TPU Films for EV Battery Protection Market Size, Share, & Industry Analysis Report

: By Type (Polyester TPU Films, Polyether TPU Films, and Polycaprolactone TPU Films), By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5698

- Base Year: 2024

- Historical Data: 2020-2023

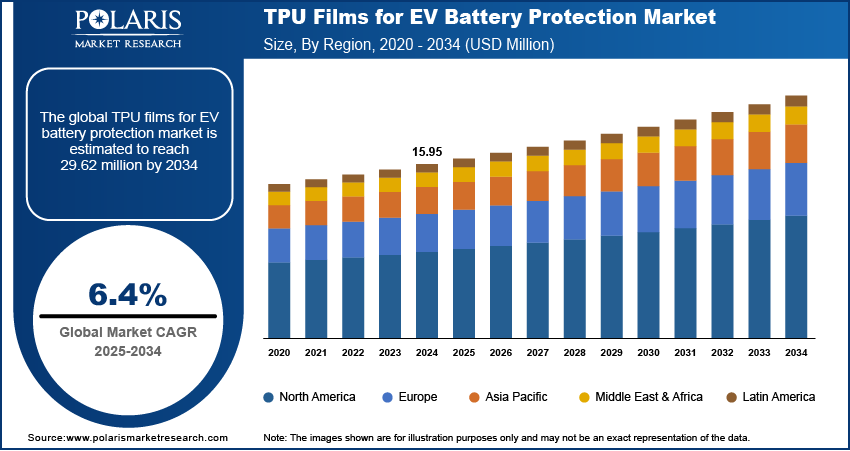

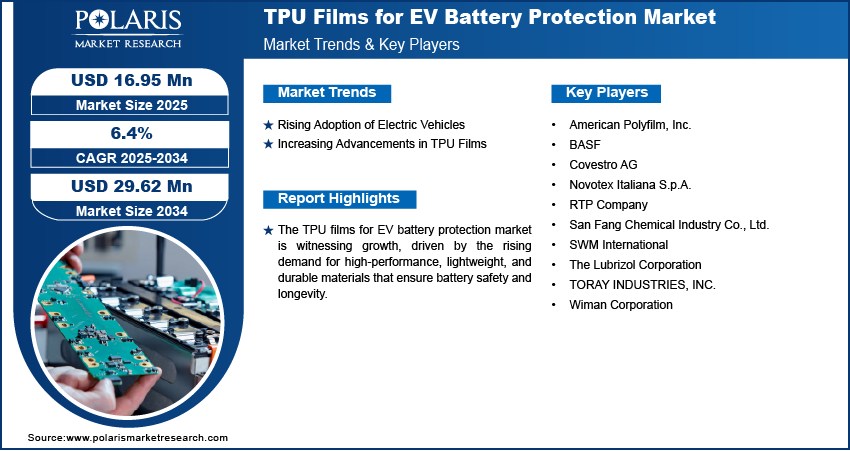

The global TPU films for EV battery protection market size was valued at USD 15.95 million in 2024, growing at a CAGR of 6.4% during 2025–2034. The growth is driven by the increasing focus on fire resistance and thermal management.

Market Overview

TPU (Thermoplastic Polyurethane) films for EV battery protection are thin, flexible layers used to insulate and shield electric vehicle (EV) batteries from mechanical damage, chemical exposure, and environmental stress. TPU films have become essential components in modern EV design due to their excellent scrape resistance, flexibility, and dielectric properties. The tightening of global safety and emissions regulations is driving their adoption. Governments and regulatory bodies worldwide are mandating stricter safety standards for electric vehicles, such as thermal management and battery integrity under extreme conditions. According to a June 2024 report by the Ministry of Consumer Affairs, India's BIS introduced IS 18590:2024 and IS 18606:2024 to improve EV safety for L/M/N category vehicles, focusing on powertrains and batteries. Separate standard IS 18294:2023 covers e-rickshaws/karts, bringing total EV standards to 30. TPU films help manufacturers meet these requirements by offering high-performance insulation and impact resistance, thereby improving the overall safety and reliability of EV battery systems.

