U.S. Geothermal Energy Market Size, Share, Trends, Industry Analysis Report

By Technology (Flash Steam, Dry Steam, Binary Cycle Power Plants), By Power Output, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6189

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

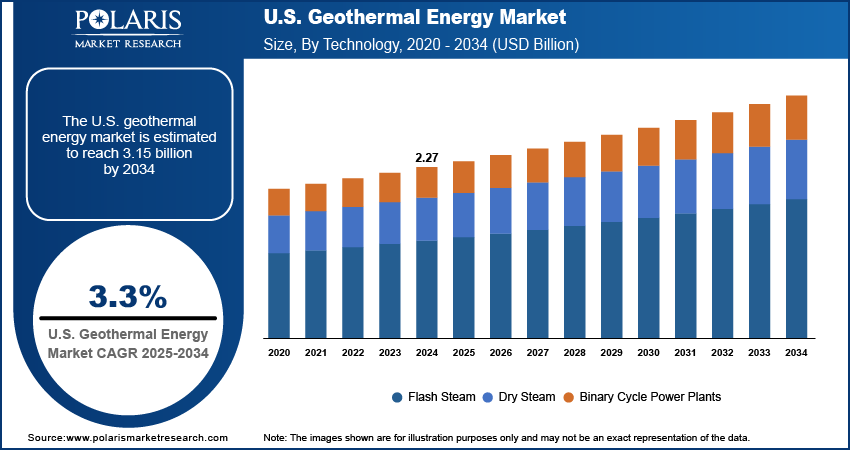

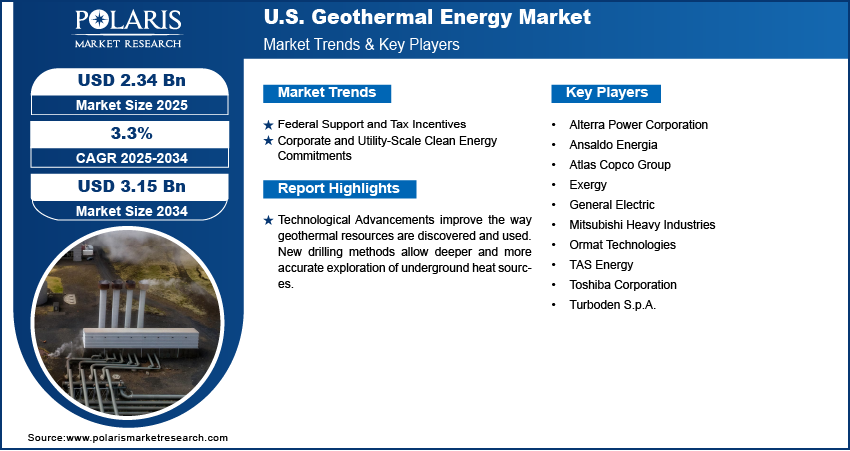

The U.S. geothermal energy market size was valued at USD 2.27 billion in 2024, growing at a CAGR of 3.3% from 2025 to 2034. The market growth is driven by federal support and tax incentives and corporate and utility-scale clean energy commitments.

Key Insights

- In 2024, the binary cycle power plants segment dominated with the largest share driven by their suitability for harnessing lower-temperature geothermal resources, conditions commonly found across the western U.S.

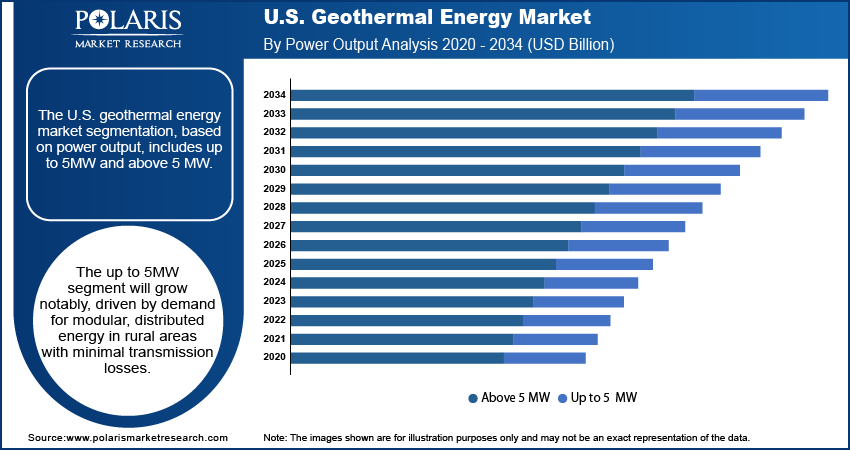

- In 2024, the above 5 MW segment dominated with the largest share due to the presence of large-scale facilities in states such as California, Nevada, and Utah, where high-temperature geothermal reservoirs are more accessible.

