Synoptophore Market Size, Share, Trends, Industry Analysis Report

: By Product (Manual and Automated), Application, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 122

- Format: PDF

- Report ID: PM1765

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

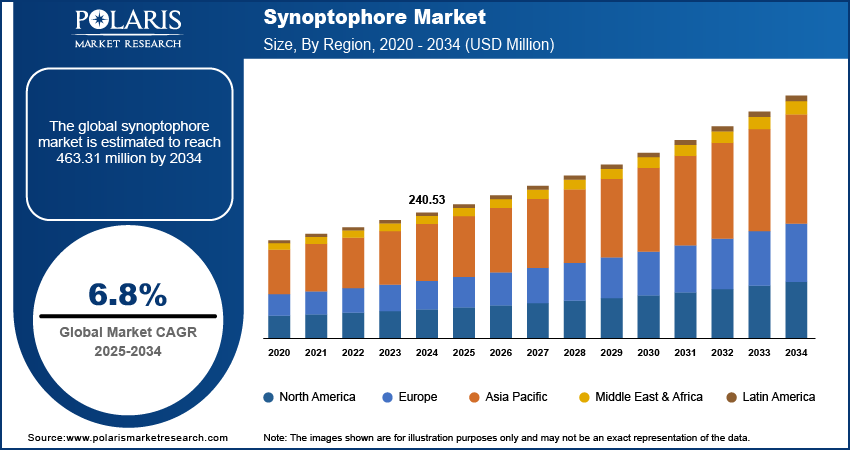

The global synoptophore market size was valued at USD 240.53 million in 2024, growing at a CAGR of 6.8% during 2025–2034. The market is driven by the rising prevalence of binocular vision disorders, advancements in ophthalmic diagnostics, growing healthcare access, and technological innovations in vision therapy, along with increasing demand for non-invasive, accurate diagnostic tools.

Key Insights

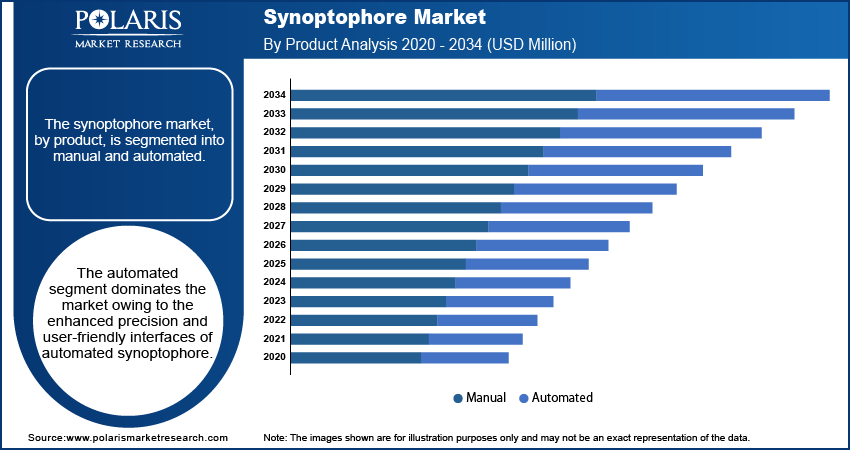

- The automated segment dominates the market due to its precise diagnostics, user-friendly interfaces, and efficiency in clinical settings.

- The diagnostics segment led the market in 2024, as synoptophores are essential for identifying binocular vision disorders and ocular muscle imbalances.

- Hospitals hold the largest share of the market due to high demand for diagnostic tools, specialized care, and advanced infrastructure.

- North America leads the synoptophore market, supported by a high prevalence of visual disorders, advanced healthcare infrastructure, and increased awareness of ophthalmic devices.

- Europe is growing rapidly, driven by increased demand for diagnostic tools, strong healthcare infrastructure, and emphasis on early detection and treatment.

- Asia Pacific is experiencing significant growth, fueled by improving healthcare in developing countries, a large pediatric population, and growing awareness of vision disorders.

Industry Dynamics

- The increasing prevalence of binocular vision disorders and technological advancements in ophthalmic diagnostics are significantly driving the market.

- Growing emphasis on early detection and personalized treatments, along with digital integration in synoptophores, further enhances market growth.

- The rising adoption of non-invasive diagnostic tools in emerging economies supports market penetration, while favorable reimbursement policies boost demand.

- Limited awareness and high cost of advanced ophthalmic devices could hinder market expansion, especially in low-income regions.

