U.S. Intelligent Building Automation Technologies Market Size, Share, Volume, Trends, Industry Analysis Report

By Component (Hardware, Software, Services), By End User – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6158

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

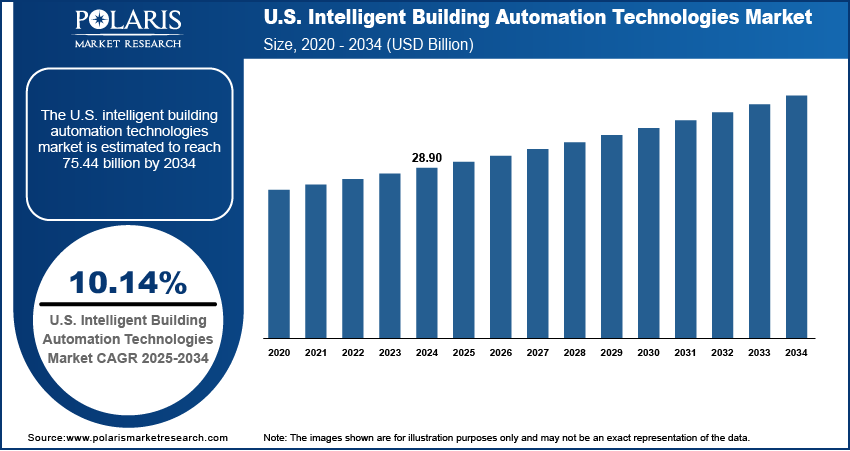

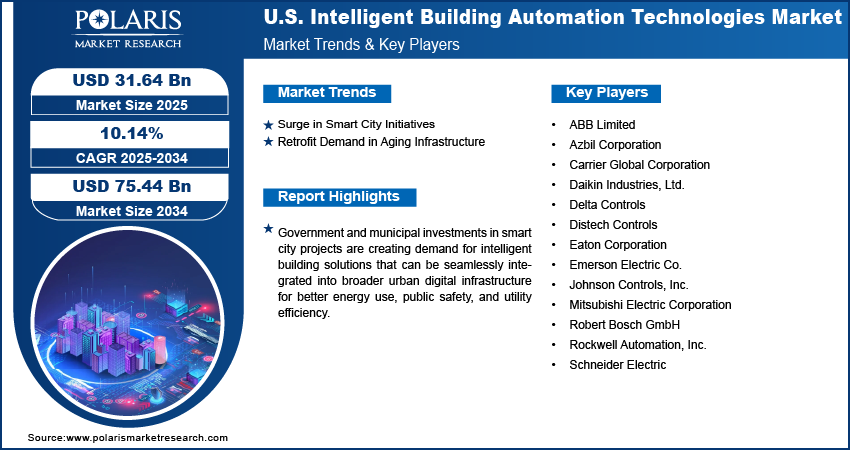

The U.S. intelligent building automation technologies market size was valued at USD 28.90 billion in 2024, growing at a CAGR of 10.14% from 2025 to 2034. Government and municipal investments in smart city projects are creating demand for intelligent building solutions that can be seamlessly integrated into broader urban digital infrastructure for better energy use, public safety, and utility efficiency.

Key Insights

- The hardware segment captured ~48% of the revenue share in 2024, driven by extensive deployment of physical devices.

- The commercial segment held around 58% of the revenue share in 2024, fueled by the widespread adoption of intelligent automation systems in office buildings, airports, hospitals, and retail complexes.

Industry Dynamics

- Increasing demand for energy efficiency and smart infrastructure is driving the adoption of automation technologies in commercial and public buildings.

- Stringent building codes and sustainability standards are pushing facility managers to upgrade to intelligent HVAC, lighting, and security systems.

- Integration of AI and IoT enables predictive maintenance and real-time energy optimization in large-scale building management systems.

- High initial installation costs and cybersecurity concerns limit faster adoption, especially among small and mid-sized commercial property owners.