- The up to 5MW segment is expected to experience significant growth during the forecast period as these compact, modular systems are ideal for decentralized energy supply in remote or rural areas and help minimize transmission losses by being installed near the point of consumption.

- The industrial segment is expected to experience significant growth during the forecast period, driven by geothermal energy's ability to reliably deliver high-temperature heat for processes in industries such as food processing, chemical production, and paper manufacturing.

Industry Dynamics

- Federal support and tax incentives drive the adoption of geothermal energy.

- Corporate and utility-scale clean energy commitments fuel the industry growth.

- Technological advancements are making geothermal energy more practical and affordable.

- High upfront capital costs for exploration, drilling, and plant setup hinder the industry growth.

Market Statistics

- 2024 Market Size: USD 2.27 billion

- 2034 Projected Market Size: USD 3.15 billion

- CAGR (2025–2034): 3.3%

To Understand More About this Research: Request a Free Sample Report

Geothermal energy is heat derived from the Earth’s interior. The energy is generated by the natural decay of radioactive elements in the Earth’s core, mantle, and crust. This heat can be harnessed to produce electricity, provide direct heating, and support industrial processes. As a renewable and reliable energy source, geothermal offers constant, low-emission power with minimal environmental impact.

Geothermal energy provides continuous, round-the-clock power, unlike solar and wind, which depend on weather conditions. This makes geothermal very valuable for U.S. power grids that need a reliable power source to balance fluctuations from other renewables. Geothermal fits well into the energy mix as states adopt clean energy goals and utilities look for steady alternatives to coal and natural gas. Its baseload nature further helps prevent blackouts during peak usage or extreme weather events. The growing demand for uninterrupted, low-emission energy across the U.S. fuels the demand for geothermal energy.

The U.S.-based companies and research institutions are leading the development of Enhanced Geothermal Systems (EGS), which is expected to unlock geothermal energy in areas without natural hot water reservoirs. This technology allows engineers to create artificial geothermal resources using advanced drilling techniques. Projects such as those led by Fervo Energy and supported by the DOE are expanding geothermal access beyond traditional hotspots. EGS opens the door to geothermal development in more parts of the U.S., including the Midwest and East Coast. It is expected to play a major role in growing the U.S. geothermal energy market as this technology matures.

Drivers & Opportunities

Federal Support and Tax Incentives: The U.S. government provides support for geothermal energy through tax credits, grants, and research funding. The Investment Tax Credit (ITC) allows developers to reduce the cost of geothermal projects by a significant margin, making them more financially viable. The U.S. Department of Energy (DOE) also funds pilot projects and research to improve geothermal technology and expand its use. These federal incentives lower the financial risk for investors and developers. Government backing are encouraging companies to explore new geothermal resources and build advanced power systems across the country, thereby driving the growth of the U.S. geothermal energy market.

Corporate and Utility-Scale Clean Energy Commitments: Large U.S. companies and utility providers are committing to 100% renewable energy targets. Technology firms such as Google, Meta, and Microsoft are investing in geothermal projects to power their data centers with clean, consistent electricity. Utilities are further adding geothermal to their renewable portfolios to meet state mandates and reduce carbon emissions. These corporate and utility commitments are increasing demand for dependable, non-intermittent energy sources. Geothermal’s ability to supply stable power makes it a strong match for long-term energy contracts, encouraging more private investment and helping scale up projects across the U.S., thereby fueling the U.S. geothermal energy market expansion.

Segmental Insights

Technology Analysis

The segmentation, based on technology, includes flash steam, dry steam, and binary cycle power plants. In 2024, the binary cycle power plants segment dominated with the largest share. The technology is ideal for areas with lower-temperature geothermal resources, which are more common across the western U.S. Unlike traditional steam plants, binary cycle systems use a secondary fluid with a lower boiling point than water, making them more efficient in moderate heat zones. Their ability to operate with smaller environmental footprints and without releasing geothermal fluids to the surface makes them attractive for sustainable development, thereby driving the segment growth.

