U.S. Battery Materials Market Size, Share, Trends, & Industry Analysis Report

By Type (Cathode, Anode, Electrolyte, Separator, and Others), By Battery Type, By Application– Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6347

- Base Year: 2022

- Historical Data: 2020-2023

Overview

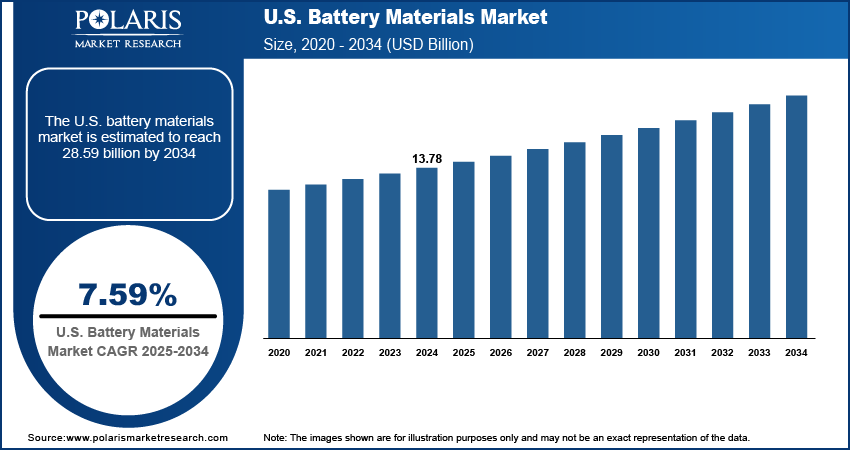

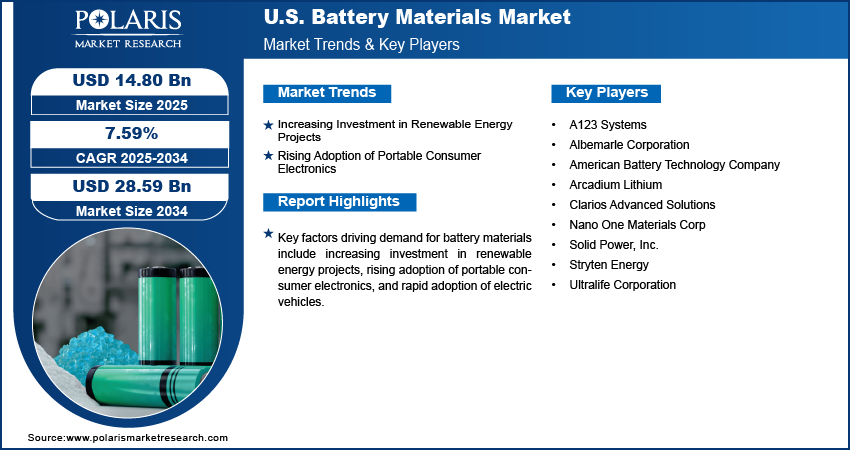

The U.S. battery materials market size was valued at USD 13.78 billion in 2024, growing at a CAGR of 7.59% from 2025 to 2034. Key factors driving demand for battery materials include increasing investment in renewable energy projects, rising adoption of portable consumer electronics, and rapid adoption of electric vehicles.

Key Insights

- The cathode segment held the largest revenue share in 2024 due to the rising EV adoption.

- The lithium ion segment dominated the revenue share in 2024 due to its superior energy density and lightweight structure.

- The electric vehicles (EVs) segment accounted for a major revenue share in 2024 due to increasing regulatory requirements for clean transportation.

Industry Dynamics

- The growing investment in renewable energy projects in the U.S. is boosting demand for battery materials, as renewable energy projects rely on large-scale batteries.

- Rising adoption of portable consumer electronics is fueling the market growth as portable consumer electronics require high-performance batteries, which in turn need specialized materials such as lithium, cobalt, nickel, graphite, and manganese.

- Growing demand for medical devices with reliable and long-lasting batteries is creating a lucrative market opportunity.

- The heavy dependence on foreign sources, especially China, for critical minerals and manufacturing expertise may hamper the market growth.

AI Impact on U.S. Battery Materials Market

- AI accelerates material discovery by predicting the performance of new battery chemistries, reducing R&D time and costs.

- Machine learning optimizes manufacturing processes, improving yield and quality in battery material production.

- Predictive maintenance powered by AI minimizes downtime in production facilities.

- AI-driven battery management systems increase lifespan and safety, boosting market competitiveness in the U.S. EV and energy storage sectors.

