U.S. HVAC Systems Market Size, Share, Trends, Industry Analysis Report

By Equipment (Heating, Ventilation, Cooling), By Application, By Distribution Channel – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6392

- Base Year: 2024

- Historical Data: 2020-2023

Overview

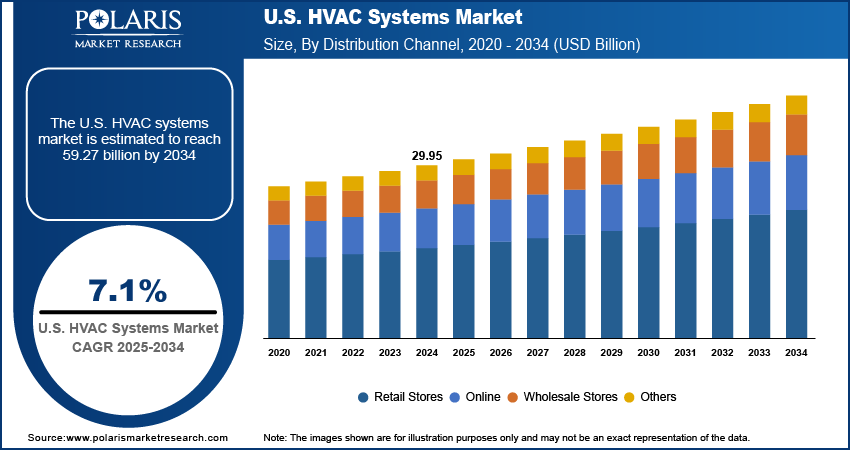

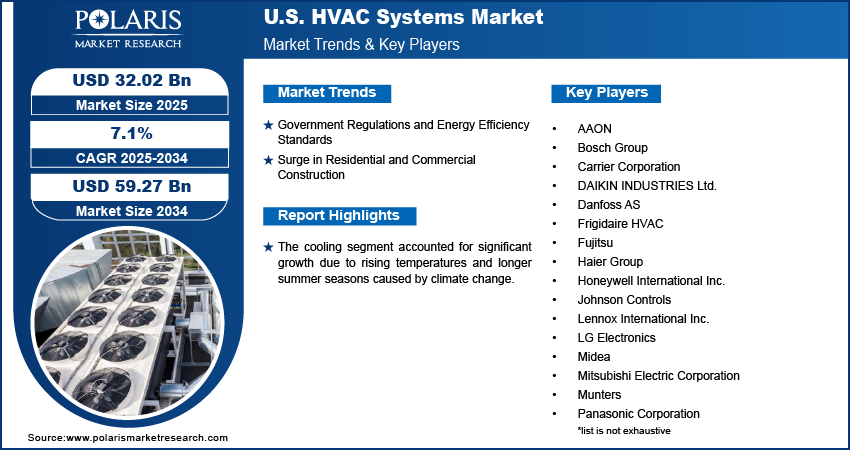

The U.S. HVAC systems market size was valued at USD 29.95 billion in 2024, growing at a CAGR of 7.1% from 2025 to 2034. The market growth is driven by rapid urbanization and construction boom, and growth in the commercial and industrial sectors.

Key Insights

- In 2024, the heating segment held the largest market share, driven by cold seasonal weather in northern and midwestern U.S. regions.

- The cooling segment is expected to register a significant growth during 2025–2034 due to rising temperatures and extended summer seasons linked to climate change.

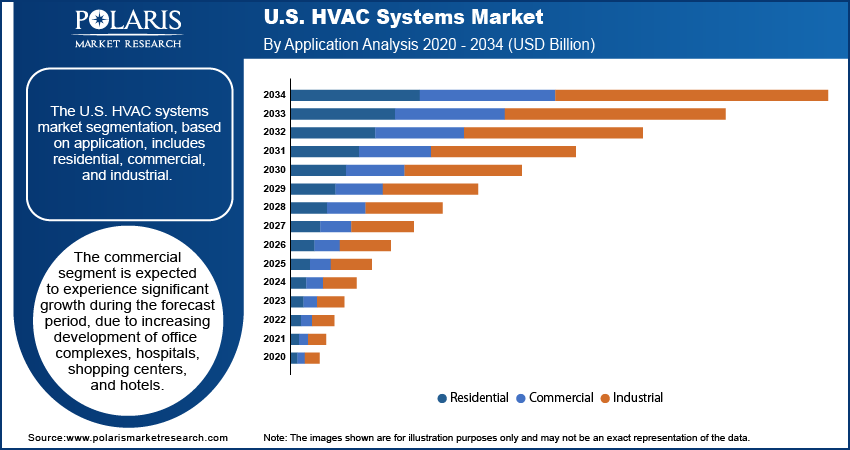

- The commercial segment is projected to grow notably, fueled by rapid expansion in offices, healthcare, hospitality, and education sectors.

