UQD Coupling Market Size, Share, Trends, Industry Analysis Report

By Type (Fixed, Rigid), By Material, By Vertical, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 130

- Format: PDF

- Report ID: PM5843

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

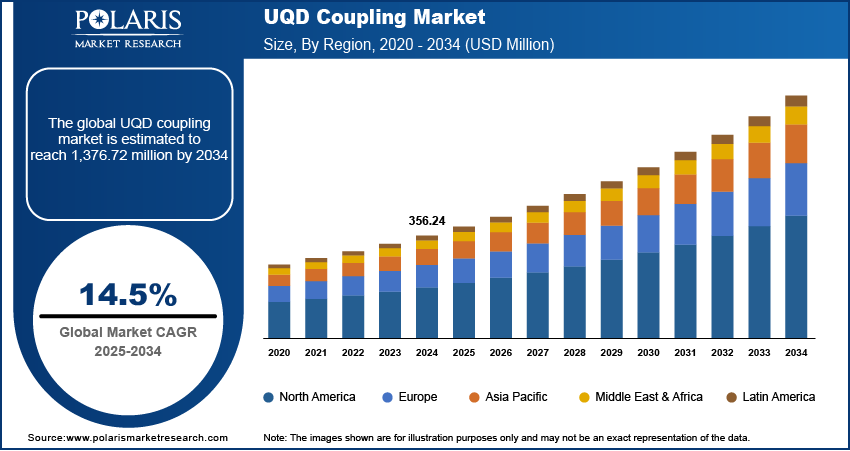

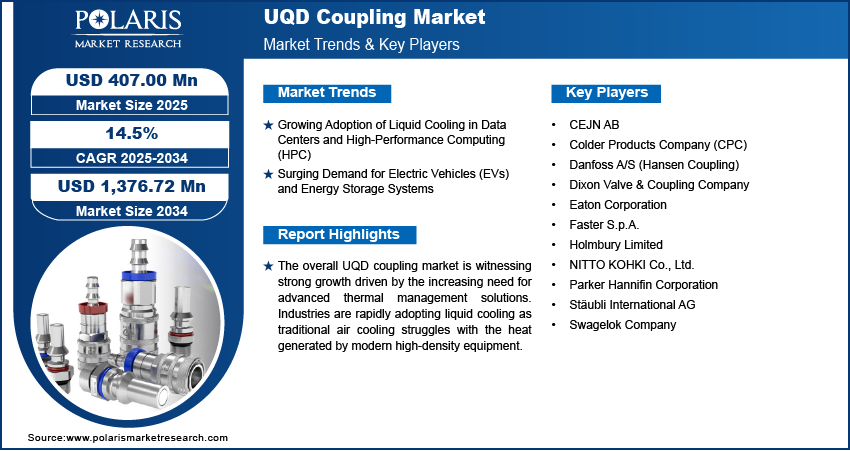

The global UQD coupling market size was valued at USD 356.24 million in 2024 and is anticipated to register a CAGR of 14.5% from 2025 to 2034. The market growth is driven by the rising demand for efficient thermal management solutions across various industries, particularly in data centers and high-performance computing.

The UQD coupling market involves specialized connectors designed for rapidly and securely linking fluid lines, especially in liquid cooling systems. These couplings minimize spillage and air inclusion during connection and disconnection, making them essential for maintaining system efficiency and preventing damage to sensitive equipment.

As electronic devices become more powerful and compact, they generate significant heat that traditional air cooling cannot handle effectively. This factor drives the shift toward liquid cooling solutions, where UQD couplings play a crucial role in ensuring reliable and leak-free fluid transfer. The growing adoption of AI and high-performance computing fuels this demand, as these systems require robust cooling to operate optimally.

The rapid expansion of data centers boosts the demand for UQD coupling. Data centers, which house vast amounts of computing and networking equipment, generate immense heat. To prevent overheating and maintain performance, liquid cooling systems are increasingly being deployed. The National Institute of Standards and Technology (NIST) highlights the importance of efficient cooling in data centers to enhance energy efficiency and reliability of IT infrastructure. UQD couplings are vital in these systems as they allow for quick and safe installation, maintenance, and upgrades of cooling lines without disrupting the entire system or risking fluid leaks.

