Truck & Bus Radial Tire Market Size, Share, Trends, Industry Analysis Report

: By Application (Trucks and Buses), Sales Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034.

- Published Date:Sep-2025

- Pages: 129

- Format: PDF

- Report ID: PM5633

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

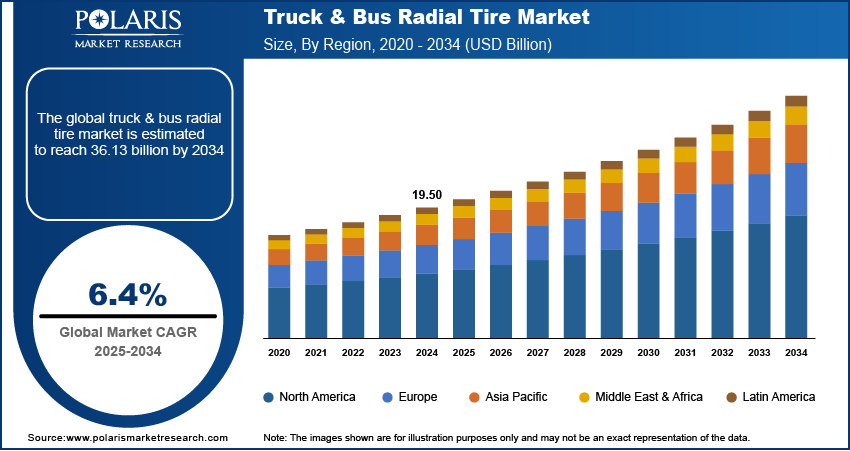

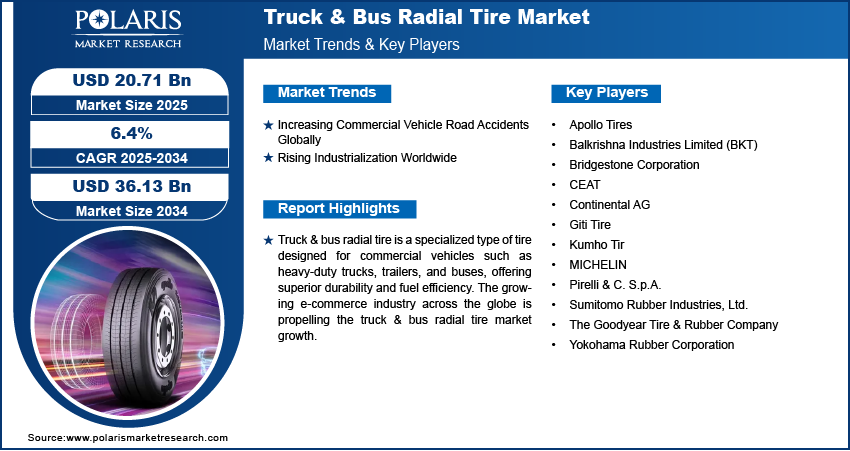

Truck & bus radial tire market size was valued at USD 19.50 billion in 2024, exhibiting a CAGR of 6.4% during 2025-2034. The market is driven by the rapid growth of global e-commerce logistics, increasing urbanization, boosting commercial vehicle use, rising road accidents prompting safer tire adoption, and expanding industrialization fueling freight and infrastructure transport demand.

Key Insights

- Trucks dominate the market due to growth in logistics, freight, and infrastructure development globally.

- Aftermarket leads sales channels from high tire replacement rates due to heavy usage and wear.

- Asia Pacific leads regionally due to strong infrastructure growth and expanding commercial transport.

- North America is expected to grow fastest with high freight volumes and developed highway systems.

Industry Dynamics

- Increasing e-commerce growth is expanding commercial vehicle fleets, driving demand for durable and fuel-efficient radial tires.

- Urbanization boosts public transportation and freight activities, leading to higher usage of truck and bus radial tires.

- Rising industrialization fuels infrastructure projects, increasing commercial vehicle deployment, and tire replacement rates.

- Stricter safety regulations and higher accident awareness push operators to invest in advanced, reliable radial tires.

- Growing adoption of electric and hybrid commercial vehicles creates demand for specialized, high-performance radial tires.

- High raw material costs and supply chain disruptions may increase tire prices, limiting market growth and adoption rates.