To Understand More About this Research: Request a Free Sample Report

The rising demand for lightweight, durable materials in EV manufacturing is accelerating the need for TPU films. According to a 2025 IEA report, 17.3 million electric cars were manufactured globally in 2024, reflecting increased demand for lightweight and durable materials in EV production. Reducing the overall weight of vehicle components has become critical as automakers aim to improve vehicle efficiency and range. TPU films contribute to this goal by offering a lightweight yet robust alternative to traditional protective materials. Their long-term durability and resistance to wear and tear ensure battery longevity without adding unnecessary mass to the vehicle structure. The combination of structural performance, chemical stability, and design flexibility positions thermoplastic polyurethane adhesive as a strategic solution in the evolving landscape of EV battery technology.

Market Dynamics

Rising Adoption of Electric Vehicles

The rising adoption of electric vehicles (EVs) is fueling the demand for TPU films in EV battery protection, as it directly increases the need for reliable and efficient battery insulation solutions. The focus on improving battery safety, thermal stability, and operational efficiency becomes more prominent as EV production scales globally. A May 2025 IEA report projected EVs will account for over 25% of global car sales in 2025, with sales surpassing 20 million units. In 2024, EV sales reached 17 million, capturing 20% market share. TPU films, known for their flexibility, scrape resistance, and chemical stability, are ideally suited to meet these requirements. Their role in preventing physical damage and assuring consistent performance across changing environmental conditions makes them critical in large-scale EV manufacturing. Integrating advanced protective materials such as TPU films is essential to maintain product reliability and consumer trust with batteries being the most valuable and sensitive component of EVs.

Increasing Advancements in TPU Films

Technological advancements in TPU film formulation and processing, such as bio-based TPU, specialized formulations, and others, have a major role in expanding their application in EV battery protection. Innovations in bio based polymer chemistry and film extrusion technologies have led to the development of TPU films with improved thermal conductivity, flame retardancy, and mechanical strength. In May 2024, Lubrizol launched a bio-based TPU portfolio with Pearlbond ECO 590 HMS, a renewable-resource adhesive resin for furniture, textiles, and transportation. The toluene-free formulation offers high-temperature resistance, hydrolysis stability, and improved processing for hot melt applications. These improvements enable manufacturers to offer thinner, lighter films without compromising performance, aligning with the industry's goals for high energy efficiency and compact battery design. Moreover, customized TPU film solutions tailored for specific battery architectures offer improved integration and performance reliability. As these technologies mature, they are driving broader adoption across the EV supply chain, reinforcing TPU films as a high-performance material in next-generation battery protection systems.

Segmental Insights

By Type Analysis

The global TPU films for EV battery protection market segmentation, based on type, includes polyester TPU films, polyether TPU films, and polycaprolactone TPU films. The polyether TPU films segment is expected to witness fastest growth during the forecast period due to its superior hydrolytic stability, flexibility at low temperatures, and excellent resistance to microbial attack. These properties make polyether-based TPU films particularly suitable for EV battery applications, where exposure to fluctuating thermal conditions and moisture entry can compromise safety and efficiency. Furthermore, polyether TPU films offer long-term durability and improved processing characteristics, which streamline battery assembly and reduce production complexities. Their chemical inactivity and compatibility with other battery components further improve their appeal for next-generation battery protection systems.

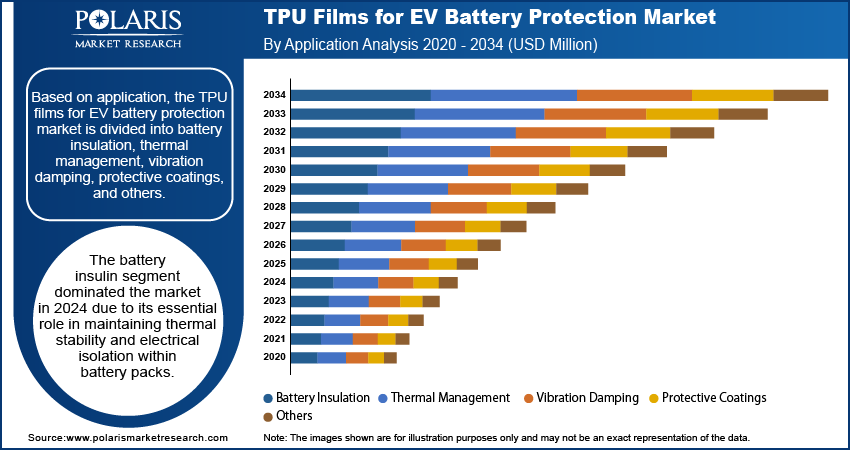

By Application Analysis

The global TPU films for EV battery protection market segmentation, based on application, includes battery insulation, thermal management, vibration damping, protective coatings, and others. The battery insulin segment dominated the market in 2024 due to its essential role in maintaining thermal stability and electrical isolation within battery packs. Effective insulation is crucial to preventing thermal runaway and assuring the safe operation of high-voltage EV batteries. TPU films serve as an ideal insulation material, offering high dielectric strength along with resistance to punctures and scrapes. The growing demand for compact and modular battery configurations also boosts the need for high-performance insulation materials that conform to complex geometries, driving the dominance of this segment.

