Tacrolimus Market Share, Size, Trends, Industry Analysis Report

By Product Type (Injections, Tablets and Capsules, Others); By Application; By End-Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 115

- Format: PDF

- Report ID: PM4519

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

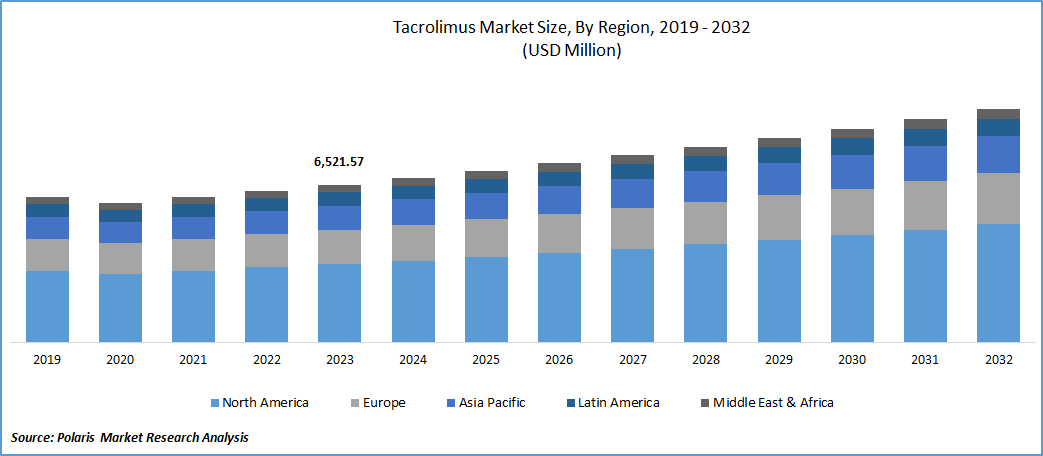

Tacrolimus market size was valued at USD 6,521.57 million in 2023. The market is anticipated to grow from USD 6,801.35 million in 2024 to USD 9,683.26 million by 2032, exhibiting the CAGR of 4.5% during the forecast period.

Market Overview

Growing number of organ transplantations across the globe is key factor driving the market growth. The demand for organ transplant procedures such as kidney, liver, heart, and lung is rising owing to factors such severe trauma, blood loss, poisoning, drug addiction, sepsis, leukemia, and other acute illnesses. Moreover, alcohol consumption, un-healthy dietary habits, lack of exercise, and drug abuse are also increasing the number of organ transplant procedures thereby, spurring the overall market growth.

- For instance, as per the estimates of the Scientific Registry of Transplant Recipients, in 2022, in the U.S. its was noted that around 2,743 people have undergone lung transplantation.

The ability of tacrolimus to prevent the body from rejecting a transplanted organ has attracted healthcare practitioners as well as market players. Moreover, increasing incidence of atopic dermatitis is expected to drive the market growth during the forecast period. Furthermore, strong focus of the market players towards the research & development activities coupled with the benefits of tacrolimus over cyclosporine will propel the market growth.

To Understand More About this Research: Request a Free Sample Report

Growth Factors

Rising number of organ transplant procedures

Tacrolimus is an immunosuppressive agent, which is primarily used in the prevention and treatment of solid-organ transplant rejection. An increasing number of kidney, liver, and lung transplants contributes to the growth.

- For instance, as per data from United Network for Organ Sharing (UNOS), in 2022, 42,887 organ transplants were performed in the U.S. alone, with rise of around of 3.7%, over 2021.

Furthermore, growing incidence of infections is expected to increase the demand for tacrolimus during the forecast period. For instance, as per the study published by National Center for Biotechnology Information (NCBI) in November 2023, in the U.S., around 1% of all hospital admissions have acute kidney injury on admission. Such large number of hospital admissions is expected to increase the organ transplantations thereby, fuelling the overall market growth.

Rising R&D expenditures for the development of tacrolimus will propel the market growth

Growing R&D spending by key companies for the development and introduction of tacrolimus is expected to contribute to the market growth in the coming years. For instance, according to the data by the clinicaltrials.gov, companies such as Astellas Pharma., Veloxis Pharmaceuticals, (Asahi Kasei Pharma Corporation), & Aurinia Pharmaceuticals have their tacrolimus drugs in the phase II of the clinical trials.

Moreover, the companies focusing on increasing the research and development expenses are expected to contribute to the market growth in the upcoming years. For instance, according to the financial results of Astellas Pharma, in fiscal year 2022, the company witnessed an increase of 12.2% in its research & development expenses, compared to fiscal year 2021. Such increase in R&D spending coupled with the strong pipeline will positively impact the tacrolimus market growth during the forecast timeframe.

Restraining Factors

Adverse effects of tacrolimus will hinder the market growth

Severe side effects from tacrolimus include decreased urine, burning or discomfort during urination, dyspnea, fast heartbeat, and pale skin. Such side effects are expected to impact the market growth negatively during the forecast timeframe. Moreover, the effectiveness of other medicines compared to tacrolimus is expected to hamper the market growth significantly.