Market Statistics

- 2024 Market Size: USD 28.90 billion

- 2034 Projected Market Size: USD 75.44 billion

- CAGR (2025–2034): 10.14%

To Understand More About this Research: Request a Free Sample Report

The intelligent building automation technologies market involves the integration of advanced systems and software that automate various building operations such as heating, ventilation, air conditioning (HVAC), lighting, security, and energy management. These technologies use sensors, controllers, and data analytics to enhance building performance, reduce energy consumption, and improve occupant comfort and safety. The U.S. market is rapidly evolving due to the convergence of smart infrastructure, IoT, and sustainability objectives. Stricter federal and state-level energy codes are pushing commercial property owners to deploy intelligent automation systems to monitor and reduce energy usage while maintaining regulatory compliance and achieving LEED certification.

Proliferation of IoT sensors and devices is enabling remote monitoring and control of building systems, improving energy performance, equipment maintenance, and user comfort through predictive analytics and automated response. Moreover, rising preference for sustainable buildings among developers and tenants is increasing investments in automated HVAC, lighting, and energy management systems that reduce emissions and improve building ratings.

Drivers & Opportunities

Surge in Smart City Initiatives: Smart city development is becoming a major catalyst for the U.S. intelligent building automation technologies market. Local governments are deploying integrated digital infrastructure to improve urban living, which includes upgrading commercial and residential buildings with automated systems. In September 2023, the Department of Commerce, in conjunction with NOAA, allocated USD 12.7 million to propel the Climate-Smart Communities Initiative forward. These buildings are being equipped with smart lighting, HVAC, energy metering, and security systems that communicate with municipal control centers. The goal is to enhance energy efficiency, reduce environmental impact, and improve public safety. Intelligent buildings are also contributing to better traffic management, grid stability, and emergency response by interacting with other smart city systems. This interconnectedness is making building automation a core component of urban planning strategies.

Retrofit Demand in Aging Infrastructure: Many buildings across the U.S. were constructed decades ago and now fall short of modern standards for energy efficiency, safety, and operational control. In May 2024, the U.S. Department of Transportation’s Federal Transit Administration designated USD 343 million in federal grant funding to enhance the infrastructure of eight rail transit systems across eight states. This initiative aims to retrofit some of the most antiquated and heavily-utilized rail networks in the country. Facility managers are increasingly turning to intelligent building automation technologies as a practical solution for retrofitting older infrastructure. These systems enable the integration of automated lighting, HVAC optimization, occupancy sensors, and centralized monitoring without needing major construction work. Retrofitting offers building owners a way to reduce operating costs, comply with new regulations, and extend the usable life of aging structures. The cost-effectiveness and non-disruptive nature of these solutions are making them an attractive option across both public and private sectors.

