Ultrapure Water Treatment Systems Market Size, Share, Trend, Industry Analysis Report

: By Technology (Electrode Deionization, Ion Exchange, Reverse Osmosis, Ultrafiltration, Others), By Application, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5943

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

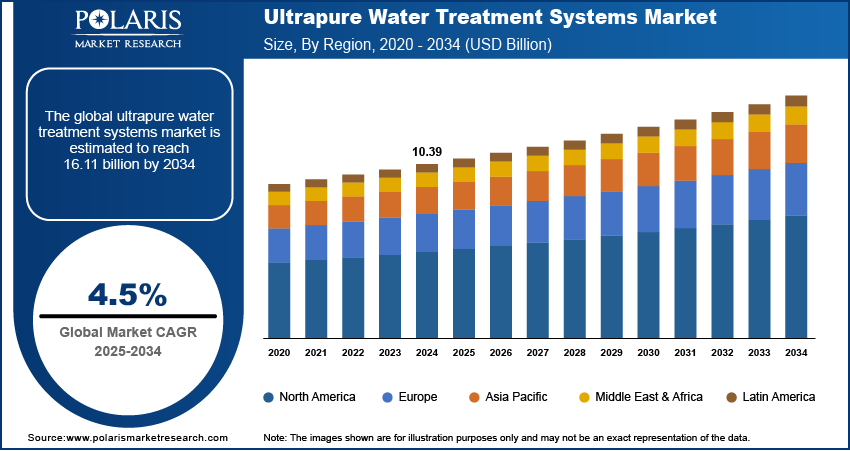

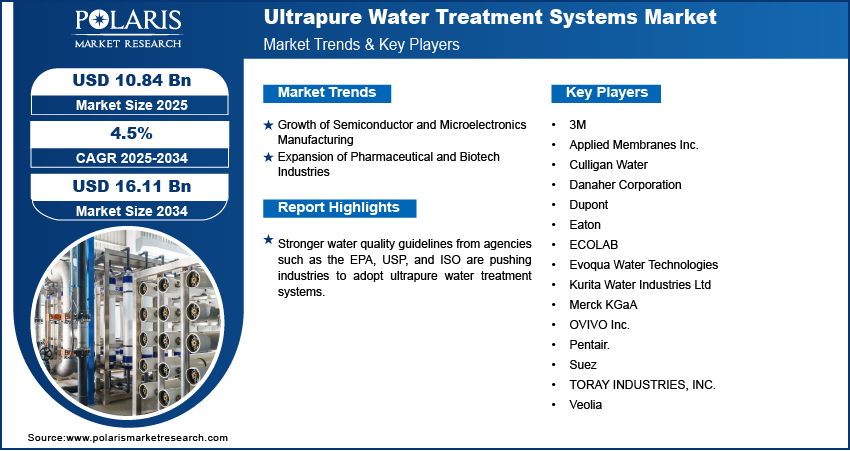

The global ultrapure water treatment systems market size was valued at USD 10.39 billion in 2024 and is projected to register a CAGR of 4.5% from 2025 to 2034. The growth of semiconductor and microelectronics manufacturing is driving market expansion. These industries require extremely high-purity water for wafer processing, cleaning, and chemical mixing. As global demand for chips and electronic components rises, manufacturers are investing in advanced water purification technologies to meet stringent quality standards and ensure reliable production processes.

The ultrapure water (UPW) treatment systems market involves advanced purification technologies designed to remove organic and inorganic contaminants, dissolved gases, and particulates from water to meet extremely stringent purity standards. These systems are critical in industries such as semiconductors, pharmaceuticals, and power generation, where even trace impurities compromise product integrity or process performance. The systems are increasingly used in power generation facilities such as thermal and nuclear power plants, which require ultrapure water to prevent scaling and corrosion in boilers and turbines. The adoption of advanced boiler feedwater treatment systems is growing alongside global energy demand.

Stronger water quality guidelines from agencies such as the EPA, USP, and ISO are pushing industries to adopt ultrapure systems. These standards cover microbial control, conductivity, TOC limits, and endotoxin levels. Additionally, cleanrooms in electronics, optics, and aerospace manufacturing rely on ultrapure water for surface preparation and equipment rinsing. Growth in these sectors is fueling demand for high-efficiency water purification infrastructure.

