Toluene Market Share, Size, Trends, Industry Analysis Report

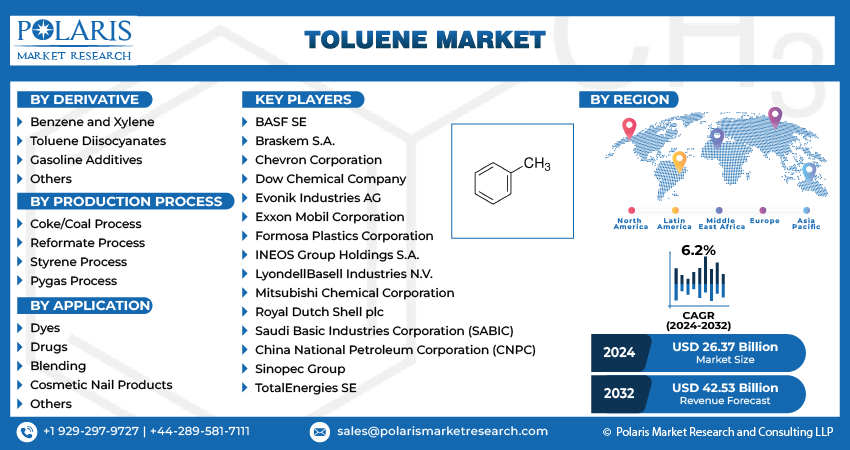

By Derivative (Benzene and Xylene, Toluene Diisocyanates, Gasoline Additives, Others); By Production Process; By Application; By Region; Segment Forecast, 2024- 2032

- Published Date:Mar-2024

- Pages: 114

- Format: PDF

- Report ID: PM4699

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

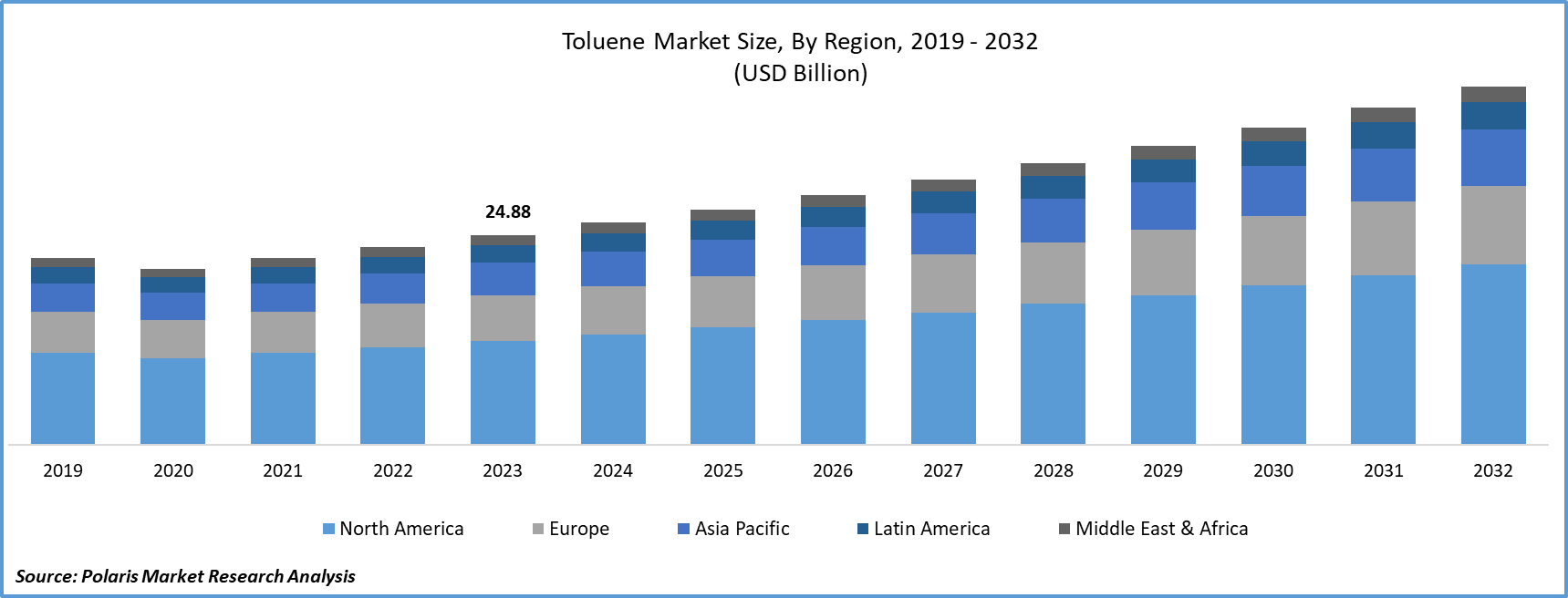

Global toluene market size was valued at USD 24.88 billion in 2023.

