Tax Tech Market Size, Share, Trends, Industry Analysis Report

: By Offering (Solutions and Services), By Deployment Mode, By Tax Type, By Organization Size, By Industry Vertical, and By Region– Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM5627

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

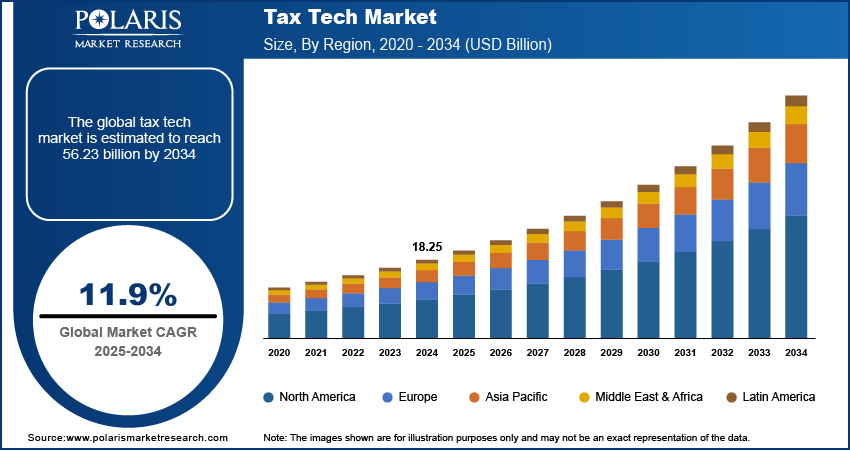

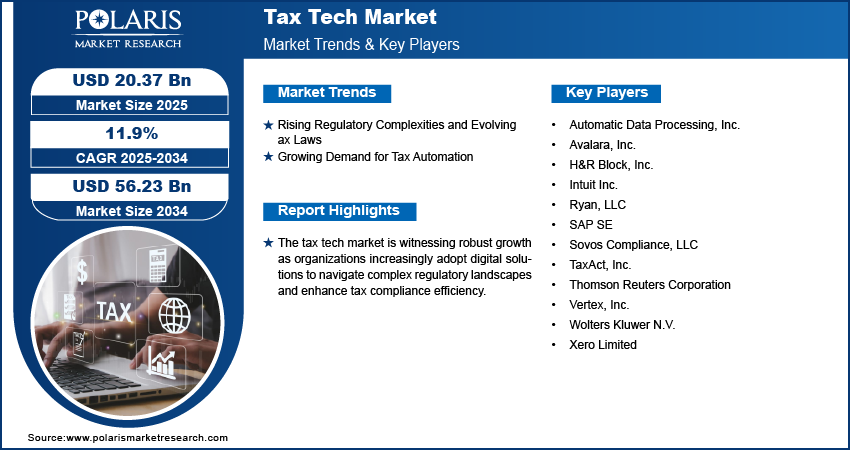

The global tax tech market size was valued at USD 18.25 billion in 2024, growing at a CAGR of 11.9% during 2025–2034. The introduction of digital tax reforms by governments globally and the rise of cloud-based tax solutions are a few of the key factors fueling market growth.

Key Insights

- The solutions segment accounted for the largest market share in 2024, primarily driven by the increased adoption of advanced tax software by enterprises.

- The IT & telecom segment is expected to witness the fastest growth, owing to the high volume of transactions in the industry.

- North America led the global market in 2024. The robust digital infrastructure and increased awareness of regulatory compliance requirements contribute to the regional market dominance.

- Asia Pacific is projected to register the fastest growth. Expanding economies and rapid digitalization are driving the regional market growth.

Industry Dynamics

- Growing regulatory complexities and evolving tax laws have led to a surge in cross-border transactions, fueling market demand.

- Increased emphasis among businesses on optimizing their finance and compliance functions is driving market growth.

- Rising integration of emerging technologies is creating several market opportunities.

- Lack of awareness of tax tech in developing countries is hindering market growth.

