Topical Drugs CDMO Market Size, Share, Trends, & Industry Analysis Report

By Formulation (Semi-Solid Formulations, Liquid Formulations, Solid Formulations, and Transdermal Products), Service, End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 130

- Format: PDF

- Report ID: PM5815

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

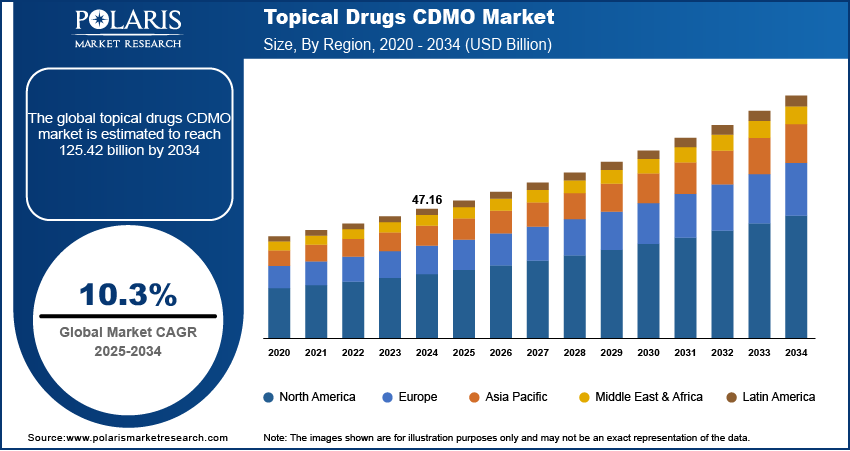

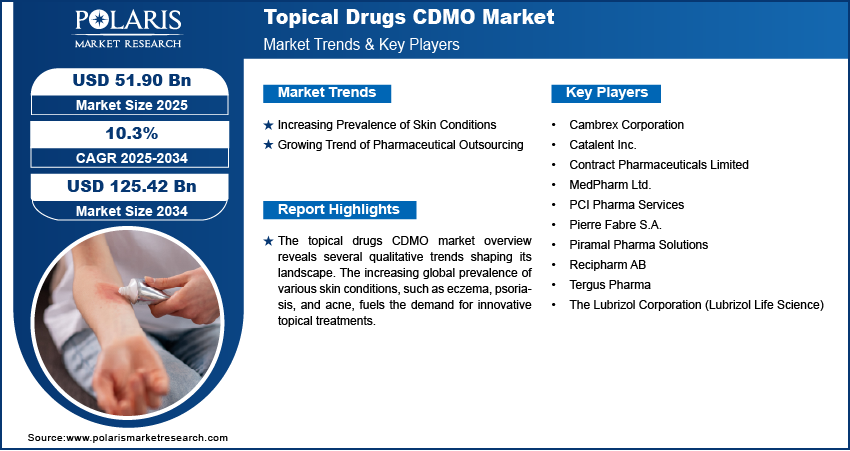

The global topical drugs CDMO market size was valued at USD 47.16 billion in 2024 and is anticipated to register a CAGR of 10.3% from 2025 to 2034. There is a rising demand for topical medications driven by the increasing prevalence of skin conditions. Pharmaceutical companies are also increasingly outsourcing their manufacturing needs to CDMOs to lower costs and speed up product development.

The topical drugs contract development and manufacturing organizations (CDMOs) market involves companies that offer specialized services for the development and manufacturing of medications applied directly to the skin or mucous membranes. These services include everything from creating the drug formula to producing it in large amounts for sale.

The increasing prevalence of skin conditions worldwide, such as atopic dermatitis, drives the industry growth. Many people suffer from various skin disorders, such as eczema, psoriasis, and acne. For example, the World Health Organization (WHO) highlights that skin diseases are among the most common human diseases, affecting millions globally and having a significant impact on quality of life. This rise in the incidence of skin-related health issues directly increases the demand for effective topical treatments. As these conditions become more widespread, pharmaceutical companies are focusing more on developing new topical drugs to address them. This, in turn, boosts the need for specialized CDMOs that can help bring these new treatments to patients efficiently.