For instance, according to a research study published by the Clínic Barcelona in February 2023, it was demonstrated that organ transplant recipients infected with COVID-19 did not develop toxicity when prednisone was used instead of tacrolimus.

Report Segmentation

The market is primarily segmented based on product type, application, end-use, and region.

|

By Product Type |

By Application |

By End-Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Dosage Form Insights

Tablets & capsules segment accounted for the largest market share in 2023

The Tablets & capsules segment held the largest share of tacrolimus market in 2023. This dominance is due to advent & high efficacy rate of extended-release capsules & tablets. Furthermore, the increasing need for organ transplantations and strong focus of companies to launch tablets & capsules drive the market growth. For instance, in December 2020, Biocon launched tacrolimus capsules in the US. Moreover, a large number of tacrolimus tablets & capsules in the pipeline will support the segment in maintaining the dominance.

By Route of Administration Insights

The oral segment held the largest share of tacrolimus market

The oral segment dominated the market in 2023. The dominance is primarily due to high preference to the oral medications. Moreover, age prescription volume of tablets and capsules will fuel the growth. For instance, according to the financial results conference of Asahi Kasei Pharma in FY2022, among the prescriptions for new kidney transplant patients, the share of Envarsus XR is nearly 35.0%.

By Application Insights

The immunosuppression segment dominated the tacrolimus market

Immunosuppression segment accounted for the largest market share in 2023. This is attributed to the rising need of immunosuppressant to prevent the organ rejection in adult patients. For instance, according to the Organ and Tissue Donation and Transplantation activity report, in the UK, the total number of kidney transplants increased by 3.0% in 2022-2023, compared to the previous year.

By End-user Insights

The hospitals segment dominated the market

The hospitals segment accounted for the significant market share. A large number of specialized transplant centers coupled with an increasing number of transplant procedures performed in hospitals contribute to the segmental share. Moreover, there has been an increase in sharing and utilization of organs among government hospitals, which is benefiting the patients on the waitlist for transplants. Thus, better performance and coordination for organ sharing will increase the number of transplant procedures in hospitals thereby, spurring the tacrolimus market growth.

Regional Insights

North America emerged as the largest market

North America accounted for the largest tacrolimus market share in 2023. Region’s dominance is attributed to the increasing number of organ donations and rising transplant procedures. For instance, according to the preliminary data from United Network for Organ Sharing (UNOS), in 2022, the total of 25,498 kidney transplants were performed in the U.S., with an increase of 3.4 percent over 2021. Moreover, increasing prescription of tacrolimus to adult patients undergoing kidney, liver, or heart transplants to prevent organ rejection drives the growth.

Asia Pacific region is expected to expand at the significant CAGR

Asia Pacific will grow with rapid pace. The high growth is owing to the increasing awareness of organ donations and rising demand for tacrolimus from the countries such as China, India, & Japan. For instance, Government of India is undertaking steps to promote organ donation in the country.

- According to the Ministry of Health and Family Welfare, Government of India has established five Regional Organ and Tissue Transplant Organizations & 16 State Organ and Tissue Transplant Organizations (SOTTOs) under the National Organ Transplant Programme (NOTP).

Key Market Players & Competitive Insights

The local companies are increasing the competition in the market

In terms of competitive scenario, the tacrolimus market is fragmented. The presence of numerous local and global players has increased the competitive environment in the market. For instance, as per the annual report 2020-21, Panacea Biotec, with its PanGraf, has maintained its leadership position in Tacrolimus market in India since more than a decade. Moreover, key companies are focusing on the strategic developments such as new product launches, acquisitions, partnerships in order to strengthen their positions in the market.

Some of the major players operating in the global market include:

- Astellas Pharma Inc. (Japan)

- Dr. Reddy's Laboratories Ltd. (India)

- Glenmark Pharmaceuticals (India)

- LEO Pharma Inc (Denmark)

- Lupin (India)

- Novartis AG (Switzerland)

- Panacea Biotec (India)

- Veloxis Pharmaceuticals, Inc. (Asahi Kasei Pharma Corporation) (U.S.)

- Viatris Inc. (U.S.)

- Vibcare Pharma Pvt. Ltd. (India)

Recent Developments in the Industry

- In September 2023, the FDAannounced that it has changed the therapeutic equivalence rating for Accord Healthcare Prograf (tacrolimus) oral capsules..

- In August 2023, Glenmark Pharmaceuticals received sANDA approval from the U.S. FDA for its Tacrolimus Ointment, 0.03%.

Report Coverage

The tacrolimus market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, dosage form, route of administration, application, end-user, and their futuristic growth opportunities.

Tacrolimus Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 6,801.35 million |

|

Revenue forecast in 2032 |

USD 9,683.26 million |

|

CAGR |

4.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

Astellas Pharma Inc., Biocon Ltd., Dr. Reddy's Laboratories Ltd., Glenmark Pharmaceuticals Inc are the key companies in Tacrolimus Market.

Tacrolimus market is CAGR of 4.5% during the forecast period

The Tacrolimus Market report covering key segments are type, application, end-use, and region.

Increasing research and development activities drive the tacrolimus market growth are the key driving factors in Tacrolimus Market

The tacrolimus market size is expected to reach USD 9,683.26 million by 2032