Takaful Insurance Market Share, Size, Trends, Industry Analysis Report

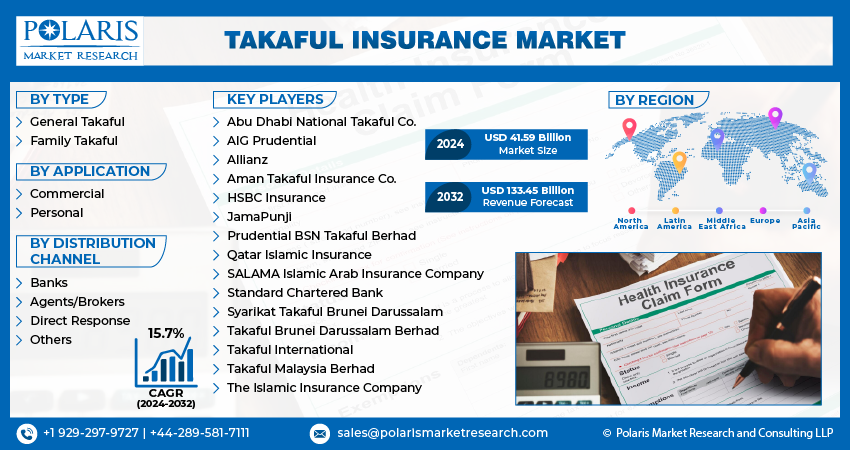

By Type (General Takaful, Family Takaful); By Application; By Distribution Channel; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 116

- Format: PDF

- Report ID: PM4369

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

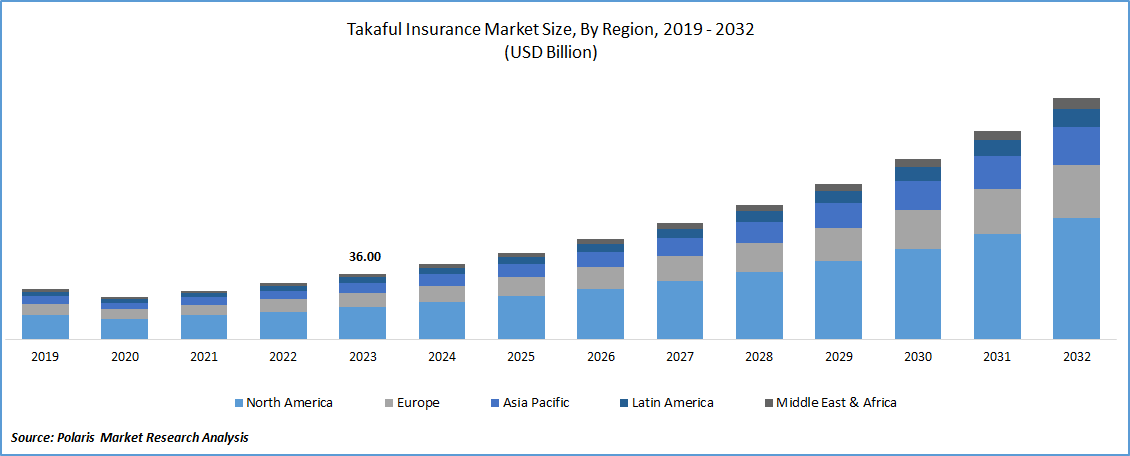

The global takaful insurance market was valued at USD 36.00 billion in 2023 and is expected to grow at a CAGR of 15.7% during the forecast period.

The takaful insurance market is driven by the escalating awareness of Islamic finance principles, fueling a surge in demand. As individuals and businesses become more informed about Sharia-compliant financial solutions, the appeal of takaful grows. The market seeks ethical alternatives, and the rising understanding of Islamic finance drives a substantial shift towards takaful. This heightened awareness not only amplifies market traction but also positions takaful as a preferred choice for those prioritizing financial instruments aligned with ethical and religious considerations.

Collaborations between takaful providers and financial institutions, as well as partnerships with international insurers, amplify market reach. Such strategic alliances foster innovation, improve services, and expand the array of product options available. Market players are introducing new solutions to cater to the growing consumer demand.