- The retail stores segment dominated with the largest share in 2024, supported by the convenience and wide product variety available in both physical and online stores.

Industry Dynamics

- Government regulations and energy efficiency standards drives the demand for HVAC systems.

- Surge in residential and commercial construction is fueling the industry growth.

- The rise of smart home technology has also impacted the HVAC industry by improving HAVC system’s appeal.

- High initial installation costs and maintenance expenses restrain the U.S. HVAC systems market growth.

Market Statistics

- 2024 Market Size: USD 29.95 billion

- 2034 Projected Market Size: USD 59.27 billion

- CAGR (2025–2034): 7.1%

AI Impact on U.S. HVAC Systems Market

- AI enhances energy efficiency in U.S. HVAC systems by continuously analyzing data to optimize performance and lower utility bills.

- Predictive maintenance powered by AI helps U.S. HVAC providers reduce unexpected equipment failures, saving repair costs and downtime.

- AI integration enables smart HVAC units to customize settings based on user behavior and weather patterns, improving comfort and air quality in homes and businesses.

- Manufacturers in the U.S. use AI analytics to predict market demand accurately, streamline production, and manage supply chains efficiently, reducing waste and inventory costs.

HVAC systems refer to heating, ventilation, and air conditioning systems that regulate indoor temperature, air quality, and comfort in residential, commercial, and industrial spaces. They include components such as air conditioners, heat pumps, furnaces, ductwork, and ventilation units. These systems help maintain a healthy and energy-efficient indoor environment by controlling temperature, humidity, and airflow.

Increasingly unpredictable weather patterns and rising temperatures across many U.S. states are leading to higher demand for reliable heating and cooling systems. Frequent heatwaves in the South and West, and severe cold spells in the North and Midwest, are prompting homeowners and businesses to invest in efficient HVAC accessories and systems. Climate change is further expanding the cooling season and intensifying the need for air conditioning in areas previously less reliant on it. This long-term trend ensures sustained growth in HVAC system installations and upgrades, particularly in regions experiencing greater climate variability and extreme weather events, thereby driving the growth.

The U.S. consumers are rapidly adopting smart home technologies, including HVAC systems. There is an increasing demand for smart thermostats, Wi-Fi-enabled systems, and HVAC units integrated with voice assistants such as Alexa or Google Assistant. These smart systems allow users to control temperature remotely, optimize energy usage, and receive real-time maintenance alerts. Smart HVAC systems have become a preferred option as Americans seek greater convenience and control over home environments. Tech-savvy consumers and energy-conscious homeowners are fueling this shift due to digitalization and connectivity, thereby driving the U.S. HVAC systems market growth.

Drivers & Opportunities

Government Regulations and Energy Efficiency Standards: Stringent energy efficiency standards set by the U.S. Department of Energy and the Environmental Protection Agency are pushing HVAC manufacturers to design greener, more efficient systems. Programs such as ENERGY STAR and SEER (Seasonal Energy Efficiency Ratio) guidelines promote the use of low-energy consumption systems. Furthermore, federal and state-level policies offering rebates and incentives for energy-efficient HVAC installations are encouraging consumers to upgrade. These regulatory efforts help reduce greenhouse gas emissions and fuel demand for compliant products, contributing significantly to the growth of the HVAC industry in the U.S.

Surge in Residential and Commercial Construction: The U.S. has experienced rapid growth in both residential and commercial construction projects, especially in urban and suburban areas. According to the U.S. Census Bureau, in June 2025, 1,314,000 residential projects were completed in the country. New housing developments, office buildings, shopping centers, schools, and hospitals are all requiring state-of-the-art HVAC installations. Developers increasingly incorporate advanced HVAC technologies into their designs as they focus on sustainable and smart infrastructure. Furthermore, a rising population and migration to warmer southern states have created demand for HVAC solutions in new homes and facilities. This construction boom, supported by economic recovery and infrastructure investment, fuels the growth in the country.

Segmental Insights

Equipment Analysis

The U.S. HVAC systems market segmentation, based on equipment, includes heating, ventilation, and cooling. In 2024, the heating segment dominated with the largest share driven by the country’s seasonal cold weather patterns, especially in the northern and midwestern states. Widespread use of furnaces, boilers, and heat pumps is essential for maintaining indoor comfort during long winters. Additionally, rising energy efficiency regulations have encouraged homeowners and businesses to upgrade older systems with more advanced, environmentally friendly heating technologies. Government incentives for energy-efficient heating units further fueled this trend. The growing demand for consistent indoor temperatures and the need to reduce energy consumption fuel the segment growth.

