U.S. Chemical Distribution Market Share, Size, Trends, Industry Analysis Report

By Product (Specialty Chemicals, Commodity Chemicals and Others); By End Use; Segment Forecast, 2024- 2032

- Published Date:Apr-2024

- Pages: 115

- Format: PDF

- Report ID: PM4812

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

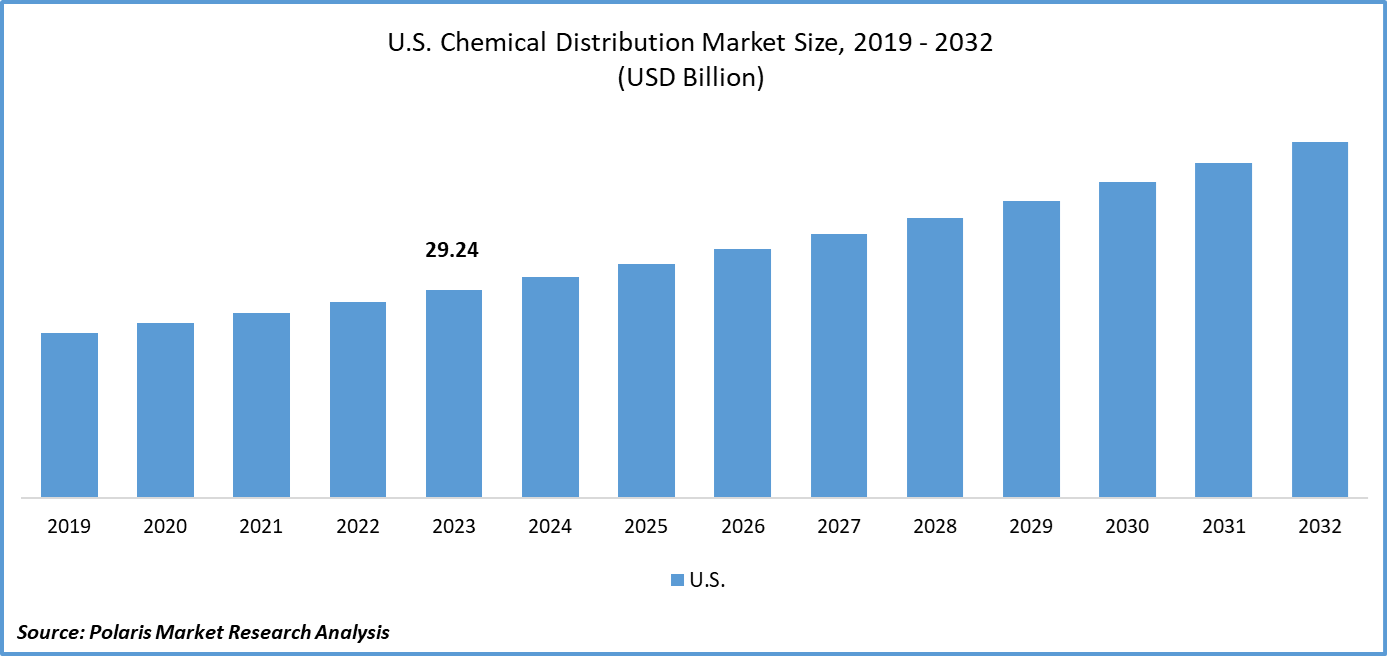

The U.S. Chemical Distribution Market size was valued at USD 29.24 billion in 2023. The market is anticipated to grow from USD 31.01 billion in 2024 to USD 49.99 billion by 2032, exhibiting a CAGR of 6.1% during the forecast period

Industry Trend

The chemical distribution landscape in the United States continues to serve as a dynamic catalyst for fostering innovation and environmental awareness across diverse sectors. Acting as a crucial link between producers and consumers, this market efficiently delivers a wide array of chemicals vital for various manufacturing processes, spanning from basic raw materials to specialized compounds and industrial goods. Its seamless operation ensures the smooth movement of substances crucial to numerous industries.

Across sectors such as manufacturing, construction, agriculture, and healthcare, the demand for chemicals undergoes continual evolution. Manufacturers entrust chemical distributors with the task of maintaining dependable supply chains, ensuring the fulfillment of production requirements while upholding rigorous quality benchmarks. The expansive and adaptable nature of the U.S. chemical distribution market plays a pivotal role in bolstering key industry expansions and propelling economic progress forward. Moreover, the market's flexibility positions it as a valuable catalyst for innovation, capable of responding adeptly to the changing needs of diverse sectors. Beyond merely fostering growth, the chemical distribution sector emerges as a significant force in shaping a sustainable and agile trajectory for industrial advancement within the United States.

