U.S. Industrial Services Market Size, Share, Trends, Industry Analysis Report

By Type (Engineering & Consulting, Installation & Commissioning, Operational Improvement & Maintenance), By Application, By End Use– Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 128

- Format: PDF

- Report ID: PM6326

- Base Year: 2024

- Historical Data: 2020-2023

Overview

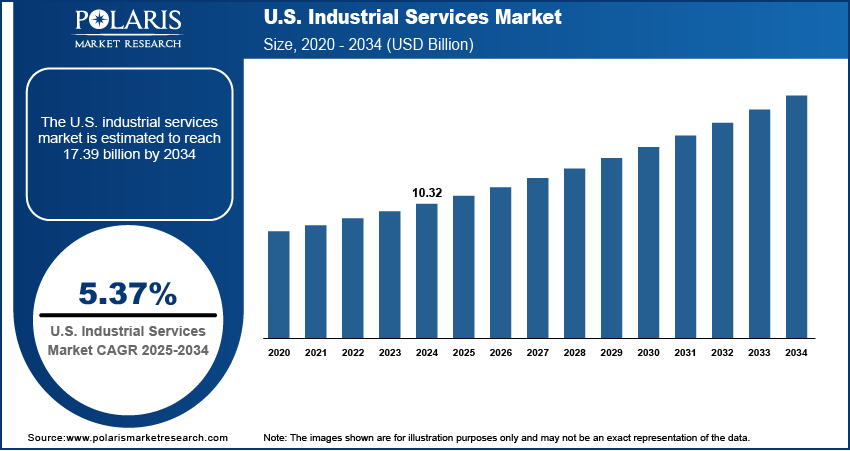

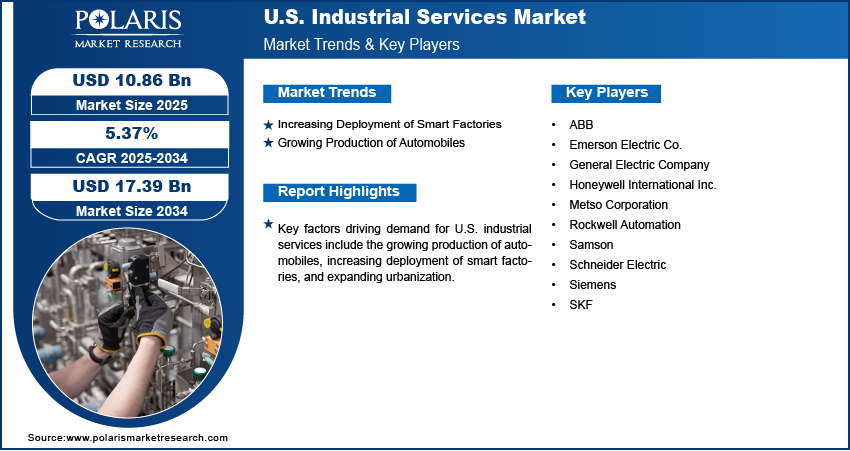

The U.S. industrial services market size was valued at USD 10.32 billion in 2024, growing at a CAGR of 5.37% from 2025 to 2034. Key factors driving demand for industrial services in the U.S. include the growing production of automobiles, increasing deployment of smart factories, and expanding urbanization.

Key Insights

- The engineering & consulting segment held the largest revenue share in 2024 due to the rising need for expert guidance in various industries such as automotive, oil & gas, and others.

- The distributed control system (DCS) segment dominated the major revenue share in 2024 due to its high reliability and precision in managing complex processes in the manufacturing industry.

Industry Dynamics

- Increasing deployment of smart factories is driving the need for advanced automation, real-time data analytics, and integrated digital systems, which is creating a demand for specialized industrial services.

- Growing production of automobiles is increasing the demand for industrial services by requiring extensive support across the manufacturing chain.

- The expanding industrialization across the country is expected to create a lucrative market opportunity during the forecast period.

- High cost of industrial services restrains the U.S. industrial services market expansion.

Market Statistics

- 2024 Market Size: USD 10.32 Billion

- 2034 Projected Market Size: USD 17.39 Billion

- CAGR (2025–2034): 5.37%

AI Impact on U.S. Industrial Services Market

- AI enhances predictive maintenance by analyzing real-time equipment data, reducing downtime, and extending asset life.

- It improves process optimization by identifying inefficiencies, enabling industries to cut costs and boost productivity.

- AI strengthens safety compliance by detecting anomalies, predicting risks, and ensuring regulatory adherence in high-risk sectors.

- AI supports workforce efficiency by automating repetitive tasks and compensating for labor shortages, allowing skilled workers to focus on high-value operations.