The market is anticipated to grow from USD 26.37 billion in 2024 to USD 42.53 billion by 2032, exhibiting the CAGR of 6.2% during the forecast period.

Market Introduction

Toluene's importance as a petrochemical feedstock drives its demand across industries. Derived from crude oil refining and benzene production, it serves as a key raw material for synthesizing chemicals. Converted into benzene, it's crucial for styrene and phenol production. Toluene also plays a vital role in xylene synthesis, which is essential for polyester fibers and PET bottles. Its versatility extends to solvents like diisocyanates for polyurethane foams and explosives.

In addition, companies operating in the market are acquiring other players to expand offerings and strengthen their market presence.

To Understand More About this Research: Request a Free Sample Report

For instance, in January 2021, INEOS finalized the acquisition of BP's worldwide Aromatics and Acetyls divisions for $5 billion. This transaction will broaden the company's portfolio and geographical presence. The acquired entities will operate under the names INEOS Acetyls and INEOS Aromatics.

The expansion of the automotive sector significantly boosts demand for toluene, a versatile chemical compound. Toluene is crucial in gasoline formulation, enhancing combustion efficiency and meeting stringent fuel quality standards. Additionally, it's integral in automotive coatings and paints, providing protection against corrosion and improving aesthetics. Its solvent properties enable effective dispersion in paint formulations, ensuring durability. Furthermore, toluene is vital in manufacturing rubber and plastic components like tires, hoses, and seals, facilitating processing. With the automotive industry's continuous global growth driven by consumer demand and clean energy initiatives, toluene demand remains robust.

Industry Growth Drivers

Growth in End-Use Industries is Projected to Spur the Product Demand

The toluene market share is experiencing substantial growth due to rising demand from multiple industries. Toluene serves as a versatile solvent and feedstock chemical, finding applications in the automotive, construction, paints, coatings, pharmaceuticals, and electronics sectors. It enhances gasoline octane ratings in the automotive industry, while its use in construction for adhesives and coatings is driven by urbanization and infrastructure projects. Additionally, toluene is crucial in paint and coating formulations, pharmaceutical manufacturing, and electronics production. With these industries expanding globally, toluene demand remains strong, indicating its diverse role across diverse industrial applications.

Rise in Demand for Solvents is Expected to Drive Toluene Market Growth

Toluene's versatility as a solvent drives its demand across various industries, including paints, pharmaceuticals, adhesives, and gasoline production. It serves as a crucial raw material for chemicals like benzene and xylene, while its primary application lies in solvent use. Toluene enhances paint application and performance, aids in drug formulation, and is vital in producing adhesives, sealants, and printing inks due to its excellent solvent properties. This widespread demand is expected to fuel market growth, though careful consideration of environmental and safety factors remains essential for sustainable usage.

Industry Challenges

Environmental Concerns are Likely to Impede the Market Growth

Growing environmental concerns are restraining the toluene market growth due to heightened regulatory scrutiny and increased awareness of its harmful effects. Classified as a hazardous air pollutant and volatile organic compound (VOC), toluene contributes significantly to air pollution and ground-level ozone formation, leading to adverse health impacts and environmental degradation. Its combustion releases volatile organic compounds, nitrogen oxides, and particulate matter, exacerbating respiratory issues and smog formation. Moreover, industrial processes and waste disposal emit toluene, contaminating soil, water, and ecosystems, posing risks to human health and wildlife. Stringent regulations and rising environmental consciousness prompt industries to seek eco-friendly alternatives, limiting toluene demand despite its widespread use.

Report Segmentation

The toluene market analysis is primarily segmented based on derivative, production process, application, and region.

|

By Derivative |

By Production Process |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Derivative Analysis

Benzene and Xylene Segment Held Significant Revenue Share in 2023

The benzene and xylene segment held a significant revenue share in 2023 due to their roles as essential petrochemical feedstocks. Derived from toluene, they are pivotal in various downstream industries like plastics, fibers, and pharmaceuticals. Benzene and xylene serve as primary building blocks for chemicals crucial in manufacturing plastics, resins, and fibers. They find extensive use in automotive, construction, electronics, and packaging industries for producing adhesives, coatings, solvents, and insulation materials. Global economic growth, urbanization, and industrialization drive their demand, particularly in emerging economies.

