Thermal Scanners Market Size, Share & Trends Analysis Report

By Wavelength (Short-Wave Infrared, Mid-Wave Infrared, Long-Wave Infrared), By End Use (Industrial, Healthcare, Aerospace & Defense, Automotive, Oil & Gas, Commercial), By Type, and By Region -Market Forecasts, 2025 - 2034

- Published Date:Sep-2025

- Pages: 117

- Format: PDF

- Report ID: PM1907

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

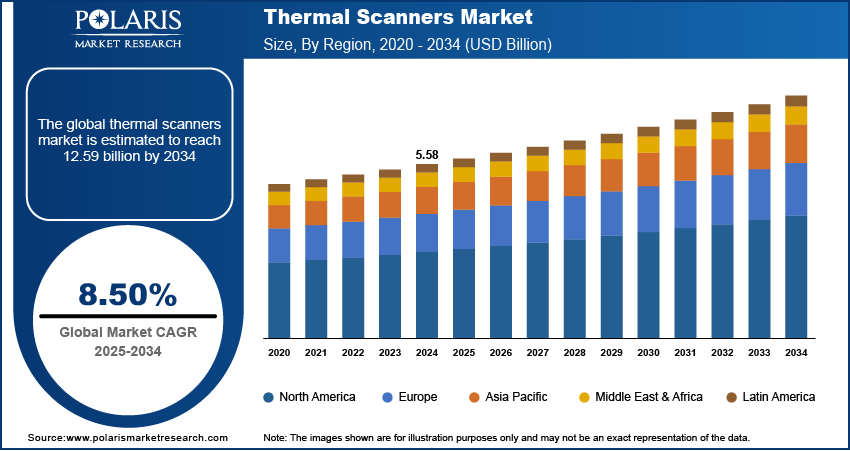

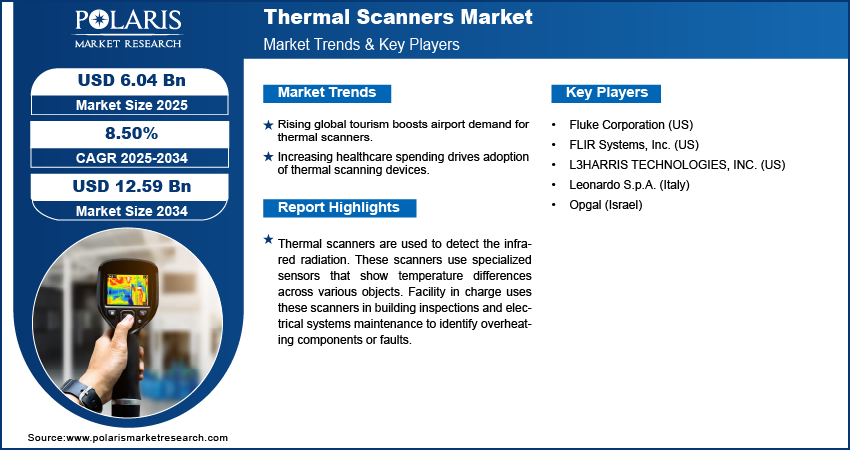

The global thermal scanners market size was valued at USD 5.58 billion in 2024. The market is projected to grow at a CAGR of 8.50% during 2025 to 2034. Key factors driving demand for thermal scanners include increasing demand for surveillance and security in public spaces, need for predictive maintenance and energy efficiency in industrial spaces, and technological advancements.

Key Insights

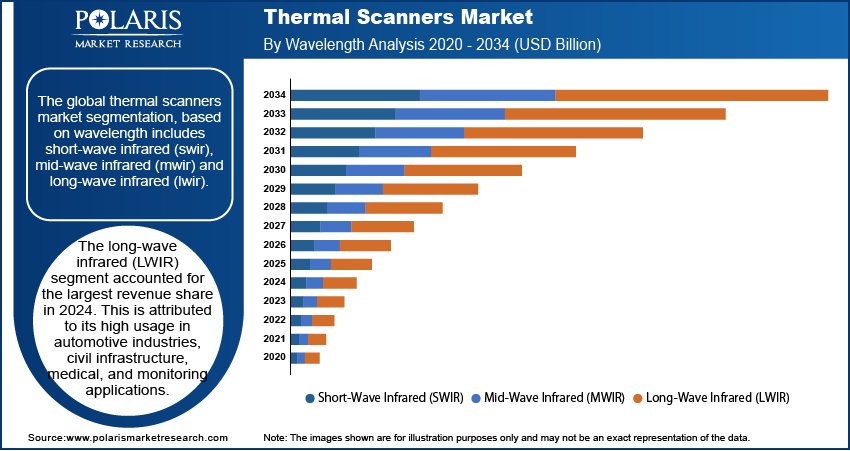

- The long-wave infrared (LWIR) segment accounted for the largest revenue share in 2024. This is attributed to its high usage in automotive industries, civil infrastructure, medical, and monitoring applications.