The U.S. market for industrial services encompasses a wide range of specialized support operations essential to manufacturing, energy, construction, automotive, and infrastructure sectors. These services include equipment maintenance, fabrication, welding, pipeline inspection, environmental compliance, and plant turnaround management. These services are used across various industries such as oil and gas, power generation, and heavy manufacturing to ensure operational efficiency, safety, and regulatory adherence.

A few benefits of industrial services include minimized downtime, extended equipment lifespan, improved productivity, and enhanced worker safety. These services support the reliability and sustainability of industrial operations by leveraging advanced technologies and skilled labor. Additionally, they contribute to cost savings and environmental protection through preventive maintenance and efficient resource management.

The demand for industrial services is driven by expanding urbanization. According to the World Bank Group, the urban population in the U.S. reached 84% in 2024 from 83% in 2022. This increased pressure on municipalities to expand their water supply, waste management, energy distribution, and transportation networks, all of which rely on industrial services. Urbanization further drove the demand for manufacturing, equipment maintenance, logistics, and engineering services to meet the demands of new residential and commercial projects. Additionally, urbanization led to the development of industrial parks and technology hubs in the country that propelled the demand for specialized industrial services such as engineering & consulting, installation & commissioning, and operational improvement & maintenance.

Drivers & Opportunities

Increasing Deployment of Smart Factories: Smart factories are driving the need for advanced automation, real-time data analytics, and integrated digital systems, which is creating a demand for specialized industrial services such as engineering & consulting, installation & commissioning, and operational improvement & maintenance. Smart factories rely on industrial service providers to manage predictive maintenance systems, optimize energy use, and ensure seamless communication between machines and control centers. Therefore, as smart factories expand, they create ongoing demand for technical training, software updates, and system integration services.

Growing Production of Automobiles: The growing production of automobiles in the U.S. is increasing the demand for industrial services by requiring extensive support across the manufacturing chain. United States motor vehicle production was reported at 10.61 million units in December 2023, an increase from 10.05 million units in December 2022. Automakers rely on industrial services such as precision machining, robotic automation, tooling, and assembly line maintenance to keep production efficient and consistent. The expansion of electric vehicle production in the country is further driving demand for specialized industrial services such as battery assembly line integration and high-voltage system testing. Additionally, surface treatment, welding, and quality control services are becoming essential to meet safety and performance standards, with the growing production. Therefore, as output rises, companies need more frequent equipment calibration, predictive maintenance, and supply chain logistics services to manage parts and materials.

Segmental Insights

Type Analysis

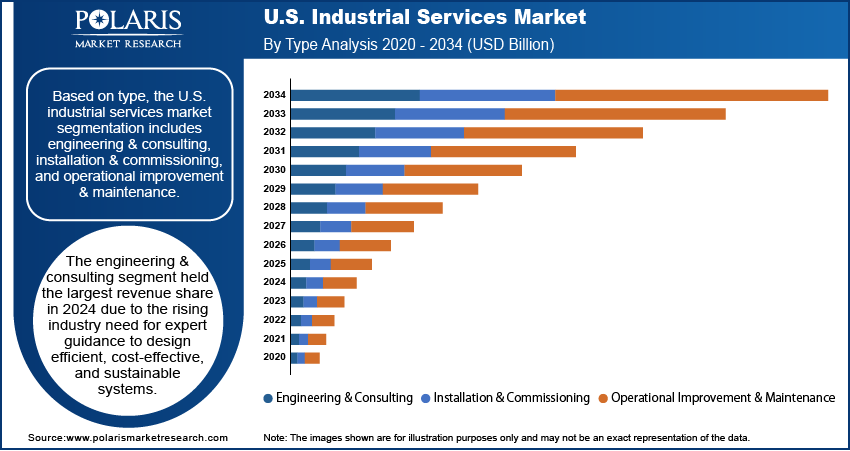

Based on type, the U.S. industrial services market segmentation includes engineering & consulting, installation & commissioning, and operational improvement & maintenance. The engineering & consulting segment held the largest revenue share in 2024 due to rising industry need for expert guidance to design efficient, cost-effective, and sustainable systems. Companies in manufacturing, energy, and chemicals sought engineering & consulting services to optimize production processes, meet strict regulatory standards, and integrate digital technologies such as Industrial Internet of Things (IIoT) and automation. Companies further invested significantly in consulting services to reduce operational risks, improve plant safety, and enhance productivity. The increasing focus on environmental compliance and carbon reduction strategies further pushed demand for engineering services.

The operational improvement & maintenance segment is projected to grow at a rapid pace during the forecast period, owing to growing pressure to minimize downtime and extend the lifecycle of expensive assets. Companies across the automotive and oil & gas industries are investing in advanced maintenance services to reduce unplanned outages, improve energy efficiency, and ensure workplace safety. The rising adoption of digital twins and AI-driven predictive analytics strengthens the segment by enabling real-time performance tracking. Increasing labor shortages and the high costs of equipment replacement are also fueling the need for reliable operational improvement & maintenance services.

