U.S. Blank Apparel Market Size, Share, Trends, Industry Analysis Report

By Type (T-shirts & Tanks, Hoodies/Sweatshirts, Bottoms, Shirts, Others), By Distribution Channel – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 123

- Format: PDF

- Report ID: PM6335

- Base Year: 2024

- Historical Data: 2020-2023

Overview

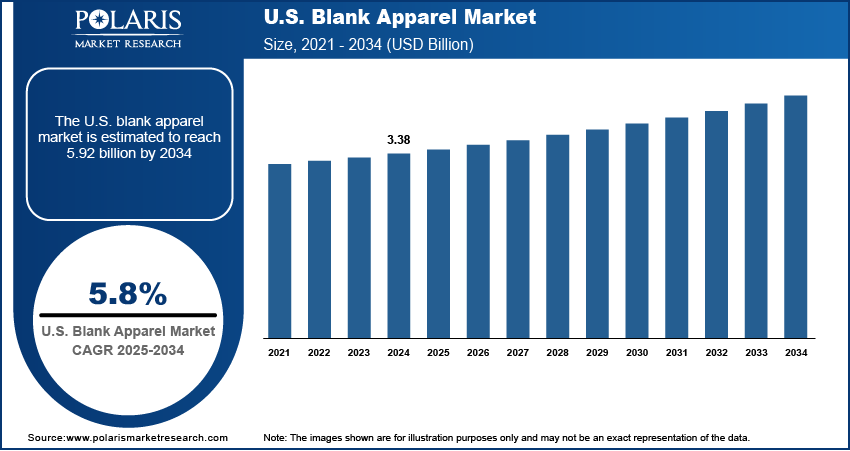

The U.S. blank apparel market size was valued at USD 3.38 billion in 2024, growing at a CAGR of 5.8% from 2025 to 2034. Key factors driving demand for blank apparel in the U.S. include increasing disposable income, expanding e-commerce sector, and the growing urbanization.

Key Insights

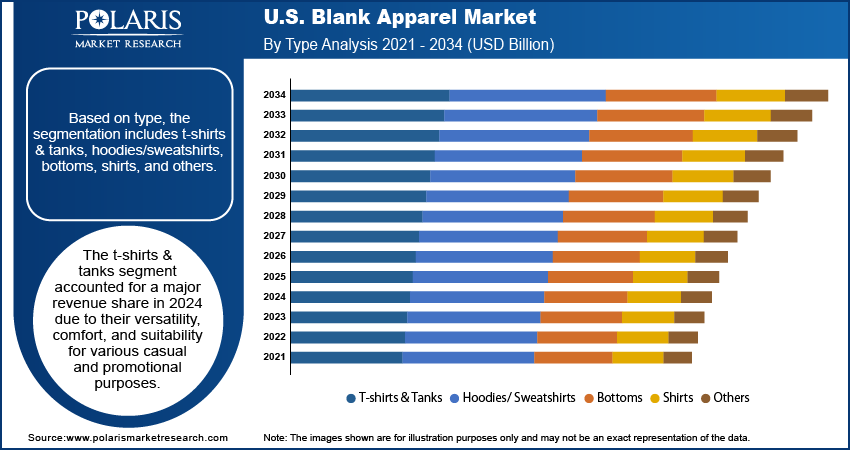

- The t-shirts & tanks segment accounted for a major revenue share in 2024 due to their suitability for various casual and promotional purposes.

- The B2C segment is expected to grow at a rapid pace during the forecast period owing to the rising consumer interest in customized fashion.

Industry Dynamics

- The increasing disposable income is fueling the adoption of blank apparel in the U.S. by driving people to invest in hobbies such as screen printing, embroidery, or tie-dye, purchasing blank t-shirts as their base materials.

- The growing urbanization is driving the U.S. blank apparel market growth by creating densely populated hubs where fashion trends spread quickly, and consumers seek versatile, affordable clothing options.

- The expanding corporate and promotional events in the U.S. are projected to create a lucrative market opportunity during the forecast period.

- High competition from international and domestic players is projected to hamper the demand for U.S blank apparel significantly.

Artificial Intelligence (AI) in the U.S. Blank Apparel Market

- AI analyzes trends to optimize inventory and reduce waste.

- Algorithms generate custom patterns, catering to niche markets.