Market Statistics

- 2024 Market Size: USD 13.58 Billion

- 2034 Projected Market Size: USD 28.59 Billion

- CAGR (2025-2034): 7.59%

Battery materials are the chemical components and substances used in the construction of batteries to store and release electrical energy through electrochemical reactions. These include cathode materials, anode materials, electrolytes, and separators that prevent short circuits. These materials are critical for the performance, energy density, safety, and lifespan of batteries, especially in lithium-ion and emerging solid-state batteries.

In the U.S., battery materials are a growing focus due to the push for energy independence, EV adoption, and clean energy infrastructure. The U.S. is investing in the domestic sourcing and processing of key materials, such as lithium, cobalt, and graphite, as well as research into sustainable and alternative materials to reduce its reliance on foreign supply chains. Initiatives by the Department of Energy and the private sector innovation aim to strengthen the U.S. battery materials industry, supporting national security, economic competitiveness, and climate goals through advanced battery technology development and recycling programs.

The demand for battery materials in the U.S. is driven by the rapid adoption of electric vehicles (EVs). According to the International Energy Agency, in 2024, electric car sales in the United States increased by 20% compared to the previous year. This is driving automakers in the country to ramp up production, which in turn is increasing the need for key materials used in lithium-ion batteries of EVs, like lithium, cobalt, nickel, and graphite. Additionally, advancements in battery technology of EVs are further intensifying the demand for high-quality, high-performance materials. Therefore, the rapid adoption of electric vehicles (EVs) in the U.S. is driving the demand for battery materials.

Drivers & Opportunities/Trends

Increasing Investment in Renewable Energy Projects: The growing investment in renewable energy projects in the U.S. is boosting demand for battery materials as renewable energy projects rely on large-scale batteries to manage the intermittent nature of wind and solar power. The Infrastructure Investment and Jobs Act (IIJA) of 2021 allocated approximately USD 550 billion for clean energy and infrastructure in the U.S. Additionally, the push for microgrids and off-grid solutions in remote areas of the country is further intensifying the need for reliable, long-lasting batteries, thereby accelerating the competition for battery materials.

Rising Adoption of Portable Consumer Electronics: Portable consumer electronics require high-performance batteries, which in turn need specialized materials such as lithium, cobalt, nickel, graphite, and manganese. The push for lightweight and energy-dense batteries in consumer electronics such as smartphones and smartwatches is further accelerating research and investment in new battery chemistries and materials. Additionally, the growing trend of replacing devices frequently to access the latest technology sustains a continuous cycle of production and consumption, keeping the demand for battery materials consistently high.

Segmental Insights

Type Analysis

Based on type, the segmentation includes cathode, anode, electrolyte, separator, and others. The cathode segment held the largest revenue share in 2024 due to the rising number of federal initiatives promoting EV adoption and renewable energy storage. Manufacturers prioritized cathode solutions to meet the surging demand for electric vehicles (EVs) and energy storage systems. Automakers increased their reliance on advanced lithium nickel manganese cobalt oxide (NMC) and lithium iron phosphate (LFP) cathodes to balance performance, cost, and safety. Additionally, major producers expanded domestic cathode production capacity to reduce dependence on imports, which further strengthened the dominance of the segment.

The electrolyte segment is projected to grow at a robust pace in the coming years, owing to the supportive government funding for innovative energy storage technologies and partnerships between material developers and automotive OEMs. Growing interest in solid-state and advanced liquid electrolytes drives research and commercialization, particularly as safety concerns surrounding thermal runaway incidents intensify. Companies are also investing heavily in next-generation electrolyte formulations to improve fast-charging capabilities, a critical requirement for EV expansion.