Market Statistics

2024 Market Size: USD 240.53 million

2034 Projected Market Size: USD 463.31 million

CAGR (2025–2034): 6.8%

North America: Largest market in 2024

AI Impact on Synoptophore Market

- AI enhances the accuracy of synoptophore diagnostics by automating image analysis, improving the precision of binocular vision disorder assessments.

- The integration of AI in synoptophores enables faster processing of patient data, reducing diagnostic time and increasing workflow efficiency in clinics and hospitals.

- AI algorithms can identify subtle ocular anomalies that may be missed by traditional methods, improving early detection of conditions such as strabismus.

- The use of AI in synoptophores aligns with the broader trend of digitization in healthcare, making the devices more adaptable and advanced.

To Understand More About this Research: Request a Free Sample Report

The synoptophore market is driven by the increasing prevalence of strabismus and other binocular vision disorders, along with advancements in ophthalmic diagnostic technologies. A synoptophore is a specialized medical device used in orthoptic assessments and vision therapy to evaluate and treat eye muscle imbalances. The growing demand for non-invasive and precise diagnostic tools in ophthalmology, coupled with a rising pediatric and geriatric patient base, contributes to market expansion. The integration of digital technologies in synoptophore systems enhances diagnostic accuracy and patient outcomes, further supporting market growth.

Key factors influencing the synoptophore market include increased awareness of vision disorders, expanding healthcare infrastructure, and the growing adoption of ophthalmic devices in emerging economies. Favorable reimbursement policies for vision therapy in developed regions also boost market penetration. Additionally, ongoing research and development efforts, along with technological advancements in ophthalmic imaging and therapy, are expected to create synoptophore market opportunities.

Synoptophore Market Dynamics

Increasing Prevalence of Binocular Vision Disorders

The rising incidence of binocular vision disorders, such as strabismus and non-strabismic anomalies, is a significant driver of the synoptophore market growth. A cross-sectional study conducted in Mangalore, India, involving 600 college students aged 18-23, revealed a prevalence rate of 76.5% for non-strabismic binocular vision disorders. Convergence insufficiency was the most prevalent at 27.5%, followed by convergence excess at 24% and accommodative insufficiency at 22.5%. These findings underscore the growing need for diagnostic and therapeutic devices like the synoptophore to address such widespread visual anomalies.

Advancements in Ophthalmic Diagnostic Technologies

Technological progress in ophthalmic diagnostics has significantly enhanced the capabilities of devices like the synoptophore. The integration of artificial intelligence (AI) into retinal imaging has markedly improved efficiency and accuracy. For instance, in april 2024, researchers at the National Institutes of Health (NIH) applied an AI technique called parallel discriminator generative adversarial network (P-GAN) to adaptive optics-optical coherence tomography (AO-OCT), achieving imaging speeds 100 times faster than manual methods and improving image contrast by 3.5-fold. Such advancements facilitate more precise assessments of binocular vision disorders, thereby driving the demand for advanced diagnostic tools in the synoptophore market.

Emphasis on Early Detection and Personalized Treatment

There is a growing emphasis on early detection and personalized treatment of ocular conditions, which propels the adoption of sophisticated diagnostic instruments like the synoptophore. The development of innovative optical ophthalmic imaging techniques, including optical coherence tomography, angiography, and visible light OCT, allows for a more thorough evaluation of patients and provides additional information on disease processes. These technologies enable clinicians to tailor interventions more effectively, thereby increasing the reliance on precise diagnostic tools such as the synoptophore to inform individualized treatment strategies.

Synoptophore Market Segment Insights

Assessment by Product

The synoptophore market, by product, is segmented into manual and automated. The automated segment dominates the market. This dominance is attributed to the enhanced precision and user-friendly interfaces of automated synoptophores, which streamline diagnostic procedures for binocular vision disorders. Healthcare professionals increasingly prefer these advanced devices due to their ability to deliver accurate measurements with reduced manual intervention, thereby improving workflow efficiency in clinical settings.

The growing emphasis on early detection and personalized treatment plans further drives the demand for automated synoptophores. These devices facilitate comprehensive assessments, enabling tailored therapeutic approaches for patients. Additionally, the integration of digital technologies in automated synoptophores allows for seamless data management and analysis, aligning with the broader trend toward digitization in healthcare. As a result, the automated segment continues to lead the market, reflecting its pivotal role in modern ophthalmic diagnostics.

Evaluation by Application

The synoptophore market, by application, is segmented into diagnostics and therapeutics. The diagnostics segment dominated the synoptophore market share in 2024, primarily due to its critical role in identifying visual disorders. Synoptophores are widely used for comprehensive assessments of ocular muscle imbalances and binocular vision issues, making them indispensable tools in ophthalmology.

