills, Simply Good Foods, Caveman Foods, Kellogg Company, Nestle, Clif Bar & Company, Glanbia, GNC Holdings, Mars Incorporated, Hormel Foods, Mondelez International, Premier Nutrition, Amway, Bountiful Company, NuGo Nutrition and Orgain.

Recent Developments

- In May 2024, Gelita launched Optibar, a collagen-peptide blend that allows manufacturers to produce protein or cereal bars with increased protein while maintaining a soft texture and long-lasting softness.

- In April 2024, Ready, a U.S. active nutrition brand, launched its Kids Whole Grain Protein Bars, made specifically to fuel active children.

- A plant-based protein bar was introduced by RXBAR, in June 2021. The brand-new RXBAR, found on RXBAR.com and in stores like Target and Kroger, is produced with 10 grams of plant-based protein bars.

Protein Bar Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 5.39 billion |

| Market size value in 2025 | USD 5.70 billion |

|

Revenue forecast in 2034 |

USD 9.66 billion |

|

CAGR |

6.03% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Source, By Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

General Mills, Simply Good Foods, Caveman Foods LLC, Kellogg Company, Nestlé S.A, Clif Bar & Company, Glanbia, GNC Holdings, Mars Incorporated, Hormel Foods, Mondelez International, Premier Nutrition, Amway, Bountiful Company, NuGo Nutrition and Orgain. |