Power Output Analysis

The segmentation, based on power output, includes up to 5MW and above 5 MW. In 2024, the above 5 MW segment dominated with the largest share as these large-scale facilities are primarily located in states such as California, Nevada, and Utah, where there is greater access to high-temperature geothermal reservoirs. They contribute significantly to grid-scale electricity generation and are often supported by long-term power purchase agreements (PPAs). Their scale makes them cost-efficient and capable of providing reliable, baseload power. Federal and state-level incentives further encourage investments in large geothermal projects, thereby fueling the segment growth.

The up to 5MW segment is expected to experience significant growth during the forecast period as these modular systems are well-suited for distributed energy needs in remote or rural communities and can be installed closer to consumption points, reducing transmission losses. The growing interest in decentralized energy, microgrids, and sustainable local energy solutions is pushing demand in this segment. Additionally, new drilling technologies and lower exploration costs are making smaller-scale geothermal more viable. These smaller units are becoming a practical solution in the renewable landscape as businesses and municipalities seek clean, reliable, and long-term energy sources, thereby driving the segment growth.

Application Analysis

The segmentation, based on application, includes residential, commercial, and industrial. The industrial segment is expected to experience significant growth during the forecast period as industries such as food processing, chemical manufacturing, and paper production require steady, high-temperature heat, which geothermal energy can provide efficiently. Unlike solar or wind, geothermal offers uninterrupted thermal energy, which is critical for process heating. Geothermal becomes an attractive alternative to fossil fuels as companies push for lower carbon emissions and energy cost savings. Industries are beginning to adopt geothermal for both heat and electricity with more government funding and rising ESG (Environmental, Social, and Governance) standards, driving demand in this segment.

Key Players and Competitive Analysis

The U.S. geothermal energy market features a competitive landscape driven by a mix of domestic and international players focused on innovation, efficiency, and project expansion. Ormat Technologies stands out as a market leader with extensive geothermal operations and technology development across the western U.S. General Electric, Mitsubishi Heavy Industries, and Toshiba Corporation contribute significantly by supplying advanced turbines and micro turbines and generators for large-scale plants. Companies such as Turboden S.p.A. and Exergy specialize in Organic Rankine Cycle (ORC) technology, supporting the growth of binary cycle plants. Atlas Copco Group and TAS Energy offer critical drilling, power systems, and modular solutions. Alterra Power Corporation, now part of Innergex, and Ansaldo Energia are increasing their presence through partnerships and new projects. As competition intensifies, emphasis is growing on low-emission technologies, enhanced geothermal systems (EGS), and expanding small-scale, distributed geothermal installations to meet clean energy goals and regional power demands in the U.S.

Key Players

- Alterra Power Corporation

- Ansaldo Energia

- Atlas Copco Group

- Exergy

- General Electric

- Mitsubishi Heavy Industries

- Ormat Technologies

- TAS Energy

- Toshiba Corporation

- Turboden S.p.A.

Geothermal Energy Industry Developments

In August 2024, Meta partnered with Sage Geosystems to launch a groundbreaking geothermal energy project using Sage’s Geopressured Geothermal System, aiming to deliver 150 MW of carbon-free power by 2027 to support Meta’s U.S. data centers with reliable, clean energy.

U.S. Geothermal Energy Market Segmentation

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Flash Steam

- Dry Steam

- Binary Cycle Power Plants

By Power Output Outlook (Revenue, USD Billion, 2020–2034)

- Up to 5MW

- Above 5 MW

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Residential

- Commercial

- Industrial

U.S. Geothermal Energy Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.27 Billion |

|

Market Size in 2025 |

USD 2.34 Billion |

|

Revenue Forecast by 2034 |

USD 3.15 Billion |

|

CAGR |

3.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 2.27 billion in 2024 and is projected to grow to USD 3.15 billion by 2034.

The market is projected to register a CAGR of 3.3% during the forecast period.

A few of the key players in the market are Alterra Power Corporation, Ansaldo Energia, Atlas Copco Group, Exergy, General Electric, Mitsubishi Heavy Industries, Ormat Technologies, TAS Energy, Toshiba Corporation, and Turboden S.p.A.

The binary cycle power plant segment dominated the market share in 2024.

The up to 5 MW segment is expected to witness the significant growth during the forecast period.