Regional Analysis

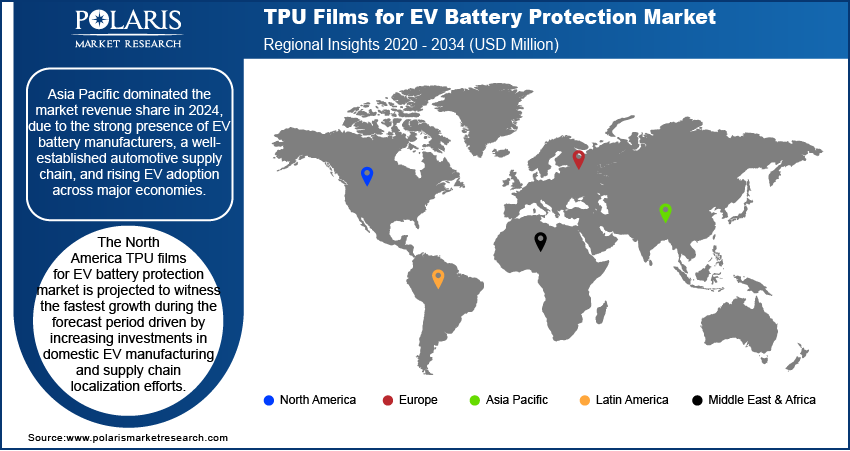

The report provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the market revenue share in 2024, due to the strong presence of EV battery manufacturers, a well-established automotive supply chain, and rising EV adoption across major economies. Countries such as China, Japan, South Korea, and India are actively investing in EV infrastructure and battery technologies, creating a high-demand environment for TPU films. In September 2024, Japan's government allocated USD 1.1 billion to fund the joint EV battery development initiative of Panasonic Energy and Subaru. Additionally, regional government policies supporting local production and innovation in advanced materials have accelerated market penetration. The region’s leadership in battery cell manufacturing and OEM partnerships reinforces its dominant position in the global TPU films for EV battery protection market.

The North America TPU films for EV battery protection market is projected to witness the fastest growth during the forecast period driven by increasing investments in domestic EV manufacturing and supply chain localization efforts. For instance, in May 2024, the US DOE allocated USD 50 million to support small auto suppliers transitioning to EV production. Michigan was designated an EV workforce hub to provide local workforce training through federal-state partnerships with the labor department. The growing emphasis on EV safety standards and energy efficiency is pushing manufacturers to adopt advanced protective materials such as TPU films. Moreover, the push toward cleaner transportation and favorable regulatory frameworks are fostering the rapid development of EV ecosystems in the region. The US and Canada, supported by federal initiatives and private sector R&D, are at the forefront of this transition, contributing significantly to the region’s high growth potential.

The Europe TPU films for EV battery protection market is projected to witness substantial growth during the forecast period due to its strong regulatory push for carbon neutrality and rapid electrification of the automotive sector. The region’s focus on environmental sustainability and circular economy principles is encouraging the use of high-performance, recyclable materials such as TPU films. European automakers are increasingly integrating advanced battery protection systems to comply with strict EU safety standards. Countries such as Germany, France, the Netherlands, and Sweden are major contributors to regional market growth, owing to their robust EV infrastructure, technological innovation, and automotive manufacturing capabilities.