Market Statistics

2024 Market Size: USD 18.25 billion

2034 Projected Market Size: USD 56.23 billion

CAGR (2025-2034): 11.9%

North America: Largest Market in 2024

AI Impact on Tax Tech Market

- AI streamlines tax filing, reporting, and compliance by automating repetitive processes and ensuring accuracy in handling complex tax codes.

- Machine learning models minimize financial and reputational risks by detecting anomalies, fraudulent claims, or errors in tax data.

- AI systems update automatically to align with evolving tax laws and cross-border regulations. This helps businesses stay compliant globally.

- Advanced algorithms provide scenario-based analysis to optimize tax strategies and forecast potential liabilities.

To Understand More About this Research: Request a Free Sample Report

Tax technology (tax tech) refers to the use of digital tools and software to manage, streamline, and automate tax-related processes within organizations. The adoption of tax tech solutions has gained momentum across industries as regulatory complexity intensifies and businesses face increasing compliance pressures. The implementation of digital tax reforms and government mandates is increasing worldwide. Governments are increasingly introducing e-invoicing, real-time reporting, and digital filing systems to enhance transparency and reduce tax evasion. In March 2024, Bloomberg Tax & Accounting launched Bloomberg Tax Workpapers, a solution designed to streamline tax documentation with integrated data prep, spreadsheets, and compliance controls. The tool addresses inefficiencies in manual tax calculation processes, reducing risks for corporate tax departments. These initiatives are pushing organizations to modernize their tax infrastructure, fostering greater reliance on tax tech platforms to remain compliant and avoid penalties.

The rise of cloud-based tax solutions is accelerating the transformation of the tax landscape. A December 2023 European Commission report found that 42.5% of EU enterprises adopted cloud computing services in 2023, reflecting growing reliance on cloud-based solutions across European businesses. Cloud storage platforms offer scalability, seamless updates, and real-time access to tax data, enabling finance teams to collaborate more effectively across geographies. These solutions are also increasingly integrated with enterprise resource planning (ERP) systems, providing a unified view of financial operations and ensuring timely compliance. Cloud-enabled tax technologies are proving essential for agile, cost-effective, and secure tax management as businesses move toward digital-first models. Together, these are reshaping the tax function from a traditionally manual process to a strategically automated domain.

Market Dynamics

Rising Regulatory Complexities and Evolving Tax Laws

Rising regulatory complexities and evolving tax laws are propelling the growth due to cross-border transactions. Digital services businesses are under continuous pressure to adapt and comply as governments frequently update tax regulations to address emerging economic models. According to a February 2025 report by the IMF, Digital payment innovations could significantly reduce cross-border transaction costs by 60% and increase volumes, particularly for remittance-reliant countries. However, short-term impacts are limited due to already low wholesale costs, while long-term potential remains transformative for financial inclusion and development. Navigating these shifting requirements increases the risk of non-compliance, errors, and financial penalties. Tax tech solutions provide a structured, automated approach to monitor, interpret, and implement these changes efficiently. Organizations can ensure timely compliance while minimizing operational disruptions by integrating regulatory updates into digital systems, making advanced tax technology a strategic necessity in today’s dynamic regulatory landscape.

Growing Demand for Tax Automation

The growing demand for tax automation further fuels the tax tech market opportunities as businesses increasingly seek to optimize their finance and compliance functions. Manual tax processes are often time-consuming, prone to inaccuracies, and unable to scale with growing data volumes. Tax automation tools enhance accuracy and efficiency and also reduce the burden on internal finance teams by streamlining calculations, reporting, and filings. In November 2023, Thomson Reuters launched updates to its tax, accounting, and audit products, such as SurePrep TaxCaddy and ONESOURCE, to automate workflows and enhance efficiency. The company also announced plans to integrate generative AI into solutions such as Checkpoint Edge and Global Trade Management. Automated tax solutions empower businesses to make informed decisions while maintaining regulatory alignment with the added benefit of real-time insights and analytics. The shift toward tax automation becomes an integral part of their digital transformation strategy as organizations prioritize cost efficiency and operational agility.