The therapeutics segment is experiencing significant growth, driven by the increasing adoption of synoptophores in vision therapy. These devices are utilized in the treatment of conditions such as amblyopia and strabismus, offering non-invasive therapeutic options that enhance patient outcomes. The shift towards personalized medicine and early intervention strategies in ophthalmology has further propelled the demand for therapeutic applications of synoptophores, contributing to the robust expansion of this segment.

Outlook by End Use

The synoptophore market, by end use, is segmented into hospitals, clinics, and others. The hospital segment holds the largest market share in the synoptophore market, primarily due to the high demand for diagnostic equipment in these settings. Hospitals generally have the infrastructure to invest in advanced diagnostic and therapeutic tools. Furthermore, they serve a large patient base, including those who require specialized vision care. The adoption of synoptophores in hospitals is driven by their ability to perform precise diagnostics and facilitate vision rehabilitation.

The clinics segment is experiencing rapid growth, attributed to shorter waiting times, easier accessibility, and lower costs compared to hospitals. The increasing number of orthoptists establishing private practices and the rising prevalence of amblyopia in rural areas further contribute to the expansion of this segment. Additionally, clinics' ability to provide specialized and personalized care makes them a preferred choice for patients seeking vision therapy and diagnostics.

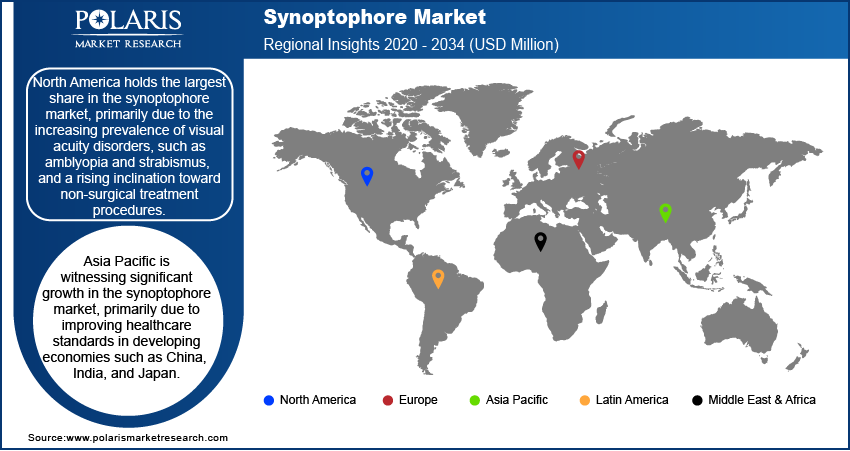

Regional Analysis

By region, the synoptophore report provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share in the synoptophore market, primarily due to the increasing prevalence of visual acuity disorders, such as amblyopia and strabismus, and a rising inclination toward non-surgical treatment procedures. The presence of key market players in the region further contributes to this dominance. Additionally, the region benefits from a well-established healthcare infrastructure and a high level of awareness regarding advanced ophthalmic diagnostic devices, contributing to the regional market dominance.

The Europe synoptophore market is experiencing rapid growth, driven by a combination of factors. The increasing prevalence of binocular vision disorders has heightened the demand for advanced diagnostic tools like synoptophores. Additionally, the region's well-established healthcare infrastructure facilitates the adoption of such specialized ophthalmic devices. A growing emphasis on early detection and treatment of visual impairments further propels market expansion. The presence of key market players and ongoing technological advancements in ophthalmic diagnostics also contribute to the market's positive trajectory in Europe.

Asia Pacific is witnessing significant growth in the synoptophore market, primarily due to improving healthcare standards in developing economies such as China, India, and Japan. The substantial pediatric population in these countries has led to an increased focus on early diagnosis and treatment of vision disorders, thereby boosting the demand for synoptophores. Enhancements in ophthalmology care infrastructure and rising awareness about eye health contribute to the market expansion in this region. Additionally, the growing adoption of advanced medical technologies aligns with the region's economic development, further supporting the synoptophore market growth.

Key Players and Competitive Insights

The synoptophore market features several active companies offering various ophthalmic diagnostic instruments. Notable among these are Prkamya Visions; 66 Vision Tech Co., Ltd.; Nanjing Redsun Optical Co., Ltd.; Gem Optical Instruments Industries; Haag-Streit Group; Takagi Seiko Co., Ltd.; Appasamy Associates; Rumax International; DAHLGREN INDIA PRIVATE LIMITED; Shanghai Link Instrument Co., Ltd.; VRmagic (a Haag-Streit subsidiary); and 6 6 Vision-Tech Co., Ltd.

