Thermal Paper Market Share, Size, Trends, Industry Analysis Report

By Application (POS, Tags & Label, Lottery & Gaming), By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 119

- Format: PDF

- Report ID: PM3744

- Base Year: 2023

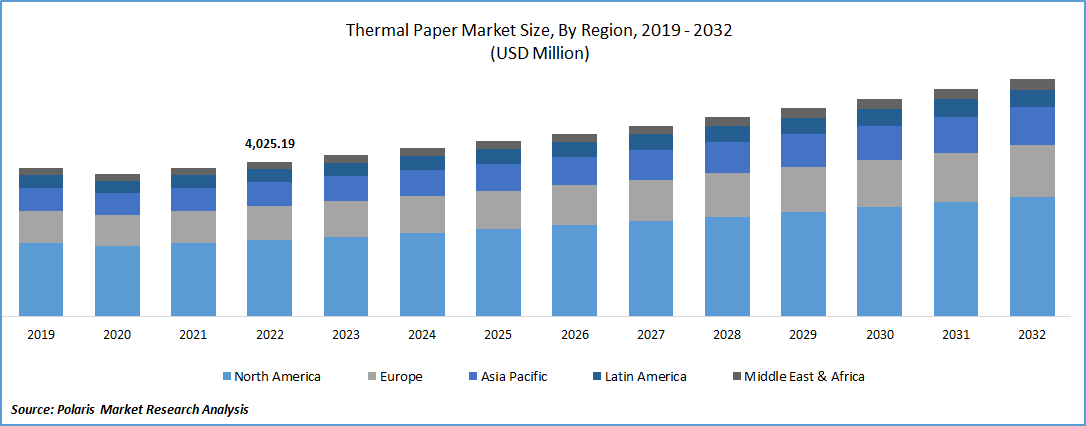

- Historical Data: 2019-2022

Report Outlook

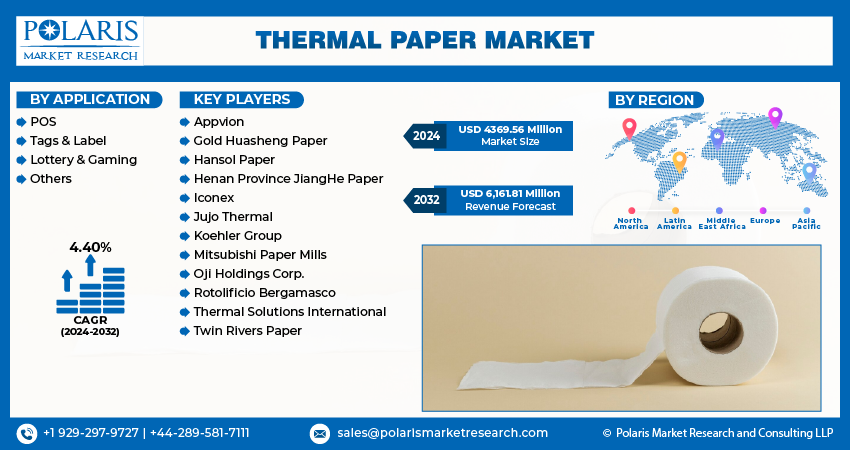

The global thermal paper market was valued at USD 4193.04 million in 2023 and is expected to grow at a CAGR of 4.40% during the forecast period.

To Understand More About this Research: Request a Free Sample Report

Increasing adoption of POS terminals in warehouses and retail establishments will propel product demand. The South Asian region is poised for market growth due to favorable business conditions from enhanced government policies and increasing domestic consumption of pharmaceutical and food and beverage items. Additionally, the thermal paper market is expected to benefit from the presence of paper manufacturers, particularly in countries like China.

Thermal paper's attributes also make it suitable for crafting robust, secure, and high-performance RFID tags, benefiting from its heightened durability and strong thermal stability. The increasing demand for RFID tags and labels is anticipated to drive the adoption of thermal paper due to its advantageous characteristics, including remarkable durability and effective temperature resistance. The expansion of retail establishments and chains in developing economies such as India and China is projected to positively influence the utilization of POS terminals, contributing to market growth. Additionally, government initiatives aimed at enhancing the food and pharmaceutical sectors in emerging economies are predicted to foster the use of thermal paper in packaging and labeling applications.

The market is characterized by a robust array of raw material suppliers that provide base paper to thermal paper manufacturers. The increasing adoption of recycled fibers in the production of the foundational product is poised to enhance market expansion. Moreover, prominent players exhibit a noteworthy degree of integration throughout the value chain, involved in both manufacturing and directly supplying the final product to consumers through direct sales channels. Market players strive to enhance their procurement strategies by practicing responsible sourcing and proactively implementing adjustments within their supply chains.

Dedicated teams oversee the assessment and resolution of procurement initiatives, particularly during the delineation of sourcing requirements, the formulation of contracts, and the tendering phase. Additionally, market contributors have initiated the acquisition of diverse supplier data encompassing aspects like financial robustness and carbon emissions as part of the pre-qualification procedure. Regulatory standards mandated by the FDA about the labeling and packaging of food products are projected to positively influence the adoption of thermal papers, particularly within the e-commerce supply chains.

Industry Dynamics

Growth Drivers

Expanding Digitalization of Transaction Processes

The market's growth rate is projected to slow down due to the expanding digitalization of transaction processes, reducing the requirement for printing at POS terminals. Moreover, internal substitutions driven by innovation might hinder the industry's growth. Nonetheless, the increasing adoption of e-commerce is anticipated to elevate the need for thermal paper, particularly labels and tags. Thermal paper will likely maintain its popularity among buyers, especially in warehouse settings, where its attributes are advantageous in minimizing labeling contamination risks associated with finished products.

