U.S. Aerospace Testing Market Size, Share, Trends, Industry Analysis Report

By Testing Type (Material Testing, Environmental Testing, Structural/Component Testing), By Application, By Aviation Type, By End Use – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 130

- Format: PDF

- Report ID: PM5842

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

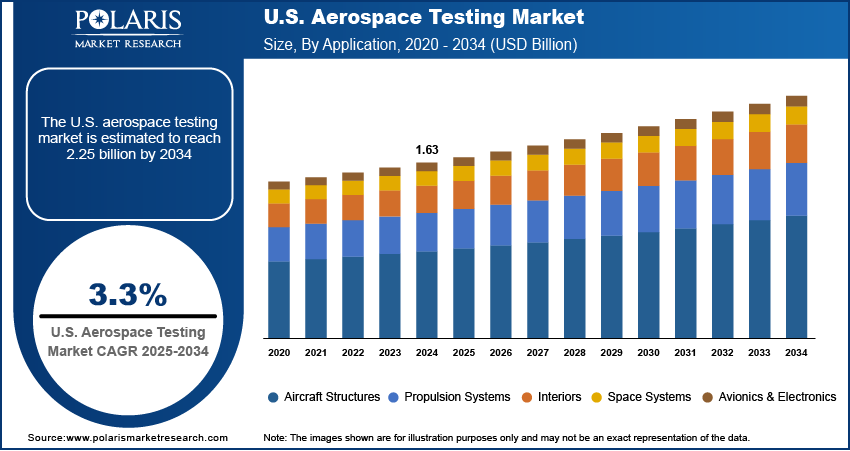

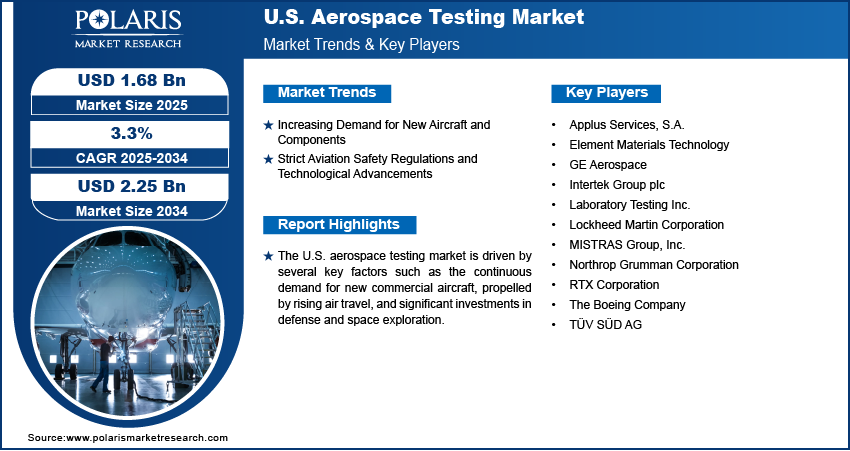

The U.S. aerospace testing market size was valued at USD 1.63 billion in 2024 and is anticipated to register a CAGR of 3.3% from 2025 to 2034. The market is largely driven by a growing demand for new aircraft and components, fueled by increasing commercial air travel and defense spending.

Key Insights

- The material testing segment held the largest market share in 2024, as testing for fatigue, tensile strength, and corrosion resistance remains essential in ensuring the performance and safety of aerospace components under extreme conditions.

- The aircraft structures segment led the market in 2024, driven by the critical need to validate airframe integrity, especially as aircraft face longer operational lifespans and are subjected to increasingly demanding environments.