Companies like Takagi Seiko Co., Ltd. are investing in product development, as demonstrated by their launch of the 2ZL-BG slit lamp microscope featuring an OM-6 flat base, aimed at improving the examination experience for eye care professionals. These strategic initiatives reflect the industry's commitment to advancing ophthalmic diagnostics and maintaining competitiveness in the evolving synoptophore market.

Haag-Streit Group, established in 1858 and headquartered in Köniz, Switzerland, specializes in the development and manufacturing of medical equipment for ophthalmology, microsurgery, and optics. Their product range includes slit lamps, perimeters, and surgical microscopes, serving eye care professionals worldwide.

Takagi Seiko Corporation, founded in 1955 and based in Takaoka, Toyama Prefecture, Japan, focuses on precision plastic molding and manufacturing. They produce a variety of products, including automotive parts, office automation components, and medical devices like ophthalmic equipment. Takagi's commitment to quality and innovation has established its presence in the global medical device market.

List of Key Companies in Synoptophore Market

- 66 Vision Tech Co., Ltd.

- Appasamy Associates

- Bino Scientific

- Chongqing Vision Star Optical Co., Ltd.

- cnshtopview

- Devine Meditech

- Gem Optical Instruments Industries

- Haag-Streit Group

- Medirer Surgical

- Nanjing Redsun Optical Co., Ltd.

- Prkamya Visions

- Rumax International

- Shanghai Link Instrument Co., Ltd.

- Takagi Seiko Co., Ltd.

- Zabbys

Synoptophore Industry Developments

- March 2025: Haag-Streit introduced the METIS 900, a comprehensive ophthalmic surgical control center that integrates various surgical technologies into a single platform.

- May 2021: Haag-Streit UK announced the launch of the Eyestar 900 in the UK. The Eyestar 900 is a swept-source OCT-based eye analyzer with swept-source technology. The analyzer enables precise measurement of the entire eye and the topographic assessment of the front and back corneal surface and the anterior chamber, including the lens.

Synoptophore Market Segmentation

By Product Outlook (Revenue – USD Million, 2020–2034)

- Manual

- Automated

By Application Outlook (Revenue – USD Million, 2020–2034)

- Diagnostics

- Therapeutics

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Hospitals

- Clinics

- Others

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Synoptophore Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 240.53 million |

|

Market Size Value in 2025 |

USD 256.29 million |

|

Revenue Forecast by 2034 |

USD 463.31 million |

|

CAGR |

6.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The synoptophore market has been segmented into detailed segments of product, application, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

Companies in the synoptophore market focus on growth and marketing strategies that emphasize technological advancements, product differentiation, and global market expansion. Manufacturers are investing in research and development to integrate digital imaging, automation, and enhanced user interfaces into their devices. Strategic collaborations with healthcare institutions and ophthalmic professionals help strengthen market presence and brand credibility. Additionally, companies are leveraging online platforms and digital marketing to increase product awareness and reach a broader customer base. Expansion into emerging markets, supported by distribution partnerships and regulatory approvals, remains a key approach to sustaining long-term growth.

FAQ's

The synoptophore market size was valued at USD 240.53 million in 2024 and is projected to grow to USD 463.31 million by 2034.

The market is projected to register a CAGR of 6.8% during the forecast period.

North America had the largest share of the market in 2024.

The synoptophore market features several active companies offering various ophthalmic diagnostic instruments. Notable among these are Prkamya Visions; 66 Vision Tech Co., Ltd.; Nanjing Redsun Optical Co., Ltd.; Gem Optical Instruments Industries; Haag-Streit Group; Takagi Seiko Co., Ltd.; Appasamy Associates; Rumax International; DAHLGREN INDIA PRIVATE LIMITED; Shanghai Link Instrument Co., Ltd.; VRmagic (a Haag-Streit subsidiary); and 6 6 Vision-Tech Co., Ltd.

The automated segment accounted for the largest share of the market in 2024.

A synoptophore is a specialized ophthalmic device used to diagnose and treat binocular vision disorders, such as strabismus (eye misalignment) and amblyopia (lazy eye). It functions by presenting separate images to each eye, allowing clinicians to assess and train a patient's eye coordination, fusion, and depth perception. The device enables orthoptic exercises and vision therapy, helping to improve binocular vision by stimulating proper eye alignment and muscle coordination. Synoptophores are widely used in hospitals, eye clinics, and optometric practices for both diagnostic and therapeutic applications.