To Understand More About this Research:Request a Free Sample Report

Market Dynamics

Growth of Semiconductor and Microelectronics Manufacturing

Growing semiconductor and microelectronics production demands extremely clean environments, where trace amounts of impurities compromise yield and performance. The Semiconductor Industry Association reported that global semiconductor sales reached USD 57.0 billion in April 2025, marking a 2.5% increase from the USD 55.6 billion recorded in March 2025. This figure also represents a substantial year-over-year growth of 22.7% when compared to April 2024's sales of USD 46.4 billion. The shift toward advanced node designs and increased use of sensitive materials in chip fabrication intensified the need for ultrapure water in wafer cleaning, photolithography, and etching processes. Ultrapure water acts as a carrier, cleanser, and solvent during the numerous stages of production, requiring complete removal of particulates, dissolved gases, organics, and ions. Manufacturers are upgrading water treatment systems to meet stricter purity standards and minimize contamination risks. This growing emphasis on micro-level precision and miniaturization is directly driving the demand for high-capacity and reliable ultrapure water treatment technologies in fabrication facilities. Hence, the rising semiconductor and microelectronics manufacturing drives the demand for ultrapure water treatment systems.

Expansion of Pharmaceutical and Biotech Industries

Pharmaceutical and biotechnology companies rely on ultrapure water for a range of critical processes, including ingredient mixing, process equipment cleaning, and injectable formulations. Regulatory bodies require strict adherence to water quality standards such as USP and EU Pharmacopeia, making purification systems an essential part of the infrastructure. Growth in vaccine development, biologics production, and sterile manufacturing is increasing the need for contamination-free environments. Ultrapure systems ensure compliance with good manufacturing practices while reducing microbial and endotoxin levels that could affect drug efficacy. Rising investments in life sciences R&D and global expansion of manufacturing units are further strengthening demand for advanced water purification technologies tailored for pharmaceutical applications.

Segment Insights

Technology Analysis

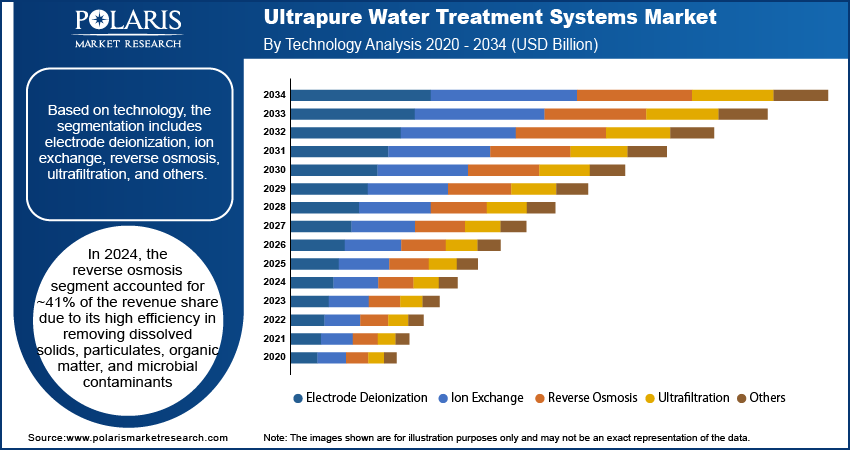

Based on technology, the segmentation includes electrode deionization, ion exchange, reverse osmosis, ultrafiltration, and others. In 2024, the reverse osmosis segment accounted for ~41% of the revenue share due to its high efficiency in removing dissolved solids, particulates, organic matter, and microbial contaminants. In industries such as semiconductors and pharmaceuticals, where extremely low conductivity water is essential, reverse osmosis serves as a foundational purification step. System advancements that enable modular design, lower energy consumption, and improved membrane life have supported widespread deployment across both large-scale and compact setups. Reverse osmosis membrane also offers scalability and compatibility with other polishing systems, enhancing its utility in multi-stage water treatment infrastructure across critical industrial applications.

The electrode deionization segment is expected to register the highest CAGR of 8.0% during the forecast period, as various industries pursue continuous, chemical-free water purification solutions that meet high resistivity standards. This technology combines ion exchange resins with electrical current, delivering ultrapure water without requiring frequent chemical regeneration, which reduces environmental impact and operational complexity. Its suitability for polishing stages in microelectronics and pharmaceutical applications is driving demand, particularly in cleanroom environments where ionic contaminants are reduced to parts per trillion. Improved cost efficiency, minimal maintenance, and advancements in automation and monitoring have further positioned electrode deionization as a preferred next-generation technology for high-purity water production.

Application Analysis

Based on application, the segmentation includes cleaning, etching, ingredient, and others. In 2024, the cleaning segment accounted for ~50% of the revenue share. Cleaning processes in semiconductor, pharmaceutical, and biotechnology industries require ultrapure water to eliminate the slightest traces of particles, ions, and organic residues from surfaces, tools, and equipment. The effectiveness of these cleaning cycles is directly linked to the purity level of the water used, impacting final product quality and compliance standards. In semiconductor wafer fabrication, even nanometer-sized particles can compromise circuit integrity, necessitating multiple rinse cycles using high-grade water. Demand for contamination-free manufacturing environments across high-tech industries is propelling investments in cleaning-focused water treatment systems. As production complexity rises, maintaining ultra-low contaminant levels in cleaning applications continues to be a top priority.

