U.S. Epoxy Resins Market Size, Share, Trends, & Industry Analysis Report

By Type (DGBEA, DGBEF), By Application – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6348

- Base Year: 2024

- Historical Data: 2020-2023

Overview

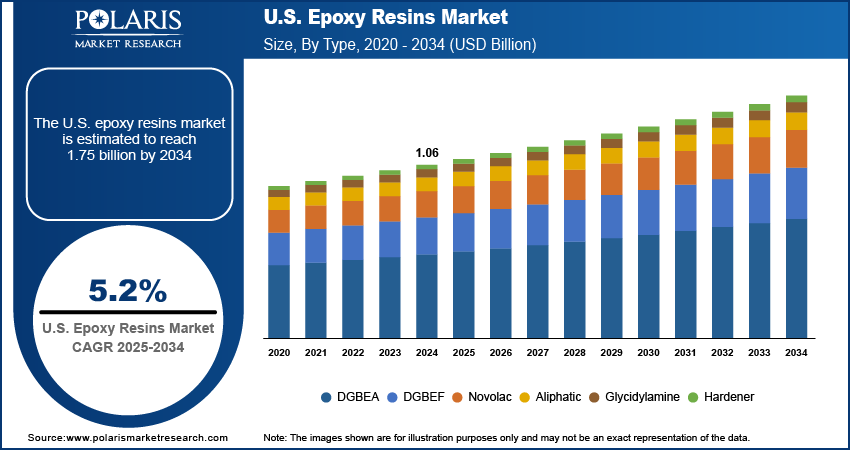

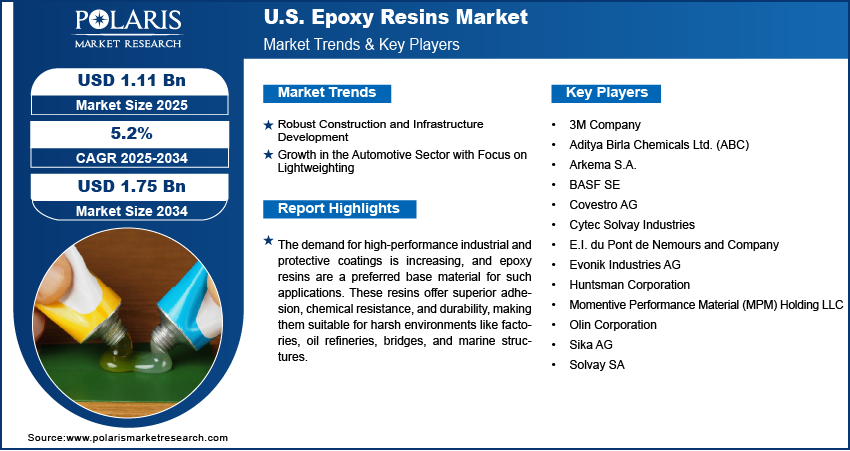

The U.S. epoxy resins market size was valued at USD 1.06 billion in 2024, growing at a CAGR of 5.2% from 2025–2034. Key factors driving demand is robust construction and infrastructure development, and growth in the automotive sector with focus on lightweighting.

Key Insights

- The DGBEA segment is anticipated to grow at a CAGR of 4.6% over the forecast period, driven by its broad application in key U.S. industries such as automotive, electronics, and construction.

- The DGBEF segment is projected to hold a notable market share during the forecast period, owing to its low viscosity and excellent performance in high-precision applications, particularly within the electronics sector.

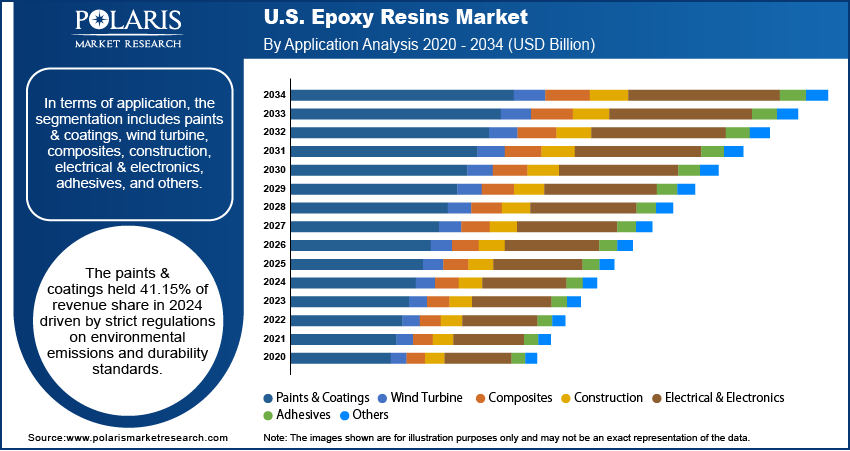

- The paints and coatings application accounted for 41.15% of the U.S. epoxy resin market revenue in 2024, fueled by robust demand across infrastructure, automotive, and industrial maintenance sectors.