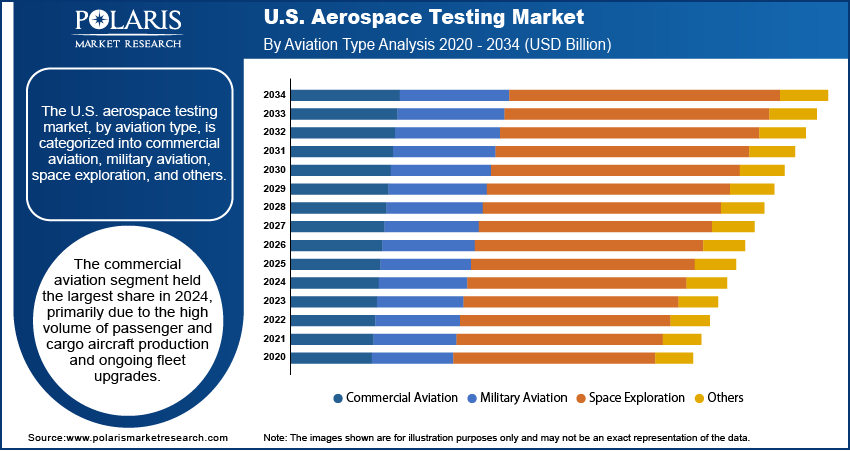

- The commercial aviation segment dominated the market in 2024, primarily due to the high output of passenger and cargo aircraft, ongoing upgrades to improve fuel efficiency, and rigorous safety testing required for FAA certification.

- The OEMs segment captured the largest share in 2024, as major aerospace manufacturers conduct extensive in-house testing during design, prototyping, and pre-certification stages to meet regulatory and customer performance benchmarks.

Industry Dynamics

- Growing demand for advanced aircraft performance and safety standards is driving the need for rigorous aerospace testing. Additionally, increasing R&D investments by aerospace OEMs to develop lighter, more durable materials and next-generation systems is fueling market growth.

- The surge in commercial aircraft production and fleet modernization initiatives across the U.S. is significantly boosting demand for structural, material, and system-level aerospace testing services.

- The high costs of advanced testing infrastructure and the complexity of compliance with evolving FAA and DoD regulations are limiting smaller players from scaling their operations.

- Technological advancements in non-destructive testing (NDT) and simulation tools offer significant growth opportunities, enabling faster and more cost-effective testing solutions for both operated and unmanned aircraft systems.

Market Statistics

- 2024 Market Size: USD 1.63 billion

- 2034 Projected Market Size: USD 2.25 billion

- CAGR (2025-2034): 3.3%

To Understand More About this Research: Request a Free Sample Report

The U.S. aerospace testing market involves the thorough evaluation of aircraft, spacecraft, and aerospace components to ensure they meet stringent standards for safety, performance, and reliability. This includes various types of tests such as structural, environmental, and material analysis, which are crucial for the development and certification of new aerospace products.

One major driver is the increasing demand for new aircraft and components, driven by a rise in commercial aircraft travel and defense spending. Another significant factor is the strict aviation safety regulations, which require detailed and rigorous testing. The ongoing progress in aerospace technology, including the development of new materials and complex systems, also significantly influences the need for advanced testing services.

As more people travel by air globally, airlines need more aircraft, both new ones and updated versions of existing models. This growing demand directly increases the need for comprehensive testing services. Every new aircraft design, along with its engines and other major components, must undergo extensive testing, including aircraft engine testing, to ensure its safety and reliability before it can be put into service. This emphasis on safety and the continuous introduction of new aircraft types create a steady demand for aerospace testing.

Industry Dynamics

Increasing Demand for New Aircraft and Components

The U.S. aerospace testing market is significantly driven by the consistent and growing demand for new aircraft and their various components. This demand stems from both the commercial aviation sector, which is expanding due to rising passenger numbers, and the defense sector, which is seeing increased investments in modernization and new technologies. As more new aircraft are designed, manufactured, and delivered, each requires extensive testing at every stage of its lifecycle, from raw materials to complete systems, to ensure performance, safety, and regulatory compliance.

