Unmanned Traffic Management Market Share, Size, Trends, Industry Analysis Report

By Component; By Type; By Application; By End Use (Commercial, Government and Law); By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 114

- Format: PDF

- Report ID: PM3243

- Base Year: 2023

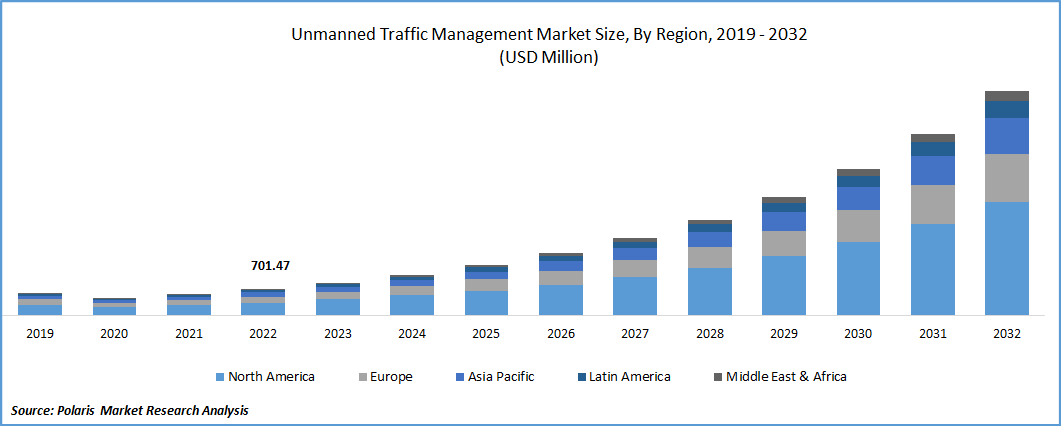

- Historical Data: 2019-2022

Report Outlook

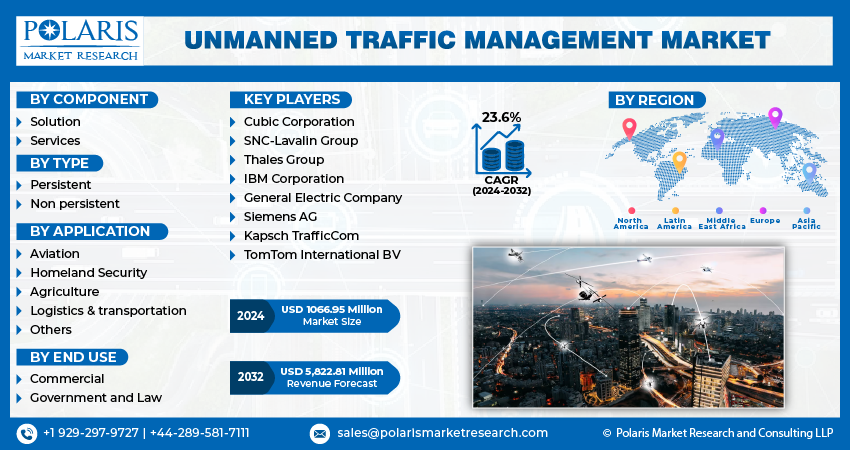

The unmanned traffic management market size was valued at USD 864.91 million in 2023 and it is expected to expand at a 23.6% compound annual growth rate (CAGR) from 2023 to 2032. The industry has expanded as a result of rising demand for real-time traffic information from drivers and passengers, as well as an increase in the number of cars on the road. Moreover, a lack of adequate infrastructure and growing government attempts for efficient traffic management continue to be important growth drivers.

Know more about this report: Request for sample pages

The rise of smart cities is one of the main factors influencing demand for traffic management systems. Transportation officials can respond to emergencies more quickly due to increased traffic efficiency. In addition, increasing the usage of public transit can help create smart cities by reducing airborne pollutants and carbon dioxide emissions. Additionally, these traffic control solutions offer real-time data for analysis and prompt emergency response. These advantages provided by ITMS would further support the unmanned traffic management market expansion throughout the course of the forecast period.

Despite the pandemic epidemic, the market is anticipated to experience tremendous growth during the remainder of 2022. Even if the demand is unlikely to completely decline, project delays and changes in certain product areas are anticipated to be unavoidable. Over the projection period, the market expands due to increased traffic effectiveness. Therefore, it is projected that the post-pandemic period will present profitable growth possibilities for the market's established players in ITMS

Also, the unmanned traffic management manufacturing factories were forced to cease operations due partially or entirely to the statewide lockdown. The COVID-19 pandemic's negative effects have caused delays in global operations and initiatives aimed at advancing unmanned traffic control.

