Ultrasound Needle Guides Market Share, Size, Trends, Industry Analysis Report

By Type (Disposable, Reusable); By Application; By End-Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM3885

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

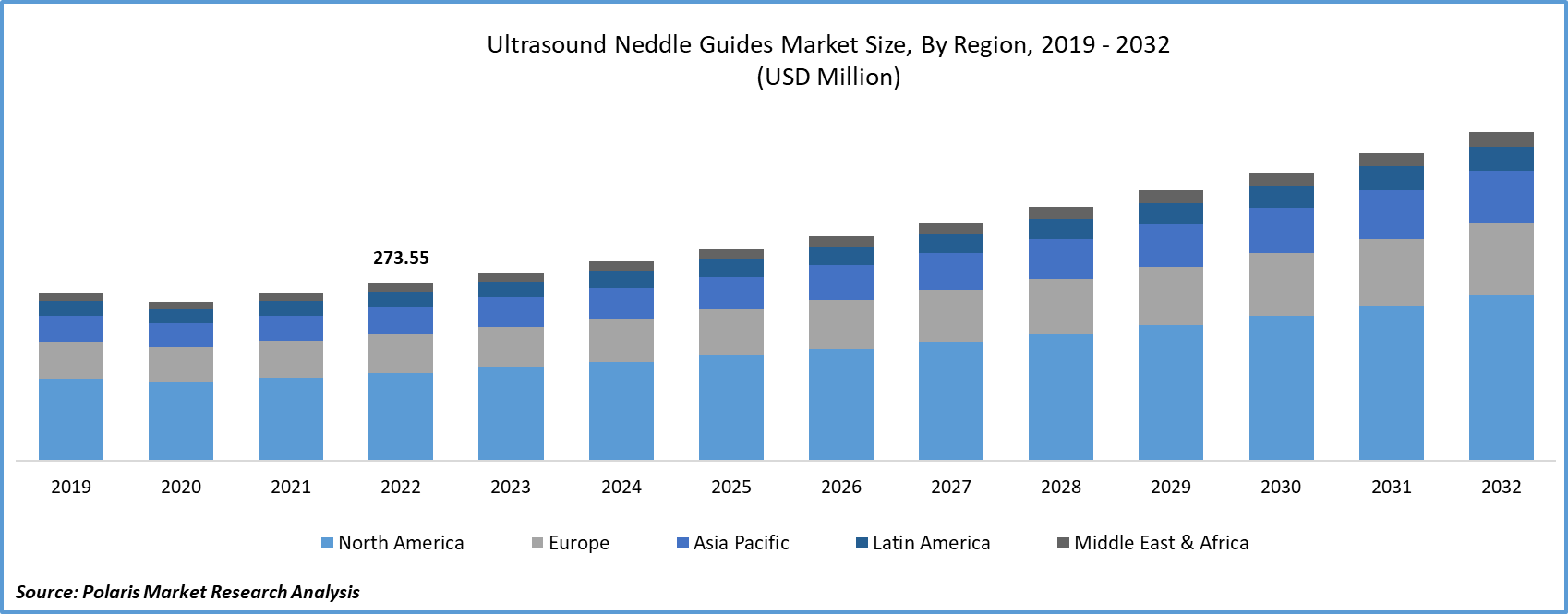

The global ultrasound needle guides market was valued at USD 289.45 million in 2023 and is expected to grow at a CAGR of 6.50% during the forecast period.

The ultrasound needle guide market is expanding, driven by a combination of factors, including the rising need for point-of-care ultrasound systems, the increasing utilization of ultrasound-guided needle placement, a growing demand for minimally invasive procedures, and continuous advancements in ultrasound imaging technology. Furthermore, the increasing incidence of chronic diseases like cancer and diabetes, coupled with a rising population of elderly patients in need of minimally invasive surgeries, is anticipated to boost the demand for ultrasound needle guides further.

To Understand More About this Research: Request a Free Sample Report

Within the realm of native biopsies, employing a needle guide not only enhances the quality of biopsies but also diminishes the occurrence of minor complications. To exemplify, an article published in March 2023 in Scientific Reports emphasizes the importance of standardizing the tissue acquisition procedure for pancreatic cancer using the Franseen needle in conjunction with the fanning technique through an endoscope to achieve precise diagnoses.

Advancements in ultrasonic imaging technology have made it possible to generate sharper, higher-resolution images. These technological breakthroughs empower healthcare professionals to discern even the most delicate and intricate anatomical structures within the body. Furthermore, ultrasound needle guides provide a visual tool that ensures exact needle placement, thereby enhancing the precision of procedures such as biopsies, aspirations, and injections.

To exemplify the significance of these technological advancements, in November 2022, at the Radiological Society of North America 2022 event, Philips unveiled a portable ultrasound device with the purpose of broadening the accessibility of precise initial diagnoses to a more extensive range of patients.

Nevertheless, sophisticated ultrasound needle guide systems can incur substantial acquisition and operational expenses, potentially hindering their widespread adoption, particularly in resource-constrained settings. The market for medical electronic devices, including ultrasound needle guides, is highly competitive, with numerous companies offering various solutions. This competition can influence ultrasound needle guides market share and pricing.