Application Analysis

In terms of application, the U.S. industrial services market segmentation includes distributed control system (DCS), programmable controller logic (PLC), supervisory control and data acquisition (SCADA), electric motors & drives, valves & actuators, manufacturing execution system, and others. The distributed control system (DCS) segment dominated the major revenue share in 2024 due to its ability to manage complex processes with high reliability and precision. Power generation, oil and gas, and chemical manufacturing facilities adopted DCS solutions to ensure consistent operations, achieve seamless integration with safety systems, and meet stringent regulatory requirements. Companies invested in these systems to optimize energy consumption, minimize human errors, and enhance plant productivity. The growing need for centralized monitoring and control across large-scale facilities also supported the dominance of the DCS segment.

End Use Analysis

In terms of end use, the U.S. industrial services market segmentation includes oil and gas, chemicals, automotive, pharmaceuticals, and others. The oil and gas segment accounted for a major revenue share in 2024 due to increasing pressure to modernize aging infrastructure and optimize production costs amid fluctuating crude oil prices. Companies within the oil & gas sector deployed advanced maintenance services, engineering solutions, and digital monitoring systems to minimize downtime and extend equipment life. Strict environmental and safety regulations also pushed firms to adopt specialized services that ensured compliance while enhancing energy efficiency. The need to maximize output from aging facilities and the growth of shale gas production further fueled demand for industrial services in the oil & gas sector.

The automotive segment is expected to grow at a rapid pace in the coming years, owing to the rising investments in automation, smart manufacturing, and sustainable production practices. The transition toward electric vehicles (EVs) requires new production lines, advanced robotics, and precise quality control, driving demand for installation, commissioning, and maintenance services. Automakers are also adopting digital twins, predictive maintenance, and data-driven services to reduce costs and improve efficiency in high-volume production environments. Growing consumer demand for EVs and government incentives for clean mobility are pushing companies to expand manufacturing capacity, creating continuous opportunities for service providers.

Key Players & Competitive Analysis

The U.S. industrial services market features a highly competitive landscape shaped by key players such as ABB, Emerson Electric Co., General Electric Company, Honeywell International Inc., Siemens, SKF, and others. These companies offer a broad range of services, including predictive maintenance, asset optimization, automation integration, and digital transformation solutions. Competition is driven by technological innovation, particularly in IoT, AI, and cloud-based platforms that enhance operational efficiency. Established firms leverage their global expertise and strong service networks, while regional providers focus on niche applications and localized support. Strategic partnerships, mergers, and acquisitions are common as companies aim to expand service portfolios and capture market share. With increasing demand for smart manufacturing and sustainability, vendors differentiate through advanced analytics, energy efficiency solutions, and end-to-end lifecycle services, making the industrial services sector dynamic and innovation-focused.

A few major companies operating in the U.S. industrial services market include ABB, Emerson Electric Co., General Electric Company, Honeywell International Inc., Metso Corporation, Rockwell Automation, Samson, Schneider Electric, Siemens, and SKF.

Key Companies

- ABB

- Emerson Electric Co.

- General Electric Company

- Honeywell International Inc.

- Metso Corporation

- Rockwell Automation

- Samson

- Schneider Electric

- Siemens

- SKF

U.S. Industrial Services Industry Developments

In May 2025, Siemens announced an expansion of its industrial AI offerings with advanced AI agents designed to work seamlessly across its established Industrial Copilot ecosystem.

In September 2024, ABB announced the launch of a new suite of service offerings designed to simplify maintenance and improve the operational health of crucial mining assets.

U.S. Industrial Services Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Engineering & Consulting

- Installation & Commissioning

- Operational Improvement & Maintenance

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Distributed Control System (DCS)

- Programmable Controller Logic (PLC)

- Supervisory Control and Data Acquisition (SCADA)

- Electric Motors & Drives

- Valves & Actuators

- Manufacturing Execution System

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Oil and Gas

- Chemicals

- Automotive

- Pharmaceuticals

- Others

U.S. Industrial Services Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 10.32 Billion |

|

Market Size in 2025 |

USD 10.86 Billion |

|

Revenue Forecast by 2034 |

USD 17.39 Billion |

|

CAGR |

5.37% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 10.32 billion in 2024 and is projected to grow to USD 17.39 billion by 2034.

The market is projected to register a CAGR of 5.37% during the forecast period.

A few of the key players in the market are ABB, Emerson Electric Co., General Electric Company, Honeywell International Inc., Metso Corporation, Rockwell Automation, Samson, Schneider Electric, Siemens, and SKF.

The engineering & consulting segment dominated the market revenue share in 2024.

The automotive segment is projected to witness the fastest growth during the forecast period.