The cooling segment accounted for significant growth due to rising temperatures and longer summer seasons caused by climate change. Southern and western states, in particular, experienced increased demand for air conditioning systems to ensure comfort and safety. The adoption of smart air conditioners and inverter-based cooling technologies further contributed to the segment’s growth. Additionally, a surge in residential construction and retrofitting projects boosted sales of energy-efficient cooling systems. Consumers are increasingly seeking systems that offer both performance and cost savings, which has led to strong growth in the cooling segment nationwide.

Application Analysis

The U.S. HVAC systems market segmentation, based on application, includes residential, commercial, and industrial. The commercial segment is expected to experience significant growth due to rapid expansion in sectors such as offices, healthcare, hospitality, and education. Post-pandemic, there has been an increased focus on indoor air quality and building ventilation, prompting commercial establishments to upgrade or install new HVAC systems. Government mandates and green building certifications are further encouraging businesses to invest in energy-efficient and environmentally compliant HVAC systems. Moreover, technological advancements such as building automation and HVAC integration with smart systems are being widely adopted in commercial settings, fueling the segment growth.

Distribution Channel Analysis

The segmentation, based on end user, includes online, retail stores, wholesale stores, and others. The retail stores segment dominated with the largest share, driven by the convenience and wide product variety available in physical and online retail outlets. Major home improvement chains such as Home Depot and Lowe’s offer a broad selection of HVAC units, often with financing options and installation support, making it easier for consumers to make purchases. Retailers have further expanded their online presence, offering detailed product specifications and virtual consultations. This accessibility, coupled with strong brand presence and marketing, has led to increased customer preference for purchasing HVAC systems through retail channels in the U.S., thereby boosting the segment growth.

Key Players and Competitive Analysis

The U.S. HVAC systems market is highly competitive and characterized by the presence of numerous global and domestic players offering diverse and technologically advanced solutions. A few key industry leaders include Carrier Corporation, Trane, Lennox International Inc., and Johnson Controls, all of which maintain strong brand loyalty and extensive distribution networks. Companies such as Daikin Industries Ltd., Mitsubishi Electric Corporation, LG Electronics, and Samsung are aggressively expanding their U.S. footprint by offering energy-efficient, smart HVAC systems that meet growing consumer demand for sustainability. Rheem Manufacturing, Bosch Group, and AAON also play vital roles by catering to residential, commercial, and industrial sectors with specialized solutions. Innovations in smart thermostats, inverter technology, and eco-friendly refrigerants are intensifying competition, while regulatory standards around energy efficiency continue to influence product development. As a result, companies are heavily investing in R&D, strategic partnerships, and service networks to gain a competitive edge and capture greater market share..

Key Players

- AAON

- Bosch Group

- Carrier Corporation

- DAIKIN INDUSTRIES Ltd.

- Danfoss AS

- Frigidaire HVAC

- Fujitsu

- Haier Group

- Honeywell International Inc.

- Johnson Controls

- Lennox International Inc.

- LG Electronics

- Midea

- Mitsubishi Electric Corporation

- Munters

- Panasonic Corporation

- Rheem Manufacturing Company

- SAMSUNG

- STULZ Air Technology Systems, Inc.

- Trane

HVAC Systems Industry Developments

In January 2025, Panasonic launched the OASYS Residential Central Air Conditioning System in the U.S., introducing a first-of-its-kind energy-efficient solution that integrates Mini Split AC, ERV, and transfer fans to enhance indoor comfort and sustainability.

In April 2025, Foster International launched its own HVAC brand, FOSTER, offering energy-efficient systems and smart technologies designed for residential, commercial, and industrial applications, reinforcing its commitment to innovation, sustainability, and regional leadership in the HVAC industry.

U.S. HVAC Systems Market Segmentation

By Equipment Type Outlook (Revenue, USD Billion, 2020–2034)

- Heating

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Electric Baseboards

- Heating Cables

- Others

- Ventilation

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Others

- Cooling

- Air Conditioning

- Chillers

- Cooling Towers

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Residential

- Commercial

- Industrial

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Online

- Retail Stores

- Wholesale Stores

- Others

U.S. HVAC Systems Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 29.95 Billion |

|

Market Size in 2025 |

USD 32.02 Billion |

|

Revenue Forecast by 2034 |

USD 59.27 Billion |

|

CAGR |

7.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 29.95 billion in 2024 and is projected to grow to USD 59.27 billion by 2034.

The market is projected to register a CAGR of 7.1% during the forecast period.

A few of the key players in the market are AAON, Bosch Group, Carrier Corporation, DAIKIN INDUSTRIES Ltd., Danfoss AS, Frigidaire HVAC, Fujitsu, Haier Group, Honeywell International Inc., Johnson Controls, Lennox International Inc., LG Electronics, Midea, Mitsubishi Electric Corporation, Munters, Panasonic Corporation, Rheem Manufacturing Company, SAMSUNG, STULZ Air Technology Systems, Inc., and Trane.

The heating segment dominated the market share in 2024.

The commercial segment is expected to witness the significant growth during the forecast period.