Industry Dynamics

Growth Drivers

Augment the presence of the target audience across the Globe will Facilitate Market Growth

Ultrasound needles find applications in the diagnosis and treatment of diseases, including cancer and cardiovascular diseases (CVD). The prevalence of these target diseases is on the rise worldwide, driven by factors such as a growing geriatric population and the increasing adoption of sedentary lifestyles. In 2020, nearly 9.3% of the global population was aged 65 years and older, a figure projected to reach 16% by 2050. According to the CDC, by 2050, the average global lifespan is expected to increase by ten years. This demographic shift places mounting pressure on public health systems and underscores the escalating demand for effective disease diagnosis and treatment.

Report Segmentation

The market is primarily segmented based on type, application, end-use, and region.

|

By Type |

By Application |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

The Disposable segment held the largest revenue share in 2022

In 2022, the Disposable segment held the largest revenue share. Disposable needle guides offer simplicity and efficiency by eliminating the necessity for workflow optimization, cleaning, and sterilization, resulting in time savings. Their single-use design not only enhances infection control by minimizing the risk of cross-contamination and diseases but also makes them well-suited for clinics and smaller healthcare facilities. Their flexibility is particularly advantageous in point-of-care settings, and their ease of setup and use further contributes to their appeal in these environments.

On the other hand, Improper disinfection of reusable devices between uses can lead to infections. Single-use needle guides mitigate this risk. Because disposable needle guides do not necessitate extensive disinfection procedures, healthcare facilities can streamline their operational processes. The demand for disposable needles has increased over the years due to their cost-effectiveness, simplicity, and advantages in terms of infection control.

By Application Analysis

The Regional Anesthesia segment accounted for the highest market share during the forecast period

The advent of ultrasound technology has ushered in a significant transformation in regional anesthesia by enabling the continuous monitoring of nerves and needle placement, thereby enhancing the precision and safety of procedures. This advancement contributes to expedited patient recovery and reduced postoperative pain while also lowering the likelihood of complications such as nerve injury, vascular puncture, and inadvertent intravascular injections when needles are accurately placed. Anesthesiologists can administer anesthesia with greater security by using ultrasound guidance to avoid critical structures.

On the other hand, the tissue biopsy segment is projected to experience the most substantial Compound Annual Growth Rate (CAGR) throughout the forecast period. This is attributed to the significant market share held by the tissue biopsy segment, primarily owing to its critical role in diagnosing a wide range of medical conditions. In the realm of ultrasound needle guides, tissue biopsies reign supreme, as ultrasound guidance is indispensable to ensure accurate needle placement for obtaining dependable samples. With the healthcare sector increasingly emphasizing early and precise diagnoses, the demand for minimally invasive procedures such as ultrasound-guided biopsies have surged. Consequently, the tissue biopsy market segment has witnessed remarkable growth, driven by the increasing need for precision and the rising prevalence of conditions like cancer and others.

Regional Insights

North America dominated the largest market in 2022

In 2022, North America asserted its market dominance, buoyed by the presence of major manufacturers within the region. Moreover, the growing incidence of cancer cases is a key driver of regional market expansion. For instance, according to the National Journal of Health Statistics, in 2023, the United States is expected to witness 1,958,310 new cancer cases and 609,820 fatalities. This is anticipated to result in an increased demand for ultrasound needle guides due to the rise in cancer-related procedures and biopsies. Additionally, the need for diagnostic and treatment procedures for these conditions, driven by the high incidence rate, has led to the expansion of the endoscopic ultrasound needles market.

Asia Pacific is anticipated to achieve the highest CAGR in the forecast period. This growth is attributed to the adoption of advanced medical technologies and the improvement of healthcare services, leading to increased healthcare expenditures in various Asia-Pacific countries. Several Asian nations, such as Singapore, Thailand, and India, have emerged as sought-after medical tourism hubs due to their top-tier medical facilities and cost-effective treatments. This trend may contribute to heightened demand for state-of-the-art medical equipment, including ultrasound needle guides, within the region.

Numerous regional economies are actively investing in enhancing their ultrasound and other medical imaging capabilities, fostering opportunities for technological and device innovations that align with these advancements. Moreover, heightened research and development investments from manufacturers, coupled with ongoing government initiatives, are playing a substantial role in driving growth within the regional market.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- Advance Medical Designs, Inc.

- Argon Medical Devices

- Aspen Surgical

- Becton, Dickinson and Company

- BIRR

- FUJIFILM Holdings Corporation

- Geotek Medical

- Hologic, Inc.

- InnoFine

- IZI Medical

- KOELIS

- Remington Medical Inc.

- Rocket Medical

- Roper Technologies (CIVCO Medical Solutions)

- Sheathing Technologies, Inc.

- Siemens Healthineers AG

- weLLgo Medical Products GmbH

Recent Developments

- In April 2022, Audax Private Equity's investment in Aspen Surgical has enabled the company to bolster Aspen's pursuit of imminent organic growth and more substantial acquisition opportunities, further solidifying its global expansion as a prominent provider of single-use surgical products within acute care and surgical environments.

- In March 2021, Aspen Surgical recently completed the acquisition of Bluemed Medical Supplies, a move that has reinforced Aspen's extensive range of surgical disposables and products dedicated to patient and staff safety, thereby enhancing its presence in the acute care market.

Ultrasound Needle Guides Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 306.61 million |

|

Revenue forecast in 2032 |

USD 506.28 million |

|

CAGR |

6.50% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments Covered |

By Type, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |