Technical Textiles Market Size, Share, Trends, Industry Analysis Report

: By Technology (3D Knitting, 3D Weaving, Thermo-forming, Nano Fibers, Finishing Treatments, and Others), By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM1135

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

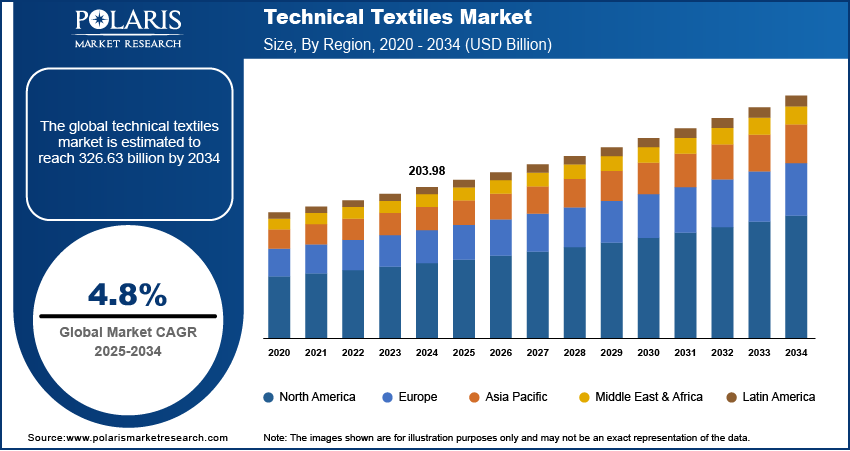

The global technical textiles market size was valued at USD 203.98 billion in 2024. It is expected to grow from USD 213.60 billion in 2025 to USD 326.63 billion by 2034, at a CAGR of 4.8% from 2025 to 2034. The market growth is primarily driven by increasing demand for high-performance materials, growing awareness of safety and stringent regulations, and advancements in material science and manufacturing technologies.

Key Insights

- The indutech segment accounted for the largest market share in 2024.

- The 3D weaving segment dominated the market in 2024 due to its capacity to generate intricate and excessively combined three dimensional framework vanquishing conventional textile manufacturing methods.

- North America dominated the market in 2024.

- The US market flourished due to it having established manufacturing base and robust presence of leading textile firms.

- Asia Pacific is anticipated to register the highest CAGR.

- India is leading the market due to augmenting manufacturing foundation, growing domestic demand, and encouraging government policies.

Industry Dynamics

- The augmentation of automotive industry pushed by surging vehicle demand is driving the need for technical textiles.

- Geotextiles are growingly utilized in construction and infrastructure projects which are used in enhancing soil robustness, drainage, irrigation regulation and road longevity.

- Technical textiles plays a vital role in several sectors such as automotive, construction, healthcare, aerospace, and protective clothing.

- Increased manufacturing prices may act as a restraining factor for the market growth.

Market Statistics

2024 Market Size: USD 203.98 billion

2034 Projected Market Size: USD 326.63 billion

CAGR (2025-2034): 4.8%

North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Technical textiles refer to a specialized category of textiles designed and engineered for specific functionalities, surpassing the conventional role of fabrics primarily for clothing or decoration. Unlike traditional textiles, technical textiles are developed with a purpose-driven approach, incorporating advanced materials and technologies to introduce specific performance characteristics. This diverse category of textiles encompasses a wide range of applications, including geotextiles, medical textiles, agro-textiles, protective clothing, and industrial textiles.

Technical textiles are defined as textile substances and commodities utilized essentially for their technical conduct and operational attributes instead of their attractiveness or ornamental features. This is one of the speediest evolving domains of the textile industry, which is making futuristic, pepped-up fabric designed not just to look captivating but to dispense a notable added value in the context of operationalization. The textile coating procedure is broadly utilized in the making of technical textiles.

The technical textiles market has emerged as a rapidly growing market within the broader textile industry. It plays an important role in various sectors such as automotive, construction, healthcare, aerospace, and protective clothing. The increasing demand for high-performance materials in industries such as automotive and aerospace, where lightweight and durable textiles are crucial, has been a significant driver. Also, the growing awareness of safety and stringent regulations related to workplace safety and environmental protection have propelled the demand for protective clothing and geotextiles. Advancements in material science and manufacturing technologies have enabled the development of innovative technical textiles with properties such as flame resistance, antibacterial capabilities, and smart functionalities, further expanding their applications.