To Understand More About this Research: Request a Free Sample Report

Industry Dynamics

Growing Adoption of Liquid Cooling in Data Centers and High-Performance Computing (HPC)

The increasing density of hardware in data centers and HPC environments is leading to a significant rise in heat generation. Traditional air-cooling methods are often insufficient to manage these higher heat loads efficiently, prompting a shift toward more effective liquid cooling solutions. UQD couplings are essential components in these liquid cooling systems, enabling quick, leak-free, and safe connections for fluid lines. This allows for easier maintenance, upgrades, and overall improved operational efficiency in critical IT infrastructure.

The need for enhanced cooling solutions in data centers is underscored by research that highlights the challenges of energy efficiency. A study titled "Data Center Energy Efficiency Investments: Qualitative Evidence from Focus Groups and Interviews," published by the U.S. Environmental Protection Agency (EPA), discusses how data centers are among the fastest-growing energy users and emphasizes the remaining opportunities to reduce energy consumption through improved efficiency. The increased need for efficient thermal management in such energy-intensive environments directly drives the demand for UQD couplings.

Surging Demand for Electric Vehicles (EVs) and Energy Storage Systems

The global push for sustainable transportation and energy solutions has led to a rapid increase in the adoption of electric vehicles and the development of large-scale energy storage systems, such as battery energy storage solutions (BESS). Effective thermal management is critical for the performance, safety, and longevity of batteries in both EVs and BESS. Liquid cooling systems are widely used to regulate battery temperatures, and UQD couplings are vital for ensuring secure and efficient fluid connections within these complex cooling circuits.

The International Energy Agency (IEA) reported in 2023 that electric car registrations reached 14 million, accounting for about 18% of all cars sold, up from 14% in 2022. This substantial increase in EV adoption necessitates advanced battery cooling systems, thereby driving the demand for UQD couplings.

Segmental Insights

Type Analysis

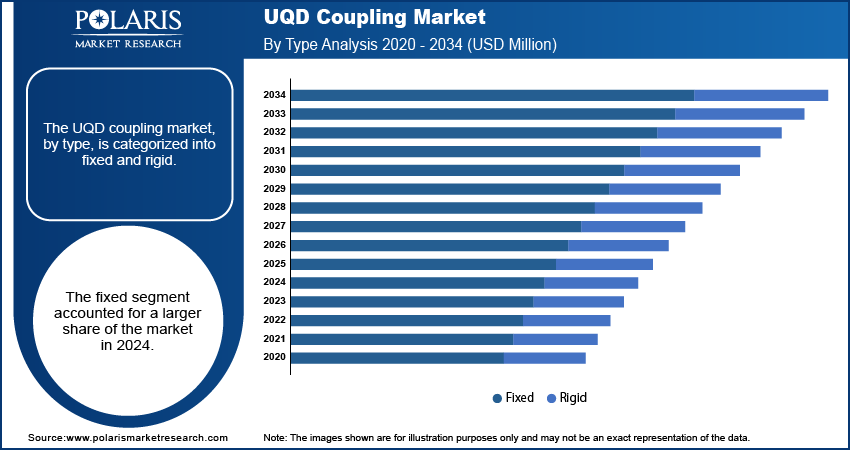

The fixed type segment held a larger share in the market in 2024, demonstrating its widespread adoption and proven reliability across various industrial applications. These couplings are fundamental for fluid and pneumatic systems where a secure, dependable connection is consistently needed, such as in general manufacturing processes and conventional hydraulic systems. Their robust design and straightforward operation have made them a standard component, providing essential functionality for operations that prioritize stability and minimal fluid loss during connection and disconnection procedures. This broad utility underpins their significant presence and continued demand in the industry.

The rigid segment is anticipated to register the highest growth rate during the forecast period, driven by evolving industry trends that demand more specialized and precise connection solutions. This category, including advanced designs such as blind-mate couplings, is increasingly vital for high-density environments such as next-generation data centers and sophisticated industrial automation systems. These applications benefit from the ability of "Rigid" couplings to offer consistent performance and alignment in hard-to-reach or complex installations, enabling greater operational efficiency and reducing downtime in advanced technological infrastructures.

