U.S. Diabetes Devices Market Share, Size, Trends, Industry Analysis Report

By Type (BGM Devices, Continuous Glucose Monitoring Devices, and Insulin Delivery Devices); By End-use; By Distribution Channel; Segment Forecast, 2024- 2032

- Published Date:Jun-2024

- Pages: 118

- Format: PDF

- Report ID: PM4954

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

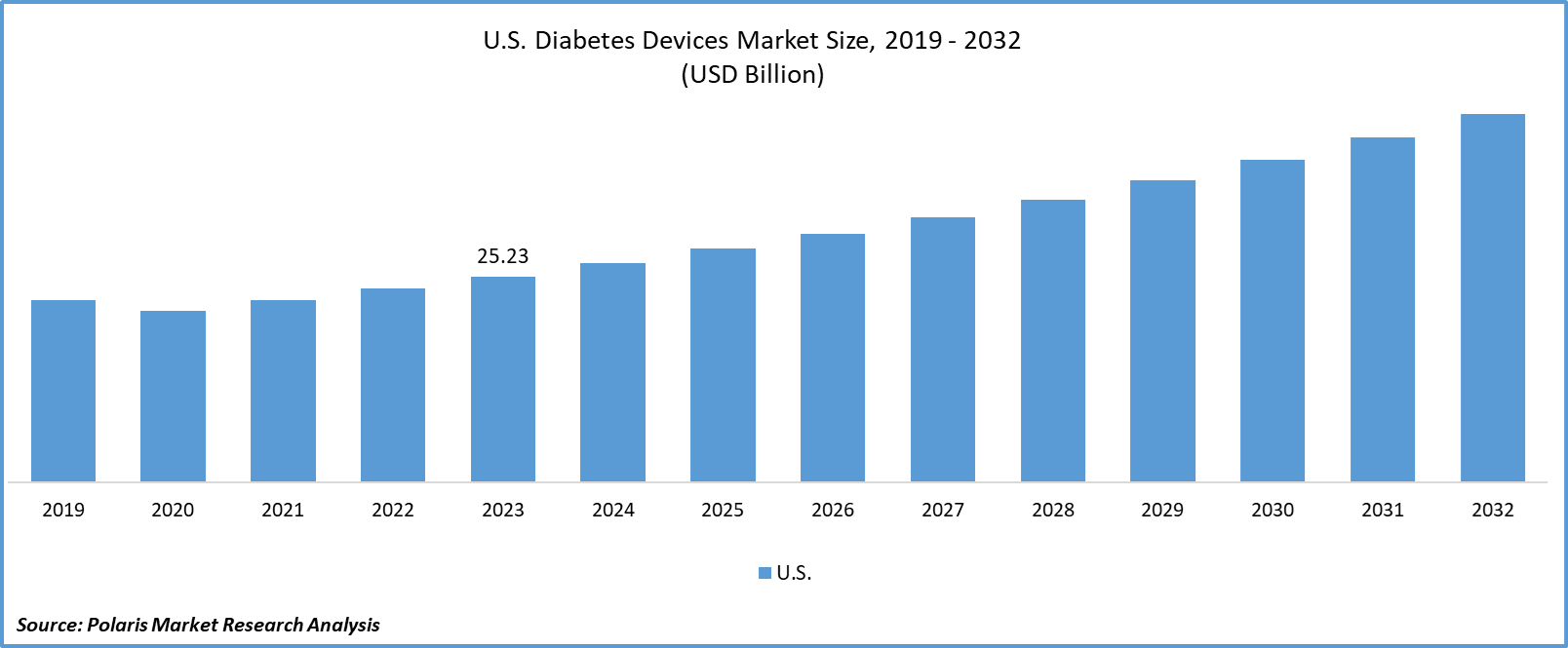

U.S. Diabetes Devices Market size was valued at USD 25.23 billion in 2023. The market is anticipated to grow from USD 26.80 billion in 2024 to USD 44.36 billion by 2032, exhibiting the CAGR of 6.5% during the forecast period.

