Train Seat Market Share, Size, Trends, Industry Analysis Report

By Train Type (Regional/Intercity, High Speed, Metro, Light, and Others); By Product; By Railcar Type; By Region; Segment Forecast, 2024 – 2032

- Published Date:Jan-2024

- Pages: 115

- Format: PDF

- Report ID: PM3832

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

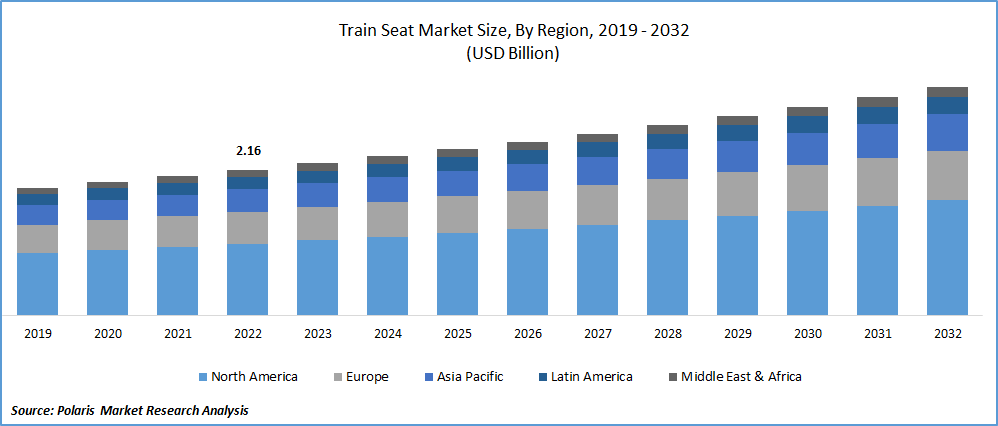

The global train seat market was valued at USD 2.26 billion in 2023 and is expected to grow at a CAGR of 4.60% during the forecast period.

The rapidly increasing demand or adoption of ergonomic and modular train seat designs across the world and the rising integration of advanced or innovative connectivity and entertainment features, coupled with the surging number of people opting for travel as a major mode of transportation, are among the primary factors influencing the growth of the market.

To Understand More About this Research: Request a Free Sample Report

In addition, governments and major private operators are significantly investing in the expansion and modernization of railway infrastructure, which includes high-speed rail projects, new train routes, and station upgrades, which all have been contributing to the growth of the train seat market.

- For instance, in January 2023, Indian Railways announced that they had successfully concluded the trial of a new Artificial Intelligence Programme and have also launched the Ideal Train Profile in order to maximize seat capacity utilization. The project is currently started at seven zonal railways, including the Northern, Southern, Eastern, South Central, Western, South Central, and West Central Railway.

Moreover, the rising implementation and integration of Internet of Things technology into train seats, mainly to develop connected seats that can easily collect data on seat occupancy, temperature, and passenger preferences, allowing operators to optimize seating arrangements and improve passenger experiences, have been among the leading factors gaining traction in the recent years.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the train seat market. During the rapid spread of the deadly coronavirus globally, many countries implemented travel restrictions and lockdown measures, leading to a significant decline in passenger numbers and demand for new train seats and seat upgrades. Many rail infrastructure projects were delayed or put on hold due to the uncertainty caused by the pandemic, which largely affected the demand for new trains as well as train seats.

Industry Dynamics

Growth Drivers

Rising demand for comfortable and customizable train seats

The exponentially rising focus of major rail operators and governments across both developed and developing countries towards introducing new trains with several advanced or innovative convenient features, including comfortable seats, along with the surging prevalence of customization options in the train seats to cater to diverse passenger preferences across the world, are among the major factors propelling the demand and growth of the train seat market.

Furthermore, there has been significant growth in technological innovations in seat design, materials, and features, such as integrated entertainment systems, charging ports, and adjustable configurations, that have led to higher replacement of older seats with newer and more advanced models along with the rising number of supportive policies or incentives for the development of sustainable transportation systems, are likely to boost global market growth.

Report Segmentation

The market is primarily segmented based on seat type, product, railcar type, and region.

|

By Seat Type |

By Product |

By Railcar Type |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Seat Type Analysis

Regional/intercity segment accounted for the largest market share in 2022

The regional/intercity segment accounted for the largest market share. The growth of the segment market can be mainly accelerated by rising renovation or upgradation efforts in various aging train fleets and increased maintenance coupled with the surge in regional or intercity travel cities across the world. Besides this, the significant emergence of trains as a greener alternative to cars and places, as a result of rising awareness of environmental issues and the need to reduce emissions, thereby fueling the segment market growth.

The metro segment is likely to exhibit the fastest growth rate over the next coming years, mainly due to rapidly increasing urbanization and population growth in cities all over the world that have led to higher demand for public transportation, including metro systems. As a greater number of people rely on metros for daily commuting, the need for comfortable and efficient seating becomes crucial. It creates ample growth opportunities for the segment market soon.