- The construction segment captured 7.5% of the revenue share in 2024, supported by strong growth in the U.S. construction industry, which increasingly relies on epoxy resins for flooring, adhesives, sealants, and structural repair solutions.

Industry Dynamics

- Robust construction and infrastructure development are driving the demand for epoxy resins.

- Growth in the automotive sector with focus on lightweighting is driving the U.S. epoxy resins market

- The demand for high-performance industrial and protective coatings is increasing, and epoxy resins are a preferred base material for such applications.

- Fluctuating raw material prices and the growing popularity of alternative resins limits the growth.

Market Statistics

- 2024 Market Size: USD 1.06 Billion

- 2034 Projected Market Size: USD 1.75 Billion

- CAGR (2025-2034): 5.2%

AI Impact on the Industry

- AI accelerates epoxy resin formulation by analyzing chemical properties, curing behaviors, and performance metrics to design resins with enhanced strength, flexibility, and thermal resistance.

- Integration of AI enables predictive modeling to optimize resin compositions and curing processes, reducing trial-and-error in R&D and shortening time-to-market.

- AI-powered market intelligence tools track industry trends, customer demands, and competitive landscapes, helping manufacturers align product offerings with evolving market needs.

- AI-driven automation improves supply chain and production workflows, enhancing quality control, minimizing defects, and reducing operational costs across epoxy resin manufacturing plants.

Epoxy resin is a type of thermosetting polymer known for its strong adhesive properties, chemical resistance, and durability. It is formed through the reaction of epoxide compounds with hardeners, creating a rigid, high-performance material. Commonly used in coatings, electronics, construction, and composites, epoxy resin provides excellent mechanical strength and environmental protection.

Stringent environmental regulations in the U.S., especially from the Environmental Protection Agency (EPA), are encouraging the shift toward low volatile organic compounds and eco-friendly epoxy resins. Manufacturers are innovating new formulations to comply with these standards without compromising performance. This is especially important in the construction, automotive, and industrial coatings sectors, where emissions and worker safety are major concerns. Consumer and corporate preference for greener materials is further rising. This shift is pushing epoxy resin producers in the U.S. to focus on sustainability, thereby fueling the expansion.

The U.S. electronics industry is one of the most technologically advanced in the world, and epoxy resins are essential for circuit boards, insulation systems, and semiconductor encapsulation. The demand for heat-resistant and electrically insulating materials is rising with continued growth in IoT devices, smartphones, medical electronics, and data centers. Epoxy resins help protect sensitive components from moisture, vibration, and thermal stress. The U.S.'s focus on semiconductor manufacturing, especially with recent CHIPS Act initiatives, is further accelerating domestic production and, in turn, increasing resin consumption in electronics applications, thereby driving the growth.

Drivers & Opportunities

Robust Construction and Infrastructure Development: The U.S. is experiencing large investments in construction and infrastructure, including highways, commercial buildings, and public works projects. Epoxy resins are widely used in this sector for coatings, adhesives, sealants, and flooring systems due to their durability and chemical resistance. Recent federal infrastructure bills and state-level funding are accelerating projects that require high-performance materials to withstand harsh environmental and mechanical conditions. The demand for epoxy-based construction solutions increases across the country as urbanization expands and the need for long-lasting infrastructure rises, thereby boosting the growth.

Growth in the Automotive Sector with Focus on Lightweighting: There's a strong push toward lightweight materials as automakers in the U.S. aim to improve fuel efficiency and reduce emissions. Epoxy resins are increasingly used in structural adhesives, coatings, and composite components in electric vehicle and conventional vehicles. Their ability to improve strength while keeping weight low supports new-age vehicle designs and safety standards. U.S. manufacturers are adopting more resin-based components with the growing popularity of EVs and hybrid vehicles, fueling demand. Additionally, government policies and incentives for electric mobility further support this trend, thereby fueling the growth in the country.

Segmental Insights

Type Analysis

Based on type, the segmentation includes DGBEA, DGBEF, novolac, aliphatic, glycidylamine, and hardener. DGBEA segment is projected to grow at a CAGR of 4.6% over the forecast period driven by its widespread use across industries such as automotive, electronics, and construction. DGBEA resins offer excellent mechanical strength, thermal stability, and chemical resistance, making them ideal for high-performance coatings and adhesives. The increasing demand for lightweight yet durable materials in aerospace and automotive sectors is supporting this segment’s growth. Additionally, its compatibility with various hardeners and modifiers gives manufacturers flexibility, which is particularly important in meeting evolving U.S. industry standards and environmental regulations.

