U.S A2 Dairy Products Market Share, Size, Trends, Industry Analysis Report

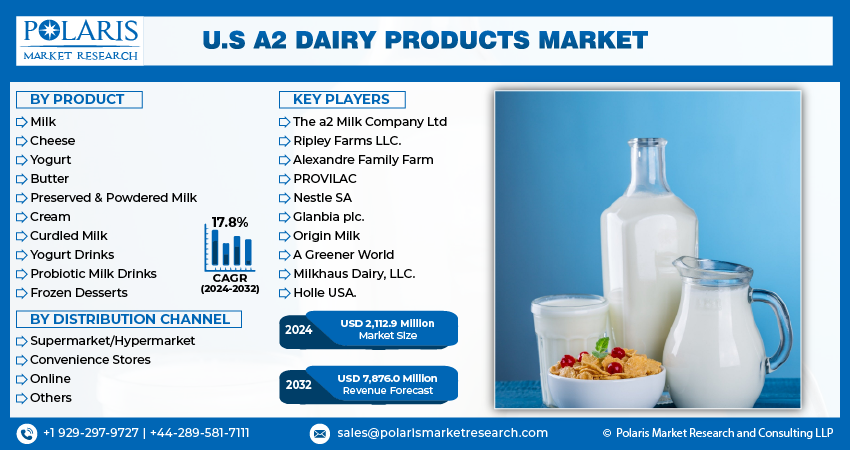

By Product (Milk, Cheese, Yogurt, Butter, Preserved & Powdered Milk, Cream, Curdled Milk, Yogurt Drinks, Probiotic Milk Drinks, Frozen Desserts); By Distribution Channel; Segment Forecast, 2024- 2032

- Published Date:Jun-2024

- Pages: 120

- Format: PDF

- Report ID: PM4968

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

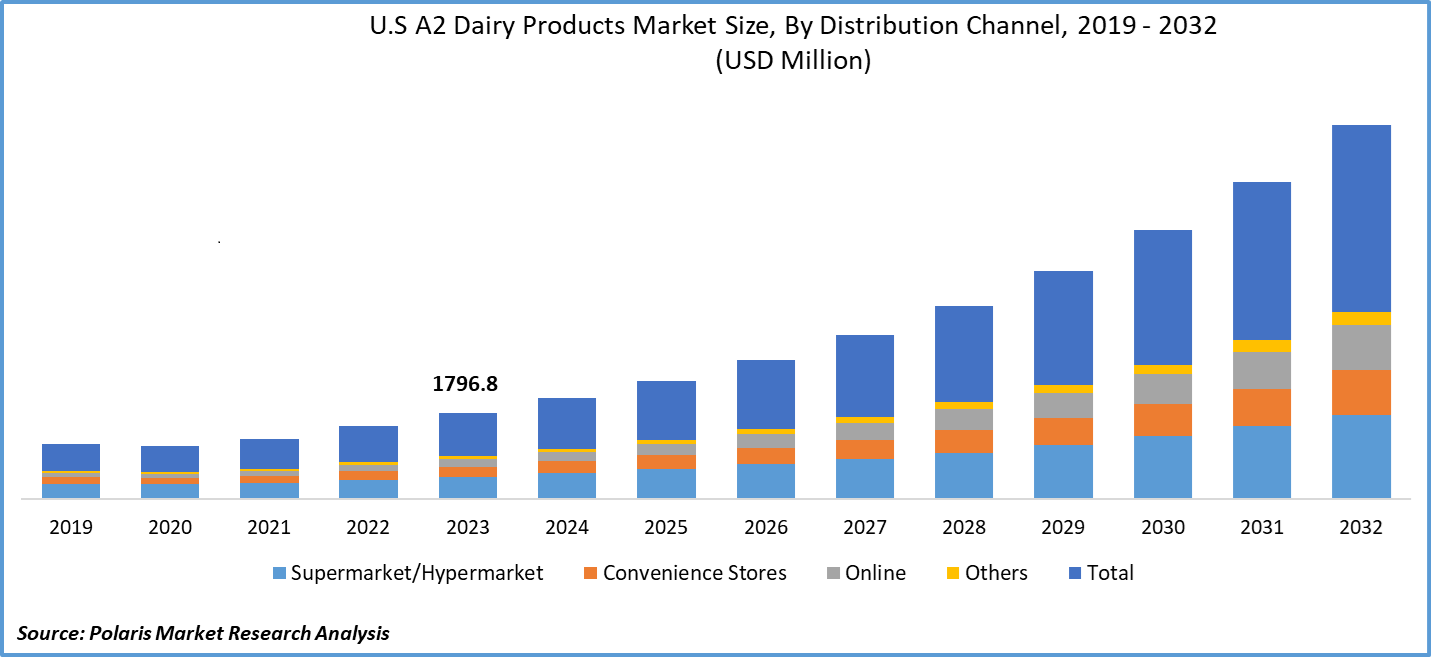

The U.S A2 Dairy Products Market size was valued at USD 1,796.8 million in 2023. The market is anticipated to grow from USD 2,112.9 million in 2024 to USD 7,876.0 million by 2032, exhibiting a CAGR of 17.8% during the forecast period.