The ingredient segment is projected to register the highest CAGR of 5.9% from 2025 to 2034 due to its increasing use as a direct ingredient in the formulation of pharmaceutical products, cosmetic solutions, and certain food and beverage products where safety and purity are paramount. This trend is particularly prominent in parenteral drugs and biologics, where endotoxin-free water is essential. The growing regulatory focus on water quality used in drug and food production is pushing manufacturers to upgrade to higher-grade purification technologies. Rising demand for clean-label ingredients and injectable medications is boosting investments in ingredient-grade water systems. Manufacturers are also implementing real-time monitoring and validation tools to ensure quality consistency across batches.

End Use Analysis

Based on end use, the segmentation includes food & beverage, healthcare, pharmaceuticals, power generation, semiconductor, and others. In 2024, the semiconductor segment accounted for ~42% of the revenue share. The semiconductor industry relies on ultrapure water throughout its fabrication process for wafer rinsing, cleaning, and etching steps. Any impurity at the microscopic level results in defective chips, leading to substantial yield losses. The demand for high-purity water has surged due to the increasing miniaturization of integrated circuits and the adoption of advanced process nodes. Foundries are scaling their purification capacity to support higher chip output while adhering to tighter purity specifications. Robust water treatment infrastructure is essential to achieving stable performance in modern semiconductor facilities, which are expanding both in scale and technical sophistication.

The pharmaceuticals segment is projected to register a CAGR of 5.3% from 2025 to 2034. Pharmaceutical manufacturers are intensifying their focus on water quality to meet evolving regulatory standards and safeguard product integrity. Ultrapure water is critical in the production of injectable, oral solutions, topical agents, and during cleaning and sterilization of process equipment. Increasing development of complex biologics, sterile drugs, and high-potency compounds demands highly purified water that is free of pyrogens, microbes, and chemical contaminants. Growing investments in global pharmaceutical production facilities and contract manufacturing are accelerating the adoption of advanced water treatment systems tailored to GMP and pharmacopeia standards.

Regional Analysis

The North America ultrapure water treatment systems market is projected to register a CAGR of 4.5% from 2025 to 2034 due to strong demand from semiconductor fabrication plants. Life sciences manufacturing is expanding investment in high-spec water treatment systems across North America. For instance, in May 2025, Florida's governor officially opened an advanced reverse osmosis water treatment facility on Stock Island, marking a significant investment of USD 47 million in the region's water infrastructure. Advanced chip production processes and new fabs under construction are pushing requirements for water purity to even stricter limits. Increasing drug development and sterile manufacturing by pharmaceutical companies is accelerating the adoption of validated purification infrastructure. Government incentives for reshoring critical technologies, combined with stricter environmental compliance mandates, are supporting long-term infrastructure upgrades. Rising awareness about minimizing process contaminants and enhancing operational reliability is further reinforcing market momentum in the region’s high-tech industries.

U.S. Ultrapure Water Treatment Systems Market Insight

The U.S. accounted for ~80% of the revenue share in North America market. Robust investments in semiconductor foundries and biologics manufacturing positioned the country as a leading market for ultrapure water systems. Technological advancements and a strong base of cleanroom-intensive industries are fueling the need for precision water treatment solutions. Widespread adoption of water reuse strategies in regulated environments is also boosting system demand.

Asia Pacific Ultrapure Water Treatment Systems Market Overview

In 2024, Asia Pacific accounted for ~40% of the revenue share across the world, due to rapid industrialization and large-scale expansion of semiconductor and pharmaceutical manufacturing. The Semiconductor Industry Association reported a rise in semiconductor sales for April, year-over-year growth figures showing significant increases. Asia Pacific and all other regions experienced a growth of 23.1%, China reported a 14.4% increase, and Japan registered a 4.3% rise. Countries such as Taiwan, South Korea, and China require precision-grade water for sub-10nm processes, increasing system complexity and volume. Biopharmaceutical and contract manufacturing growth is also accelerating the need for contamination-free production environments. Supportive regulatory frameworks and aggressive infrastructure development initiatives are encouraging adoption across both domestic and export-focused operations. Growing local expertise in system engineering and integration is contributing to the regional market’s dominance, supported by competitive pricing and accelerated timelines for installation and commissioning.

China Ultrapure Water Treatment Systems Market Outlook

The China market is growing rapidly due to the massive expansion of domestic semiconductor capabilities and investments in vaccine and biologic production. Government-backed infrastructure plans, tech sovereignty initiatives, and cleanroom standardization policies are encouraging wide-scale adoption of multi-stage purification technologies. Rising export competitiveness is also pushing process standardization.

