Synthetic Leather Market Share, Size, Trends, Industry Analysis Report

By Type (Bio-based, Polyurethane, Polyvinyl Chloride, Others); By End Use; By Region; Segment Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 118

- Format: PDF

- Report ID: PM1987

- Base Year: 2024

- Historical Data: 2020-2023

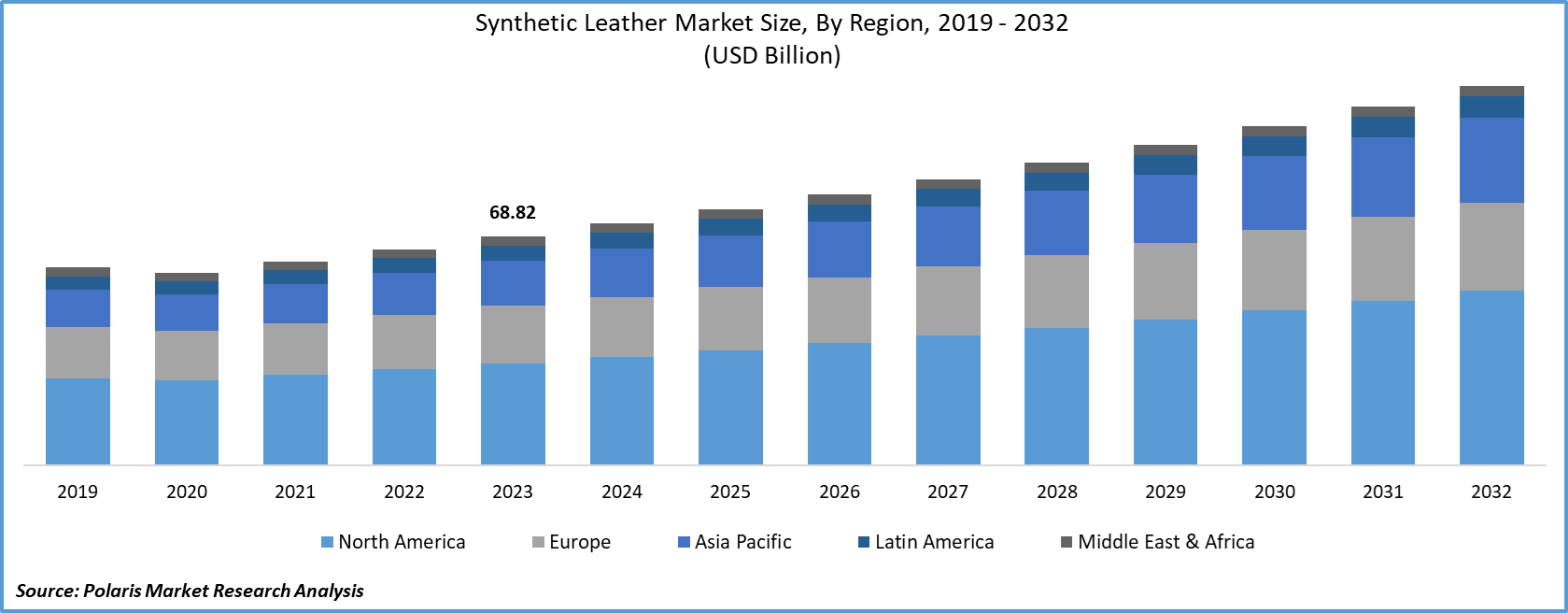

The global synthetic leather market size was valued at USD 72.69 billion in 2024, growing at a CAGR of 5.8% from 2025–2034. Key factors driving demand include rising disposable income of consumers and improving lifestyles, rising automotive industry demand, growth in demand for vegan & cruelty-free products, and strict environmental regulations on the leather tanning industry.

Key Insights

- Polyurethane leather segment dominated the market in 2024. This is due to its wide use in the furnishing, automotive, and apparel sectors.

- The demand for the product from the footwear sector is expected to witness rapid growth during the forecast period. This is due to the use of synthetic leather for durable footwear, water-resistant materials that are capable of withstanding weather conditions and wear and tear over time.