Report Segmentation

The market is primarily segmented based on application and regions.

|

By Application |

By Region |

|

|

To Understand the Scope of this Report: Speak to Analyst

By Application Analysis

POS Application Segment Held the Largest Share in 2022

The POS Application segment held the largest revenue share. This can be attributed to the escalating consumption of consumer goods, which has spurred the proliferation of retail establishments worldwide. As retail stores expand to cater to growing demand, there has been a concurrent surge in the utilization of thermal paper for POS terminal transactions.

The thermal paper finds versatile applications across various sectors. It is employed in retail stores, supermarkets, warehouses, and industrial and logistical settings for tasks like packaging and labeling. This widespread adoption is owing to the inherent advantages of thermal paper technology. Notably, the production cost of thermal paper is kept low due to factors like inkless printing and the straightforward maintenance of printing equipment.

Furthermore, the appeal of thermal paper is augmented by its user-friendly attributes. The seamless printing process facilitated by inkless technology and the convenience of maintaining printing equipment with minimal effort resonates well with end-users. As a result, thermal paper has garnered a strong preference among businesses seeking efficient and cost-effective printing solutions for their POS operations, contributing significantly to the segment's market dominance.

Users, particularly those in warehouse settings, favor thermal paper for labeling and tagging due to their inclination toward utilizing RFID tags. These RFID tags are renowned for their robustness and security, making them a superior option to alternative tagging methods. Additionally, the surge in the demand for leisure gaming activities, particularly in economies where tourism is a pivotal factor, is anticipated to act as a catalyst for market growth.

The online ticketing platforms segment will grow at a substantial pace. Thermal paper still finds extensive application within the gaming industry. It prints essential items like lottery tickets, enabling secure and efficient ticketing processes. Additionally, thermal paper is employed for printing coinless slot machine receipts, allowing players to track their credits and winnings conveniently. Moreover, thermal paper produces receipts and tickets for sportsbooks and totes, facilitating seamless and organized betting procedures for enthusiasts.

By Regional Analysis

Apac Held the Largest Revenue Share in 2022

APAC is expected to dominate the market. Rapid expansion of retail chains across the region is a key driver. Consumers in this region strongly prefer easily accessible consumer goods, leading to the establishment of numerous retail outlets and stores to cater to their demands. This proliferation of retail establishments has substantially increased the demand for thermal paper used in point-of-sale (POS) terminal transactions, as these terminals rely on thermal paper for printing receipts and transaction records.

Escalating industrial activities is pivotal in boosting the demand for thermal paper in labeling applications. As industries grow and expand, efficient labeling and identification of products becomes crucial. The thermal paper finds extensive use in producing labels for various industrial applications, ensuring clear and legible information representation. Furthermore, the rising market for Fast-Moving Consumer Goods (FMCG) goods in developing regional economies contributes significantly to the surge in thermal paper demand. The growing consumer base and increased consumption of everyday products have prompted manufacturers to expand their production capacities to meet the rising demand.

Europe will grow at the fastest pace. Increasing adoption of thermal paper in various end-uses within the region plays a pivotal role. Thermal paper finds applications in diverse industries, including supplement packaging, labeling, and the gaming sector. The pharmaceutical and supplement industries require clear and informative labels for their products, driving the demand for thermal paper with efficient printing capabilities.

As the region emphasizes environmental consciousness, manufacturers will likely shift their focus toward more sustainable production methods and materials. This shift might entail exploring alternatives to traditional thermal paper production processes that can have a lower environmental impact. This change aligns with Europe's sustainability goals and regulations, which may lead to the development of eco-friendly thermal paper options.

Competitive Insight

Prominent industry participants strategically establish production facilities across different regions, facilitating streamlined supply chains to cater to consumer demands effectively. Dominant players exhibit robust levels of both forward and backward integration, which enhances their competitive standing. This integration dynamic has intensified market competition, creating challenges for new entrants seeking to establish a foothold in the industry.

Some of the major players operating in the global market include:

- Appvion

- Gold Huasheng Paper

- Hansol Paper

- Henan Province JiangHe Paper

- Iconex

- Jujo Thermal

- Koehler Group

- Mitsubishi Paper Mills

- Oji Holdings Corp.

- Rotolificio Bergamasco

- Thermal Solutions International

- Twin Rivers Paper

Recent Developments

- In April 2022, Jujo Thermal has unveiled its intentions to introduce new names for its range of direct thermal papers. This move signifies the company's strategic approach to enhance its product offerings and potentially improve market positioning.

- In April 2023, Koehler Paper & Nissha have joined forces in a collaborative effort to introduce a sustainable packaging solution known as Metivo advanced packaging paper. This innovative product is created by utilizing Koehler's Nexplus barrier paper technology. The collaboration represents a strategic partnership between the two companies to address the growing demand for environmentally friendly and effective packaging solutions.

Thermal Paper Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 4369.56 million |

|

Revenue Forecast in 2032 |

USD 6,161.81 million |

|

CAGR |

4.40% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments Covered |

By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation |

FAQ's

The global thermal paper market size is expected to reach USD 6,161.81 million by 2032.

Key players in the market are Oji Holdings Corp., Thermal Solutions International, Iconex, Twin Rivers Paper, Appvion, Koehler Group.

Asia Pacific contribute notably towards the global thermal paper market.

The global thermal paper market is expected to grow at a CAGR of 4.4% during the forecast period.

The thermal paper market report covering key segments are application, and regions.