Europe Ultrapure Water Treatment Systems Market Analysis

The market in Europe is growing due to the expansion of biotech clusters and increased semiconductor capacity in countries such as Germany and France. Strong regulatory emphasis on water quality in pharmaceutical production, combined with clean energy-driven hydrogen projects, is reinforcing the adoption of ultra-purification systems. Ongoing modernization of legacy facilities to meet new GMP and environmental compliance benchmarks is boosting demand for modular and scalable water treatment platforms. Cross-industry collaborations in the EU to support digital manufacturing, automation, and contamination control are further enhancing technology uptake. Investments in high-purity systems for precision engineering and R&D labs are also expanding the addressable market.

UK Ultrapure Water Treatment Systems Market Assessment

The UK market is growing steadily due to rising demand for GMP-compliant pharmaceutical production. Ongoing investments in data centers and semiconductor pilot lines are boosting system installations across the UK. Focus on sustainable manufacturing and high-spec water reuse systems is contributing to long-term market visibility.

Key Players and Competitive Analysis

The competitive landscape of the ultrapure water treatment systems market is shaped by intense industry analysis, where key players are aligning their strategies with evolving purity standards in semiconductor, pharmaceutical, and biotech sectors. Expansion strategies focus on penetrating emerging economies and reinforcing presence in cleanroom-dominated industries. Leading participants are engaging in mergers and acquisitions to consolidate capabilities in membrane filtration, ion exchange, and UV oxidation technologies. Joint ventures and strategic alliances are increasingly formed to integrate automation and smart monitoring features, enhancing system efficiency and reducing operational downtime.

Post-merger integration efforts are streamlining product portfolios and optimizing supply chains to respond rapidly to customized high-purity water demands. Continuous technological advancements in electrode deionization, remote diagnostics, and compact modular systems are driving differentiation. Companies are utilizing expertise from various sectors to support niche applications such as precision optics and medical device cleaning, thereby enhancing their position.

Key Players

- 3M

- Applied Membranes Inc.

- Culligan Water

- Danaher Corporation

- Dupont

- Eaton

- ECOLAB

- Evoqua Water Technologies

- Kurita Water Industries Ltd

- Merck KGaA

- OVIVO Inc.

- Pentair.

- Suez

- TORAY INDUSTRIES, INC.

- Veolia

Ultrapure Water Treatment Systems Industry Developments

In June 2025, Aquatech acquired Century Water, which engaged in ultrapure water and wastewater recycling solutions. The move strengthened Aquatech’s position in Southeast Asia and expanded its capabilities in semiconductor and pharmaceutical water treatment.

In July 2024, Silanna Semiconductor installed a customized three-stage ultrapure water system at its Brisbane site. The system, featuring reverse osmosis, electrode deionization, UV treatment, and polishing, ensured high water purity with minimal downtime and chemical use, supporting the company’s manufacturing and sustainability goals.

Ultrapure Water Treatment Systems Market Segmentation

By Technology Outlook (Revenue USD Billion, 2020–2034)

- Electrode Deionization

- Ion Exchange

- Reverse Osmosis

- Ultrafiltration

- Others

By Application Outlook (Revenue USD Billion, 2020–2034)

- Cleaning

- Etching

- Ingredient

- Others

By End Use Outlook (Revenue USD Billion, 2020–2034)

- Food & Beverage

- Healthcare

- Pharmaceuticals

- Power Generation

- Semiconductor

- Others

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Ultrapure Water Treatment Systems Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 10.39 billion |

|

Market Size in 2025 |

USD 10.84 billion |

|

Revenue Forecast by 2034 |

USD 16.11 billion |

|

CAGR |

4.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 10.39 billion in 2024 and is projected to grow to USD 16.11 billion by 2034.

The global market is projected to register a CAGR of 4.5% during the forecast period.

In 2024, Asia Pacific accounted for ~40% of the revenue share due to rapid industrialization and large-scale expansion of semiconductor and pharmaceutical manufacturing.

A few of the key players include 3M; Applied Membranes Inc.; Culligan Water; Danaher Corporation; Dupont; Eaton; ECOLAB; Evoqua Water Technologies; Kurita Water Industries Ltd; Merck KGaA; OVIVO Inc.; Pentair.; Suez; TORAY INDUSTRIES, INC.; and Veolia.

In 2024, the reverse osmosis segment accounted for ~41% of the revenue share due to its high efficiency in removing dissolved solids, particulates, organic matter, and microbial contaminants

In 2024, the cleaning segment accounted for ~50% of the revenue share. Cleaning processes in semiconductor, pharmaceutical, and biotechnology industries require ultrapure water to eliminate the slightest traces of particles, ions, and organic residues from surfaces, tools, and equipment.