To Understand More About this Research:Request a Free Sample Report

The acquisitions landscape within the U.S. chemical distribution market has been marked by strategic transactions aimed at reshaping the competitive landscape and driving growth. Across the industry, companies have pursued acquisitions as a means to expand their market presence, diversify their product portfolios, and enhance their capabilities. These acquisitions often target companies with complementary strengths, such as country expertise, specialized product lines, or value-added services. Additionally, acquisitions have focused on vertical integration strategies, where distributors acquire upstream suppliers or downstream customers to gain greater control over the supply chain and improve operational efficiency. Consequently, substantial growth is anticipated in the company's share of the U.S. Chemical Distribution Market during the projected period.

For instance, in February 2023, Univar Solutions Inc. announced its strategic acquisition of ChemSol Group, a major ingredients and specialty chemicals distributor, aimed at fortifying its presence in Central America. This acquisition extends across key regions, including Costa Rica, El Salvador, Panama, Guatemala, and Honduras, underscoring Univar's commitment to expanding its reach. Beyond bolstering its footprint, the acquisition also serves to enrich Univar's ingredients and specialties portfolio. By integrating ChemSol's offerings, Univar gains access to a broader range of products and expertise, further enhancing its ability to cater to the evolving needs of customers across various industries.

Chemical distributors now have a fresh market opportunity to serve as crucial intermediaries between manufacturers and end-users. With access to valuable insights from the chemical industry regarding planned applications, related products, and the development of environmentally sustainable alternatives, distributors can play a pivotal role. By providing advisory services alongside their traditional trading activities, distributors can actively contribute to the expansion of the market. The realm of chemical distribution encompasses various tasks, including the transportation and storage of chemicals in both bulk and packaged formats. These chemicals are distributed using a variety of containers such as sacks, barrels, containers, and pipelines. Serving as the backbone of numerous industries, including oil and petroleum, cosmetics, food, textiles, paint, construction, and agriculture, the chemical industry provides essential raw materials. Hence, the market is estimated to show tremendous growth in the U.S. chemical distribution market share.

Key Takeaway

- By product category, the petrochemicals under commodity chemicals held the largest market share in 2023.

- By end use category, the industrial manufacturing segment accounted for the largest market share in 2023.

What are the Market Drivers Driving the Demand for the U.S Chemical Distribution Market?

Increasing Industrial Growth and Manufacturing Demand Have Been Projected to Spur Product Demand

The expansion of key industries like manufacturing, construction, healthcare, and agriculture plays a vital role in propelling the demand for chemicals within the United States. These sectors are highly dependent on a diverse range of chemicals to facilitate essential production processes. For instance, manufacturing industries utilize chemicals for materials processing, while construction relies on them for adhesives, coatings, and sealants. Similarly, healthcare sectors require chemicals for pharmaceutical production and medical device sterilization, while agriculture utilizes fertilizers, pesticides, and herbicides.

As these industries continue to grow and evolve, the demand for chemicals rises correspondingly. This surge in demand necessitates efficient distribution channels to ensure a steady and reliable supply of chemicals to end-users across the nation. This results in increasing demands for the chemical distribution market in the U.S., thereby increasing the size of the U.S. chemical distribution market. Chemical distributors play a pivotal role in meeting this demand by optimizing logistics, ensuring timely deliveries, and maintaining high standards of product quality and safety.

In addition to meeting these industries' current demands, chemical distributors anticipate future needs and trends. They continually adapt their services to align with changing market dynamics, technological advancements, and regulatory requirements, contributing to the overall growth and sustainability of the chemical industry in the United States.

Which Factor is Restraining the Demand for U.S Chemical Distribution?

The Fluctuations in Raw Material Prices are Expected to Hinder the Growth of the Market

Fluctuations in raw material prices are a significant factor that can restrain the demand for U.S. chemical distribution. The chemical distribution industry is heavily dependent on the cost of raw materials, which can vary due to factors such as changes in supply and demand dynamics, geopolitical events, currency fluctuations, and environmental regulations.

