U.S. Building Envelope Market Size, Share, Trends, Industry Analysis Report

By Product (Walls & Cladding Systems, Roofs, Windows & Doors, Others), By End Use – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 124

- Format: PDF

- Report ID: PM6401

- Base Year: 2024

- Historical Data: 2020-2023

Overview

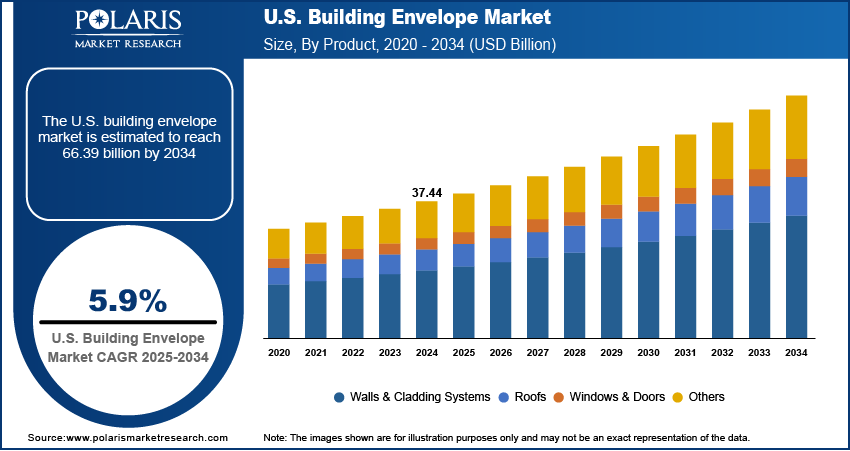

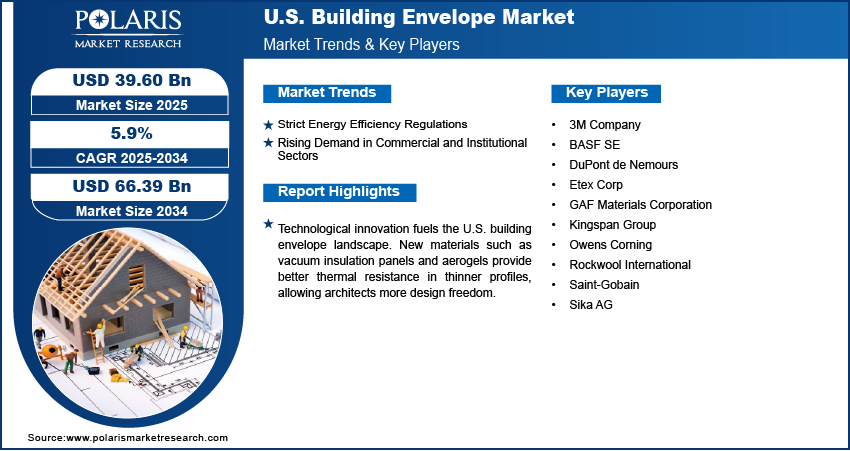

The U.S. building envelope market size was valued at USD 37.44 billion in 2024, growing at a CAGR of 5.9% from 2025 to 2034. The market growth is driven by strict energy efficiency regulations, rising demand in commercial and institutional sectors, and technological advancements in the materials that are making envelope more efficient.

Key Insights

- In 2024, the walls and cladding systems segment led the market, supported by their critical role in enhancing energy efficiency, thermal insulation, and moisture control in buildings.

- The roofing segment recorded notable growth in 2024, fueled by rising investments in energy-efficient infrastructure and the need for weather-resistant construction solutions.

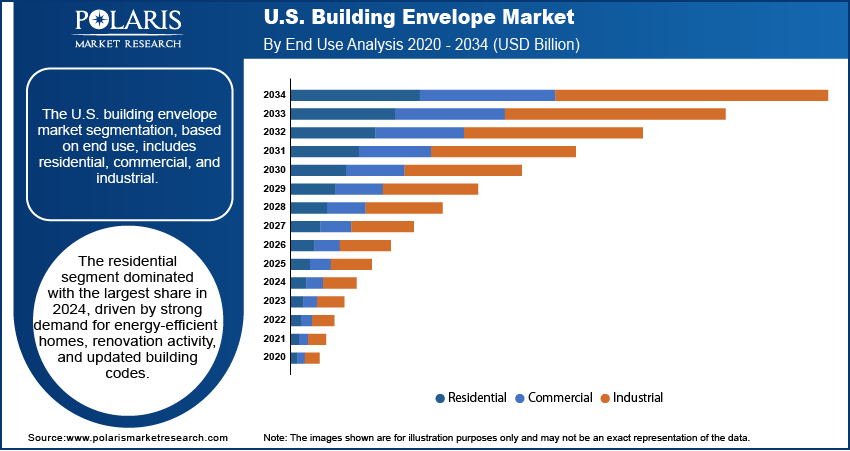

- The residential segment held the largest share in 2024, driven by growing demand for energy-saving homes, increased renovation activity, and the enforcement of updated building codes.