To Understand More About this Research: Request a Free Sample Report

Industry Dynamics

Increasing Prevalence of Skin Conditions

The rising number of people suffering from various skin conditions globally is a significant factor boosting the market. The conditions range from common issues such as acne and eczema to more severe or chronic diseases such as psoriasis and fungal infections. The World Health Organization (WHO) highlighted in a news article in March 2023 that skin conditions are estimated to affect 1.8 billion people at any given time. Additionally, a study titled "Common Skin Diseases and Their Psychosocial Impact among Jazan Population, Saudi Arabia: A Cross-Sectional Survey during 2023," published in PubMed Central in October 2024, found that hair loss was the most prevalent skin condition, affecting 61.1% of the study population, with acne affecting 38.3%. This ongoing prevalence of skin disorders drives research and development efforts, directly increasing the demand for CDMO services that can formulate and manufacture these specialized topical drugs.

Growing Trend of Pharmaceutical Outsourcing

Many pharmaceutical companies are increasingly choosing to outsource their drug discovery, development and manufacturing activities to contract development and manufacturing organizations (CDMOs). This outsourcing trend is driven by several advantages, including cost efficiency, access to specialized expertise, robust regulatory compliance, time efficiency, and the ability to scale production flexibly. By partnering with CDMOs, pharmaceutical companies can avoid the substantial capital investment required for building and maintaining in-house facilities, allowing them to focus more on core activities such as research and marketing.

A government report named "Study on CRO Sector in India Conducted by Department of Pharmaceuticals Ministry of Chemicals & Fertilizers" mentioned that the global contract research outsourcing market was expected to grow at a CAGR of 7% between 2022 and 2030. While this report focuses on contract research, it highlights a broader industry trend toward outsourcing topical drugs.

Segmental Insights

By Formulation

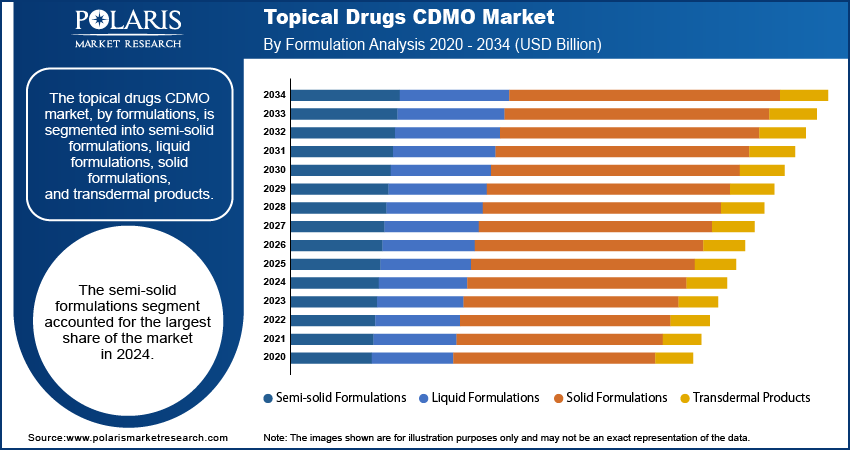

The semi-solid formulations segment held the largest share in 2024, due to their broad application across various therapeutic areas, including dermatology, pain management, and anti-infectives. Creams, gels, and ointments are widely favored due to their ease of application, localized action, and good patient acceptance, making them a go-to choice for many topical treatments. The ongoing development and regulatory approvals of new drugs in these forms further solidify their leading position. For instance, the US FDA's approval of topical creams for conditions such as vitiligo in recent years highlights the continued importance and expansion of semi-solid formulations.

The liquid formulations segment is anticipated to register the highest growth rate during the forecast period. This segment, which includes solutions and suspensions, is gaining traction due to advancements in drug delivery systems and increasing patient preference for convenient, easy-to-use liquid options. Innovations in sprays, foams, and specific liquid-based topical products are driving their adoption. For example, recent developments in antimicrobial agents for burn injuries often involve liquid formulations, indicating a growing demand for such products in specialized areas of care. This trend points to a dynamic shift as pharmaceutical companies explore novel ways to deliver active ingredients topically.