The sustained growth in air travel and defense spending directly translates into a higher volume of aerospace products needing rigorous testing. According to the Bureau of Transportation Statistics (BTS), U.S. air carriers reported 83.6 billion revenue tonne-miles of cargo and freight flown within and out of the U.S. in 2024, an increase from 80.2 billion in 2023, as reported in their "U.S. Aircraft Market Size, and Growth Report, 2032". This shows the growing activity in the aviation sector, which consequently propels the need for testing services.

Strict Aviation Safety Regulations and Technological Advancements

Continuously evolving and stringent aviation safety regulations, alongside rapid technological advancements in the industry, drives the U.S. aerospace testing market expansion. The Federal Aviation Administration (FAA) and other regulatory bodies impose rigorous testing requirements to ensure the airworthiness and safety of all aerospace products. These regulations often necessitate new or more complex testing procedures as aircraft technology advances.

The introduction of innovative materials such as advanced composites and the development of more sophisticated electronic systems and autonomous functionalities demand specialized and highly accurate testing protocols. For example, the FAA regularly updates its "Aviation Handbooks & Manuals", which detail the extensive testing and certification processes required for various aircraft components and systems, reflecting the ongoing need to evaluate new technologies thoroughly. This constant evolution in both regulatory standards and aerospace technology directly fuels the demand for comprehensive and advanced aerospace testing capabilities.

Segmental Insights

Testing Type Analysis

The material testing segment held the largest share of the U.S. aerospace testing market in 2024. This is mainly due to the constant development and adoption of new, lightweight, and high-performance materials such as advanced composites and specialized alloys in aircraft and spacecraft manufacturing. These materials must undergo rigorous testing to ensure they can withstand extreme conditions, such as high temperatures, stress, and fatigue, over extended periods.

The software testing segment is anticipated to register the highest growth rate during the forecast period. This growth is driven by the increasing complexity and integration of electronic systems and advanced software in modern aircraft, including avionics, flight control systems, and unmanned aerial vehicles (UAVs). As aerospace systems become more reliant on software, ensuring its flawless operation, security, and compatibility with hardware is paramount for safety and performance.

Application Analysis

The aircraft structures segment held the largest share in 2024 due to the critical importance of airframe durability and reliability. Every new aircraft design and ongoing maintenance, repair, and overhaul (MRO) activities require extensive testing of the fuselage, wings, and other structural components. These parts are subjected to immense stress, fatigue, and varying environmental conditions throughout an aircraft's operational life. The National Aeronautics and Space Administration (NASA) emphasizes the importance of rigorous structural analysis for aircraft certification, highlighting the implementation of "Rapid Tools into a Stress Framework" that aids in quantifying safety margins for numerous load cases to demonstrate airframe safety.

The avionics and electronics segment is anticipated to record the highest growth rate during the forecast period. This surge is directly linked to the increasing complexity and integration of advanced electronic systems in modern aircraft and space vehicles. As aircraft become more digitally sophisticated, with intricate navigation, communication, flight control, and sensor systems, the demand for precise and comprehensive testing of these electronic components escalates. The Department of Defense (DoD) routinely seeks new approaches for testing the reliability of next-generation electronic aircraft, as highlighted by requirements for radiation-induced Single-Event Effects (SEE) testing for high-reliability components.

Aviation Type Analysis

The commercial aviation segment held the largest share in 2024, mainly due to the high volume of aircraft produced for passenger and cargo transport, coupled with continuous fleet modernization and the introduction of new models. Every new aircraft, engine, and system, along with routine maintenance and upgrades, necessitates extensive testing to meet stringent regulatory requirements for airworthiness and safety. For instance, the Federal Aviation Administration (FAA) continuously updates its "Airman Certification Standards," with the latest versions published in April 2024 for various pilot categories. These standards underpin the rigorous testing and training required for safe commercial operations, highlighting the ongoing need for certified and tested aircraft and components.