- In 2024, Asia Pacific dominated the market revenue share. This is due to its well-developed manufacturing infrastructure and extensive industrial use in large sectors.

- North America is projected to witness substantial growth in the synthetic leather market over the forecast period. This is duae to the rise in consumer demand for sustainable and cruelty-free options.

Industry Dynamics

- Rising production costs and gaps in performance in comparision to genuine leather restrict adoption in applications which demand for quality.

- Demand for animal-free and sustainable products from consumers boost the expansion opportunities for the manufacturers.

- Rise in urbanization and disposable incomes boost the demand for these leathers particularly in footwear, automotive, bags, and interior driven by strict regulations on animal welfare and impact on purchasing power.

- Advances in technology and bio-based materials create growth opportunities and expansion into diverse use of application with improved durability and asthetics.

Market Statistics

- 2024 Market Size: USD 72.69 billion

- 2034 Projected Market Size: USD 127.46 billion

- CAGR (2025-2034): 5.8%

- Asia Pacific: Largest market in 2024

Synthetic leather is made from polyvinyl chloride, polyurethane, or textile-polymer composite microfibers. Their use in applications such as automotive, furniture, clothing, fashion accessories, shoes, and more boosts their demand. It offers high durability, less maintenance, and ease of cleaning. Synthetic material is easier to cut and sew, and it has a uniform appearance. The rising awareness and strict laws and regulations surrounding animal cruelty have boosted synthetic faux materials as an alternative. The shift in consumer preferences and behaviors among young people highlights that consumers are increasingly opting for functional products and witnessing more behavioural change towards the prices compared to getting all genuine alternatives. This shift will drive more consumption of all synthetic leather products that are low in cost and function well. Consumers are willing to accept products made from synthetic rubber due to its cost-effectiveness and the range of products it can produce across the manufacturing sector.

To Understand More About this Research: Request a Free Sample Report

The rise of strict environmental regulations on the leather tanning industry further boosts the expansion opportunities. The natural tanning process involves heavy use of chemicals, such as chromium and other substances, which creates a risk for both consumers and the environment. Governments across regions are expanding restrictions on the use of wastewater discharge, toxic chemicals, and leather processing emissions. The regulatory policies have encouraged the industries to aim for safe and sustainable options while meeting environmental regulations.

Industry Dynamics

Growth Drivers

The global market for synthetic leather is driven by the rising disposable income of consumers and improving lifestyles. The growing use of the product in the manufacturing of footwear and handbags in countries such as China, Japan, and India boosts the market growth. Rising urbanization and growing demand from the automotive and furnishing sectors have accelerated the adoption of the product. Growth in awareness and campaigns regarding animal rights with the introduction of strict regulations regarding animal welfare have further encouraged consumers to turn towards synthetic leather. Technological advancements, increasing adoption of bio-based leather, new product launches and acquisitions by leading players in the market, and increasing use in diverse applications are factors expected to offer growth opportunities during the forecast period.

Furthermore, the application of the product has increased in the automotive sector in recent years. It is increasingly used to enhance the aesthetic, comfort, durability, and versatility of vehicles. Synthetic leather is a cost-effective alternative to genuine one and finds application in the manufacturing of car seats, door panels, steering wheel covers, seat belts, and dashboards, among others. The rise in market demand for passenger vehicles, growing adoption of alternative-fuel vehicles, and increasing need to reduce maintenance costs of commercial vehicles have supported the adoption of the material in the automotive industry. Rising modernization of vehicles, development of autonomous vehicles, and increasing penetration of luxury vehicles further influence the market growth for the material.

Know more about this report: request for sample pages

Which emerging trend is expected to fuel the expansion of the synthetic leather market during the forecast period?