- The commercial segment is projected to grow at a rapid pace in the coming years, owing to the thermal scanners' wide usage at airports since the outbreak of the global pandemic disease coronavirus.

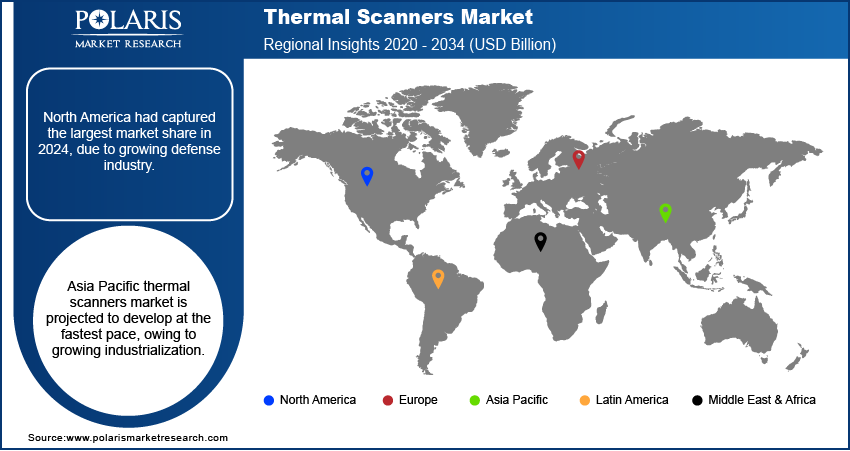

- North America dominated the global thermal scanners market in 2024. This is attributed to the presence of prominent players such as Fluke Corporation, L3harris Technologies, Inc., and FLIR Systems, Inc.

- Asia Pacific thermal scanners market is projected to develop at the fastest pace, owing to growing industrialization.

Industry Dynamics

- Growing international tourism across the globe is propelling the demand for thermal scanners. This is due to the high usage of these scanners at airports.

- The increasing healthcare spending across the globe is also increasing the demand for thermal scanners.

- Technological advancements and growing urbanization are creating a lucrative market opportunity.

- High cost may hamper the market growth.

Market Statistics

- 2024 Market Size: USD 5.58 Billion

- 2034 Projected Market Size: USD 12.59 Billion

- CAGR (2025-2034): 8.50%

- North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

Thermal scanners are used to detect the infrared radiation. These scanners use specialized sensors that show temperature differences across various objects. Facility in charge uses these scanners in building inspections and electrical systems maintenance to identify overheating components or faults. Security teams also use these scanners for surveillance and search operations in total darkness. Healthcare facilities such as hospitals and clinics use them for measuring patient body temperature. The market is being driven by a surge in mass screening of COVID-19 cases and rapid adoption in the defense sector for security and surveillance services.

Thermal scanners are expected to see increased usage in the industrial and healthcare sectors. Manufacturing plants use them for predictive maintenance, equipment safety, and quality control. Moreover, hospitals and clinics use these scanners for non-contact fever screening and infection control at entry points. The growing cases of infectious diseases, such as those linked with cardiovascular diseases, are driving hospitals to adopt thermal scanners

Industry Dynamics

Growth Drivers

The growing international tourism across the globe is increasing the demand for thermal scanners. Airports, hotels, and transportation hubs use these scanners to screen large numbers of travelers for fever and other health risks. The market for thermal scanners has been also fueled by the high adoption of these systems for border control, law enforcement, and structural health monitoring of aircraft applications, as they aid in the quick detection and targeting of enemy forces. Furthermore, the high helathcare spending in many parts of world has certainly pushed high demand for thermal scanners. The development of advanced thermal scanners by key companies are also leading to the market growth.

Thermal Scanners Market Report Scope

The market is primarily segmented on the basis of type, wavelength, end use, and region.

|

By Type |

By Wavelength |

By End Use |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Wavelength

The long-wave infrared (LWIR) segment accounted for a major revenue share in 2024. This is due to its superior sensitivity to small temperature differences.These scanners perform efficently in atmospheric conditions such as fog, smoke, and dust. This makes these scanners ideal for border security where visibility is limited. Furthermore, the growing need for semiconductor inspection, moisture detection, spectroscopy, and scientific research contributed to the segment's development. These scanners are also used in automotive industries, civil infrastructure, medical, and monitoring applications.