The space exploration segment is anticipated to exhibit the highest growth rate during the forecast period. This anticipated surge is fueled by increased government and private investments in space missions, including lunar landings, Mars expeditions, and the deployment of satellite constellations. As ambitions in space grow, the need for advanced testing of spacecraft, rockets, and payloads under simulated extreme space environments becomes paramount. NASA, for example, extensively conducts "Testing and Analysis" at facilities such as the White Sands Test Facility to evaluate materials and components for hazardous environments, including hypervelocity impact testing to simulate orbital debris impacts, as highlighted in their information updated in 2024.

End Use Analysis

The OEMs segment held the largest share of the U.S. aerospace testing market in 2024. These companies are responsible for the initial design, development, and production of new aircraft, spacecraft, and their complex systems. Their role demands extensive and meticulous testing at every phase, from raw material validation to component performance and full-scale structural integrity checks, ensuring that all products meet rigorous safety standards and performance specifications before they are delivered.

The government and space agencies segment is anticipated to record the highest growth rate during the forecast period. This growth is driven by increasing investments in advanced defense programs and ambitious space exploration initiatives. As governments expand their capabilities in areas such as satellite deployment, hypersonic flight, and crewed missions to the Moon and Mars, the demand for highly specialized testing to validate advanced technologies and ensure mission success grows rapidly.

Key Players and Competitive Insights

The U.S. aerospace testing market features a diverse competitive landscape, with a mix of large, established players and specialized firms. Competition centers on offering a broad range of testing capabilities, advanced technologies, and adherence to stringent industry regulations. Companies often strive to provide comprehensive solutions, from material analysis to full-scale system validation, to cater to the varied needs of aircraft manufacturers, defense contractors, and space agencies.

A few prominent companies in the industry include The Boeing Company; GE Aerospace; RTX Corporation (Collins Aerospace); Lockheed Martin Corporation; Northrop Grumman Corporation; Element Materials Technology; MISTRAS Group, Inc.; Intertek Group plc; Applus Services, S.A.; TÜV SÜD AG; and Laboratory Testing Inc.

Key Players

- Applus Services, S.A.

- Element Materials Technology

- GE Aerospace

- Intertek Group plc

- Laboratory Testing Inc.

- Lockheed Martin Corporation

- MISTRAS Group, Inc.

- Northrop Grumman Corporation

- RTX Corporation (which includes Collins Aerospace)

- The Boeing Company

- TÜV SÜD AG

Industry Developments

June 2025: Lockheed Martin announced a contract award from the U.S. Government to produce Generation 4 Target Acquisition Designation Sight/Pilot Night Vision Sensor (Gen 4 TADS/PNVS) systems.

U.S. Aerospace Testing Market Segmentation

By Testing Type Outlook (Revenue – USD Billion, 2020–2034)

- Material Testing

- Environmental Testing

- Structural/Component Testing

- Electromagnetic Compatibility (EMC) Testing

- Software Testing

- Others

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Aircraft Structures

- Propulsion Systems

- Interiors

- Space Systems

- Avionics & Electronics

By Aviation Type Outlook (Revenue – USD Billion, 2020–2034)

- Commercial Aviation

- Military Aviation

- Space Exploration

- Others

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- OEMs

- MROs (Maintenance, Repair & Overhaul)

- Airlines & Defense Operators

- Government & Space Agencies

- Others

U.S. Aerospace Testing Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.63 billion |

|

Market Size in 2025 |

USD 1.68 billion |

|

Revenue Forecast by 2034 |

USD 2.25 billion |

|

CAGR |

3.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 1.63 billion in 2024 and is projected to grow to USD 2.25 billion by 2034.

The market is projected to register a CAGR of 3.3% during the forecast period.

A few key players in the market include Corporation; Northrop Grumman Corporation; Element Materials Technology; MISTRAS Group, Inc.; Intertek Group plc; Applus Services, S.A.; TÜV SÜD AG; and Laboratory Testing Inc.

The material testing segment accounted for the largest share of the market in 2024.

The avionics and electronics segment is expected to witness the fastest growth during the forecast period.