By Service

The contract manufacturing segment held the largest share of the topical drugs contract development and manufacturing organizations market in 2024, as pharmaceutical companies are seeking specialized expertise and scalable production facilities for their topical medications. Outsourcing manufacturing allows these companies to streamline operations, manage costs effectively, and ensure high-quality production that meets strict regulatory standards. For instance, the ongoing demand for various topical creams, gels, and ointments for widespread skin conditions, as well as cosmetic applications, consistently drives the need for large-scale, efficient production that CDMOs are well-equipped to provide.

The contract development segment is anticipated to register the highest growth rate during the forecast period. This subsegment focuses on the early stages of drug creation, including formulation development, analytical testing, and clinical trial material production. As drug innovation continues, particularly with more complex active pharmaceutical ingredients and novel delivery systems, specialized development services become increasingly critical. The rising investments in research and development for new topical treatments, including advanced therapies for chronic skin diseases, drive the need for CDMOs with advanced scientific capabilities to bring these innovative products in the market.

By End Use

The pharmaceutical companies segment held the largest share of the topical drugs CDMO market in 2024. Traditional pharmaceutical firms have a long history of developing and commercializing a wide range of topical products, from over-the-counter creams to prescription ointments. They often have extensive product pipelines and require consistent, large-scale manufacturing capabilities, making CDMO partnerships highly beneficial for efficiency and cost control. For instance, the US FDA regularly approves new topical drug applications from pharmaceutical companies, indicating their continued investment and output in this space, which directly translates to sustained demand for CDMO services.

The biopharmaceutical companies segment is anticipated to register the highest growth rate during the forecast period. This growth is driven by the increasing focus on advanced biological drugs and novel therapeutic approaches, many of which are now being explored for topical application. As biopharmaceutical companies, often smaller or more specialized, seek to bring these innovative treatments to market, they increasingly rely on CDMOs for their specialized development and manufacturing expertise, particularly for complex formulations. This trend is fueled by new research into skin immunology and advanced delivery systems for large molecules.

Regional Analysis

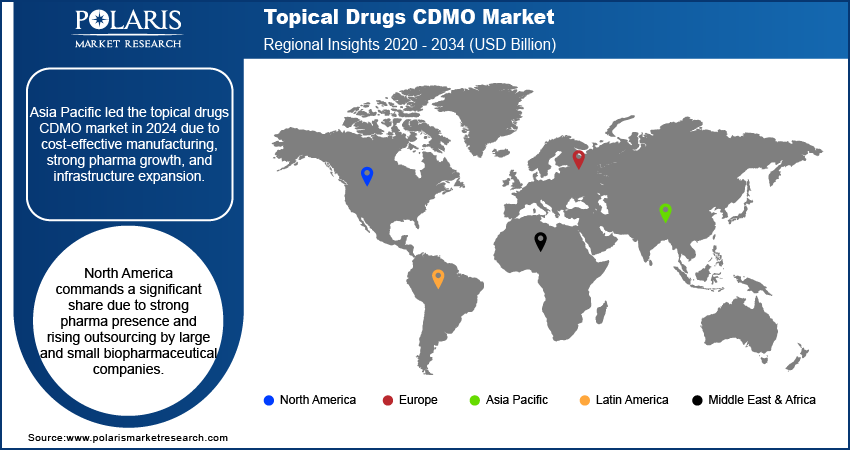

The Asia Pacific topical drugs CDMO market held the largest share in 2024, fueled by the increasing healthcare spending across the region, a growing focus on pharmaceutical innovation, and the advantage of more cost-effective manufacturing capabilities compared to Western regions. Many global pharmaceutical companies are looking to Asia Pacific for outsourcing due to these benefits, leading to a rise in the number of CDMOs with improved infrastructure and capabilities. The China topical drugs CDMO market is a prominent market in this region, driven by its vast manufacturing capacity, a large patient population, and increasing investments in pharmaceutical R&D.

North America Topical Drugs CDMO Market

North America holds a significant share of the topical drugs CDMO market. This region benefits from a strong presence of both large pharmaceutical companies and numerous smaller biopharmaceutical firms, many of whom are increasingly looking to outsource their development and manufacturing needs. The rising occurrence of various skin disorders, coupled with a focus on advanced drug delivery technologies, drives the demand for specialized topical formulations. CDMOs in North America offer innovative capabilities and adhere to stringent regulatory standards, making them preferred partners for bringing new topical treatments to market efficiently.

