U.S. Aluminum Composite Material Market Size, Share, Trends, & Industry Analysis Report

By Product Type (Fire-Resistant, Anti-Bacterial, Anti-Static), By Coating Type, By Application, By Distribution Channel, and By Country – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM6225

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

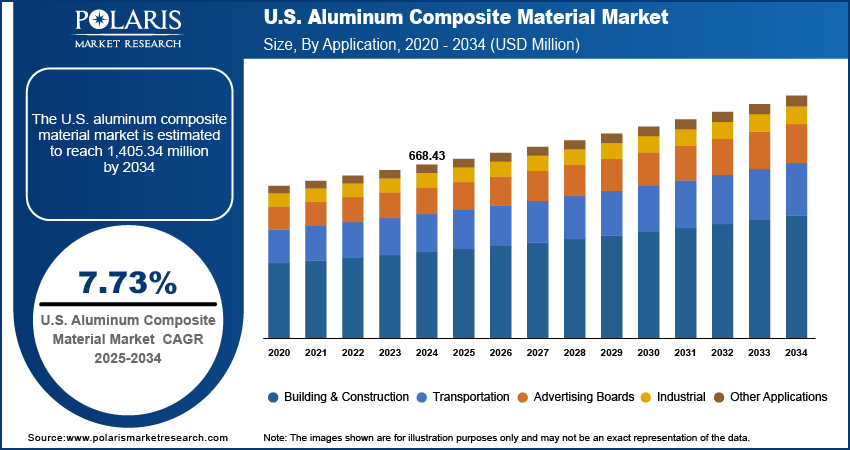

The U.S. aluminum composite material market size was valued at USD 668.43 million in 2024, growing at a CAGR of 7.73% during 2025–2034. Expansion of commercial real estate, including office complexes, retail centers and transportation hubs is driving demand for sustainable building materials that meet federal green construction goals.

Key Insights

- The polyvinylidene difluoride segment dominated the aluminum composite material market share in 2024, driven by its superior weather resistance, color retention, and durability for exterior cladding applications.

- The transportation segment is projected to grow at the fastest CAGR, fueled by increasing demand for lightweight and fuel-efficient vehicles, as well as wider adoption of aluminum composite panels in railways, metro systems, and cargo trucks.

Industry Dynamics

- Expansion of commercial real estate, including office complexes, retail centers, and transportation hubs is driving the demand for the ACM market.

- Rising demand for sustainable building materials in line with federal green construction goals fuels the market growth across the U.S.

- Growing use of eco-friendly core materials to meet green building certifications creates opportunity for ACM industry in the coming years.

- Fluctuations in aluminum prices impacting overall production costs thus restraining the growth of the ACM market.

Market Statistics

- 2024 Market Size: USD 668.43 Million

- 2034 Projected Market Size: USD 1,405.34 Million

- CAGR (2025–2034): 7.73%

Aluminum composite material in the U.S. is recognized for its durability, lightweight structure and design flexibility across residential, commercial and industrial construction. Comprising aluminum sheets bonded to a non-aluminum core, it offers high weather resistance and low maintenance, making it suitable for building facades, signage and interior applications. Manufacturers are adopting advanced coating technologies, precision cutting systems and automated fabrication lines to improve surface quality and reduce material waste. Energy-efficient production processes and recycling initiatives are implemented to meet sustainability goals and comply with environmental regulations.

Rising applications for aluminum composite material are expanding in curtain walls, cladding systems, corporate signage and interior partitions for its uniform finish and wide color range. Customized surface treatments are improving scratch resistance and fire performance, driving demand in high-traffic and safety-sensitive installations. Digital design tools, robotic platforms and integrated inventory platforms are introduced to handle complex specifications and ensure timely delivery while controlling costs.

