Tactical Data Link Market Size, Share, Trends, & Industry Analysis Report

By Solution (Hardware, Software), By Data Link Type, By Platform, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 117

- Format: PDF

- Report ID: PM2772

- Base Year: 2024

- Historical Data: 2020-2023

What is Tactical Data Link Market Size?

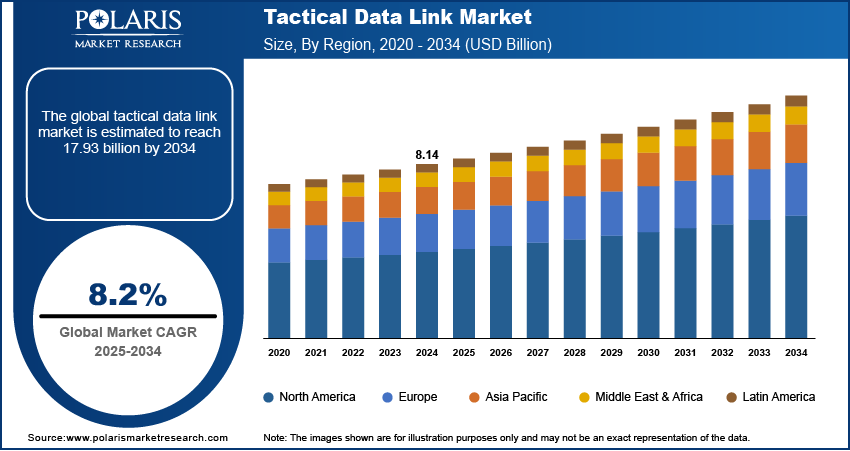

The global tactical data link market was estimated at USD 8.14 billion in 2024 and is expected to grow at a CAGR of 8.2% during the forecast period. The global market is driven by the growing usage of the tactical data link and the rising demand for a secure network to share data at fast speeds.

Key Insights

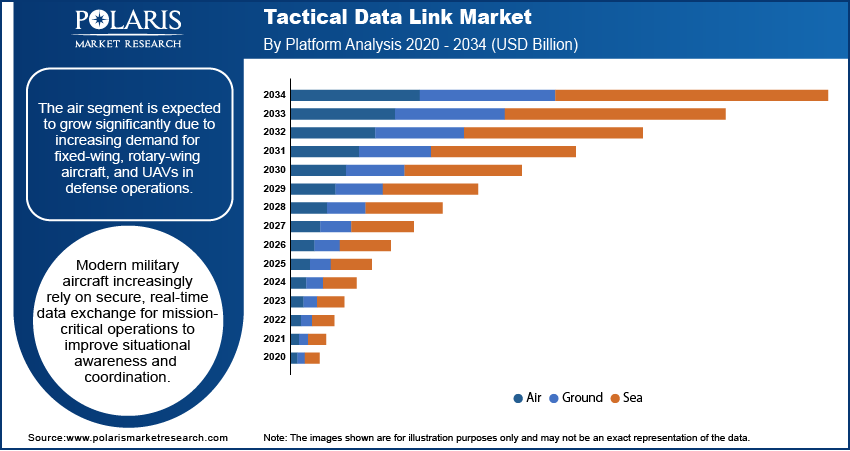

- The air is expected to witness significant growth during the forecast period due to the rising need for fixed-wing and rotary-wing aircraft and unmanned aerial vehicles for defense operations.

- The hardware dominated with largest share in 2024 due to rising use of modern tactical data connection technologies.

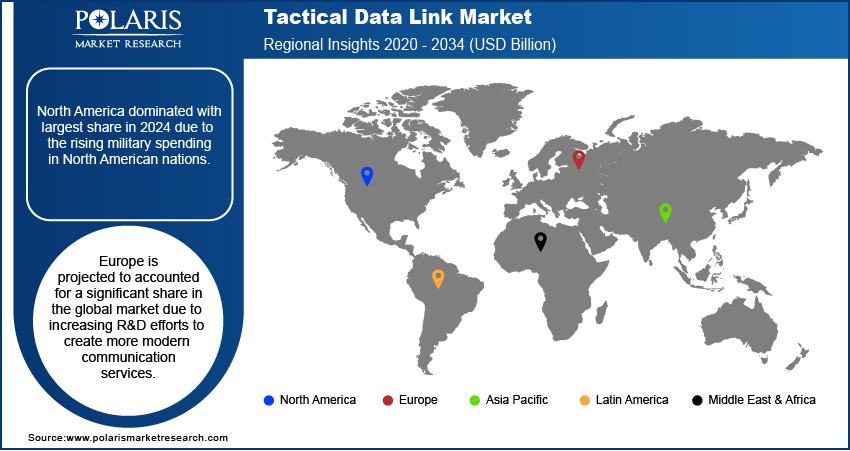

- North America dominated with largest share in 2024 due to the rising military spending in North American nations.