Segment Insights

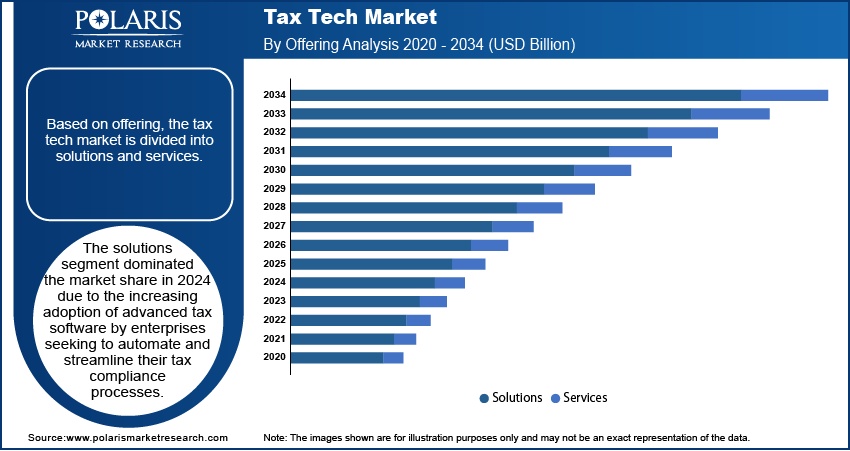

Tax Tech Market Assessment by Offering

The global market segmentation, based on offering, includes solutions and services. The solutions segment dominated in 2024 due to the increasing adoption of advanced tax software by enterprises seeking to automate and streamline their tax compliance processes. These solutions, which include tax calculation engines, e-invoicing systems, and reporting platforms, offer real-time data processing, integration with financial systems, and enhanced accuracy in tax filing. Businesses are prioritizing comprehensive tax solutions to reduce compliance risks and operational inefficiencies as regulatory requirements become more complex and frequent. The demand for scalable and customizable software solutions has further driven the segment’s dominance, positioning it as the core component of tax technology ecosystems.

Tax Tech Market Evaluation by Industry Vertical

The global market segmentation, based on industry vertical, includes BFSI, IT & telecom, retail & e-commerce, manufacturing, healthcare & life sciences, government & public sector, energy & utilities, and others. The IT & telecom segment is expected to witness the fastest growth during the forecast period driven by the industry's high volume of transactions, multinational operations, and the need to manage complex tax structures across jurisdictions. These companies often operate in multiple tax regimes, making automation and compliance essential to maintain accuracy and efficiency. IT and telecom firms are rapidly investing in tax tech to remain agile and compliant with digital services subject to evolving tax rules, particularly in areas such as value-added tax (VAT) and digital service tax (DST). Their early adoption of digital transformation strategies also supports the seamless integration of tax technologies into broader enterprise systems.