Urban development projects in the U.S. are driving demand for aluminum composite material due to its lightweight structure, durability and ability to meet performance requirements for large-scale construction and public infrastructure. In November 2023, the U.S. government passed the Bipartisan Infrastructure Law (BIL), which provides USD 1.2 trillion for transportation, energy, and climate projects. Most of this funding is given to state and local governments. Architects and planners are incorporating ACM into building facades, transportation hubs and public spaces to achieve modern aesthetics with minimal maintenance. Growing focus on sustainable construction is driving the use of recyclable cores, energy-efficient coating systems and waste-reducing fabrication processes. Compliance with green building regulations and the need for cost-effective, long-lasting solutions are positioning ACM as a preferred choice for projects that require design versatility, structural reliability and environmental responsibility.

Drivers & Opportunities

Expansion of Commercial Real Estate Across the U.S.

The growth of commercial real estate in the U.S. is accelerating the adoption of aluminum composite material in high-visibility projects. Office complexes, shopping malls, and transport terminals require exterior cladding that combines visual appeal with long-term durability. According to the National Low Income Housing Coalition (NLIHC), the U.S. federal budget for FY2025 allocates USD 32.3 billion for housing vouchers, USD 6.2 billion for public housing operations, and USD 4.7 billion for homeless assistance programs. ACM offers a lightweight structure, ease of installation, and a wide range of design finishes, making it a preferred choice for modern architectural concepts. Its ability to maintain performance under varied environmental conditions supports its use in busy commercial zones. The material’s adaptability to different structural requirements is enabling developers to meet aesthetic, functional, and cost-efficiency goals in large-scale construction.

Rising Demand for Sustainable Building Materials to Meet Green Construction Goals

Federal initiatives promoting eco-friendly construction are driving demand for recyclable, energy-efficient materials such as aluminum composite panels. As per the U.S. EPA, green building standards such as ENERGY STAR, U.S. Green Building Council’s LEED, or Passive House encourages the use of sustainable materials such as aluminum composite panels for energy efficiency and recyclability. ACM manufacturers in the U.S. are adopting processes that reduce waste, lower energy consumption, and incorporate recyclable cores to meet sustainability targets. Government directives, including commitments to net-zero emissions and green building certifications, are influencing material selection for public and private projects. ACM’s long service life and minimal maintenance requirements further enhance its environmental value. These attributes make it suitable for projects seeking Leadership in Energy and Environmental Design (LEED) compliance and other sustainability benchmarks while maintaining high visual and structural standards.

Segmental Insights

Product Type Analysis

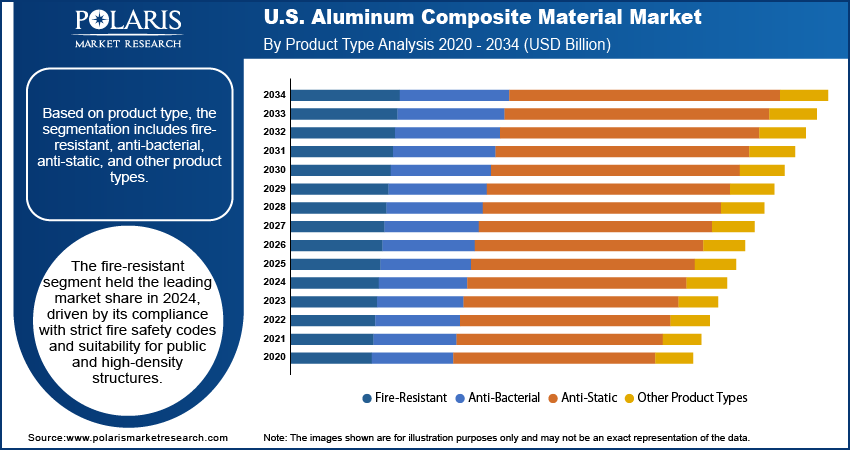

Based on product type, the segmentation includes fire-resistant, anti-bacterial, anti-static, and other product types. The fire-resistant segment dominated the market in 2024, driven by stringent U.S. building codes and safety regulations for public and commercial structures. The use of mineral-filled cores in fire-resistant ACM ensures compliance with fire performance standards, making it the preferred choice for high-rise buildings, transportation hubs, and educational facilities. Its ability to provide thermal stability without compromising design flexibility is supporting widespread adoption in urban development projects. Demand is also driven by insurance and regulatory requirements that prioritize fire-safe materials for cladding and interior partitions, ensuring long-term performance and occupant safety in high-traffic environments.