- Europe is projected to accounted for a significant share in the global market due to increasing R&D efforts to create more modern communication services.

Industry Dynamics

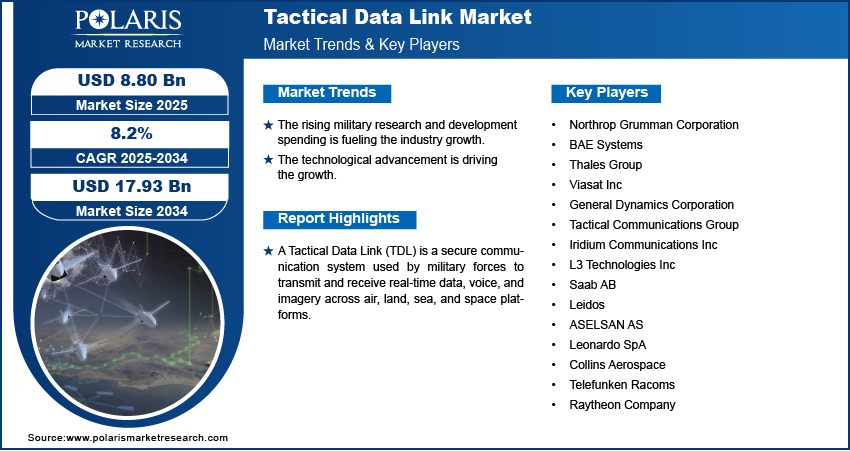

- The rising military research and development spending is fueling the industry growth.

- Increasing adoption of uncrewed aerial vehicles and next-generation fighters for target acquisition, surveillance, and air-to-air combat is driving the growth.

- The technological advancement is driving the growth.

- High implementation and integration costs associated with tactical data link systems limits the growth.

Market Statistics

- 2024 Market Size: USD 8.14 Billion

- 2034 Projected Market Size: USD 17.93 Billion

- CAGR (2025-2034): 8.2%

- Largest Market: North America

To Understand More About this Research: Request a Free Sample Report

Impact of AI on Industry

- Improve decision making by analyzing large amount of real-time battlefield data from TDLs.

- Optimize data traffic management by prioritizing and managing bandwidth in TDLs.

- Improves detection and response to cyber threats targeting tactical communication systems, boosting the security of TDL networks.

A Tactical Data Link (TDL) is a secure communication system used by military forces to transmit and receive real-time data, voice, and imagery across air, land, sea, and space platforms. It enables interoperability between different units, enhancing situational awareness and coordinated operations. TDLs, such as Link 16, are critical for executing Joint All-Domain Command and Control (JADC2) strategies

Ground, naval, and aerial platforms are implementing tactical data link systems to improve communication efficiency. The airborne platform widely uses tactical data connection technologies for various uses, including tracking aircraft performance and air traffic control. Furthermore, it is anticipated that, over time, aircraft modernization initiatives implemented in both developed and emerging nations will support the expansion of the tactical data connection industry.

Industry Dynamics

Growth Drivers

What Factors are Driving the Tactical Data Link Market Growth?

Military research and development spending is rising, which promotes the creation of network-enabled weaponry and the fusion of operated and unmanned systems. The increased usage of Integrated Air Defence Systems (IADS) pose increasingly complex and challenging operational conditions. This drives the demand for TDLs. Additionally, manned aircraft and unmanned systems working together increase the combat mass needed in highly competitive circumstances. Some operations include uncrewed aerial vehicles (UAVs) and next-generation fighters (NGOs) for target acquisition, surveillance, and air-to-air combat. Furthermore, the most recent development in the market is the growing use of network-enabled weapons (NEWs). Network-enabled weapons can find, track, and engage a target more quickly than traditional weapons. As a result, it lessens the chance of fratricide, de-conflicts operations, and raises the likelihood of hitting real-time targets by preventing duplication of effort.

Report Segmentation

The market is primarily segmented based on solution, data link type, platform, application, and region.

|

By Solution |

By Data Link Type |

By Platform |

By Application |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Which Segment by Solution Dominated in 2024?