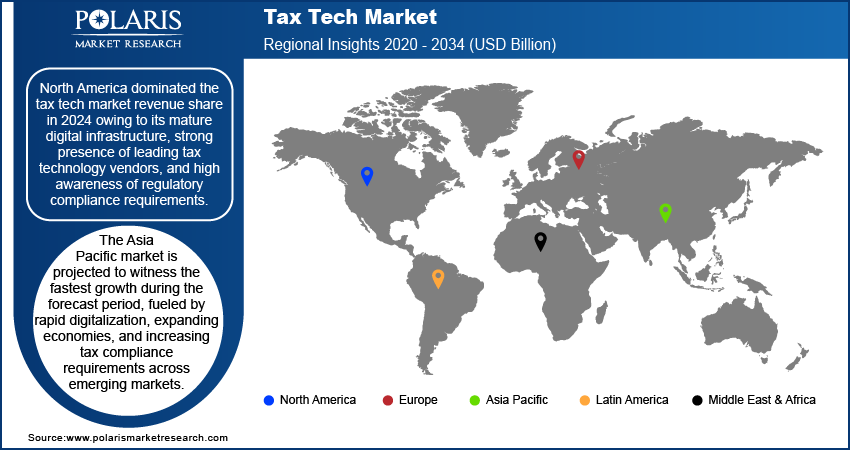

Regional Analysis

By region, the report provides insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market revenue share in 2024 owing to its mature digital infrastructure, strong presence of leading tax technology vendors, and high awareness of regulatory compliance requirements. The region’s complex tax environment, characterized by federal, state, and local tax layers, creates a strong demand for robust, automated tax solutions. Enterprises across sectors are increasingly prioritizing digital transformation and compliance automation, supported by favorable government initiatives and strict enforcement policies. For instance, a June 2024 FRBR report found that 60% of all US firms and nearly 85% of large firms adopted automation technologies within the past year, reflecting widespread integration of automation across businesses of varying sizes. Additionally, North America’s early adoption of cloud billing technologies and sophisticated financial systems has further facilitated the widespread deployment of tax tech solutions across organizations of all sizes.

The Asia Pacific market is projected to witness the fastest growth during the forecast period, fueled by rapid digitalization, expanding economies, and increasing tax compliance requirements across emerging markets. Governments in the region are actively modernizing their tax frameworks through initiatives such as e-invoicing, digital tax reporting, and GST implementations, prompting businesses to adopt advanced tax technologies. In December 2024, CBDT initiated an e-campaign to address discrepancies between AIS and ITR filings for FY 2021-22 and 2023-24, targeting non-filers with high-value transactions. The effort aligns with the e-Verification Scheme, 2021, to improve tax compliance. Furthermore, the growing presence of multinational enterprises and a rising focus on operational efficiency are driving demand for scalable, cloud-based tax solutions. The adoption of tax tech in Asia Pacific is set to accelerate significantly as regional companies embrace automation to stay competitive and compliant.

Tax Tech Market – Key Players & Competitive Analysis Report

The tax technology sector is experiencing considerable transformation as digital solutions revolutionize compliance processes. Established players such as Thomson Reuters, Intuit, and Wolters Kluwer dominate through comprehensive suites offering end-to-end functionality. In contrast, cloud-native disruptors such as Avalara and Vertex gain momentum with API-first approaches and specialized solutions. Economic and geopolitical shifts are accelerating adoption as governments worldwide implement complex digital tax reporting requirements. Companies investing in AI capabilities demonstrate clear competitive advantages, with predictive analytics and automated decision-making becoming key differentiators. Strategic alliances between established providers and innovative startups are reshaping the competitive landscape. Industry leaders pursue sustainability strategy and transformation initiatives to address ESG reporting requirements, creating new revenue opportunities for specialized compliance tools. Small and medium-sized businesses represent an underserved but rapidly growing segment, driving demand for affordable, user-friendly solutions. Joint ventures between tax specialists and accounting platforms are creating integrated ecosystems that enhance customer stickiness. Competitive advantage will increasingly derive from technological advancement in AI/ML capabilities, API flexibility, and seamless integration with broader finance systems. Companies that deliver both compliance assurance and strategic tax insights will secure dominant positions in this evolving market. A few key major players are Wolters Kluwer N.V.; H&R Block, Inc.; Avalara, Inc.; Vertex, Inc.; Thomson Reuters Corporation; SAP SE; Automatic Data Processing, Inc.; Sovos Compliance, LLC; Intuit Inc.; Xero Limited; TaxAct, Inc.; and Ryan, LLC.

SAP SE is a global provider of enterprise software, offering comprehensive tax technology solutions that are deeply integrated within its cloud ERP platforms, notably SAP S/4HANA Cloud. SAP’s tax management capabilities are designed to automate compliance, enhance transparency, and streamline global tax operations. Leveraging advanced technologies such as artificial intelligence and machine learning, SAP enables organizations to minimize compliance risks, optimize tax strategies, and adapt to rapidly changing regulatory environments. The platform provides real-time insights into tax positions, automates tax calculations, and supports electronic invoicing and statutory reporting, ensuring organizations can meet local and international tax mandates efficiently. SAP’s solutions also allow for the centralization of tax controls, automated remediation workflows, and scenario-based tax planning, empowering businesses to make data-driven decisions and maintain a robust audit trail. The integration of SAP Business Technology Platform (BTP) further supports tax teams with analytics, custom applications, and seamless data management. SAP continues to expand its AI-driven functionalities, positioning itself at the forefront of tax technology transformation and enabling clients to future-proof their tax operations while reducing costs and improving compliance outcomes as digital taxation and regulatory complexity increase.