In the upcoming years, the mid-wave infrared (MWIR) segment is anticipated to rise at a significant pace in the coming years. This is atrributed to its high usage in long-range observation, medical diagnosis, satellite-based weather profile tracking, and deforestation mapping. These scanners also provide superior image clarity for industrial process monitoring and aerospace applications, which is increasing their demand across the globe.

Insight by End Use

The demand for thermal scanners in commercial segment is expected to witness the fastest growth over the projected period. This growth is attributed to the thermal scanners wide usage at airports since the outbreak of the global pandemic disease coronavirus. Commercial spaces such as malls, hotels, motels, and others are deploying these spaces to reduces the pentration of infectious diseases and to enhance the security and safety of the place. Moreover, ongoing launches of advanced scanners also drove the segment's dominance. For instance, Ramco Systems launched improved versions of thermal scanning and facial recognition to detect the temperatures at commercial spaces.

Geographic Overview

North America had captured the largest market share in 2024, due to growing defense industry. The presence of prominent players such as Fluke Corporation, L3harris Technologies, Inc., and FLIR Systems, Inc.; have also contributed to the market dominance. The high healthcare spending and awarness about infectious diseases propelled the demand for thermal scanners in the region, particualry in the US. The large numbers of airports in the U.S. and wide tourist destination contributed to the market growth in the region.

Which Country Dominated the Thermal Scanners Market in North America in 2024?

The U.S. held the largest share of the North America thermal scanners industry in 2024. Upsurging demand in the security, healthcare, and industrial sectors propels the adoption of thermal scanners in the country. Increasing technological advancements and rising government investments are also expected to drive the industry expansion. Further, various industries use these scanners for non-destructive testing, condition monitoring, and equipment maintenance to prevent costly device failures. Also, rising automation and smart manufacturing boost the adoption of integrated thermal imaging systems across the country. In addition, the presence of key players across the U.S. propels the industry expansion. The following table contains major companies, their key products, and other insights.

|

Company |

Key Products |

End-Use Industries |

Recent Developments |

|

Teledyne FLIR LLC |

Handheld & fixed thermal cameras |

Industrial & public safety, OEM, defense, and marine |

In June 2025, Flir launched its newest high-resolution thermal security camera, the Flir PT-Series AI SR, for commercial and industrial applications. |

|

Fluke Corporation |

Ti480 PRO, TiX580 |

Industrial inspections, predictive maintenance |

Launched iSee Mobile Thermal Camera for contractors, electricians, and the HVAC industry in 2024 |

|

L3Harris Technologies, Inc. |

ENVG-B, a dual-waveband goggle with fused white phosphor and thermal technologies. |

Defense & military, aerospace, industrial |

- |

|

Seek Thermal |

Seek Shot, Seek Compact |

Professional inspections, DIY, security |

Launched its next-generation thermal sensor technology for automotive in June 11. |

|

FOTRIC Inc. |

FOTRIC 220/320 series, AnalyzIR software |

Industrial, research, predictive maintenance |

Released H7 Handheld Acoustic Imaging Camera in October 2025. |

|

Optotherm, Inc. |

Infrared cameras & systems |

Industrial process monitoring, manufacturing |

Launched Micros thermal imaging microscope in 2024. |

Asia Pacific thermal scanners market is projected to grow at the fastest pace. This is attributed to the high number of vendors offering cost-effective solutions. China took the lead in terms of revenue in the region, owing to growing urabnization and industrilization. The growing tourism in countries such as India is also driving the demand for thermal scanners. Airports use these scanners to screen large numbers of travelers for fever.

Competitive Insight

Some of the key players operating in the thermal sanners market are L3HARRIS TECHNOLOGIES, INC. (US), Fluke Corporation (US), FLIR Systems, Inc. (US), Leonardo S.p.A. (Italy), and Opgal (Israel). To boost their market, these businesses have used both organic and inorganic growth strategies such as product launches and innovations, alliances, deals, contracts, and mergers and acquisitions.

Industry Developments

April 2023, Seek Thermal Inc. announced the launch of its newest product, the FirePRO 300.

Thermal Scanners Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 5.58 Billion |

|

Market Size in 2025 |

USD 6.04 Billion |

|

Revenue Forecast by 2034 |

USD 12.59 Billion |

|

CAGR |

8.50% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global market size was valued at USD 5.58 billion in 2024 and is projected to grow to USD 12.59 billion by 2034.

• The global market is projected to register a CAGR of 8.50% during the forecast period.

• North America dominated the market in 2024.

• A few of the key players in the market are L3HARRIS TECHNOLOGIES, INC. (US), Fluke Corporation (US), FLIR Systems, Inc. (US), Leonardo S.p.A. (Italy), and Opgal (Israel).

• The long-wave infrared (LWIR) segment dominated the market revenue share in 2024.