The anti-bacterial segment is projected to grow at the fastest CAGR during the forecast period, due to rising hygiene and safety requirements in healthcare, hospitality, and food service infrastructure. The integration of antimicrobial agents into ACM surfaces helps inhibit bacterial growth, making it suitable for interior wall panels, signage, and decorative applications in sensitive environments. Growth is fueled by increasing investment in healthcare facilities and commercial spaces with high hygiene standards. Technological advancements are enabling durable, washable finishes that maintain their antimicrobial properties over time, expanding the adoption of anti-bacterial ACM in both new construction and renovation projects.

Coating Type Analysis

By coating type, the segment includes polyvinylidene difluoride, polyethylene, polyester, and other coating types. The polyvinylidene difluoride segment dominated the market in 2024, driven by its superior resistance to UV radiation, weathering, and chemical exposure. PVDF-coated ACM panels maintain color stability and gloss retention over long periods, making them suitable for exterior cladding in diverse climatic conditions across the U.S.. The coating’s low maintenance requirements and ability to support a wide range of colors and textures have increasing its adoption in high-profile architectural projects. The segment’s dominance is further driven by its compliance with environmental and performance standards, which ensures its continued preference in commercial and institutional building applications.

The polyester segment is projected to grow at the fastest CAGR during the forecast period, due to its cost-effectiveness and suitability for interior and short-term exterior applications. Polyester-coated ACM offers good surface smoothness and vibrant color options, making it ideal for signage, exhibition stands, and interior decorative panels. The rising demand for budget-friendly cladding and branding solutions in retail, hospitality, and event infrastructure is contributing to market expansion. Recent improvements in polyester coating formulations are enhancing scratch resistance and durability, further supporting adoption in projects where lifecycle cost and visual impact are key considerations.

Application Analysis

Based on application, the segmentation includes building & construction, advertising boards, transportation, industrial, and other applications. The building and construction segment dominated the market in 2024, driven by the material’s versatility in curtain walls, cladding, and facade applications. ACM provides a lightweight yet durable solution that supports modern architectural designs while reducing structural load. Its ability to deliver weather resistance, thermal performance, and customizable aesthetics led to strong demand from both commercial and institutional projects. The segment’s dominance is driven by ongoing urban infrastructure investments in the U.S., where developers are selecting ACM to meet functional, aesthetic, and cost-efficiency goals in high-rise, mixed-use, and public building construction.

The transportation segment is projected to grow at the fastest CAGR during the forecast period, due to the rising adoption of ACM in bus terminals, airports, rail stations, and automotive manufacturing. The Airport Infrastructure Grant program under the Infrastructure Investment and Jobs Act provides USD 14.5 billion over five years for airport upgrades. In FY25, the FAA allocated USD 2.89 billion, bringing total funding to nearly USD 12 billion for projects across U.S. airports. ACM panels are used for vehicle bodies, interior partitions, and station cladding, offering weight reduction benefits that improve fuel efficiency. The material’s weather resistance and ease of maintenance are valuable for transport-related infrastructure exposed to heavy public use. Investments in modernizing transportation facilities and fleets are creating opportunities for lightweight, durable materials, making ACM a preferred choice in the sector’s expansion and renovation projects.

Distribution Channel Analysis

By distribution channel, this segment includes direct sales, distributors, and online sales. The direct sales segment dominated the market in 2024, driven by strong relationships between ACM manufacturers and large-scale construction contractors, architects, and developers. Direct sales enable bulk supply, tailored specifications, and faster project delivery timelines. This channel also supports collaborative design and customization, ensuring the ACM products meet exact project requirements. Large infrastructure and corporate projects rely on direct sourcing to maintain quality control and achieve cost advantages. The segment’s strength is further enhanced by its ability to provide technical support, installation guidance, and integrated logistics services for complex construction projects.

The online sales segment is projected to grow at the fastest CAGR during the forecast period, due to increasing digital procurement in the construction and signage industries. E-commerce platforms allow contractors, small-scale fabricators, and designers to access a wide range of ACM products with transparent pricing and quick delivery. The shift toward online sourcing is fueled by improved logistics networks and detailed digital catalogs that simplify product selection. Growing adoption of online ordering for smaller, customized quantities is expanding the market reach of manufacturers, making it easier to serve regional and niche customer segments.

Key Players & Competitive Analysis Report

The U.S. aluminum composite material industry is moderately competitive, driven by steady demand from building, infrastructure, transportation, and signage applications. Leading manufacturers are focusing on advanced coating technologies, precision fabrication, and strong supply networks to meet varied project requirements. Competitive positioning is influenced by investments in automated production lines, fire-retardant product development, and customized panel solutions. Companies are improving operational efficiency through robotic cutting systems, digital design integration, and optimized distribution channels. Strategic partnerships with construction firms and architects are supporting wider market reach, while sustainability-focused production processes are enhancing compliance with green building standards and regulatory requirements.

Key companies in the U.S. aluminum composite material industry include Alfrex, Inc., 3A Composites U.S.A Inc., Mitsubishi Chemical Group, Curbell Plastics, Inc., Maxmetal, Alucoil, Stacbond, East Coast Metal Systems, Fairview Architectural North America, John W. McDougall Co., Alutec, and Cope Plastics, Inc.

Key Players

- 3A Composites U.S.A Inc.

- Alfrex, Inc.

- Alucoil

- Alutec

- Cope Plastics, Inc.

- Curbell Plastics, Inc.

- East Coast Metal Systems

- Fairview Architectural North America

- John W. McDougall Co.

- Maxmetal

- Mitsubishi Chemical Group

- Stacbond

Industry Developments

March 2025: 3A Composites U.S.A rebranded its metal panel range as ALUCOLUX to align with its global brand and strengthen the ALUCOBOND PLU.S. product line. The ALUCOLUX panels are durable, recyclable, and available in various thicknesses and colors for interior and exterior use.

U.S. Aluminum Composite Material Market Segmentation

By Product Type Outlook (Revenue, USD Million, 2020–2034)

- Fire-Resistant

- Anti-Bacterial

- Anti-Static

- Other Product Types

By Coating Type Outlook (Revenue, USD Million, 2020–2034)

- Polyvinylidene Difluoride

- Polyethylene

- Polyester

- Other Coating Types

By Application Outlook (Revenue, USD Million, 2020–2034)

- Building & Construction

- Exterior Cladding

- Interior Decoration

- Roofing & Canopies

- Advertising Boards

- Transportation

- Automotive

- Railways

- Marine

- Industrial

- Machinery Enclosures

- Cleanrooms

- Other Applications

By Distribution Channel Outlook (Revenue, USD Million, 2020–2034)

- Direct Sales

- Distributors

- Online Sales

U.S. Aluminum Composite Material Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 668.43 Million |

|

Market Size in 2025 |

USD 719.00 Million |

|

Revenue Forecast by 2034 |

USD 1,405.34 Million |

|

CAGR |

7.73% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The U.S. market size was valued at USD 668.43 million in 2024 and is projected to grow to USD 1,405.34 million by 2034.

The U.S. market is projected to register a CAGR of 7.73% during the forecast period.

A few of the key players in the market are Alfrex, Inc., 3A Composites U.S.A Inc., Mitsubishi Chemical Group, Curbell Plastics, Inc., Maxmetal, Alucoil, Stacbond, East Coast Metal Systems, Fairview Architectural North America, John W. McDougall Co., Alutec, and Cope Plastics, Inc.

The fire-resistant segment dominated the market in 2024, driven by strict enforcement of fire safety regulations and the rising use of non-combustible cladding materials in high-rise buildings and public infrastructure.

The transportation segment is projected to grow at the fastest CAGR, due to increasing demand for lightweight and durable materials in electric vehicles, trains, and public transport infrastructure.