By Product Analysis

Non-recliner segment expected to hold the significant market share over forecast period

The non-recliner segment is expected to hold the majority market share in terms of revenue in 2022, which is largely accelerated by an exponential rise in the demand for non-recliner seats, particularly in the metro and light trains, along with the higher prevalence of upgrading existing conventional trains. These types of seats are more likely to be cost-effective to manufacture, install, and maintain compared to other recliner counterparts, which lead manufacturers and train operators to significant cost saving, mainly for large-scale projects.

The luxury/premium segment led the industry market with noteworthy market share in 2022 on account of its superior comfort compared to other seats available in the market, as they generally have extra padding, reclining features, and large legroom and are also associated with a sense of sophistication and status, attracting consumers who are more likely to pay a premium for an elevated and unique experience during the journey.

By Railcar Type Analysis

Overland segment is expected to witness highest growth during projected period

The overland segment is expected to grow at the highest growth rate during the study period, which is mainly driven by the significant expansion of cities and their population, which results in higher demand for efficient transportation and surging investments in railway infrastructure, leading to improved connectivity and better travel experience. For instance, according to the United Nations, currently, 55% of the world’s total population lives in urban areas or cities, and the percentage is estimated to increase to around 68% by 2050, adding another 2.5 billion to the urban areas.

The long-distance segment held the maximum market share in terms of revenue in 2022, which is largely attributed to the growing prevalence or proliferation of trains as a highly effective mode of transportation for longer distances, as they offer a balance of comfort and speed and also reduce road congestion.

Regional Insights

North America region dominated the global market in 2022

The North America region dominated the global market with considerable market share in 2022 and is projected to maintain its market dominance throughout the study period. The regional market growth is mainly attributable to the presence of a highly developed and mature vehicle and transportation industry, particularly in countries like the US and Canada, coupled with the rising number of rail operators focusing on the upgradation of their train fleets to provide better passenger comfort and amenities.

The Asia Pacific region is anticipated to be the fastest growing region with a healthy CAGR over the study period, owing to the surging adoption of various technologically advanced systems in emerging economies like China, India, and Malaysia and the growing implementation of these countries on metro developments, the extension of existing lines, and increasing intercity trade and commuting.

For instance, in July 2023, Indian Railways announced that they are all set to launch another Vande Bharat train in Rajasthan that will connect Jodhpur & Sabarmati in Gujrat. The train will be providing a luxurious travel experience along with world-class facilities onboard and consists of two-seat categories, including Executive Class & AC Chair cars.

Market Key Players & Competitive Insight

The competitive landscape of the train seat market is characterized by intense rivalry among manufacturers and suppliers striving to meet the growing demand for advanced and customized seating solutions. Key players are continually investing in research and development to stay ahead in technological innovations, focusing on comfort, materials, and entertainment features to attract both rail operators and passengers. Additionally, partnerships and collaborations between seat manufacturers, rail operators, and governments to align with evolving passenger preferences and sustainability goals are becoming essential strategies for gaining a competitive edge in this dynamic market.

Some of the major players operating in the global market include:

- Borcade

- Camira Fabrics

- Compin-Fainsa

- Delta Furniture

- Fenix Group

- FISA Srl

- Freedman Seating Co.

- Franz Kiel GmbH

- GINYO Transport

- Grammar AG

- Jia Yi Seating

- KTK Group

- Kustom Seating Unlimited

- McConnell Seat

- Rescroft Ltd.

- Saira Seats

- Seats Incorporated

- Shanghai Tanda

- Transcal Ltd.

- USSC Group

Recent Developments

- In December 2022, Jaipur announced the launch of a semi-high-speed train for the way to Indore, which is estimated to take place in January 2023. The new semi-high-speed train has recliner seats with better ventilation and an optimum air conditioning facility.

- In September 2021, Grammer announced its expansion in the Chinese automotive market with the opening of a new production facility in the economic metropolis of Shenyang, which produces high-quality center consoles and many other interior components for various vehicles like trains, trucks, and buses. The new production plant has a total area of 8,000 square meters, including 3,500 square meters of production space.

Train Seat Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2.36 billion |

|

Revenue forecast in 2032 |

USD 3.39 billion |

|

CAGR |

4.60% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Seat Type, By Product, By Railcar Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

key companies in train seat market are Lauren Corporation, Lucky Brands LLC, Capri Holding Limited, H&M Hennes & Mauritz AB.

The global train seat market is expected to grow at a CAGR of 4.6% during the forecast period.

The train seat market report covering key segments are seat type, product, railcar type, and region.

key driving factors in industrial train seat market are rising demand for comfortable and customizable train seats.

The global train seat market size is expected to reach USD 3.39 billion by 2032.