Key Players and Competitive Analysis

The TPU films for EV battery protection sector is gaining traction, driven by technological advancements in flame-retardant and self-healing materials. Industry trends show growing demand in developed markets such as North America and Europe, where EV adoption and safety regulations are strict. Competitive analysis reveals players such as Covestro and Huntsman are making strategic investments in high-performance TPU formulations to address latent demand for lightweight, durable battery encapsulation. Meanwhile, emerging markets in Asia present expansion opportunities fueled by local EV production growth, though economic and geopolitical shifts may impact raw material sourcing. Disruptions and trends, such as solid-state battery integration and recyclable TPU films, are reshaping revenue growth potential. Small and medium-sized businesses are innovating in niche business segments, while larger firms focus on sustainable value chains through partnerships with battery manufacturers. Expert insights highlight that competitive positioning is balancing cost efficiency with UL94 V-0 flame resistance standards, especially amid supply chain disruptions for polyols and diisocyanates. A few key players are American Polyfilm, Inc.; BASF; Covestro AG; Novotex Italiana S.p.A.; RTP Company; San Fang Chemical Industry Co., Ltd.; SWM International; The Lubrizol Corporation; Toray Industries, Inc.; and Wiman Corporation.

BASF is a global chemical company recognized for its comprehensive solutions in electric vehicle (EV) battery protection, such as advanced thermoplastic polyurethane (TPU) films and coatings. BASF’s TPU, marketed under the Elastollan brand, is engineered to address the demanding requirements of EV battery systems, offering a combination of flexibility, mechanical strength, weather resistance, and flame retardant. These properties are crucial for safeguarding battery components from environmental hazards such as moisture, dust, chemicals, and mechanical impacts, thereby extending battery life and enhancing safety. BASF’s TPU films and coatings are designed to provide robust surface protection and insulation for battery modules, supporting thermal management and fire resistance, major concerns in lithium-ion battery applications. The company’s innovations include both flexible TPU grades for components such as charging cables and specialized coatings such as Oxsilan and CathoGuard, which deliver corrosion resistance and improve the durability of battery packs and surrounding structures.

Toray Industries, Inc. is an innovator in advanced materials, including specialized films for electric vehicle (EV) battery protection. Leveraging decades of expertise in polymer science and film technology, the company develops high-performance thermoplastic polyurethane (TPU) films that address the strict demands of the EV industry. These TPU films are engineered to provide a robust barrier against mechanical stress, moisture, dust, and chemical ingress, which are critical factors in maintaining the safety and longevity of EV battery packs. Toray’s TPU films offer an optimal combination of flexibility, mechanical strength, and thermal stability, allowing them to conform to complex battery geometries while delivering reliable protection against punctures and abrasions. Their chemical resistance and flame-retardant properties are particularly valuable in mitigating risks associated with thermal runaway and fire hazards in lithium-ion battery systems. Toray is focused on improving the electrical insulation, thermal management, and sustainability of its TPU films, including bio-based and recyclable options to support the circular economy.

Key Players in TPU Films for EV Battery Protection Market

- American Polyfilm, Inc.

- BASF

- Covestro AG

- Novotex Italiana S.p.A.

- RTP Company

- San Fang Chemical Industry Co., Ltd.

- SWM International

- The Lubrizol Corporation

- TORAY INDUSTRIES, INC.

- Wiman Corporation

TPU Films for EV Battery Protection Industry Developments

February 2025, Lubrizol launched a new ESTANE TPU production line in Shanghai and released a white paper on car paint protection film industry growth, supporting its local production strategy and value-chain innovation in Asia Pacific.

April 2024, Lubrizol Corporation introduced the ESTANE TPU Empowerment Ecosystem, a program enabling manufacturers using 100% ESTANE TPU in films or PPF products to validate product quality for customer assurance.

TPU Films for EV Battery Protection Market Segmentation

By Type Outlook (Revenue, USD Million, 2020–2034)

- Polyester TPU Films

- Polyether TPU Films

- Polycaprolactone TPU Films

By Application Outlook (Revenue, USD Million, 2020–2034)

- Battery Insulation

- Thermal Management

- Vibration Damping

- Protective Coatings

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

TPU Films for EV Battery Protection Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 15.95 million |

|

Market Size Value in 2025 |

USD 16.95 million |

|

Revenue Forecast by 2034 |

USD 29.62 million |

|

CAGR |

6.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 15.95 million in 2024 and is projected to grow to USD 29.62 million by 2034.

The global market is projected to register a CAGR of 6.4% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are American Polyfilm, Inc.; BASF; Covestro AG; Novotex Italiana S.p.A.; RTP Company; San Fang Chemical Industry Co., Ltd.; SWM International; The Lubrizol Corporation; Toray Industries, Inc.; and Wiman Corporation.

The battery insulin segment dominated the market in 2024.

The polyether TPU films segment is expected to witness the fastest growth during the forecast period.