Material Analysis

The metals segment, specifically encompassing steel, brass, and aluminum, held the largest share in 2024. This dominance is driven by the inherent durability, strength, and reliability of these materials, making them ideal for demanding environments such as data centers, industrial manufacturing, and automotive applications. For example, stainless steel couplings are frequently chosen for their exceptional corrosion resistance and ability to withstand high temperatures and pressures, as highlighted in a February 2024 Danfoss news release about their UQD couplings for data center rack applications.

The polymer segment is anticipated to register the highest growth rate during the forecast period. This acceleration is driven by ongoing advancements in material science, leading to the development of lightweight, corrosion-resistant, and cost-effective alternatives. These innovative materials, including carbon fiber reinforced composites, offer excellent strength-to-weight ratios and design flexibility, making them increasingly suitable for applications where weight reduction and specific performance characteristics are crucial.

Vertical Analysis

The data center segment held the largest share in 2024, due to the intense demand for efficient thermal management solutions in these environments, where increasing power density leads to significant heat generation. Liquid cooling systems, which heavily rely on UQD couplings for secure and spill-free connections, are becoming essential to maintain optimal performance and prevent equipment damage. For instance, the National Renewable Energy Laboratory (NREL) highlights in its "High-Performance Computing Data Center Warm-Water Liquid Cooling" research how liquid cooling allows for greater energy efficiency and higher rack power densities, underscoring the critical role of these couplings.

The energy storage segment is anticipated to exhibit the highest growth rate during the forecast period. The global shift toward renewable energy and sustainable transportation is fueling a surge in the deployment of large-scale battery systems, which require sophisticated thermal management to ensure safety, extend lifespan, and optimize performance. UQD couplings are crucial for the efficient circulation of coolants within these battery packs. A press release from the Press Information Bureau (PIB) of the Indian government on June 9, 2025, states that India is making a "Big Push to Battery Energy Storage" with a new Viability Gap Funding scheme for 30 GWh of BESS, indicating significant investment and expansion in this sector, thereby driving demand for UQD couplings.

Regional Overview

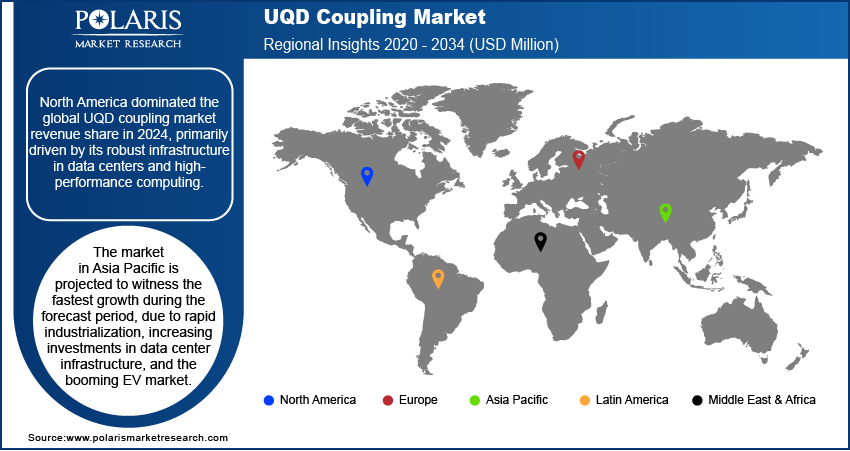

The North America UQD coupling market held the largest share in 2024, primarily driven by its robust infrastructure in data centers and high-performance computing. The region has seen substantial investments in large-scale data facilities and cloud computing platforms, which are increasingly adopting liquid cooling solutions to manage intense heat loads. This strong demand for efficient thermal management, coupled with ongoing technological advancements and a strong presence of key market players, ensures North America's dominance in the UQD coupling sector.

U.S. UQD Coupling Market Insight

In North America, the U.S. stands out as a major contributor to the market. The country's strong focus on developing advanced technologies, including artificial intelligence and machine learning, directly translates into a high demand for sophisticated cooling systems. The presence of numerous hyperscale data centers and research institutions actively engaged in advanced computing applications drives the need for reliable and high-performance UQD couplings. The widespread adoption of liquid cooling in various industries across the U.S. further solidifies its position as a significant market.

