Train Battery Market Share, Size, Trends, Industry Analysis Report

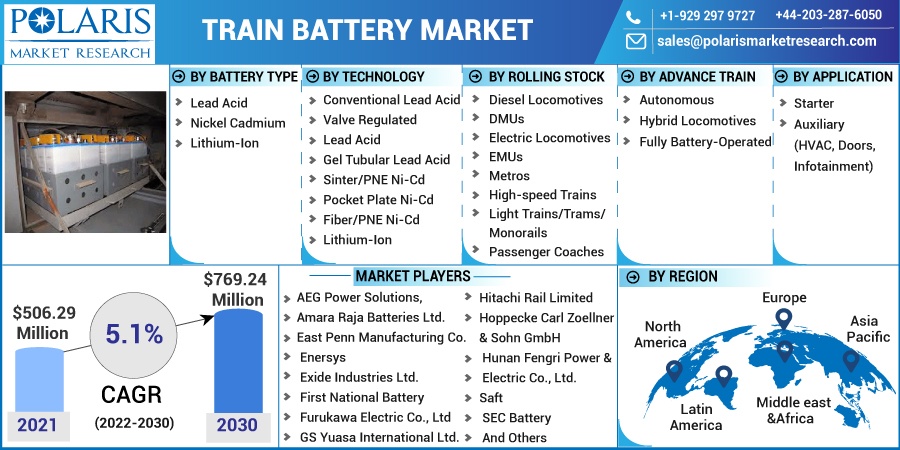

By Advance Train (Autonomous Trains, Hybrid Locomotives, Fully Battery-operated Trains); By Battery Type; By Application; By Technology; By Rolling Stock; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 118

- Format: PDF

- Report ID: PM2478

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

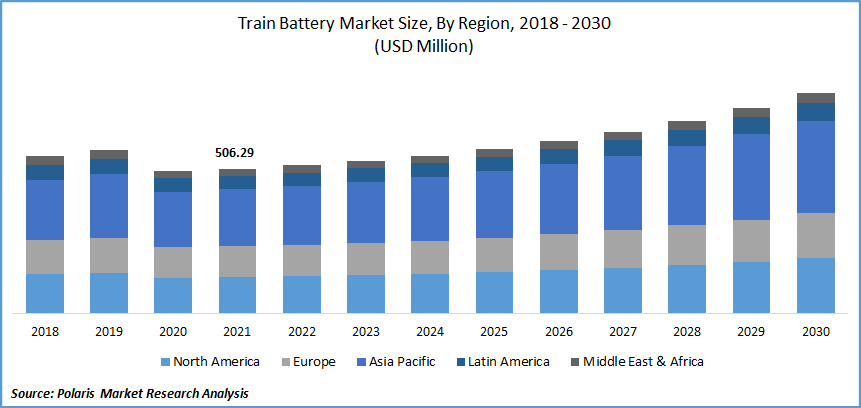

The global train battery market was valued at USD 506.29 million in 2021 and is expected to grow at a CAGR of 5.1% during the forecast period. Over the last few decades, there has been an exponential increase in demand for rail development for both increased passenger mobility and increased freight mobility. Since rails can carry four times as much weight as vehicles with the same amount of fuel, they are regarded as the most fuel-efficient form of transportation.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

High-speed rail demand is expected to grow along with urbanization and energy-efficient transportation system demand. As a result, the industry is projected to grow. In addition, it is anticipated that the introduction of high-speed rails in developing nations would create prospects for the market's expansion to a greater extent through the development of hybrid rail systems and a significant rise in autonomous rails.

The outbreak of the Covid-19 pandemic had negatively impacted the growth of the train battery market. Worldwide lockdown and stringent regulation disrupted the supply chain of the market. During the onset of the pandemic, nations across the globe witnessed economic crises that adversely affected the operations of the industries.