To lessen traffic congestion, nations all around the world are working to change their infrastructure for traffic management. Also, the use of telematics services in vehicles has a big impact on safety and security. These services increase the safety of drivers, lower fuel usage, enhance driving behavior, and facilitate cost savings. The use of telematics tracking systems in automobiles allows for remote access to and activation of vehicles via radio frequency identification (RFID). The market for Traffic Management systems is predicted to increase as a result of these factors.

The development of smart cities, the introduction of adaptive Traffic Management controls, and the expansion of adaptive Traffic Management analytics are significant drivers of the deployment of traffic management systems. Mobility as a Service (MaaS) demand has also increased due to increasing traffic congestion and vehicular pollution, which is expected to fuel unmanned traffic management market expansion during the forecast period.

Governments and companies across the world are showing signs of an upbeat shift to smart transportation, which will enhance transportation networks for smart cities.

Industry Dynamics

Growth Drivers

Over the past few years, interest in drones and other unmanned aerial vehicles (UAVs) has grown across a range of businesses. Commercial applications and operating techniques are being improved by drone technologies' self-sufficiency. The media, surveying, entertainment, advertising, remote sensing, precision agriculture, cleaning up contaminated areas, real estate, building, environment monitoring, forest monitoring, and emergency management & disaster response applications are just a few of the industries that are interested in using drones.

Also, the current ATM systems that are employed to regulate the quantity of conventional airplanes rely on pricey human monitoring. The unmanned air vehicle cannot be controlled by these systems. As a result, the demand for UTM is increasing as drone deployment increases. Additionally, it is anticipated that the growing need for speedy, lightweight deliveries and the usage of drones in logistics.

Report Segmentation

The market is primarily segmented based on component, type, application, end use, and region.

|

By Component |

By Type |

By Application |

By End Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Software segment is anticipated to grow significantly over the forecast period

The segment growth is driven by increasing investments in developing advanced software solutions for air traffic planning. AirMap Inc. created programming arrangements that assist military powers with overseeing UAV traffic over touchy areas and complete strategic missions securely. Deployed soldiers can use the software's visual intelligence and real-time insights to make decisions out in the field.

Furthermore, Collins Aerospace, ANRA Technologies, and OneSky developed software platforms to schedule and deconflict drone operations. Thus, increasing demand for unmanned aerial vehicles and growing expenditure on the development of advanced UTM software are projected to show remarkable growth during the forecast period.

North America held the largest market share in 2022

The Department of Transportation (DOT) of the United States is making significant investments in the creation, application, and adoption of Traffic Management systems all over the nation. The implementation of Traffic Management systems is being pushed by the region's numerous government initiatives that place a major emphasis on enhancing transportation infrastructure.

A revolution in the area's transportation network due to improvements in communication technology and efforts to solve traffic congestion for increased transport capacity effectiveness through real-time exchange. Also, the increasing use of radio and mobile devices with short-range dedicated technology among drivers in the area is boosting the demand for ITMS solutions during the projection year.

Competitive Insight

Cubic Corporation, SNC-Lavalin Group (Atkins), Thales Group, International Business Machines Corporation, General Electric Company, Siemens AG, Kapsch TrafficCom, and TomTom International BV are some of the leading companies in the unmanned traffic management market.

Recent Developments

- In April 2022, the Indian government introduced the Onboard Driver Assistance Warning System (ODWAS). This bus signal priority system uses car-borne sensors to monitor the surroundings of the vehicle and the driver's propensity, and it generates visual notifications. Moreover, the system makes use of a radar sensor, navigational controls, and a driver aid console.

Unmanned Traffic Management Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1066.95 million |

|

Revenue forecast in 2032 |

USD 5,822.81 million |

|

CAGR |

23.6% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Component, By Type, By Application, By End Use and By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Cubic Corporation, SNC-Lavalin Group (Atkins), Thales Group, International Business Machines Corporation, General Electric Company, Siemens AG, Kapsch TrafficCom, and TomTom International BV |

FAQ's

The unmanned traffic management market report covering key segments are component, type, application, end use, and region.

Unmanned Traffic Management Market Size Worth $5,822.81 Million By 2032.

The unmanned traffic management market expected to expand at a 23.6% compound annual growth rate (CAGR) from 2023 to 2032.

North America is leading the global market.

Key driving factors in unmanned traffic management market are growing need for speedy, lightweight deliveries and the usage of drones in logistics.