Europe UQD Coupling Market Analysis

Europe represents a substantial and growing market for UQD couplings, fueled by increasing industrial automation, a strong emphasis on energy efficiency, and the expanding electric vehicle sector. European countries are actively investing in advanced manufacturing processes and renewable energy initiatives, both of which require robust and efficient fluid transfer systems. The region's commitment to reducing energy consumption in data centers also promotes the adoption of liquid cooling, thereby driving the demand for UQD couplings. Germany, as a major economic powerhouse in Europe, plays a crucial role in the regional market. Its strong automotive industry, coupled with significant investments in research and development for new energy vehicles, creates a high demand for advanced thermal management solutions for batteries. Furthermore, the country’s rising focus on Industry 4.0 and smart manufacturing initiatives drives the need for reliable and efficient quick-disconnect solutions in automated industrial processes, contributing significantly to the Germany UQD coupling market growth.

Asia Pacific UQD Coupling Market Overview

Asia Pacific is rapidly emerging as a dynamic and fast-growing market for UQD couplings. This growth is propelled by rapid industrialization, increasing investments in data center infrastructure, and the booming electric vehicle market, particularly in countries such as China. The region's expanding manufacturing capabilities across electronics and automotive sectors also contribute to the rising demand for efficient thermal management and fluid handling systems, making UQD couplings a vital component for numerous applications.

Key Players and Competitive Insights

The UQD coupling market features a competitive landscape where established players with a long history in fluid transfer solutions compete for market share alongside specialized innovators. Competition revolves around product performance, material advancements, customization options, and the ability to meet stringent industry standards for leak-free operation and high flow rates.

A few prominent companies in the industry include Parker Hannifin Corporation, Eaton Corporation, Colder Products Company (CPC), Stäubli International AG, CEJN AB, Danfoss A/S (Hansen Coupling), Faster S.p.A., Swagelok Company, Holmbury Limited, Dixon Valve & Coupling Company, and NITTO KOHKI Co., Ltd.

Key Players

- CEJN AB

- Colder Products Company (CPC)

- Danfoss A/S (Hansen Coupling)

- Dixon Valve & Coupling Company

- Eaton Corporation

- Faster S.p.A.

- Holmbury Limited

- NITTO KOHKI Co., Ltd.

- Parker Hannifin Corporation

- Stäubli International AG

- Swagelok Company

Industry Developments

January 2025: Dixon Valve highlighted its extensive portfolio of high-quality components for thermal management, emphasizing its tailored solutions to address the unique challenges of cooling data centers.

December 2024: Dixon joined the Open Compute Project (OCP) to support its entry into the thermal management market. This collaboration aligns Dixon with a community focused on efficient designs for scalable computing infrastructure.

UQD Coupling Market Segmentation

By Type Outlook (Revenue – USD Million, 2020–2034)

- Fixed

- Rigid

By Material Outlook (Revenue – USD Million, 2020–2034)

- Metal

- Polymer

- Composite

By Vertical Outlook (Revenue – USD Million, 2020–2034)

- Data Center

- HPC

- Liquid

- IT & Electronics Cooling

- Energy Storage

- Industrial Automation

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

UQD Coupling Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 356.24 million |

|

Market Size in 2025 |

USD 407.00 million |

|

Revenue Forecast by 2034 |

USD 1,376.72 million |

|

CAGR |

14.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 356.24 million in 2024 and is projected to grow to USD 1,376.72 million by 2034.

The global market is projected to register a CAGR of 14.5% during the forecast period.

North America dominated the market share in 2024.

A few key players in the market include Parker Hannifin Corporation; Eaton Corporation; Colder Products Company (CPC); Stäubli International AG; CEJN AB; Danfoss A/S (Hansen Coupling); Faster S.p.A.; Swagelok Company; Holmbury Limited; Dixon Valve & Coupling Company; and NITTO KOHKI Co., Ltd.

The fixed segment accounted for a larger share of the market in 2024.

The data center segment is expected to witness the fastest growth during the forecast period.