Thin Film Solar Cells Market Share, Size, Trends, Industry Analysis Report

By Substrate (Plastic, Metal, and Glass); By Type; By End-User; By Region; Segment Forecast, 2023- 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM3469

- Base Year: 2023

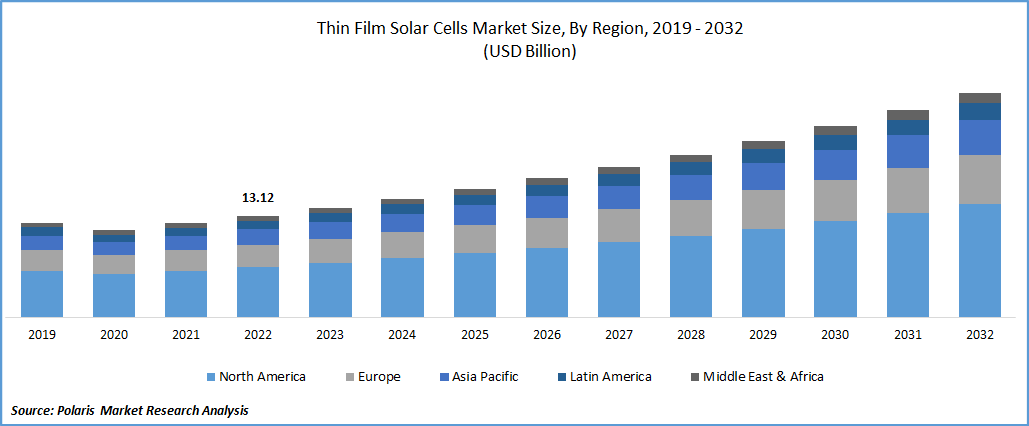

- Historical Data: 2019-2022

Report Outlook

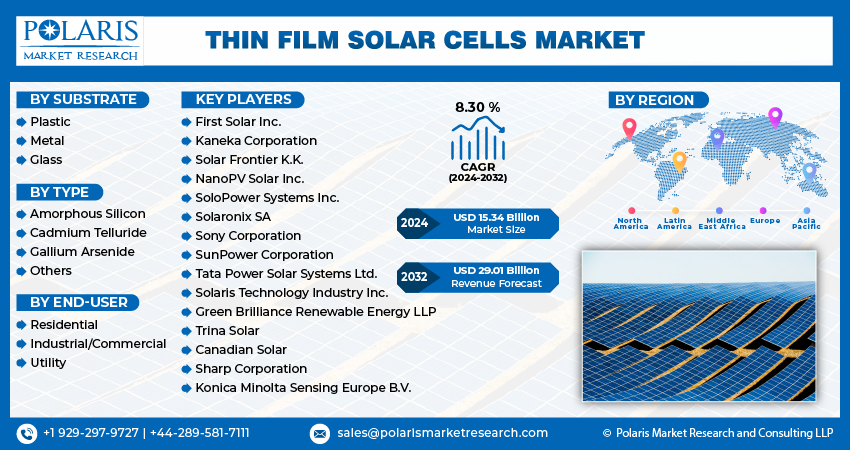

The global thin film solar cells market was valued at USD 14.19 billion in 2023 and is expected to grow at a CAGR of 8.30% during the forecast period. Rising consumer energy demand and an increase in the number of people moving towards renewable energy sources, coupled with the lower PV module prices and increased consumption of energy due to the declining prices and easy availability across both developed and developing economies, are the major factors projected to boost the demand and growth of the market. In addition, companies operating in the market are concentrating on developing new technologies with improved manufacturing processes and capabilities to reduce their carbon footprint and operational costs, which will likely fuel market growth soon. For instance, in November 2022, the University of Oxford announced the launch of a brand-new world-class research facility to provide capabilities for next-generation advanced functional materials to help crucial societal, environmental, and industrial challenges.

To Understand More About this Research: Request a Free Sample Report

Moreover, the widespread usage of thin-film photovoltaic technologies and energy-efficient technologies for a wide range of industrial and residential applications, including consumer electronics, space, and military. The need for highly flexible and eco-friendly products has also risen as a key consequence of establishing several regulations and strict energy norms that have positively influenced the global market.

However, the lower productivity of the product compared to other alternatives and the negative impact of these solar cells on the environment that forced governments to impose several regulations are the key factors hampering the market growth. Deadly coronavirus worldwide has haled the manufacturing of thin film solar cells due to imposed locks and other restrictions on trade activities. During the pandemic, many companies halted their operations because of less workforce and a slow sales decline, as several utilities and commercial projects were on hold.

Industry Dynamics

Growth Drivers

The rising awareness among key players and buyers across the globe regarding the adverse effect of other types of solar cells on the environment has fueled the adoption of thin film solar cells and driven the global thin film solar cells market growth at a rapid pace. Additionally, the rise in the installation of solar systems, mainly because of the continuous decline in the prices of solar cell modules and rapid urbanization, and augmented consumer spending, are also likely to impact market growth positively. Furthermore, the improvement in infrastructure development activities and growth in the number of strategic collaborations among major companies, along with the recent technical advancements, which reduce the production cost of the product while extending profitable opportunities to the market, will further create huge growth opportunities in the forecast period.