Market Overview

Diabetes devices encompass a wide range of products and services related to the management and treatment of diabetes within the United States. This market includes devices such as glucose monitoring systems, insulin delivery systems, continuous glucose monitoring (CGM) devices, insulin pumps, insulin pens, and other related accessories and consumables.

To Understand More About this Research:Request a Free Sample Report

These include blood glucose meters and testing strips used by individuals with diabetes to monitor their blood sugar levels. The market for glucose monitoring systems includes both traditional glucose meters and newer technologies such as continuous glucose monitoring (CGM) systems.

CGM devices continuously monitor glucose levels throughout the day and night, providing real-time data to users. These devices typically consist of a small sensor placed under the skin, a transmitter, and a receiver or smartphone app for displaying glucose readings. The CGM market has been experiencing significant growth due to the benefits of continuous glucose monitoring in diabetes management.

Furthermore, rising FDA approvals, awareness among U.S. citizens, the aging population, sedentary lifestyles, and innovations in minimally invasive procedures to manage real-time glucose levels are key enablers in the adoption of diabetes devices. Further, obesity and a busier lifestyle also cause diabetes. Moreover, the high prevalence of the obese population in the U.S. will spur the demand for diabetes devices for diagnosis and prevention.

For instance, according to the data published by the Centers for Disease Control and Prevention (CDC), approximately 35% of adults in the U.S. have obesity.

Texas expected to grow at the rapid rate. This growth is primarily due expected rise in diabetics in coming years. As per the estimates of the Texas Diabetes Council (TDC), in 2021, diabetes prevalence rate stood at 11.5%, constituting 2.5 Mn people in the state. Rise in prevalence rate is primarily due to late diagnosis, owing to delay in treatment, risk of diabetes-based complications, such as heart attacks, renal failures, diabetic keto-acidosis, and stroke.

Moreover, the high consumption of fast food across the U.S. has increased the risk of obesity and type 2 diabetes. For instance, in the U.S. more than 25% of adults in the U.S. consume fast food daily. The market is influenced by factors such as the prevalence of diabetes, technological advancements in device design and functionality, regulatory landscape, reimbursement policies, and consumer preferences. With the rising prevalence of diabetes and increasing awareness about the importance of diabetes management, the market for diabetes devices continues to grow, presenting opportunities for innovation and market expansion.

Growth Factors

Rising Prevalence of Pre-Diabetic and Diabetic Among U.S Adults

Rising diabetes and pre-diabetes are the conditions in which blood glucose levels are recorded above their optimum range. High glucose levels cause many health ailments and damage prime organs, such as heart, nerve-related disorders, eye complications, and kidneys among geriatrics. As per the estimates of the NIDDKD, in 2021, there were around 38.4 Mn people aged 18 years and above in the U.S. living with diabetes, constituting 11.6% of the country’s population. Of these, only 29.7 million people have been diagnosed. It also includes 3,52,000 children and adults aged below 20 years, with 304,000 with type I diabetes.

Moreover, the diagnosed diabetes prevalence rate in was seen highest among Indian-born Americans & Alaska native adults (13.6%), followed by non-Hispanic (12.1%), Hispanics (11.7%), and non-Hispanic whites (6.9%)

The Rising Economic Burden of Diabetes Increases the Need for Diabetes Management

The rising economic burden of diabetes necessitated the need to manage it at the individual level. In 2022, it is estimated that the total cost of diabetes in the U.S. stood at USD 412.9 Bn, which includes USD 306.6 Bn and USD 106.3 Bn in direct and indirect medical costs to manage blood glucose. Diabetics, on average, spend around USD 19,736 annually, of which nearly USD 12,022 is directly attributed to diabetes complications.

Diabetes supplies and glucose-lowering agents account for almost 17% of total costs attributed to diabetes. Indirect costs include reduced employment due to disability (USD 28.3 Bn), medication-related presenteeism (USD 35.8 Bn), and lost productivity owing to premature deaths (USD 32.4 Bn).