The synthetic leather market is experiencing a significant transformation. The market is expected to grow in the coming years, driven by rising focus on technological advancements and a growing shift toward sustainable materials. Numerous industry players are pioneering next-generation sustainable, ethical, and innovative materials. Investors and companies emphasizing recycled, bio-based, and lab-grown leather alternatives are well-positioned to capitalize on this trend. There is a rising demand for ethical and sustainable synthetic leathers across various industries, such as automotive, fashion, and furniture. Further, collaborations between industry players and brands boost the industry expansion. The following table provides information on key players and their technologies.

|

Company |

Technology/Material |

Key Features |

Applications |

|

Teijin Limited |

Cordley ( a generic brand of artificial and synthetic leathers, and films) |

Water-repellent, high strength and durability, grip performance |

Automotive interiors, Balls, Shoes |

|

Filwel Co., Ltd. + Bellbio |

Bellbio, Patora, Belesa |

Scratch-resistant, lightweight, waterproof, sustainable, available in various colors and patterns |

School bags, belts, automotive, outdoor goods |

|

H.R. Polycoats Pvt. Ltd. |

PVC-based artificial leather |

Durable and soft, easy to stitch and stretch, flexible, glossy finishing |

Footwear, automotive, fashion |

|

Kuraray Co., Ltd. |

Clarino Amaretta Tirrenina |

Lightweight, flexible, water-resistance Easy care, machine washable, lightweight, uniform stretch and elasticity, high tear resistance |

Fashion, automotive, sports goods |

|

Yantai Wanhua Synthetic Leather Group |

PU synthetic leather |

Advanced polyurethane technology |

Automotive, furniture, fashion |

Report Segmentation

The market is primarily segmented on the basis of type, end-use, and region.

|

By Type |

By End-Use |

By Region |

|

|

|

Know more about this report: request for sample pages

Type Analysis

The segmentation based on type includes bio-based, polyurethane, polyvinyl chloride, and others. The polyurethane leather segment dominated the market in 2024 due to its wide use in the furnishing, automotive, and apparel sectors. Polyurethane leather is manufactured from a thermoplastic polymer. It is easy to manufacture, water-resistant, and available in a variety of colors and styles. Polyurethane leather adoption enhances flexibility, durability, support, comfort, and aesthetics. Furthermore, growth in PU production has also shifted focus to sustainable products such as options for water-based polyurethane, which minimizes the dependence on solvents that can be harmful to humans and the environment.

End Use Analysis

On the basis of end use, the market is segmented into apparel, furnishing, automotive, footwear, electronics, and others. The demand for the product from the footwear sector is expected to be high during the forecast period. Using synthetic leather, footwear is durable, water-resistant, and capable of withstanding weather conditions and wear and tear over time. Synthetic leather footwear is cost-effective and environmentally safer. Increasing disposable income and improving living standards support the growth of this segment. The cost-effectiveness of these leathers enables companies to offer affordable, high-quality designs to boost purchasing power and align with recent fashion trends. Furthermore, a rise in investments by fast-fashion brands and sportswear companies to develop sustainable and advanced leather has boosted the innovation and appeal.

Geographic Overview

Regional Analysis

Asia Pacific dominated the market revenue share in 2024. This is due to its well-developed manufacturing infrastructure and extensive industrial use in large sectors. The region benefits from economies of scale due to its robust manufacturing plants and mature supply chains, which maximize economies of scale, production volumes, and ultimately costs of input. Synthetic leather is important in footwear, automobile interiors, and consumer goods. The region serves as a major producer and consumer in these areas, which is further supported by widespread acceptance and availability across segments, and the capacity of the region to provide a wide range of textures, grades, and finished products for different market requirements. Additionally, rapid urbanization, as well as a desire by consumers to purchase low-cost alternatives to luxury-branded and genuine leather, has also supported increased consumption across the region.

North America Synthetic Leather Assessment

North America is projected to witness substantial growth in the synthetic leather market over the forecast period, driven by increasing consumer demand for sustainable and cruelty-free options. There is a growing demand in the region toward ethical consumption and an increasing focus on products that consider animals and the environment. Furthermore, synthetic leather offer a durable, versatile, and affordable alternative to real leather in various applications, such as footwear, apparel, and automotive. Shift toward widespread acceptance and ethical consumption of premium and innovative synthetic materials boosts market growth.