DGBEF segment is expected to witness a significant share over the forecast period due to its lower viscosity and superior performance in electronics and precision applications. Its use is rising in high-performance coatings and encapsulation processes in the U.S. electronics industry, which is witnessing rapid growth fueled by innovations in semiconductors and smart devices. The DGBEF resin’s excellent chemical resistance and low shrinkage make it particularly valuable for high-end applications requiring fine detail and stability. These properties align with the U.S. push for miniaturized and high-performance electronic components.

Application Analysis

In terms of application, the segmentation includes paints & coatings, wind turbine, composites, construction, electrical & electronics, adhesives, and others. The paints & coatings held 41.15% of revenue share in 2024 driven by strong demand in infrastructure, automotive, and industrial maintenance sectors. Epoxy coatings are known for their corrosion resistance, durability, and adhesion to various substrates. The need for protective coatings is surging with the U.S. government emphasizing infrastructure modernization, including roads, bridges, and industrial facilities. Additionally, the growth of green buildings and environmentally friendly construction practices is pushing the demand for low-VOC, high-performance epoxy coatings, thereby driving the segment growth.

The construction segment held significant revenue share in 2024, holding 7.5% as the U.S. construction industry significantly drives demand for epoxy resins, especially in flooring, sealants, adhesives, and structural repairs. The need for durable, long-lasting materials is rising with federal and state-level investments in public infrastructure and commercial real estate. Epoxy resins are widely used for their chemical resistance, high bonding strength, and ability to withstand heavy loads, making them ideal for industrial floors, bridges, and tunnels. Their quick curing time and adaptability to various climates further add to their appeal. Epoxy solutions with improved environmental profiles are gaining traction across the U.S as sustainability becomes a greater focus in construction, thereby fueling the segment growth.

Key Players & Competitive Analysis

The U.S. epoxy resins market features a highly competitive landscape dominated by global chemical giants and specialized manufacturers. Key players such as 3M Company, BASF SE, Covestro AG, Huntsman Corporation, and Olin Corporation maintain strong market positions through technological innovation and diversified product portfolios. Companies like Evonik Industries AG, Momentive Performance Materials, and Arkema S.A. are actively investing in R&D to create advanced, sustainable epoxy formulations tailored to U.S. demand for high-performance coatings, adhesives, and composites. Strategic partnerships, mergers, and capacity expansions are common tactics, especially in response to growing demand in automotive, aerospace, electronics, and infrastructure sectors. The market is also seeing a shift towards low-VOC and bio-based resins, pushing companies to innovate for regulatory compliance and environmental sustainability. Additionally, Sika AG, Solvay SA, and Aditya Birla Chemicals Ltd. continue to strengthen their regional presence, making the U.S. epoxy resin market both dynamic and innovation-driven.

Key Players

- 3M Company

- Aditya Birla Chemicals Ltd. (ABC)

- Arkema S.A.

- BASF SE

- Covestro AG

- Cytec Solvay Industries

- E.I. du Pont de Nemours and Company

- Evonik Industries AG

- Huntsman Corporation

- Momentive Performance Material (MPM) Holding LLC

- Olin Corporation

- Sika AG

- Solvay SA

Industry Developments

March 2025, BASF and Sika launched a new epoxy hardener, Baxxodur EC 151, designed for flooring coatings. The product delivered high gloss, fast curing, low VOC emissions, and enhanced durability, supporting sustainability and performance in industrial and commercial flooring applications.

U.S. Epoxy Resins Market Segmentation

By Type Outlook (Volume, Kilo Tons, Revenue, USD Billion, 2021–2034)

- DGBEA

- DGBEF

- Novolac

- Aliphatic

- Glycidylamine

- Hardener

By Application Outlook (Volume, Kilo Tons, Revenue, USD Billion, 2021–2034)

- Paints & Coatings

- Wind Turbine

- Composites

- Construction

- Electrical & Electronics

- Adhesives

- Others

U.S. Epoxy Resins Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.06 Billion |

|

Market Size in 2025 |

USD 1.11 Billion |

|

Revenue Forecast by 2034 |

USD 1.75 Billion |

|

CAGR |

5.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in Kilo Tons, Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Volume Forecast, Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, and segmentation. |

FAQ's

The market size was valued at USD 1.06t billion in 2024 and is projected to grow to USD 1.75 billion by 2034.

The market is projected to register a CAGR of 5.2% during the forecast period.

Germany dominated the market in 2024

A few of the key players in the market are 3M Company; Aditya Birla Chemicals Ltd. (ABC); Arkema S.A.; BASF SE; Covestro AG; Cytec Solvay Industries; E.I. du Pont de Nemours and Company; Evonik Industries AG; Huntsman Corporation; Momentive Performance Material (MPM) Holding LLC; Olin Corporation; Sika AG; Solvay SA.

The DGBEA segment dominated the market revenue share in 2024.

The construction segment is projected to witness the fastest growth during the forecast period.