- AI-driven machines streamline production, cutting costs and time.

- AI helps in identifying eco-friendly materials and processes, appealing to conscious consumers

Market Statistics

- 2024 Market Size: USD 3.38 Billion

- 2034 Projected Market Size: USD 5.92 Billion

- CAGR (2025–2034): 5.8%

Blank apparel refers to clothing items that are unbranded and free of designs. These garments allow businesses, designers, and individuals to add their prints, embroidery, or branding. Common types of blank apparel include plain t-shirts, hoodies, polo shirts, and sweatshirts, typically made from materials such as cotton, polyester, or blends. Blank apparel is popular among screen printers, promotional product companies, and fashion startups due to its versatility and cost-effectiveness. It is available in various colors, sizes, and styles to suit different needs.

The U.S. blank apparel industry refers to undecorated clothing manufactured in the country, often prioritizing quality and ethical production. These garments are favored by businesses and designers seeking domestically sourced, customizable apparel. Popular US-made blank brands include American Apparel, Bella+Canvas, and Los Angeles Apparel, known for their durable fabrics and sustainable practices. Choosing US-blank apparel supports local economies and reduces shipping delays, making it ideal for small batches, quick orders, and brands emphasizing "Made in the USA".

The U.S. blank apparel market demand is driven by the expanding e-commerce sector. According to the U.S. Census Bureau, in the first quarter of 2025, e-commerce sales increased by 5.6% from the first quarter of 2024. This allowed businesses, startups, and individuals in the country to easily source high-quality blank garments from global suppliers at competitive prices. Additionally, ecommerce streamlines bulk ordering for schools, sports teams, and corporate clients, who use blank uniforms and promotional wear. The convenience of online marketplaces, fast shipping, and seamless design tools is further encouraging more consumers and businesses to choose custom apparel, sustaining steady demand for blank garments. Therefore, the rising e-commerce sector is fueling the U.S. blank apparel market growth.

Drivers & Opportunities

Increasing Disposable Income: Increasing disposable income in the U.S. is driving people to invest in hobbies such as screen printing, embroidery, or tie-dye, purchasing blank t-shirts, hoodies, and sweatshirts as their base materials. For instance, Bureau of Economic Analysis, in its report, stated that disposable personal income in the U.S. increased by 0.6% in April 2025 from March 2025. Additionally, higher disposable income is allowing consumers to prioritize quality over quantity, leading them to choose durable, well-made blanks from reputable brands rather than cheap, low-quality alternatives. Increasing disposable income is also fueling the growth of small businesses and startups that rely on blank apparel for printing their designs, as entrepreneurs with more financial flexibility invest in inventory to meet rising customer demand. Therefore, as disposable incomes rise, even niche markets, such as eco-conscious buyers seeking sustainable basics or fitness enthusiasts opting for performance-ready blank apparel, contribute to increasing sales.

Growing Urbanization: Growing urbanization in the U.S. is driving the demand for blank apparel by creating densely populated hubs where fashion trends spread quickly, and consumers seek versatile, affordable clothing options. People in urban areas are adopting fast-paced lifestyles that prioritize convenience, leading them to favor blank apparel, which serves as simple yet adaptable clothing for work, casual wear, or customization. Urban environments also built a culture of self-expression, where young professionals, students, and creatives are using blank t-shirts, hoodies, and sweatshirts as canvases for DIY projects, branding, or streetwear styling. The rise of gig economies and startup cultures in cities is further driving demand, as small businesses and freelancers order blank apparel for merchandise, uniforms, or promotional events. The density of urban populations is also supporting the growth of print-on-demand businesses, which rely on blank apparel to fulfill customized orders quickly. Hence, urbanization is accelerating the demand for blank apparel by enabling easy access and encouraging a culture of customization, affordability, and versatility in fashion.

Segmental Insights

Type Analysis

Based on type, the segmentation includes t-shirts & tanks, hoodies/ sweatshirts, bottoms, shirts, and others. The t-shirts & tanks segment accounted for a major revenue share in 2024 due to their versatility, comfort, and suitability for various casual and promotional purposes. Consumers preferred these products due to their affordability, wide availability, and adaptability for printing and customization, which made them a popular choice among businesses, event organizers, and fashion brands. The growth of athleisure and casualwear trends further fueled demand, as people increasingly opted for breathable and lightweight clothing for everyday wear. E-commerce platforms and on-demand printing services also contributed to t-shirt sales by offering quick turnaround times and a wide range of design options.