Industry Trend

The consumption of nutritious foods is becoming increasingly popular among consumers worldwide. Dairy products, which include milk and yogurt, are among the most consumed foods in the world. A2 milk's strong nutritional value is essential for a baby's growth. A2 milk has no hormones or antibiotics and is a rich source of calcium as well as other necessary vitamins and minerals. It has been demonstrated that A1 beta-casein milk causes babies to emit more BCM-7, which has been linked to a number of stomach-related issues.

To Understand More About this Research:Request a Free Sample Report

The competitive landscape surrounding the acquisition of a2 Milk is characterized by significant strategic movements within the dairy industry, reflecting the growing demand for specialty and premium dairy products. a2 Milk, known for its unique A2 beta-casein protein, has carved out a distinct niche in the market by catering to consumers seeking digestive benefits and health-conscious options. The acquisition has attracted interest from major dairy conglomerates and investment firms aiming to diversify their product portfolios and capitalize on the increasing consumer preference for functional and differentiated dairy products. This acquisition is expected to intensify competition among leading dairy producers as they strive to enhance their market positions and expand their offerings in the premium dairy segment.

- For instance, in August 2021, the a2 Milk Company (a2MC) completed its acquisition of a 75% stake in dairy nutrition company Mataura Valley Milk (MVM). The acquisition is crucial from a strategic perspective since it offers a2MC the chance to engage in the production of nutritional products, supplier and geographic diversity, connection building with important partners in China, and supplier diversification.

The A1 and A2 proteins differ by a single amino acid, and some studies have suggested that A1 beta-casein may be more difficult to digest for some people and may lead to digestive discomfort. The A2 milk comes from cows that have been selectively bred to produce only the A2 beta-casein protein. The increasing market share of the hypermarkets/supermarkets segment has, in turn, increased the demand for purchasing products in bulk, as customers want to make fewer trips to the store and receive more value for their money. This has, in turn, increased the sales of dairy products in the U.S A2 Dairy Products Market.

Key Takeaway

- By product category, the milk segment accounted for the largest market share in 2023.

- By distribution channel category, the online segment is projected to grow at the highest CAGR during the projected period.

What are the Market Drivers Driving the Demand for the U.S A2 Dairy Products Market?

Growing Consumer Interest for A2 Dairy Products in USA

Consumer interest in A2 dairy products is on the rise in the USA for a variety of reasons. Some consumers believe that A2 milk and dairy products are easier to digest and may be a healthier alternative to traditional dairy products. Some people experience discomfort after consuming traditional dairy products due to lactose intolerance or other digestive issues. A2 dairy products are marketed as being easier to digest, and some consumers report feeling better after switching to A2 milk or yogurt. A2 milk and dairy products are marketed as being higher in certain nutrients, such as protein and calcium, then traditional dairy products. Some consumers are drawn to these potential nutritional benefits and believe that A2 dairy products are a healthier choice. Some people are allergic or sensitive to the A1 protein found in traditional dairy products. A2 dairy products may be a suitable alternative for these individuals. Companies marketing A2 dairy products have invested in advertising and educational campaigns to raise awareness of the potential benefits of A2 milk and dairy products. This has helped to generate consumer interest and increase demand. Overall, growing consumer interest in A2 dairy products in the USA can be attributed to a combination of health concerns, nutritional benefits, allergies and sensitivities, and marketing efforts.

Which Factor is Restraining the Demand for U.S A2 Dairy Products?

Higher Cost of A2 Dairy Products

The higher cost of A2 dairy products is a significant challenge facing the A2 dairy market in the USA. As mentioned earlier, cows that produce A2 milk are a specific breed, and it can be difficult and expensive to maintain a consistent supply of A2 milk. This limited supply leads to higher prices for A2 milk and dairy products. Maintaining a separate supply chain for A2 milk and dairy products requires additional production costs, such as specialized breeding, separate milking and processing facilities, and separate transportation and storage. These higher production costs are passed on to consumers in the form of higher prices. Companies producing A2 milk and dairy products must invest in marketing and education efforts to raise awareness and drive demand. These additional costs also contribute to the higher price of A2 dairy products.

A2 dairy products may be subject to additional regulatory requirements, which can increase the cost of production and lead to higher prices. While the higher cost of A2 dairy products may be a barrier for some consumers, many are willing to pay a premium for the potential health benefits and ease of digestion that A2 dairy products offer. However, in order to achieve broader adoption, it will be important for A2 dairy producers to find ways to reduce production costs and make their products more affordable for a wider range of consumers.