By Production Process Analysis

Reformate Process Segment Held Significant Revenue Share in 2023

The reformate process segment held a significant revenue share in 2023 due to its ability to produce high-purity toluene suitable for diverse applications. Its stringent quality control ensures consistent product quality, appealing to end-users. Additionally, the process offers higher efficiency and yield, making it cost-effective for manufacturers. Given the demand for superior-quality toluene, industries like pharmaceuticals, paints, and coatings prefer this method. Moreover, it often complies with regulatory standards and environmental regulations, appealing to companies emphasizing sustainability. Ongoing technological advancements further enhance its efficiency and sustainability.

By Application Analysis

Drugs Segment Held Significant Revenue Share in 2023

The drugs segment held a significant revenue share in 2023 due to its crucial role in pharmaceutical production. Toluene serves as a solvent and reagent in synthesizing active pharmaceutical ingredients (APIs) and drug formulations like tablets, capsules, and topical preparations. It is integral in producing specialty pharmaceuticals, such as inhalants and transdermal patches, requiring precise formulation. Additionally, toluene facilitates drug delivery systems like microspheres and nanoparticles for controlled release. Its usage as a laboratory reagent in pharmaceutical research and development further strengthens its demand. Moreover, increasing global healthcare expenditure drives demand for pharmaceuticals, sustaining toluene consumption in pharmaceutical manufacturing.

Regional Insights

Asia-Pacific Region Accounted for a Significant Market Share in 2023

In 2023, the Asia-Pacific region accounted for a significant market share due to rapid economic growth and industrialization. Increased demand rises from sectors like manufacturing, construction, and automotive industries. With a large and growing population, consumption of toluene-driven products such as plastics and coatings rises. Expansion in key industries like chemicals and pharmaceuticals further boosts demand. Infrastructure projects also contribute to the demand for toluene-based materials. Government policies promoting industrial growth and investments drive demand. Additionally, the presence of key manufacturers and a burgeoning chemical industry ensures the region's substantial market share in the market size.

The North American toluene market share is diverse, with significant demand across sectors like chemicals, automotive, construction, pharmaceuticals, and paints. Toluene serves as a crucial feedstock for benzene and xylenes in the chemical industry and as a gasoline additive for the automotive sector. In construction, it is utilized in adhesives, coatings, and insulation materials. Stringent environmental regulations drive the adoption of eco-friendly alternatives and sustainable practices. The market is characterized by its varied applications and evolving trends towards sustainability and innovation, reflecting its importance in the region's industrial landscape.

Key Market Players & Competitive Insights

The toluene market players encompasses a wide range of participants, and the anticipated entry of new competitors is set to escalate competition. Established frontrunners consistently upgrade their technologies to sustain a competitive edge, prioritizing efficiency, dependability, and safety. These companies prioritize strategic initiatives like forging partnerships, enhancing product ranges, and engaging in collaborative ventures. Their objective is to surpass rivals in the sector, securing a notable market share.

Some of the major players operating in the global toluene market include:

- BASF SE

- Braskem S.A.

- Chevron Corporation

- China National Petroleum Corporation (CNPC)

- Dow Chemical Company

- Evonik Industries AG

- Exxon Mobil Corporation

- Formosa Plastics Corporation

- INEOS Group Holdings S.A.

- LyondellBasell Industries N.V.

- Mitsubishi Chemical Corporation

- Royal Dutch Shell plc

- Saudi Basic Industries Corporation (SABIC)

- Sinopec Group

- TotalEnergies SE

Recent Developments

- In March 2023, Mitsui Chemicals, Inc. unveiled intentions to enhance the production capacity of its Toluene Diisocyanate (TDI) facility at Omuta Works in July 2025. TDI serves as a fundamental ingredient in the manufacture of polyurethane.

- In November 2021, Meghmani Finechem Limited revealed its strategy to expand its operations into chlorotoluene and its associated value chain. The new facility will manufacture intermediates essential for producing active ingredients in pharmaceuticals and agrochemicals.

Report Coverage

The toluene market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, derivatives, production processes, applications, and their futuristic growth opportunities.

Toluene Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 26.37 billion |

|

Revenue forecast in 2032 |

USD 42.53 billion |

|

CAGR |

6.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global Toluene market size is expected to reach USD 42.53 billion by 2032

Key players in the market are BASF SE, Braskem S.A., Chevron Corporation, Exxon Mobil Corporation, Formosa Plastics Corporation

Asia-Pacific contribute notably towards the global Toluene Market

Global toluene market exhibiting the CAGR of 6.2% during the forecast period.

The Toluene Market report covering key segments are derivative, production process, application, and region.