The hardware segment dominated with largest share in 2024 as defense forces increasingly use modern tactical data connection technologies for effective communication and real-time data transfer among troops and authorities. For instance, the US Special Operations Command (USSOCOM) awarded L3Harris Technologies an IDIQ contract worth USD 552 million in May 2022 to provide Falcon IV AN/PRC-167 radio systems, thereby driving the segment growth.

Why Air Segment is Expected to Witness Significant Growth?

The air segment is anticipated to increase at a significant CAGR over the forecast period. This expansion is attributable to the rising need for fixed-wing and rotary-wing aircraft and unmanned aerial vehicles (UAVs) for defense operations. Modern military aircraft increasingly rely on secure, real-time data exchange for mission-critical operations to improve situational awareness and coordination. Additionally, advancements in airborne platforms and the growing adoption of network-centric warfare drive demand for advanced TDL systems in air operations, thereby driving the segmental growth.

How North America Captured Largest Share in 2024?

North America dominated with largest share in 2024 due to rising military spending in North American nations like the United States to adopt cutting-edge technological solutions for effective communication and seamless mission operations across the land, naval, and airborne platforms. For instance, Data Link Solutions was awarded a USD 33.6 million contract by the US Department of Defense (DoD) in June 2020 to provide a Multifunctional Information Distribution System (MIDS). Investment like this is fueling the demand for the advance systems in military operations, thereby driving the growth in the region.

What is the Reason for Europe's Significant Growth?

Europe is expected to witness significant growth during the forecast period as companies in the regions are increasing R&D efforts to create more modern communication services. European countries are actively spending on development of advance systems for military operations, which in turn is driving the expansion in the region. Moreover, presence of major players in the region is improving the accessibility, which further boost the industry growth in the region.

Who are the Major Players in Tactical Data Link Market?

There are numerous major players in the global market, such as Northrop Grumman Corp, BAE Systems, Thales Group, Viasat, General Dynamics Corp, Tactical Communications, Iridium Communications, Harris Corporation, Saab AB, Leidos, ASELSAN, Leonardo, Collins Aerospace, Telefunken Racoms, Raytheon Company, and others.

Recent Developments

- October 2022, L3Harris Technologies acquired Viasat’s Tactical Data Links business for USD 1.96 billion to strengthen its JADC2 capabilities, expanding secure multi-domain communication and networking solutions by integrating Link 16 systems across 20,000 global U.S. and allied military platforms.

- May 2022, as part of the US Army's Combat Net Radio (CNR) upgrade program, Thales was one of two (2) vendors to get an Indefinite Delivery, Indefinite Quantity (IDIQ) contract. A five-year essential ordering period and an additional five-year optional ordering period are both parts of the competitive 10-year contract for the Combat Net Radio (CNR) program.

- In November 2020, Curtiss-Wright Corporation bought Pacific Star Communications, Inc. for USD 400 million. Through this transaction, Curtiss-Wright Corporation expanded its network of suppliers for cutting-edge tactical and business network communications solutions.

Tactical Data Link Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 8.14 billion |

| Market size value in 2025 | USD 8.80 billion |

|

Revenue forecast in 2034 |

USD 17.93 billion |

|

CAGR |

8.2% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Solution, By Datalink Type, By Platform, By Application, and By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Northrop Grumman Corporation, BAE Systems, Thales Group, Viasat, Inc., General Dynamics Corporation, Tactical Communications Group, Iridium Communications Inc, L3 Technologies Inc (Merged With Harris Corporation), Saab AB, Leidos, ASELSAN AS, Leonardo SpA, Collins Aerospace, Telefunken Racoms, Raytheon Company, and others. |

FAQ's

• The market size was valued at USD 8.14 Billion in 2024 and is projected to grow to USD 179.93 Billion by 2034.

• The market is projected to register a CAGR of 8.2% during the forecast period.

• A few of the key players in the market are Northrop Grumman Corporation, BAE Systems, Thales Group, Viasat, Inc., General Dynamics Corporation, Tactical Communications Group, Iridium Communications Inc, L3 Technologies Inc (Merged with Harris Corporation), Saab AB, Leidos, ASELSAN AS, Leonardo SpA, Collins Aerospace, Telefunken Racoms, Raytheon Company, and others.

• The hardware segment accounted for the largest market share in 2024.

• The air segment is expected to record significant growth.