- The commercial segment is projected to witness strong growth, supported by continued expansion in office spaces, healthcare facilities, educational institutions, and retail developments.

Industry Dynamics

- Strict energy efficiency regulations drive the demand for building envelopes.

- Rising demand in commercial and institutional sectors is fueling the industry growth.

- Technological innovation fuels the U.S. building envelope landscape.

- High initial costs of advanced building envelope systems are restraining the adoption of building envelopes.

Market Statistics

- 2024 Market Size: USD 37.44 billion

- 2034 Projected Market Size: USD 66.39 billion

- CAGR (2025–2034): 5.9%

AI Impact on U.S. Building Envelope Market

- AI improve energy efficiency by optimizing building envelope design through advanced simulations that reduce thermal loss and improve insulation performance.

- AI-powered sensors enable real-time monitoring, detecting air leaks and moisture intrusion early, which helps prevent costly damage and improves building durability.

- AI supports predictive maintenance, allowing building owners to proactively manage repairs and extend the lifespan of envelope materials, reducing long-term costs.

- However, high implementation costs and lack of AI integration expertise in the construction sector hinder widespread adoption of AI in building envelope systems.

The building envelope is the outer shell of a building that separates the interior from the external environment. It includes elements such as walls, roofs, windows, doors, and insulation that control air, moisture, heat, and light flow. Its main role is to provide structural support, energy efficiency, and protection from the weather.

There is increasing awareness in the U.S. about sustainability and environmental impact. Programs such as LEED certification encourage the use of environmentally friendly building envelope materials that reduce energy consumption and improve indoor air quality. Green building practices have become a significant driver, with architects and contractors choosing eco-friendly insulation, high-performance windows, and air barriers. This focus on sustainable construction supports the adoption of innovative envelope solutions that contribute to healthier living spaces and compliance with voluntary and mandatory environmental standards, further driving the growth.

Technological innovation fuels the U.S. building envelope market expansion. New materials such as vacuum insulation panels and aerogels provide better thermal resistance in thinner profiles, allowing architects more design freedom. Smart building envelopes equipped with sensors adapt to changing weather conditions, optimizing energy use and comfort. Coatings that reflect solar radiation reduce cooling loads, while durable, moisture-resistant membranes improve building longevity. These advancements help meet increasingly stringent energy codes and consumer expectations. Manufacturers invest heavily in research and development to bring innovative, cost-effective products to market, driving competition and improving building performance.

Drivers & Opportunities

Strict Energy Efficiency Regulations: Strict energy codes in the U.S. such as the International Energy Conservation Code (IECC) and ASHRAE standards require buildings to meet higher energy efficiency levels. These regulations push builders and developers to use better insulation, airtight membranes, and high-performance windows to reduce energy waste. Compliance with these codes is essential to receive construction permits and meet federal and state sustainability goals. This has increased the demand for advanced building envelope products that improve thermal performance and reduce heating and cooling costs. Efficient envelopes become more important for reducing operational expenses and environmental impact as energy prices fluctuate, thereby driving its adoption.

Rising Demand in Commercial and Institutional Sectors: The commercial and institutional building sectors are rapidly growing in the U.S., driving demand for high-performance building envelopes. Offices, schools, hospitals, retail centers, and government buildings require systems that combine energy efficiency, durability, and aesthetic appeal. These sectors adopt the latest green building standards, focusing on occupant comfort, operational cost savings, and long-term sustainability. Large-scale development projects and renovations, especially in urban areas, boost demand for advanced façades, curtain walls, and glazing systems. This trend encourages manufacturers and contractors to supply customized solutions suited to commercial and institutional needs, thereby fueling the industry revenue.