Report Segmentation

The market is primarily segmented based on substrate, type, end-user, and region.

|

By Substrate |

By Type |

By End-User |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Plastic segment is expected to witness highest growth during forecast period

The plastic segment is projected to grow at a CAGR during the projected period, mainly driven by its wide range of beneficial characteristics and features such as cost-effectiveness, easy availability, high flexibility, and lightweight. In addition, with the rising environmental concerns and growing focus of numerous companies to reduce their environmental footprint, the demand for recyclable plastic material is drastically increasing all over the world, which in turn is propelling the demand and growth of the segment market.

The metal segment led the industry market with substantial revenue share in 2022, largely attributable to its ability to offer high efficiency and durability and better resistance to several environmental factors, including temperature changes and moisture, that make them more reliable and long-lasting. Additionally, several governments worldwide are promoting the use of renewable energy, including solar power, which has led to incentives and subsidies for companies involved in producing thin-film solar cells that positively impacted the segment market growth in recent years.

Cadmium telluride segment accounted for the largest market share in 2022

The cadmium telluride segment accounted for the largest market share in 2022 and is likely to retain its market position throughout the forecast period. These solar cells have high conversion efficiency, which makes them able to easily convert a large percentage of the sunlight they receive into electricity, which fuels the product adoption as an attractive option for locations with high levels of solar irradiation along with the lower carbon footprint of these cells as compared to others available in the market, are major key factors influencing the growth of the segment market.

The gallium arsenide segment is expected to grow at the fastest growth rate over the next coming years on account of the rapid increase in the demand for renewable energy due to the growing concerns regarding climate change coupled with the higher technological advancements that have led to the development of new material and manufacturing processes, that made the product more efficient and cost-effective.

Utility segment held the significant market revenue share in 2022

The utility segment held a significant market share in revenue share in 2022, which is highly accelerated due to the continuous rise in research and development spending and focus on key market players on reducing the installation and maintenance costs coupled with the constant advances in thin film solar technology. Moreover, various countries worldwide are introducing several incentives and subsidies towards the development of renewable energy sources like solar power and many others, which boost the demand and needs in the utility segment.

Asia Pacific region dominated the global market in 2022

The Asia Pacific region dominated the global market with the largest market share in 2022 and is expected to maintain its dominance over the anticipated period. The growth of the segment market can be largely attributed to the rapidly increasing deployment of solar PV modules in many utility-scale, residential, and commercial applications, along with the rise in infrastructure development and growing investments for the expansion of manufacturing capabilities across the region. For instance, in July 2021, First Solar Inc. announced its plans to invest around USD 684 million in a fully vertically integrated facility. The new facility will have a nameplate capacity of 3.3 gigawatts with the First Solar expansion in India and the United States, which will double its current manufacturing capacity.

The Europe region is expected to be the fastest growing region during the projected period, owing to the growing consumption of clean energy and rising energy efficiency among a large number of consumers along with the implementation of reducing greenhouse gases emissions, especially in countries like Germany, France, and the United Kingdom.

Competitive Insight

Some of the major players operating in the global market include First Solar Inc., Kaneka Corporation, Solar Frontier K.K., NanoPV Solar Inc., SoloPower Systems Inc., Solaronix SA, Sony Corporation, SunPower Corporation, Tata Power Solar Systems Ltd., Solaris Technology Industry Inc., Green Brilliance Renewable Energy LLP, Trina Solar, Canadian Solar, Sharp Corporation, and Konica Minolta Sensing Europe B.V.

Recent Developments

- In November 2021, Graphene & Solar Technologies acquired Patented Thin-Film Technology Development Corp for a broad range of applications & also patented 5G EMF network. This acquisition has been done against a purchase consideration of USD 47 million and will take the company's market position to new heights.

Thin Film Solar Cells Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 15.34 billion |

|

Revenue forecast in 2032 |

USD 29.01 billion |

|

CAGR |

8.30 % from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Substrate, By Type, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

First Solar Inc., Kaneka Corporation, Solar Frontier K.K., NanoPV Solar Inc., SoloPower Systems Inc., Solaronix SA, Sony Corporation, SunPower Corporation, Tata Power Solar Systems Ltd., Solaris Technology Industry Inc., Green Brilliance Renewable Energy LLP, Trina Solar, Canadian Solar, Sharp Corporation, and Konica Minolta Sensing Europe B.V. |

FAQ's

key companies in thin film solar cells market are First Solar Inc., Kaneka Corporation, Solar Frontier K.K., NanoPV Solar Inc., SoloPower Systems Inc., Solaronix SA, Sony Corporation, SunPower Corporation.

The global thin film solar cells market is expected to grow at a CAGR of 8.3% during the forecast period.

The thin film solar cells market report covering key segments are substrate, type, end-user, and region.

key driving factors in thin film solar cells market are rising electricity demand in remote areas.

The global thin film solar cells market size is expected to reach USD 29.01 billion by 2032