Competitive Landscape

The synthetic leather industry is highly competitive, driven by technological advancements in bio-based materials and the desire to build sustainable value chains. Vendors are increasingly defining their strategies based on strategic investments in R&D and targeting expansion opportunities in new markets, which are marked by unmet demand and potential for affordable and high-quality alternatives. Competitive intelligence analysis reveal that major companies capitalize on disruptions and trends like the shift towards vegan products and materials. Furthermore, success is dependent on their niche product offerings and responding to economic and geopolitical events impacting access to raw materials for small to medium-sized businesses. Innovations that drive material performance and sustainability will shape the future of industry ecosystems.

A few players in the synthetic leather market include Teijin Limited, Filwel Co. Ltd., H.R. Polycoats Pvt. Ltd., Kuraray Co. Ltd., Mitsubishi Chemicals Corp., Yantai Wanhua Synthetic Leather Group Co. Ltd., Kolon Industries, Inc., San Fang Chemical Industry Co. Ltd., Toray Industries, Inc., Alfatex N.V., NAN YA plastics corporation, Mayur Uniquoters Limited, Hanwa Chemical Corp., DuPont Tate & Lyle Bio Products Company, LLC, and Zhejiang Hexin Industry Group Co., Ltd.

These players are expanding their presence across various geographies and entering new markets in developing regions to expand their customer base and strengthen their presence in the market. The companies are also introducing new innovative products in the market to cater to the growing consumer demands.

Synthetic Leather Market Development

July 2024: BASF SE (Germany) announced the launch of Haptex 4.0, a cutting-edge polyurethane solution for recyclable synthetic leather. According to BASF, Haptex 4.0 is produced without any waste residue as its 100% recyclable.

August 2023: Roadwire Automotive Leather was acquired by Katzkin-Leather Inc. (USA) With the new acquisition, Katzkin aims to increase the capacity of Katzkin to serve all of its clients, including OEMs, dealers, and numerous customers.

Synthetic Leather Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 72.69 Billion |

| Market size value in 2025 | USD 76.80 Billion |

|

Revenue forecast in 2034 |

USD 127.46 Billion |

|

CAGR |

5.8% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Volume in Million Meters; Revenue in USD Billion; and CAGR from 2025 - 2034 |

|

Segments covered |

By Type, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Teijin Limited, Filwel Co. Ltd., H.R. Polycoats Pvt. Ltd., Kuraray Co. Ltd., Mitsubishi Chemicals Corp., Yantai Wanhua Synthetic Leather Group Co. Ltd., Kolon Industries, Inc., San Fang Chemical Industry Co. Ltd., Toray Industries, Inc., Alfatex N.V., NAN YA plastics corporation, Mayur Uniquoters Limited, Hanwa Chemical Corp., DuPont Tate & Lyle Bio Products Company, LLC, and Zhejiang Hexin Industry Group Co., Ltd. |

FAQ's

• The global market size was valued at USD 2.61 billion in 2024 and is projected to grow to USD 127.46 billion by 2034.

• The global market is projected to register a CAGR of 7.35% during the forecast period.

• In 2024, Asia Pacific dominated the market.

• A few key players are Teijin Limited, Filwel Co. Ltd., H.R. Polycoats Pvt. Ltd., Kuraray Co. Ltd., Mitsubishi Chemicals Corp., Yantai Wanhua Synthetic Leather Group Co. Ltd., Kolon Industries, Inc., San Fang Chemical Industry Co. Ltd., Toray Industries, Inc., Alfatex N.V., NAN YA plastics corporation, Mayur Uniquoters Limited, Hanwa Chemical Corp., DuPont Tate & Lyle Bio Products Company, LLC, and Zhejiang Hexin Industry Group Co., Ltd.

• The polyurethane leather segment dominated the market in 2024.

• The demand for the product from the footwear sector is expected to be high during the forecast period.