When raw material prices experience sudden increases or volatility, it can disrupt the cost structure along the supply chain. Distributors may need help in accurately predicting and managing these costs, which can lead to higher operational expenses and reduced profit margins. Consequently, this can deter customers from purchasing chemicals or prompt them to explore alternative sourcing options. Moreover, fluctuating raw material prices can introduce uncertainty into business planning and decision-making processes for both distributors and their customers. Companies may hesitate to invest in large quantities of chemicals or embark on long-term projects if they are unsure about future cost implications. This hesitancy can further dampen demand for chemical distribution services and may hinder the U.S. chemical distribution market share.

Report Segmentation

The market is primarily segmented based on product and end use.

|

By Product |

By End-Use |

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By Product Insights

Based on a product analysis, the market is segmented into specialty chemicals, commodity chemicals, and others. In 2023, the petrochemicals under commodity chemicals held the largest market share. primarily because they serve as key raw materials for downstream products such as plastic resins, synthetic fibers, dyes, pigments, synthetic rubber, surfactants, and more. Additionally, petroleum is a major source of both fuel and feedstock for petrochemical manufacturing.

Commodity chemicals are foundational substances used in large quantities across various industries, such as manufacturing, construction, agriculture, and healthcare. These chemicals serve as basic building blocks for countless products and processes, including plastics, detergents, fertilizers, and pharmaceuticals. As a result, the broad applicability of commodity chemicals contributes to their dominant position within the market. The consistent and substantial demand for commodity chemicals drives their prominence within the U.S. chemical distribution market. Commodity chemicals often represent essential components of the economy, and their consumption is closely tied to economic growth and industrial activity. During periods of economic expansion, demand for commodity chemicals tends to increase as industries ramp up production within the market.

By End Use Insights

Based on end-use analysis, the market has been segmented on the basis of specialty chemicals, commodity chemicals, and others. The industrial manufacturing segment accounted for the largest market share in 2023. It encompasses a wide range of sectors, including automotive, electronics, machinery, and consumer goods. As the U.S. economy continues to recover and expand, there is an increasing demand for manufactured goods both domestically and internationally. This growth in industrial manufacturing activities drives the demand for various chemicals used in production processes. Continuous technological advancements and innovation characterize the industrial manufacturing sector. This trend fuels the demand for specialized chemicals distributed by chemical distributors.

Competitive Landscape

In the U.S. chemical distribution market, competition is widespread among numerous players, resulting in a fragmented landscape. Key service providers in this sector consistently upgrade their technologies to stay ahead, placing a strong emphasis on efficiency, reliability, and safety to maintain a competitive advantage. To further entrench their position in the market, these companies underscore the importance of establishing strategic partnerships, continuously improving their products, and engaging in collaborative ventures.

Some of the major players operating in the global market include:

- Ashland

- Azelis

- Brenntag AG

- CONNELL BROTHERS

- Helm AG

- ICC Industries, Inc.

- NEXEO Solutions

- Safic Alan

- Univar Solutions Inc.

Recent Developments

- In October 2023, Azelis, a major innovation service provider in the specialty chemicals industry, expanded its global presence in the flavors and fragrances sector by recently acquiring BLH SAS (BLH), a renowned distributor of flavors and fragrances specializing in the fine perfumery market in France.

- In March 2023, Aik Moh Group is acquired by Brenntag to boost its industrial chemicals distribution and production while also providing value-added services like repacking, logistics, warehousing, blending and mixing, primarily focusing on South-East Asia.

Report Coverage

The U.S. chemical distribution market report emphasizes on key country across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product and end use, and their futuristic growth opportunities.

U.S. Chemical Distribution Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 31.01 billion |

|

Revenue forecast in 2032 |

USD 49.99 billion |

|

CAGR |

6.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Product and By End Use |

|

Customization |

Report customization as per your requirements with respect to countries, country, and segmentation. |

FAQ's

U.S. Chemical Distribution Market Size Worth $ 49.99 Billion By 2032

The top market players in U.S. Chemical Distribution Market are Ashland, Azelis, Brenntag AG, CONNELL BROTHERS, Helm AG, ICC Industries, Inc

The U.S. Chemical Distribution Market exhibiting a CAGR of 6.1% % during the forecast period

U.S. Chemical Distribution Market report covering key segments are product and end use.

The key driving factors in U.S. Chemical Distribution Market are Increasing industrial growth and manufacturing demand have been projected to spur product demand