Report Segmentation

The U.S A2 Dairy Products market is primarily segmented based on product, and distribution channel

|

By Product |

By Distribution Channel |

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By Product Insights

Based on a product analysis, the U.S A2 Dairy Products Market is segmented into milk, cheese, yogurt, butter, preserved & powdered milk, cream, curdled milk, yogurt drinks, probiotic milk drinks, and frozen desserts. The milk segment held the largest market share in 2023. A2 milk refers to a type of milk that contains only the A2 beta-casein protein, whereas traditional milk typically contains both the A1 and A2 beta-casein proteins. The A1 and A2 proteins differ by a single amino acid, and some studies have suggested that A1 beta-casein may be more difficult to digest for some people and may lead to digestive discomfort. The A2 milk arrives from cows that have been selectively made to produce only the A2 beta-casein protein. This type of milk has gained popularity in recent years, as some people believe that it is more effortless to summarize and may be a better option for those with lactose intolerance or digestive issues related to traditional milk. The A2 milk is available in many countries around the world and is sold as a specialty product at a premium price. Some companies also use A2 milk to produce other dairy products, such as cheese and yogurt. However, the research on the potential health benefits of A2 milk still needs to be expanded and conclusive, and it is important to consult with a healthcare professional before making any changes to your diet.

By Distribution Channel Insights

Based on distribution channel analysis, the U.S A2 Dairy Products Market has been segmented on the basis of supermarkets/hypermarkets, convenience stores, online, and others. The online segment is anticipated to be the fastest-growing CAGR during the forecast period. The main reason behind the rise in sales through internet retailing is the level of convenience that it provides for consumers, as they find it easy to choose their preferred brands and also get vast varieties in flavor and product choices. The growth opportunity for the sales of dairy products through online channels has forced online vendors to improve the purchase processes in terms of security and reliability, which, in turn, has propelled the demand for these products.

Moreover, vendors are embracing online retail techniques, such as entering partnerships with different online retailers, in order to broaden their geographic reach and increase their margins. These initiatives benefit the market studied during the forecast period. The COVID-19 impact has led to an increasing number of online orders, as consumers are reluctant to visit the market physically. Presently, on-door delivery has become the major driving factor for the increased sales of dairy products, as consumers prefer to receive the parcels at their doorsteps instead of going out. However, shorter shelf-life, lower degree of internet connectivity, and lack of tech-savvy consumers are some of the reasons that may restrict the growth of the online channels segment of the market studied.

Competitive Landscape

Enterprises allocate resources to Research and Development (R&D) for diverse motives, encompassing expanded market presence, expense reductions, promotional strides, and alignment with prevailing trends. Engaging in R&D empowers a company to track or outpace market dynamics, thereby ensuring its continued relevance. The advantages of R&D are manifold, ranging from the potential for augmented productivity to the creation of fresh product offerings.

Some of the major players operating in the U.S. market include:

- The a2 Milk Company Ltd

- Ripley Farms LLC.

- Alexandre Family Farm

- PROVILAC

- Nestle SA

- Glanbia plc.

- Origin Milk

- A Greener World

- Milkhaus Dairy, LLC.

- Holle USA.

U.S A2 Dairy Products Market Recent Developments

- In August 2022, the a2 Milk Company (a2MC) broaden its array of a2 Milk offerings in Australia by introducing a lactose-free variant. This variant addressed the requirements of one in four Australians grappling with milk intolerance, whether self-diagnosed or professionally confirmed.

- In May 2022, a collaboration between the a2 Milk Company and Lincoln University birthed a novel initiative aimed at fostering sustainable dairy farming practices in New Zealand. The partnership, formed between a2 Milk Company and Lincoln University, the sole specialist institution in New Zealand focused on land-based studies, heralded the launch of The Farm Sustainability Fund.

- In August 2021, the a2 Milk Company (a2MC) had finalized the acquisition of a 75% stake in dairy nutrition firm Mataura Valley Milk (MVM). This strategic acquisition presents a2MC with opportunities to venture into nutritional product manufacturing, diversify suppliers and geographical reach, forge connections with key stakeholders in China, and broaden its supplier base.

Report Coverage

The U.S A2 Dairy Products Market report emphasizes on key country across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, and distribution channel, and their futuristic growth opportunities.

U.S A2 Dairy Products Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2,112.9 million |

|

Revenue forecast in 2032 |

USD 7,876.0 million |

|

CAGR |

17.8% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Product, and By Distribution Channel |

|

Customization |

Report customization as per your requirements with respect to countries, and segmentation. |

FAQ's

The key companies in U.S A2 Dairy Products Market The A2 Milk Company Ltd., Ripley Farms LLC

The U.S A2 Dairy Products Market exhibiting a CAGR of 17.8% during the forecast period.

U.S A2 Dairy Products Market report covering key segments are product, and distribution channel

The key driving factors in U.S A2 Dairy Products Market are Growing consumer interest for a2 dairy products in USA

U.S A2 Dairy Products Market Size Worth $ 7,876.0 Million by 2032