Segmental Insights

Product Analysis

The U.S. building envelope market segmentation, based on product, includes walls & cladding systems, roofs, windows & doors, and others. In 2024, the walls & cladding systems segment dominated with the largest share due to their essential role in improving energy efficiency, thermal performance, and moisture protection. These systems are critical for meeting national and state-level energy codes, especially in states with extreme seasonal weather. Additionally, increasing demand for durable, fire-resistant, and low-maintenance materials in both new construction and retrofits is driving their widespread adoption. Builders further favor innovative cladding options for aesthetic flexibility and compliance with green building certifications, thereby driving the segment growth.

The roofs segment accounted for significant growth due to increasing investments in energy-efficient buildings and weather-resilient construction. The demand has surged for insulated, reflective, and impact-resistant roofing systems with energy costs rising and extreme weather events becoming more common. These roofs help reduce heat gain, lower air conditioning usage, and improve indoor comfort, which are major priorities in energy-conscious commercial and residential construction. Furthermore, government incentives for cool roofs and renewable energy installations, such as solar panels, have increased interest in high-performance roofing materials that integrate with smart energy systems, fueling growth in the segment.

End Use Analysis

The segmentation, based on end use, includes residential, commercial, and industrial. The residential segment dominated with the largest share in 2024, driven by strong demand for energy-efficient homes, renovation activity, and updated building codes. Homeowners are increasingly investing in improved insulation, upgraded windows, and airtight construction to reduce energy bills and improve comfort. Government programs and incentives promoting sustainable housing further encourage builders to adopt advanced building envelope systems. The use of high-performance envelope products rises across both new construction and home retrofits as the U.S. housing sector focuses on long-term value, reduced carbon emissions, and indoor air quality, thereby fueling the segment growth.

The commercial segment is expected to experience significant growth during the forecast period, driven by expanding development in offices, hospitals, educational facilities, and retail centers. These buildings require envelope systems that offer durability, modern aesthetics, and compliance with increasingly strict energy and environmental regulations. Developers are focusing on LEED certification and zero-energy building goals, which require high-performing façades, advanced glazing, and well-sealed building envelopes. Additionally, growing awareness of long-term operational savings and occupant comfort is encouraging investments in envelope upgrades during renovations. This rising demand for energy-conscious commercial construction is propelling the growth of the segment.

Key Players and Competitive Analysis

The U.S. building envelope market features a competitive landscape led by global and regional players such as 3M Company, BASF SE, DuPont de Nemours, Etex Corp, GAF Materials Corporation, Kingspan Group, Owens Corning, Rockwool International, Saint-Gobain, and Sika AG. These companies compete on innovation, product performance, and compliance with evolving U.S. energy efficiency codes and sustainability standards. Many are investing in R&D to develop advanced insulation materials, air and moisture barriers, and reflective roofing systems that align with green building certifications such as LEED. Partnerships with contractors, architects, and distributors enhance market reach and project specifications. Players are also expanding local manufacturing to meet growing demand and shorten supply chains. Moreover, with increasing pressure to deliver high-performance, resilient, and energy-efficient building envelopes, competition focuses on technological advancement, cost-effectiveness, and sustainability, which is shaping a dynamic and rapidly evolving U.S. market landscape.

Key Players

- 3M Company

- BASF SE

- DuPont de Nemours

- Etex Corp

- GAF Materials Corporation

- Kingspan Group

- Owens Corning

- Rockwool International

- Saint-Gobain

- Sika AG

U.S. Building Envelope Industry Developments

In February 2025, Typar launched several innovative building envelope products at the 2025 International Builders’ Show, including the industry’s first transparent acrylic flashing, new liquid flashing, a commercial peel-and-stick wrap, and a cold-weather spray adhesive, enhancing performance and installation efficiency.

U.S. Building Envelope Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Walls & Cladding Systems

- Roofs

- Windows & Doors

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Residential

- Commercial

- Industrial

U.S. Building Envelope Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 37.44 Billion |

|

Market Size in 2025 |

USD 39.60 Billion |

|

Revenue Forecast by 2034 |

USD 66.39 Billion |

|

CAGR |

5.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 37.44 billion in 2024 and is projected to grow to USD 66.39 billion by 2034.

The market is projected to register a CAGR of 5.9% during the forecast period.

A few of the key players in the market are 3M Company, BASF SE, DuPont de Nemours, Etex Corp, GAF Materials Corporation, Kingspan Group, Owens Corning, Rockwool International, Saint-Gobain, and Sika AG.

The walls & cladding system segment dominated the market share in 2024.

The commercial segment is expected to witness the significant growth during the forecast period.