Restraining Factors

Stringent Regulations for Approval of Diabetes Devices may Hamper the Market Growth

There are certain regulations imposed for the commercialization of medical devices, including those for use in diabetes management. This is attributed to eliminating risks associated with a device. For instance, technologies such as reusable and more accurate devices are still in the early stages of development. These devices must be accurate and suitable for all age groups and patients. However, certain regulatory approval processes are required to commercialize diabetes devices.

Report Segmentation

The market is primarily segmented based on type, end-use, and distribution channel.

|

By Type |

By End-use |

By Distribution Channel |

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Type Insights

The Continuous Glucose Monitoring Devices Segment Held the Largest Market Share in 2023

Continuous glucose monitoring devices segment accounted for the largest market share in 2023. This dominance is primarily due to rise in rise diabetics in the U.S. with rising cases of people suffering with obesity and faulty lifestyle. Moreover, rising awareness among the citizens increasing the adoption of wearables counting calories and helping in maintaining blood glucose level on real time basis.

By End-Use Insights

The Hospitals Segment Held the Largest Revenue Share in 2023

The hospitals segment held the largest market share in 2023. The segment’s growth is attributed to factors such as rising cases of diabetes and adopting advanced diabetes technologies and devices to improve patient care. The rapid increase in the burden of diabetes has led to the improvement of the capacity of primary health care for early diagnosis, treatment, as well as prevention of diabetes-related complications.

For instance, according to the statistics reported by the U.S. Department of Commerce, over 10% of the population in the U.S. are diagnosed with Type 1, Type 2, or gestational diabetes.

Key Market Players & Competitive Insights

Strategic Partnerships to Drive the Competition

The U.S. diabetes devices market is highly competitive with presence of both big and smaller players. Companies in the sectors are seeking heavy investments to increase their technological abilities to manage diabetes effectively. For instance, in January 2024, Adipo Therapeutics, a pharmaceutical company involved in the development of obesity & type II diabetes in collaboration with Purdue University, have secured funding USD 1.9 Mn. This funding will used in development of promising candidate “ADPO-002” to treat obesity-borne diabetic population.

Some of the major players operating in the global market include:

- Abbott Diabetes Care

- B Braun Melsungen AG

- BD

- Biocorp

- Johnson & Johnson

- LifeScan Inc.

- Medtronic PLC

- Molex

- Roche Diabetes Care

- Senseonics, Inc.

- Tandem Diabetes Care, Inc.

Recent Developments in the Industry

- In May 2023, Medtronic plc announced an agreement to acquire EOFlow Co., a manufacturer of wearable & disposable insulin delivery device.

- In October 2023, GlucoModicum teamed with the Phillips Medisize announced the development of non-invasive, needle-free CGM.

Report Coverage

The diabetes devices market report emphasizes on key countries across the country to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, end-use, distribution channel, and their futuristic growth opportunities.

U.S. Diabetes Devices Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 26.80 billion |

|

Revenue forecast in 2032 |

USD 44.36 billion |

|

CAGR |

6.5% from 2024 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Competitive Landscape |

Company Profiles/Industry participants profiling includes company overview, financial information, product/service benchmarking, and recent developments |

|

Report Format |

PDF + Excel |

|

Customization |

Report customization as per your requirements with respect to countries, country, and segmentation. |

FAQ's

The key companies in U.S. Diabetes Devices Market Abbott Diabetes Care, BD, Medtronic PLC, Molex, Roche Diabetes Care.

U.S. Diabetes Devices Market exhibiting the CAGR of 6.5% during the forecast period.

U.S. Diabetes Devices Market report covering key segments are type, end-use, distribution channel

The key driving factors in U.S. Diabetes Devices Market Rising prevalence of pre-diabetic and diabetic among U.S adults

U.S. Diabetes Devices Market Size Worth $ 44.36 Billion By 2032.