US Topical Drugs CDMO Market Insight

In North America, the US is a major contributor to the topical drugs CDMO landscape. The country consists of a highly developed pharmaceutical and biotechnology sector, characterized by substantial research and development investments. The increasing prevalence of skin conditions and a strong consumer demand for innovative dermatological solutions significantly boost the need for topical drug development and manufacturing services. Furthermore, the robust regulatory framework and the presence of numerous specialized CDMOs capable of handling complex formulations contribute to the country's prominent share.

Europe Topical Drugs CDMO Market

Europe is recognized for its strong pharmaceutical industry and emphasis on high-quality manufacturing standards. The regional market benefits from a growing aging population, which often presents an increased need for various topical medications, including those for chronic skin conditions and pain management. European CDMOs are known for their advanced technological capabilities and adherence to rigorous regulatory guidelines, making them attractive partners for both regional and global pharmaceutical companies seeking to develop and produce topical drugs. The Germany topical drugs CDMO market held a major share in Europe in 2024. Germany's pharmaceutical industry is highly innovative and well-established, with a strong focus on research and development. The country's robust healthcare infrastructure and a high demand for specialized dermatological products contribute to the growth of its topical CDMO sector. German CDMOs are often at the forefront of adopting new technologies and maintaining strict quality control, making them a hub for advanced topical drug development and manufacturing.

Key Players and Competitive Insights

The topical drugs CDMO market is highly competitive, characterized by a mix of large, established players and smaller, specialized firms. Companies aim to differentiate themselves through technological advancements, specialized formulation expertise, and adherence to global regulatory standards. The competition often revolves around offering comprehensive services from early-stage development to commercial manufacturing, with a focus on quick turnaround times and cost-effectiveness.

A few prominent companies in the industry include The Lubrizol Corporation (Lubrizol Life Science), Cambrex Corporation, Catalent Inc., Recipharm AB, Pierre Fabre S.A., Piramal Pharma Solutions, PCI Pharma Services, MedPharm Ltd., Tergus Pharma, and Contract Pharmaceuticals Limited.

Key Players

- Cambrex Corporation

- Catalent Inc.

- Contract Pharmaceuticals Limited

- MedPharm Ltd.

- PCI Pharma Services

- Pierre Fabre S.A.

- Piramal Pharma Solutions

- Recipharm AB

- Tergus Pharma

- The Lubrizol Corporation (Lubrizol Life Science)

Industry Developments

January 2025: Mankind Pharma’s OTC division launched Heal-o-Kind, a four-in-one first aid gel containing nano crystalline silver. The advanced formulation treats wounds, burns, bruises, and cuts, offering faster skin absorption and healing than traditional silver-based products..

July 2024: MedPharm and Tergus Pharma merged to form a specialized CDMO focused on topical and transepithelial drugs. Operating under MedPharm, the facility will support scientific research, clinical trial manufacturing, and commercial-scale production for the pharmaceutical industry.

Topical Drugs CDMO Market Segmentation

By Formulation Outlook (Revenue – USD Billion, 2020–2034)

- Semi-solid Formulations

- Liquid Formulations

- Solid Formulations

- Transdermal Products

By Service Outlook (Revenue – USD Billion, 2020–2034)

- Contract Development

- Contract Manufacturing

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Pharmaceutical Companies

- Biopharmaceutical Companies

- Others

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Topical Drugs CDMO Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 47.16 billion |

|

Market Size in 2025 |

USD 51.90 billion |

|

Revenue Forecast by 2034 |

USD 125.42 billion |

|

CAGR |

10.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 47.16 billion in 2024 and is projected to grow to USD 125.42 billion by 2034.

The global market is projected to register a CAGR of 10.3% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few key players in the market include The Lubrizol Corporation (Lubrizol Life Science), Cambrex Corporation, Catalent Inc., Recipharm AB, Pierre Fabre S.A., Piramal Pharma Solutions, PCI Pharma Services, MedPharm Ltd., Tergus Pharma, and Contract Pharmaceuticals Limited.

The semi-solid formulations segment accounted for the largest share of the market in 2024.

The liquid formulations segment is expected to witness the fastest growth during the forecast period.