Furthermore, rail battery manufacturers were compelled to shut the production at their manufacturing facilities. Due to the fact that major countries such as China were under a state of lockdown to stop the disease's spread, battery producers saw difficulties in the supply chains.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The key factors driving the growth in the train battery market include rapid urbanization in developing and developed economies, demand for rails with low maintenance requirements, development of hybrid rail systems, electrification of rails, rising demand for high-speed trains, and increasing need for energy-efficient transportation systems.

A stable electrical supply is also required by the increasing number of locomotives, which is driving up the demand for improved and better batteries. Furthermore, the increased proliferation of autonomous rail is further contributing to the industry growth owing to the advanced features of such rails including automated doors, safety systems, information systems, and efficient lighting.

Data about cuttings, embankments, lineside infrastructure, structures, and vegetation, such as trees, can be collected by autonomous rails. With the use of this, a topographic database can be built, and a baseline of normality may be established against which deviations can be monitored in real-time.

Report Segmentation

The market is primarily segmented on the basis of battery type, technology, rolling stock, advance train, application, and region.

|

By Battery Type |

By Technology |

By Rolling Stock |

By Advance Train |

By Application |

By Region |

|

|

|

|

|

|

Know more about this report: Request for sample pages

Insight by Technology

Based on technology, the valve-regulated lead-acid segment is anticipated to be the largest market during the forecast period. The demand for a steady power supply in order to prevent operational interruptions has increased due to the rapid expansion in demand for rail batteries.

Additionally, the market is driven by the features of the VRLA batteries, such as high charge efficiency, highrate capacity, and maintenance-free life. There is no electrolyte leakage in these batteries.

Insight by Battery Type

Based on battery type, the lithium-ion segment is expected to register higher growth. The demand for lithium-ion batteries is rising as a result of improvements made to the technology used to produce them. The necessity to lighten high-speed rails and their increased longevity is also a contributing factor to the surge in use.

Geographic Overview

Asia Pacific is projected to be the largest and fastest-growing market over the forecast period. This growth of the industry is attributed to the rising demand for rails from developing nations such as China and India. The process of installing bullet rails is anticipated to propel market growth for rail batteries in both countries. The electrification of rails is being accelerated by the nations' to minimize air pollution and other environmental concerns.

North America is anticipated to witness significant growth in the global market. Factors such as the technological advancements, integration of data analytics, as well as the expansion of high-speed rail networks in the region are likely to accelerate the growth of the train battery market.

Competitive Insight

Some of the major players operating in the global market include AEG Power Solutions, Amara Raja Batteries Ltd., East Penn Manufacturing Company, Enersys, Exide Industries Ltd., First National Battery, Furukawa Electric Co., Ltd, GS Yuasa International Ltd., Hitachi Rail Limited, Hoppecke Carl Zoellner & Sohn GmbH, Hunan Fengri Power & Electric Co., Ltd., Power & Industrial Battery Systems GmbH, Saft, SEC Battery, and Shuangdeng Group Co., Ltd.

For instance, in October 2020, The Chennai Division of Southern Railway in India created a dual-mode battery-cumulative-AC locomotive called "PASUMAI" that can operate in both wired and unwired/non-wired parts.

Furthermore, The FLXdrive, the first battery-electric freight train in the world, was introduced at Pittsburgh's Carnegie Mellon University that will assist move the more than 1.7 billion tons of freight that is transported annually over American railroads.

Train Battery Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 506.29 million |

|

Revenue forecast in 2030 |

USD 769.24 million |

|

CAGR |

5.1% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Battery Type, By Technology, By Rolling Stock, By Advance Train, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

AEG Power Solutions, Amara Raja Batteries Ltd., East Penn Manufacturing Company, Enersys, Exide Industries Ltd., First National Battery, Furukawa Electric Co., Ltd, GS Yuasa International Ltd., Hitachi Rail Limited, Hoppecke Carl Zoellner & Sohn GmbH, Hunan Fengri Power & Electric Co., Ltd., Power & Industrial Battery Systems GmbH, Saft, SEC Battery, and Shuangdeng Group Co., Ltd. |