Avalara, Inc. is a global provider of cloud-based tax compliance automation, serving over 43,000 customers across more than 75 countries. Founded in 2004 and headquartered in Seattle, Avalara has established itself as a pioneer in simplifying the complexities of sales tax, VAT, GST, and cross-border tax compliance for businesses of all sizes. Its flagship product, AvaTax, uses advanced geospatial technology to determine precise tax rates and jurisdictions based on exact street addresses, enabling highly accurate and real-time tax calculations. Avalara’s suite of solutions extends beyond calculation to include automated tax return preparation, exemption certificate management, and support for electronic invoicing and audit readiness. The company’s software integrates with more than 1,200 ERP, e-commerce, and accounting platforms, making it accessible and scalable for diverse industries and business models. Avalara’s automation capabilities drive significant efficiency gains, with customers reporting up to 90% increases in tax research efficiency and substantial reductions in time spent on returns and exemption management. While the platform is robust and content-rich, some users note a learning curve and opportunities for improved user experience.

List of Key Companies in Tax Tech Market

- Automatic Data Processing, Inc.

- Avalara, Inc.

- H&R Block, Inc.

- Intuit Inc.

- Ryan, LLC

- SAP SE

- Sovos Compliance, LLC

- TaxAct, Inc.

- Thomson Reuters Corporation

- Vertex, Inc.

- Wolters Kluwer N.V.

- Xero Limited

Tax Tech Industry Developments

January 2025: Tax Systems launched Pillar2, a SaaS solution to streamline OECD Pillar Two compliance for multinationals. The tool integrates with TaxSuite to centralize tax data, reduce reporting errors, and ensure consistent cross-jurisdictional tax filings.

January 2025: Microsoft launched an automated tax calculation feature that migrates core tax master data to an advanced tax engine, ensuring accuracy by auto-generating records from existing tax codes, sales tax groups, and item tax groups.

February 2023: Avalara launched its Property Tax solution, an automated compliance tool for managing real and personal property taxes. The cloud-based system aims to streamline tax processes and reduce errors for businesses and accounting professionals.

Tax Tech Market Segmentation

By Offering Outlook (Revenue, USD Billion, 2020–2034)

- Solutions

- Services

By Deployment Mode Outlook (Revenue, USD Billion, 2020–2034)

- Cloud-Based

- On-Premises

By Tax Type Outlook (Revenue, USD Billion, 2020–2034)

- Direct Tax

- Indirect Tax

By Organization Size Outlook (Revenue, USD Billion, 2020–2034)

- Large Enterprises

- SMEs

By Industry Vertical Outlook (Revenue, USD Billion, 2020–2034)

- BFSI

- IT & Telecom

- Retail & E-Commerce

- Manufacturing

- Healthcare & Life Sciences

- Government & Public Sector

- Energy & Utilities

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Tax Tech Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 18.25 billion |

|

Market Size Value in 2025 |

USD 20.37 billion |

|

Revenue Forecast in 2034 |

USD 56.23 billion |

|

CAGR |

11.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global size was valued at USD 18.25 billion in 2024 and is projected to grow to USD 56.23 billion by 2034.

The global market is projected to register a CAGR of 11.9% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Wolters Kluwer N.V.; H&R Block, Inc.; Avalara, Inc.; Vertex, Inc.; Thomson Reuters Corporation; SAP SE; Automatic Data Processing, Inc.; Sovos Compliance, LLC; Intuit Inc.; Xero Limited; TaxAct, Inc.; and Ryan, LLC.

The solutions segment dominated the market share in 2024.

The IT & telecom segment is expected to witness the fastest growth during the forecast period.