Market Dynamics

Expansion of Automotive Industry

The automotive industry relies heavily on technical textiles for both safety and comfort. The expansion of the industry, driven by rising vehicle demand, is driving the requirement for technical textiles. According to the International Organization of Motor Vehicle Manufacturers, vehicle sales in 2024 were 82,061,217, showcasing the growth of the industry. These textiles are used in airbags, seat belts, headliners, carpets, insulation, and soundproofing materials. The demand for such specialized materials is growing as global car production rises, especially in developing countries. Technical textiles offer lightweight, durable, and cost-effective solutions, helping manufacturers improve fuel efficiency and meet safety standards. Additionally, the rise in electric vehicles (EVs) and innovations in vehicle interiors are boosting the need for advanced textiles, thereby driving technical textiles market growth.

Rising Demand from Construction Industry

Technical textiles, particularly geotextiles, are increasingly used in construction and infrastructure projects. They help improve soil strength, drainage, erosion control, and road durability. Governments around the world are investing in highways, bridges, railways, and smart cities, all of which require long-lasting and efficient construction materials. According to the US Census Bureau, in the US alone, monthly construction spending in February 2025 was USD 2,195.8 billion. Geotextiles are cost-effective and help extend the life of infrastructure, reducing long-term mainteNanoce costs. Their use also supports sustainable construction practices by improving water management and reducing environmental impact. The need for reliable construction solutions is rising as urbanization and industrialization continue, driving the demand for technical textiles in the infrastructure sector.

Segment Analysis

Market Assessment by Application

The technical textiles market segmentation, based on end use, includes clothtech, sportech, mobiltech, indutech, hometech, packtech, and others. The indutech segment is expected to witness significant growth during the forecast period due to the increasing demand for specialized textiles designed to cater to industrial applications. Indutech textiles have several applications in a wide range of industries, including manufacturing, construction, and automotive, where their unique properties contribute significantly to enhanced performance and durability. The rising need for advanced materials that can withstand extreme conditions, such as high temperatures, corrosive environments, and mechanical stress, has driven the adoption of Indutech textiles, thereby driving the segmental growth.

Market Evaluation by Technology

The technical textiles market segmentation, based on technology, includes 3D knitting, 3D weaving, thermo-forming, Nano fibers, finishing treatments, and others. The 3D weaving segment dominated the market in 2024 due to its ability to create complex and highly integrated three-dimensional structures, overcoming traditional textile manufacturing methods. This innovative technique involves interlacing multiple layers of fibers in different directions, providing enhanced strength, durability, and structural enhancement to the final product.

Regional Insights

By region, the study provides the technical textiles market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the market, driven by strong demand across automotive, healthcare, defense, and industrial sectors. The region benefits from high R&D investments, leading to innovations in smart textiles, protective clothing, and medical fabrics. Government regulations around worker safety and defense needs have further boosted the use of advanced materials. The US has a well-established manufacturing base and a strong presence of leading textile companies. Additionally, the growing focus on sustainability and eco-friendly production is pushing North American manufacturers to develop more efficient and environmentally responsible technical textile solutions, thereby driving market growth.

Asia Pacific is expected to record the highest CAGR during the forecast period, fueled by rapid industrialization, urban development, and increasing healthcare needs. Countries such as China, Japan, South Korea, and Australia are leading the market with rising investments in infrastructure, automotive production, and medical technology. The region offers low-cost manufacturing and a large workforce, attracting global textile producers. Demand for geotextiles, medical textiles, and industrial fabrics is rising due to ongoing development projects and stricter safety standards. In addition, increasing awareness about hygiene, personal protection, and environmental concerns is supporting the growth of advanced and sustainable technical textiles across the region.

In India, demand for technical textiles is growing rapidly, due to its expanding manufacturing base, rising domestic demand, and supportive government policies. The “Make in India” initiative and special incentives for the textile industry are encouraging investments in technical textile production. Applications in agriculture, construction, healthcare, and transportation are growing rapidly. The demand for technical textiles in India is further driven by a large workforce, increasing infrastructure development, and rising safety awareness in industrial sectors. The growth of e-commerce and rising consumer demand for functional and durable products are further pushing the market growth.

Key Players and Competitive Analysis

The market opportunity is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the market by introducing innovative products to meet the demand of specific sectors. The competitive trend is amplified by continuous progress in product offerings. A few major players in the market include 3M, Ahlstrom Corporation, DuPont De Nemours & Co., Freudenberg & Co., GSE Environmental Inc., HINDOOSTAN MILLS, Huesker Synthetic GmbH, Johns Manville, Proctor and Gamble, and Royal Ten Cate.