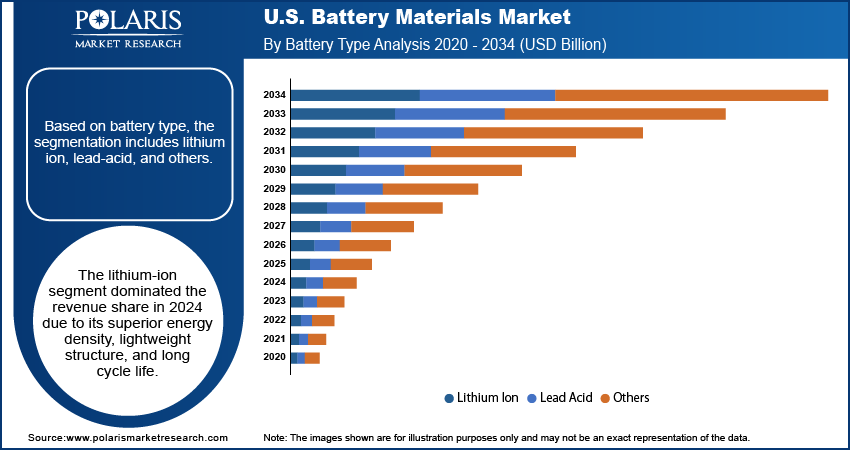

Battery Type Analysis

Based on battery type, the segmentation includes lithium ion, lead-acid, and others. The lithium ion segment dominated the revenue share in 2024 due to its superior energy density, lightweight structure, and long cycle life. The rapid expansion of electric vehicle production created strong demand for lithium-ion materials, particularly as federal tax incentives and investments in charging infrastructure encouraged consumer adoption. Energy storage projects supporting renewable integration also accelerated the need for lithium-ion solutions, as utilities sought reliable systems to stabilize the grid.

Application Analysis

In terms of application, the segmentation includes electric vehicles (EVs), consumer electronics, energy storage systems, and others. The electric vehicles (EVs) segment accounted for a major revenue share in 2024 due to rising regulatory requirements for clean transportation. Federal tax credits, stricter emissions standards, and large-scale investments in charging infrastructure encouraged both manufacturers and consumers to adopt EVs. Automakers also invested heavily in advanced battery chemistries, particularly high-nickel cathodes and LFP materials, to balance cost, performance, and safety. Strong consumer interest in sustainable mobility, combined with the launch of new EV models across multiple price segments, further strengthened the dominance of the segment.

The energy storage systems segment is expected to grow at a rapid pace in the coming years, owing to the growing integration of renewable energy sources such as solar and wind into the national grid. Utilities and commercial operators increasingly deploy large-scale battery storage to stabilize supply and ensure grid reliability during peak hours. Government funding programs and clean energy targets are further accelerating energy storage systems adoption by reducing project costs and incentivizing advanced storage technologies.

Key Players & Competitive Analysis Report

The U.S. battery materials market features a dynamic competitive landscape driven by innovation in lithium-ion and next-generation battery technologies. Key players such as Albemarle Corporation and Arcadium Lithium dominate the lithium supply segment, leveraging extensive extraction and refining capabilities. A123 Systems and Ultralife Corporation focus on advanced electrode materials and specialized battery solutions for defense and industrial applications. Emerging players such as American Battery Technology Company and Nano One Materials Corp are advancing sustainable extraction and high-performance cathode materials, respectively. Solid Power, Inc. is pioneering solid-state battery technology, positioning itself as a disruptor. Clarios Advanced Solutions and Stryten Energy contribute with lead-acid and hybrid battery systems for backup and motive power. Increasing demand for electric vehicles and energy storage is intensifying competition, prompting strategic partnerships, vertical integration, and R&D investments to secure market share and drive material efficiency, performance, and sustainability across the value chain.

Major companies operating in the U.S. battery materials industry include A123 Systems; Albemarle Corporation; American Battery Technology Company; Arcadium Lithium; Clarios Advanced Solutions; Nano One Materials Corp; Solid Power, Inc.; Stryten Energy; and Ultralife Corporation.

Key Companies

- A123 Systems

- Albemarle Corporation

- American Battery Technology Company

- Arcadium Lithium

- BASF SE

- Clarios Advanced Solutions

- Nano One Materials Corp

- Solid Power, Inc.

- Stryten Energy

- Ultralife Corporation

Industry Developments

December 2024, Nano One, a green technology company, announced the allowance and/or issuance of 7 new patents for manufacturing batteries with active materials, bringing its 2024 total patents to 11.

August 2024, Arcadium Lithium acquires Li-Metal's lithium metal business to enhance production capabilities and meet demand for next-generation battery materials.

U.S. Battery Materials Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Cathode

- Anode

- Electrolyte

- Separator

- Others

By Battery Type Outlook (Revenue, USD Billion, 2020–2034)

- Lithium Ion

- Lead Acid

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Electric Vehicles (EVs)

- Consumer Electronics

- Energy Storage Systems

- Others

U.S. Battery Materials Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 13.78 Billion |

|

Market Size in 2025 |

USD 14.80 Billion |

|

Revenue Forecast by 2034 |

USD 28.59 Billion |

|

CAGR |

7.59% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 13.78 billion in 2024 and is projected to grow to USD 28.59 billion by 2034.

The market is projected to register a CAGR of 7.59% during the forecast period.

A few of the key players in the market are A123 Systems; Albemarle Corporation; American Battery Technology Company; Arcadium Lithium; Clarios Advanced Solutions; Nano One Materials Corp; Solid Power, Inc.; Stryten Energy; and Ultralife Corporation.

The lithium ion segment dominated the market revenue share in 2024.

The energy storage systems segment is projected to witness the fastest growth during the forecast period.