The hoodies/sweatshirts segment is expected to grow at a rapid pace in the coming years, owing to the rising demand for comfortable and seasonally adaptable apparel. Consumers are increasingly valuing layering pieces that provide warmth while maintaining style, making hoodies and sweatshirts ideal for both casual and athleisure wear. Streetwear culture, celebrity endorsements, and the growing influence of social media have also boosted the appeal of these garments, particularly among younger demographics. Additionally, the adoption of sustainable fabrics and premium blends in hoodie and sweatshirt production has attracted environmentally conscious buyers, further strengthening the segment’s growth.

Distribution Channel Analysis

In terms of distribution channel, the segmentation includes B2B and B2C. The B2C segment is expected to grow at a rapid pace during the forecast period, owing to the rising consumer interest in customized fashion, direct purchasing convenience, and fast delivery options. E-commerce platforms and brand-owned online stores are also making it easier for individuals to order small quantities without the need for bulk commitments, while on-demand printing services allow for quick customization. Additionally, the shift toward sustainable and ethically produced apparel has encouraged consumers to purchase high-quality blanks for longer-term use, boosting repeat purchases. The rise of home-based small businesses selling customized garments through online marketplaces is expected to accelerate the demand in the segment further.

Key Players & Competitive Analysis

The U.S. blank apparel market is highly competitive, with key players such as Spectra USA, Los Angeles Apparel Inc., Gildan, and Fruit of the Loom dominating due to their extensive production capabilities and strong distribution networks. These companies leverage economies of scale to offer cost-effective products, making them preferred suppliers for wholesalers and decorators. Emerging brands such as Next Level Apparel compete by focusing on premium, fashion-forward basics with sustainable materials, appealing to eco-conscious consumers. Private-label brands from retailers such as Amazon Essentials and Walmart’s George also intensify competition with budget-friendly options. The market is further fragmented by regional manufacturers and import-driven distributors, creating price pressures. Innovation in fabric technology, sustainability, and customization capabilities are critical differentiators in this market.

A few major companies operating in the U.S. blank apparel industry include Spectra USA; Los Angeles Apparel Inc.; LANE SEVEN APPAREL; Independent Trading Company; Soffe; Vertical Knits, S.A. de C.V.; House of Blanks; Next Level Apparel; AS Colour; and SiATEX.

Key Companies

- AS Colour

- House of Blanks

- Independent Trading Company

- LANE SEVEN APPAREL

- Los Angeles Apparel Inc.

- Next Level Apparel

- SiATEX

- Soffe

- Vertical Knits S.A. de C.V.

- Spectra USA

U.S. Blank Apparel Industry Developments

In May 2025, Lane Seven Apparel launched two new colors, Sandshell and Sports Green for its LS14001YH Premium Youth Pullover Hoodie. Crafted from 3-End fleece, the hoodie was designed to endure seasonal wear and tear.

In January 2023, Next Level Apparel expanded internationally by acquiring Stedman. The move strengthened its presence and product portfolio, while enabling Stedman to enter the U.S. market under shared ownership with Blue Point Capital Partners' backing.

U.S. Blank Apparel Market Segmentation

By Type Outlook (Revenue, USD Billion, 2021–2034)

- T-shirts & Tanks

- Hoodies/Sweatshirts

- Bottoms

- Shirts

- Others

By Distribution Channel Outlook (Revenue, USD Billion, 2021–2034)

- B2B

- B2C

- Online

- Offline

U.S. Blank Apparel Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.38 Billion |

|

Market Size in 2025 |

USD 3.57 Billion |

|

Revenue Forecast by 2034 |

USD 5.92 Billion |

|

CAGR |

5.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 3.38 billion in 2024 and is projected to grow to USD 5.92 billion by 2034.

The market is projected to register a CAGR of 5.8% during the forecast period.

A few of the key players in the market are Spectra USA; Los Angeles Apparel Inc.; LANE SEVEN APPAREL; Independent Trading Company; Soffe; Vertical Knits, S.A. de C.V.; House of Blanks; Next Level Apparel; AS Colour; and SiATEX.

The t-shirts & tanks segment dominated the market share in 2024.

The B2C segment is expected to witness the fastest growth during the forecast period.