3M Company, originally founded in 1902 as Minnesota Mining and Manufacturing Company, is a diversified technology and science corporation headquartered in St. Paul, Minnesota. The company has operations in over 70 countries and sales in ∼200 countries. 3M business operates in various industries, including industrial, safety, healthcare, and consumer markets. The company’s portfolio features more than 60,000 products categorized into key business segments. The Safety & Industrial segment offers personal protective equipment, adhesives, abrasives, and tapes for industries such as automotive and construction. In the Transportation & Electronics segment, 3M provides solutions for automotive OEMs and electronic components. The Healthcare segment focuses on medical supplies, dental products, and health information systems for hospitals and clinics. Meanwhile, the Consumer segment includes home improvement items, office supplies, and consumer health products. 3M operates manufacturing facilities across various regions, including North America, and significant operations in Asia Pacific, particularly in India and China. The company also maintains a robust presence throughout Europe. 3M offers Nextel ceramic fibers, textiles, fabrics, and yarns designed for manufacturing applications requiring high strength, thermal stability, and durability in demanding industrial environments.

DuPont de Nemours, Inc. (DuPont) is an American multinational chemical company established in 1802 and headquartered in Wilmington, Delaware. Over its long history, the company has transitioned from producing gunpowder to focusing on specialty chemicals and advanced materials. The company’s operations are divided into two main segments: Electronics & Industrial and Water & Protection. The Electronics & Industrial segment provides materials and products for sectors including semiconductors, circuit boards, displays, healthcare, aerospace, and printing. This segment’s offerings include semiconductor manufacturing materials, interconnect films and laminates, as well as industrial polymers and lubricants. The Water & Protection segment focuses on water treatment technologies, personal protective materials, and building solutions. Products in this segment include reverse osmosis membranes under the FilmTec brand, Tyvek building materials, Styrofoam insulation, Corian surfaces, and fibers such as Kevlar and Nomex used in protective clothing. DuPont operates in ∼50 countries and serves customers in over 90 countries. It maintains manufacturing plants, research facilities, and technical centers across North America, Europe, Asia Pacific, and Latin America. Major locations include the US, Belgium, China, and India. DuPont offers high-performance fabrics, fibers, and nonwovens-such as Kevlar, Nomex, and Tyvek, and is designed for protection, durability, and diverse industrial applications, including safety, construction, and transportation.

Key Companies in Technical Textiles Market

- 3M

- Ahlstrom Corporation

- DuPont De Nemours & Co.

- Freudenberg & Co.

- GSE Environmental Inc.

- HINDOOSTAN MILLS

- Huesker Synthetic GmbH

- Johns Manville

- Proctor and Gamble

- Royal Ten Cate

Technical Textiles Industry Developments

In March 2025, three innovative test methods for soft ballistic inserts were developed and launched through a collaboration between Hohenstein and DuPont, aiming to enhance comfort, mobility, and performance in protective body armor.

In November 2023, Sense-Tex, a revolutionary fabric and yarn technology that combines advanced functionality, sustainability, and fashion, was introduced by Transforming Textiles AB. This innovative textile product seeks to provide customers with an unparalleled experience by fusing fashion with intelligent technology and environmental awareness.

Technical Textiles Market Segmentation

By Technology Outlook (Revenue USD Billion, 2020–2034)

- 3D Knitting

- 3D Weaving

- Thermo-Forming

- Nano Fibers

- Finishing Treatments

- Others

By Application Outlook (Revenue USD Billion, 2020–2034)

- Clothtech

- Sportech

- Mobiltech

- Indutech

- Hometech

- Packtech

- Others

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Technical Textiles Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 203.98 billion |

|

Market Size Value in 2025 |

USD 213.60 billion |

|

Revenue Forecast by 2034 |

USD 326.63 billion |

|

CAGR |

4.8% from 2025 to 2034 |

|

Base year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The market size was valued at USD 203.98 billion in 2024 and is projected to grow to USD 326.63 billion by 2034.

The global market is projected to register a CAGR of 4.8% during the forecast period.

North America held the largest share of the global market in 2024.

A few key players in the market are 3M, Ahlstrom Corporation, DuPont De Nemours & Co., Freudenberg & Co., GSE Environmental Inc., HINDOOSTAN MILLS, Huesker Synthetic GmbH, Johns Manville, Proctor and Gamble, and Royal Ten Cate.

The 3D weaving segment dominated the market in 2024, due to its ability to create complex and highly integrated three-dimensional structures, overcoming traditional textile manufacturing methods.

The indutech segment is expected to witness significant growth during the forecast period due to the increasing demand for specialized textiles designed to cater to industrial applications.