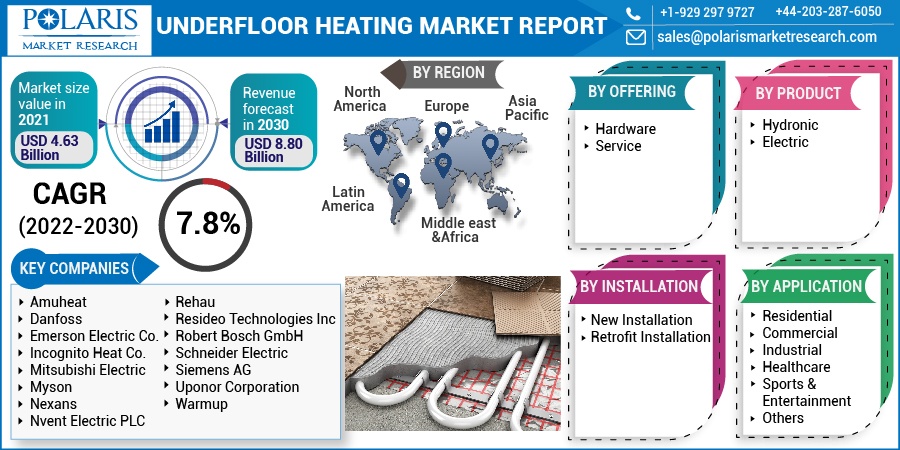

Underfloor Heating Market Share, Size, Trends, Industry Analysis Report

By Product (Hydronic Underfloor Heating, Electric Underfloor Heating); By Installation (New Installation, Retrofit Installation), By Offering; By Application; By Region; Segment Forecast, 2025 - 2034

- Published Date:Oct-2025

- Pages: 114

- Format: PDF

- Report ID: PM2445

- Base Year: 2024

- Historical Data: 2020 - 2023

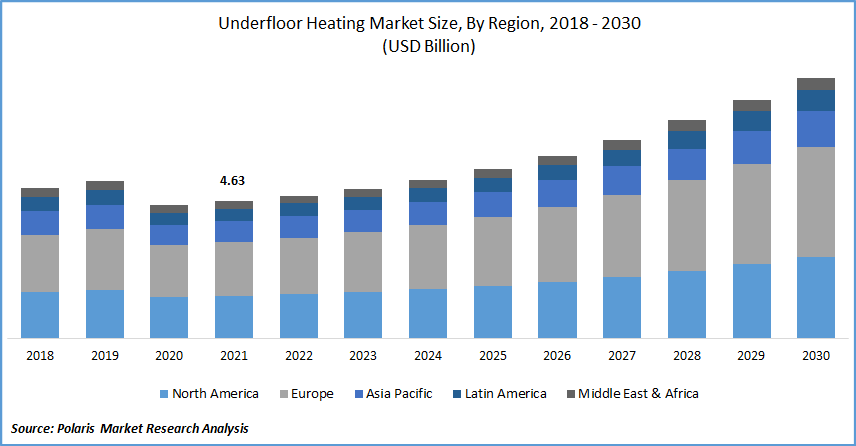

The global underfloor heating market was valued at USD 4.23 billion in 2024 and is expected to grow at a CAGR of 6.8% during the forecast period. The ongoing trend of residential infrastructure development coupled with the upsurge in consumer investments in comfort and luxury primarily drives the growth of the global market.

Key Insights

- By offering, the hardware segment held the largest share in 2024 due to the continuous demand for core components such as heating pipes, heating cables, and control systems.

- By product, the electric underfloor heating system subsegment held the largest share in 2024 due to its high energy efficiency and ability to provide consistent.

- By installation, the new installation segment held the largest share in 2024 due to rising number of new residential and commercial construction projects worldwide.

- By application, the Residential subsegment held the largest share in 2024 due to the increased consumer awareness among homeowners about the energy-efficient, eco-friendly nature and the aesthetic benefits.

- By region, Europe dominated the global market in 2024. This is due to the ongoing promotion trend of electric underfloor heating systems in the region.

Industry Dynamics

- The increasing focus on energy efficiency in buildings, backed by government regulations and rising energy costs, is a significant driver.

- A growing consumer preference for comfortable and aesthetically pleasing indoor environments boosts the demand for these systems.

- Rapid technological advancements, especially the integration of smart home systems and IoT devices, drive the widespread adoption of modern heating solutions.

Market Statistics

- 2024 Market Size: USD 4.23 billion

- 2034 Projected Market Size: USD 8.15 billion

- CAGR (2025-2034): 6.8%

- Europe: Largest market in 2024

AI Impact on the Market

- AI-driven systems learn user patterns, monitor real-time conditions, and adjust heating or cooling automatically by using predictive modeling.

- AI allows for highly personalized climate control by creating smart zones and adapting to individual preferences.

- Instead of waiting for a heating or cooling system to break down, AI continuously analyzes system performance data from sensors.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

For instance, according to the National Bureau of Statistics, from January to April 2021, the national real estate development investment in China was around USD 631.59 billion, with a year-on-year growth of 21.6%. Among these investments, residential infrastructure development investment was about USD 481.26 billion Yuan, a year-on-year increase.

Such investments in real estate and residential infrastructure development have led to the demand for the industry as an increasingly popular way to warm a home. In addition, a number of nations across the globe are observing extreme cold weather conditions, which boosts demand for industry solutions.

Industry Dynamics

Growth Drivers

The rise in awareness about energy-efficient cooling systems has driven the growth of the global underfloor heating market. For instance, underfloor heating is about 15-20% more energy efficient as compared with the traditional methods. Hence, such systems also help in the reduction of the overall carbon footprint of a building.