To Understand More About this Research: Request a Free Sample Report

For instance, in April 2023, ETAP, an InsurTech firm dedicated to enhancing the automotive experience throughout Africa, introduced ETAP Takaful, a novel car insurance product rooted in Islamic principles. This insurance offering is crafted to reallocate funds to policyholders and contribute to social welfare within their communities.

The takaful insurance market receives significant momentum from robust regulatory support and well-defined frameworks. Clear and supportive regulatory environments create a stable foundation for takaful operations, instilling confidence in both providers and consumers. Governments actively fostering Sharia-compliant financial solutions contribute to the market's growth by providing a conducive ecosystem. Regulatory backing ensures adherence to ethical principles and enhances transparency, attracting more participants to the takaful sector. The symbiotic relationship between regulatory support and the takaful market underscores the pivotal role of regulatory frameworks in fostering a thriving and resilient Sharia-compliant insurance industry.

The Takaful Insurance Market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

In the takaful insurance market, progress in technology marks a shift towards heightened efficiency and improved accessibility. The incorporation of advanced technologies, including digital platforms and insurance solutions, simplifies processes and elevates the overall customer experience. The utilization of mobile applications, online portals, and artificial intelligence contributes to a smooth takaful insurance journey, covering aspects from policy acquisition to claims handling. This technological transformation not only meets the requirements of a technologically adept clientele but also drives innovation within the takaful insurance sector.

Industry Dynamics

Growth Drivers

Growing Muslim Population and Economic Growth in Islamic Finance Hubs

The expanding Muslim population worldwide drives the growth of the takaful insurance market. As Islamic finance gains prominence, the increasing number of Muslims seeking Sharia-compliant financial solutions amplifies the demand for takaful insurance. This demographic trend creates a substantial customer base inclined towards ethical and religiously compliant insurance. The rise in the Muslim population, along with growing awareness of Islamic finance principles, further boosts market growth.

The takaful insurance market experiences a significant impact from economic growth in key Islamic finance hubs like Malaysia, Saudi Arabia, and the UAE. As these financial centers thrive, their economic prosperity positively influences the demand for Sharia-compliant financial instruments, including takaful insurance. The robust economic environments in these hubs attract investments, fostering the development of the takaful insurance sector.

Report Segmentation

The market is primarily segmented based on type, application, distribution channel, and region.

|

By Type |

By Application |

By Distribution Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

The General Takaful Segment Accounted for a Significant Market Share in 2023.

In 2023, the general takaful segment accounted for a significant market share. General Takaful is formulated to encompass an extensive spectrum of non-life risks and liabilities, featuring insurance solutions for property, motor vehicles, liability, travel, health, and various other general risk categories. Offering coverage for tangible assets like buildings, vehicles, and personal belongings, it also safeguards against liability risks, including third-party claims and legal obligations. This form of Takaful is versatile, serving both businesses and individuals alike. Tailored to address the multifaceted risks encountered in daily life, it additionally provides specialized coverage tailored to the unique needs of commercial entities. General Takaful thus presents a comprehensive and adaptable solution for a diverse range of risk scenarios.

By Application Analysis

The Commercial Segment Accounted for a Significant Market Share in 2023

In 2023, the commercial segment accounted for a significant market share. Tailored exclusively for businesses, commercial takaful insurance provides Sharia-compliant solutions covering a broad spectrum of needs. This comprehensive range includes property and liability coverage, business interruption, trade credit, and professional indemnity. Upholding Islamic principles, takaful solutions not only protect physical assets and mitigate financial losses but also embody ethical risk-sharing practices. Takaful providers go beyond conventional services by offering valuable assistance in risk management consultation and claims, presenting a holistic and ethically grounded approach to managing commercial risks within the Islamic finance framework.

By Distribution Channel Analysis

The Agents/Brokers Segment Accounted for Significant Market Share in 2023

The agents/brokers segment accounted for a significant market share in 2023. Takaful providers strategically deploy a network of agents and brokers to expand their market reach. This network is carefully established to ensure a presence in diverse regions, promoting accessibility and engagement with a wide array of consumer segments. Agents and brokers, often embedded in local communities, bring forth not only industry expertise but also an understanding of the cultural and financial nuances within specific regions. This localized knowledge enables them to tailor takaful insurance products to meet the unique needs of diverse customer bases. Agents engage in building robust customer relationships. Personalized interactions allow agents to offer valuable insights, address customer queries, and provide guidance, creating a higher level of customer engagement.

Regional Analysis

Middle East & Africa Accounted for the Largest Revenue Share in 2023

In 2023, the Middle East and Africa accounted for the largest revenue share. MEA hosts pivotal Islamic finance hubs such as Saudi Arabia, the UAE, Bahrain, and Malaysia. These nations serve as focal points for takaful innovation, acting as catalysts for growth and setting benchmarks for industry practices. Regulatory bodies like the Dubai Financial Services Authority (DFSA) and the Saudi Arabian Monetary Authority (SAMA) exhibit a meticulous approach, tailoring frameworks to regulate takaful insurance operations. This precision in regulation fortifies market stability, instills confidence, and fosters sustainable growth. The MEA takaful insurance market showcases a comprehensive array of products. From family takaful addressing life coverage needs to general takaful covering non-life risks and health takaful, this diversity strategically caters to the distinctive requirements of Islamic communities across the region.

Asia-Pacific is expected to experience significant growth during the forecast period. Within Asia, particularly in countries like Malaysia and Indonesia, Islamic finance stands as a central hub, exerting a significant impact on the evolution and expansion of the takaful insurance market in the region. The increasing understanding of Islamic finance principles and a growing inclination towards Sharia-compliant financial offerings play a substantial role in driving the escalating demand for takafuls in Asia. There is a shift among consumers towards financial solutions that align with ethical standards and transparency. This trend contributes substantially to the rising popularity and adoption of takafuls within the Asian financial landscape.

Key Market Players & Competitive Insight

The market faces fierce rivalry, with companies leveraging cutting-edge technology, top-notch product offerings, and a robust brand reputation to propel revenue expansion. Key players employ diverse tactics, including dedicated research and development, strategic mergers and acquisitions, and continuous technological advancements. These strategic maneuvers are aimed at broadening their product ranges and sustaining a competitive advantage. The market dynamic is shaped by constant innovation and a commitment to delivering high-quality solutions, underscoring the importance of strategic initiatives in ensuring sustained competitiveness.

Some of the major players operating in the global market include:

- Abu Dhabi National Takaful Co.

- AIG Prudential

- Allianz

- Aman Takaful Insurance Co.

- HSBC Insurance

- JamaPunji

- Prudential BSN Takaful Berhad

- Qatar Islamic Insurance

- SALAMA Islamic Arab Insurance Company

- Standard Chartered Bank

- Syarikat Takaful Brunei Darussalam

- Takaful Brunei Darussalam Berhad

- Takaful International

- Takaful Malaysia Berhad

- The Islamic Insurance Company

Recent Developments

- In July 2022, Bank Al Yousr, the Shariah-compliant arm of Morocco's Banque Centrale Populaire (BCP), unveiled Takaful Al Yousr, marking its inaugural Islamic insurance offering in Morocco. This product provides coverage for death and disability, ensuring the well-being of the insured and their family in the event of death or enduring disability.

- In May 2021, Takaful International Company partnered with Hannover ReTakaful to introduce a new healthcare takaful coverage named AFYA, designed for individuals up to the age of 75. AFYA offers various packages encompassing a spectrum of services, including access to a diverse network of global hospitals, healthcare facilities, and specialized clinics.

Takaful Insurance Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 41.59 billion |

|

Revenue forecast in 2032 |

USD 133.45 billion |

|

CAGR |

15.7% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Application, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

Delve into the intricacies of Non-Invasive Prenatal Testing in 2024 through the Takaful Insurance Market share, size, and revenue growth rate statistics by Polaris Market Research Industry Reports. Uncover a comprehensive analysis that not only projects market trends up to 2029 but also provides valuable insights into the historical landscape. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

FAQ's

The global takaful insurance market size is expected to reach USD 133.45 billion by 2032

Abu Dhabi National Takaful Co., AIG Prudential, Allianz, Aman Takaful Insurance Co., Takaful International are the top market players in the market.

Middle East & Africa region contribute notably towards the global Takaful Insurance Market.

The global takaful insurance market is expected to grow at a CAGR of 15.7% during the forecast period.

The Takaful Insurance Market report covering key segments are type, application, distribution channel, and region.