Market Statistics

2024 Market Size: USD 19.50 billion

2034 Projected Market Size: USD 36.13 billion

CAGR (2025–2034): 6.4%

Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Truck & bus radial tire is a specialized type of tire designed for commercial vehicles such as heavy-duty trucks, trailers, and buses, offering superior durability, fuel efficiency, and load-bearing capacity compared to traditional bias-ply tires. These tires feature a steel-belted radial construction, where layers of cords run perpendicular to the direction of the vehicle, providing better flexibility, heat dissipation, and longer tread life. Truck & bus radial tires are widely used in long-haul transportation, urban bus networks, construction logistics, and freight delivery, where reliability and performance under heavy loads are essential. The ability of radial tires to withstand prolonged use on highways and rough terrains makes them a preferred choice for commercial vehicle operators seeking cost-effective and low-maintenance solutions.

The growing e-commerce industry across the globe is propelling the truck & bus radial tire market growth. E-commerce businesses are expanding their logistics and delivery networks. This expansion is leading to a higher number of commercial vehicles, especially trucks and buses, on the road, which in turn is driving the consumption of TBR tires. Moreover, many e-commerce companies invest in their own fleets or partner with logistics firms that maintain large truck and bus operations. These fleet operators prioritize fuel efficiency, safety, and low maintenance costs, qualities that truck & bus radial tires offer, thereby increasing their adoption. Hence, as the e-commerce industry across the globe witness growth, the demand for truck & bus radial tires also spurs. For instance, as per the article published in the International Trade Administration report, the global B2C e-commerce revenue is expected to grow to USD$5.5 trillion by 2027 at a steady 14.4% compound annual growth rate.

The truck & bus radial tire market demand is driven by the increasing urbanization globally. The demand for goods, construction materials, and municipal services is rising with growing urbanization. This increasing urban activity is further driving the deployment of more commercial vehicles, especially trucks and buses, which rely on radial tires for efficiency, safety, and performance. Moreover, public transportation systems are growing rapidly in response to urbanization. City governments are investing in larger bus fleets to accommodate rising commuter traffic. These buses operate daily on city roads, covering long distances and facing stop-and-go traffic, creating a demand for truck & bus radial tires due to their durability, improved heat resistance, and longer service life. Therefore, the demand for truck & bus radial tire market is increasing with the growing urbanization globally. For instance, the World Economic Forum published a report stating that the share of the world’s population living in cities is expected to rise to 80% by 2050.

Market Dynamics

Increasing Commercial Vehicle Road Accidents Globally

Accidents often expose tire failures, such as blowouts or tread separations, prompting companies to invest in higher-quality radial tires that offer better stability and grip. Accidents may also result in tire damage, necessitating immediate replacements. This direct need for new tires drives up demand for radial tires as fleet operators ensure their vehicles remain operational and compliant with safety standards. Moreover, road accidents involving commercial vehicles lead to high awareness and enforcement of safety regulations. Governments and regulatory bodies across the globe are tightening safety standards for commercial vehicles, pushing operators to replace older or substandard tires with durable radial tires that meet updated requirements. Therefore, the rising commercial vehicle road accidents globally are driving the truck & bus radial tire market revenue. For instance, the National Safety Council published data stating that in 2022, 5,837 large trucks were involved in a fatal crash in the US, a 1.8% increase from 2021.

Rising Industrialization Worldwide

Industrialization leads to the expansion of new manufacturing units, which spurs the volume of freight movement. Trucks become the backbone of these supply chains, moving goods between factories, warehouses, ports, and markets. This surge in transportation directly increases the usage and replacement rate of truck & bus radial tires. Industrialization further leads to infrastructure development, including roads, highways, and logistic hubs. These projects require the continuous movement of construction materials and equipment, which puts more trucks and buses on the road, creating demand for radial tires as construction fleets depend on these tires due to their ability to offer longevity and handle rough terrain. Thus, the demand for truck & bus radial tire is increasing with the rising industrialization globally. For instance, according to the Economic Survey 2023-24, India witnessed 9.5% industrial growth.

Truck & Bus Radial Tire Industry Assessment by Segment

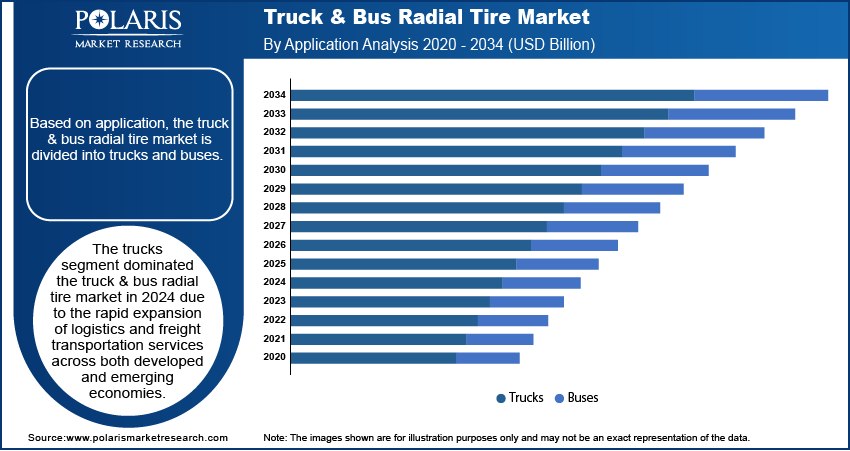

Market Evaluation by Application

Based on application, the truck & bus radial tire market is divided into trucks and buses. The trucks segment dominated the truck & bus radial tire market in 2024 due to the rapid expansion of logistics and freight transportation services across both developed and emerging economies. E-commerce growth, increased infrastructure development, and rising industrial output significantly boosted the demand for heavy-duty commercial vehicles, particularly long-haul trucks. These vehicles require durable and high-performance radial tires capable of supporting heavy loads while offering fuel efficiency and extended tread life. Additionally, government investments in road connectivity and the growing need for efficient goods movement across countries such as China, India, and the US further fueled the segment’s dominance.

Market Insight by Sales Channel

In terms of sales channel, the truck & bus radial tire market is segregated into aftermarket and OEMs. The aftermarket segment held the major market share in 2024 due to the high replacement rate of tires in commercial vehicles, especially trucks. Frequent long-distance travel and operation under varying load conditions accelerate tire wear, creating consistent demand for replacements, contributing to segment dominance. Fleet operators and independent truck owners often prefer aftermarket tires as they offer greater flexibility in pricing and availability. Additionally, the rise in average vehicle age and the growing number of trucks in service, particularly in Asia Pacific and North America, contributed to the dominance of the aftermarket segment. Tire retailers and service networks have also expanded significantly, improving accessibility and supporting the growth of aftermarket channel.

The OEMs segment is expected to grow in the coming years owing to the rising production of new commercial trucks and the increasing focus on vehicle performance and fuel efficiency. Manufacturers are now prioritizing equipping new trucks with advanced tires, such as radial tires that enhance safety, reduce rolling resistance, and support environmental standards. The adoption of hybrid and electric trucks is estimated to further strengthen OEM demand, as these vehicles require specialized tire configurations. Moreover, strong partnerships between tire manufacturers and vehicle producers, along with growing investments in smart factory setups, enable OEMs to deliver integrated, high-quality tire solutions tailored to evolving market needs.

Regional Analysis

By region, the truck & bus radial tire market report provides insight into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Asia Pacific held the largest truck & bus radial tire market share in 2024 due to the rapid growth of commercial transportation and robust infrastructure development across major economies. China dominated the region, accounting for the highest demand for truck & bus radial tires due to its expansive logistics network, growing e-commerce industry, and large fleet of heavy-duty trucks. The government's continued investments in road and highway projects, coupled with a surge in industrial output, created sustained demand for commercial vehicle radial tires. Additionally, the presence of major tire manufacturing hubs in countries such as China, India, and Thailand ensured competitive pricing and easy availability, further boosting regional truck & bus radial tire market growth. The rise of domestic and international trade routes in the region also contributed to increased tire replacement cycles, especially in long-haul truck operations, driving market expansion.

The market in North America is expected to grow at the fastest pace during the projected period, owing to high freight volumes and a strong interstate highway system. Stricter regulations around fuel efficiency and emissions are pushing fleet operators in the region to invest in advanced tire technologies, particularly those that enhance fuel economy and durability. Furthermore, the increasing adoption of smart fleet management and predictive maintenance tools encourages timely tire replacements, strengthening the aftermarket and OEM channels. The regional focus on electrification of heavy-duty trucks and continued investment in supply chain infrastructure is projected to further support North America's expanding footprint in the truck & bus radial tire market.

Truck & Bus Radial Tire Key Market Players & Competitive Analysis Report

The global truck & bus radial tire market is highly competitive, with key players leveraging strategic mergers, acquisitions, partnerships, and collaborations to strengthen their market position. Major companies such as Michelin, Bridgestone, Continental, Goodyear, and Pirelli dominate the market through aggressive expansion strategies and continuous innovation in product portfolios. Mergers and acquisitions have played a crucial role in consolidating market share. Strategic partnerships and collaborations are also shaping the competitive dynamics, with tire manufacturers collaborating with fleet operators and OEMs to develop fuel-efficient, durable, and smart tire solutions.

The truck & bus radial tire market is fragmented, with the presence of numerous global and regional market players. Major players in the market are Apollo Tires; Balkrishna Industries Limited (BKT); Bridgestone Corporation; Continental AG; CEAT; Giti Tire; Kumho Tire; MICHELIN; Pirelli & C. S.p.A.; Sumitomo Rubber Industries, Ltd.; The Goodyear Tire & Rubber Company; and Yokohama Rubber Corporation.

Continental AG, headquartered in Hanover, Germany, is a major global automotive supplier and one of the largest tire manufacturers worldwide. Established in 1871, the company specializes in innovative mobility solutions across sectors such as automotive safety, vehicle electronics, powertrains, and tire technology. Its operations are divided into four primary sectors: Automotive, Tires, ContiTech, and Contract Manufacturing. Continental produces high-performance tires for various applications, including original equipment and replacement tires for automobiles, trucks, buses, motorcycles, and bicycles. The company also offers specialty tires under brands such as General Tire and Uniroyal.

MICHELIN is a France-based multinational tire manufacturer headquartered in Clermont-Ferrand, France. Founded in 1889 by brothers Édouard and André Michelin, the company has grown to become one of the biggest tire manufacturers globally. Michelin is known for its innovations in tire technology, including the invention of the removable pneumatic tire and the radial tire, which revolutionized the market. The company operates 69 facilities across 18 countries and employs over 132,000 people worldwide. Michelin's operations extend beyond tires to include the production of guides and maps, which were initially created to encourage travel and, consequently, tire sales. The company also owns several brands, including Kléber, Uniroyal-Goodrich, and Camso, and is known for its iconic mascot, Bibendum, or the Michelin Man.

Key Companies

- Apollo Tires

- Balkrishna Industries Limited (BKT)

- Bridgestone Corporation

- CEAT

- Continental AG

- Giti Tire

- Kumho Tir

- MICHELIN

- Pirelli & C. S.p.A.

- Sumitomo Rubber Industries, Ltd.

- The Goodyear Tire & Rubber Company

- Yokohama Rubber Corporation

Truck & Bus Radial Tire Industry Developments

January 2025: Continental, a global company specializing in tires, brake systems, vehicle electronics, and other components, introduced its new Premium Contact 6 (PC6) ContiSeal and Gen 3 truck radial tires in India.

September 2024: CEAT, one of India's leading tire manufacturers, announced the launch of a truck bus radial (TBR) production line at the Chennai manufacturing plant.

November 2022: Bridgestone, announced the launch of the all-new Bridgestone R192E all-position radial tire, specially designed to empower electric buses.

October 2024: Infineon,

Truck & Bus Radial Tire Market Segmentation

By Application Outlook (Revenue, USD Billion, 2020-2034)

- Trucks

- Buses

By Sales Channel Outlook (Revenue, USD Billion, 2020-2034)

- Aftermarket

- OEMs

By Regional Outlook (Revenue, USD Billion, 2020-2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Truck & Bus Radial Tire Market Value in 2024 |

USD 19.50 Billion |

|

AI-Powered Enterprise Automation Forecast in 2025 |

USD 20.71 Billion |

|

Revenue Forecast in 2034 |

USD 36.13 Billion |

|

CAGR |

6.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global truck & bus radial tire market size was valued at USD 19.50 billion in 2024 and is projected to grow to USD 36.13 billion by 2034.

The global market is projected to grow at a CAGR of 6.4% during the forecast period.

Asia Pacific had the largest share of the global market in 2024.

Some of the key players in the market are Apollo Tires; Balkrishna Industries Limited (BKT); Bridgestone Corporation; Continental AG; CEAT; Giti Tire; Kumho Tire; MICHELIN; Pirelli & C. S.p.A.; Sumitomo Rubber Industries, Ltd.; The Goodyear Tire & Rubber Company; and Yokohama Rubber Corporation

The trucks segment dominated the truck & bus radial tire market revenue in 2024.

• The OEMs segment is expected to grow at the fastest pace in the coming years.