In addition, new infrastructure development investments around the developed, as well as developing countries, fuel the demand for such solutions. For instance, in March 2020, the government United Kingdom (UK) introduced a five-year plan to spend over USD 792.51 billion on infrastructure development in its Budget. On the other hand, in January 2022, China's cabinet announced to accelerate the pace of 102 major infrastructure projects that are outlined in its 2021-25 infrastructure development plan.

Moreover, government support and incentives for the implementation of underfloor heating solutions, growing environmental concerns, and the need for a high level of flexibility and comfort in residential buildings fuel the growth of the global market. Furthermore, the ongoing deployment trend of IoT-enabled underfloor heating systems in smart buildings is anticipated to create lucrative growth opportunities for the global market.

Know more about this report: Request for sample pages

Report Segmentation

The global market is primarily segmented on the basis of offering, product, installation, by application, and region.

|

By Offering |

By Product |

By Installation |

By Application |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Insight by Offering

The hardware segment dominated the global market. Hardware components in underfloor heating systems usually comprise pipes, distribution units, cables, control interfaces, and sensors. Therefore, the surge in demand for hardware components such as distribution units and pipes & cables for use in hydronic as well as electric underfloor heating systems primarily boosts the growth of this segment. In addition, the rise in home renovation projects along with the flourishing real estate sector fuels demand underfloor heating systems hardware, driving growth of the global market.

On the other hand, the service segment is anticipated to observe the highest CAGR during the forecast period due to the demand for services that assure the effective functioning of such solutions. In addition, the need for step-by-step installation support for such projects drives the segment growth.

Insight by Product

The electric underfloor heating segment is expected to witness the highest CAGR during the forecast period due to its low installation cost. This is attributed to the fact that the electric solution requires electricity for its operation and uses flexible, non-corrosive elements and a smaller number of components as compared with hydronic underfloor heating.

For instance, Comfort E is one of the leading new electrical solutions provided by Uponor UK. This solution has a low installation height (under 3mm) and can be installed in new and renovated homes. Moreover, the hydronic segment is expected to contribute the largest revenue in 2021, as such type of system is mostly preferred for a large area due to its energy efficiency and sustainable operation.

The hydronic underfloor heating technique heats the water and forces it from a boiler through a link of tubing located underneath the floor, thus, emitting radiant energy to the room or space. In addition, this type of system is suitable for applications across several floor surfaces including marble, carpet, timber, stone, slate, and nearly all varieties of tiles.

Insight by Installation

The new installations market segment is expected to witness the highest CAGR during the forecast period. This is attributed to the emergence of energy-efficiency policies in developed nations along with the supportive building regulations associated with sustainable homes. For instance, the current expansion of smart city and smart buildings projects around the nation have led to the development of residential and commercial infrastructure. This has fueled demand for the new installation of underfloor heating systems.

However, the retrofit segment is expected to witness a substantial growth rate over the study period. The growth of this segment is mainly driven by home renovation trends across the globe. Most of the end-users prefer retrofitted underfloor heating systems with their existing sub-floors without the need for excavation, enabling efficient and fast installation.

Geographic Overview

North America is is expected to witness substantial growth during the forecast period due to the factors such as the introduction of energy efficiency standards, rising standard of living, and demand for space underfloor heating due to extreme climatic conditions. In addition, the U.S. government, along with a number of states across the country, are providing tax credits for the implementation of efficient hydronic underfloor heating systems. Such government initiatives in the region drive the growth of the global market.

Europe dominated the global market in 2024. This is due to the ongoing promotion trend of electric underfloor heating systems in the region, which drives the growth of the market. For instance, EUHA in Europe promotes the adoption of highly efficient electric systems to reduce emissions. Furthermore, according to the European Commission, the installed base of Smart Building and Smart Home devices in this region will grow to over 980 million units by 2025. This growth of the smart building and smart home industry in this region is opportunistic for the growth of the market.

Competitive Insights

Some of the major players operating the market include Amuheat, Danfoss, Emerson Electric Co., Incognito Heat Co., Mitsubishi Electric, Myson, Nexans, Nvent Electric PLC, Rehau, Resideo Technologies Inc, Robert Bosch GmbH, Schneider Electric, Siemens AG, Uponor Corporation, and Warmup are the key players in the global market.

Industry Development

-

In February 2023, Danfoss introduced the Icon2 system, offering advanced and efficient control for hydronic underfloor heating, enhancing comfort, energy savings, and smart home integration.

-

In August 2022, nVent Electric plc extended its partnership with MAPEI, integrating MAPEI’s flooring solutions with nVent RAYCHEM’s electric underfloor heating systems for enhanced installation efficiency and performance.

Underfloor Heating Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 4.23 Billion |

| Market size value in 2025 | USD 4.51 Billion |

|

Revenue forecast in 2034 |

USD 8.15 Billion |

|

CAGR |

6.8% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Offering, By Product, By Installation, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Amuheat, Danfoss, Emerson Electric Co., Incognito Heat Co., Mitsubishi Electric, Myson, Nexans, Nvent Electric PLC, Rehau, Resideo Technologies Inc, Robert Bosch GmbH, Schneider Electric, Siemens AG, Uponor Corporation, and Warmup |

FAQ's

? The global market size was valued at USD 4.23 billion in 2024 and is projected to grow to USD 8.15 billion by 2034.

? The global market is projected to register a CAGR of 6.8% during the forecast period.

? Europe dominated the market share in 2024.

? The hardware segment accounted for the largest share of the market in 2024.