Segmental Insights

Component Analysis

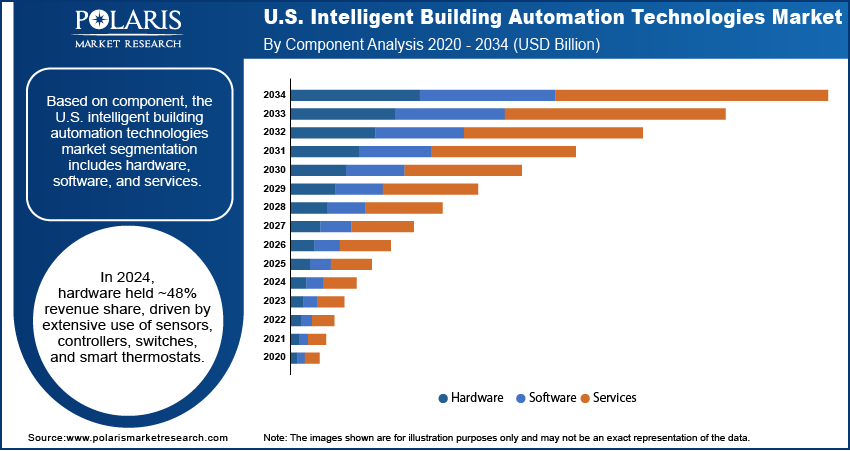

Based on component, the U.S. intelligent building automation technologies market segmentation includes hardware, software, and services. The hardware segment accounted for ~48% of revenue share in 2024 due to widespread deployment of physical devices such as sensors, controllers, switches, and smart thermostats across commercial properties. These components serve as the backbone of automated systems, enabling real-time data capture and operational control across lighting, HVAC, and security infrastructure. Increasing upgrades in legacy buildings and installations in new constructions are fueling hardware sales. Facility operators are prioritizing hardware investments that ensure immediate performance visibility and seamless connectivity to centralized automation networks, which is reinforcing the importance of hardware within the building intelligence ecosystem.

The software segment is expected to register a CAGR of 11.3% from 2025 to 2034 due to rising demand for integrated building management platforms that offer centralized control, data analytics, and automation optimization. Growth in smart city developments and energy-efficient retrofits is increasing the adoption of cloud-based dashboards and AI-driven analytics tools, which allow building managers to monitor energy usage, detect faults, and automate environmental controls remotely. Customizable and scalable software applications are supporting cross-platform integration and real-time decision-making, making software a vital enabler of intelligent infrastructure strategies across sectors aiming for predictive and cost-efficient facility management.

End User Analysis

In terms of end use, the U.S. intelligent building automation technologies market segmentation includes commercial, residential, and industrial. The commercial segment accounted for ~58% of the revenue share in 2024 due to large-scale adoption of intelligent automation systems across office buildings, airports, hospitals, and retail complexes. Facility managers are deploying these technologies to improve occupant comfort, optimize energy consumption, and reduce operational costs. Heightened focus on ESG compliance and stricter energy regulations are pushing companies to install intelligent lighting, access control, and climate management systems. High footfall, long operational hours, and the need for continuous monitoring make commercial facilities ideal candidates for comprehensive automation integration, driving substantial hardware and software investments across this sector.

The residential segment is projected to register a CAGR of 9.4% from 2025 to 2034, as consumers adopt smart home technologies that offer convenience, security, and energy efficiency. Increasing popularity of voice-controlled devices, smart thermostats, and automated lighting is accelerating the shift toward intelligent living environments. Rising awareness about home energy management, combined with federal and state incentives for energy-saving solutions, is supporting adoption across both single-family and multi-family dwellings. The ability to monitor and manage household functions remotely through mobile apps is resonating with tech-savvy homeowners. Customizable platforms and increasing affordability of smart home systems are encouraging broader residential integration of automation technologies.

Key Players and Competitive Analysis

The competitive landscape of the U.S. intelligent building automation technologies market is defined by rapid industry analysis-driven innovation and aggressive market expansion strategies. Companies are actively pursuing mergers and acquisitions to strengthen their product portfolios, improve distribution networks, and gain access to emerging technologies. Strategic alliances and joint ventures are being forged between automation technology providers, software developers, and construction firms to deliver integrated, scalable solutions for both retrofitting projects and new smart infrastructure developments. Post-merger integration efforts are focused on streamlining operations and aligning R&D capabilities to accelerate product development. Technological advancements in edge computing, wireless communication, AI-driven analytics, and cybersecurity are further reshaping competition, prompting players to enhance platform interoperability and user experience. Many firms are investing heavily in cloud-based solutions and open-source protocols to meet the growing demand for flexible, energy-efficient automation ecosystems. The market’s evolution is largely shaped by innovation agility, regulatory alignment, and collaborative development across value chains.

Key Players

- ABB Limited

- Azbil Corporation

- Carrier Global Corporation

- Daikin Industries, Ltd.

- Delta Controls

- Distech Controls

- Eaton Corporation

- Emerson Electric Co.

- Johnson Controls, Inc.

- Mitsubishi Electric Corporation

- Robert Bosch GmbH

- Rockwell Automation, Inc.

- Schneider Electric

U.S. Intelligent Building Automation Technologies Industry Developments

June 2025: Honeywell launched Honeywell Connected Solutions, an AI-driven platform that integrates key building management software into a single interface for improved operational efficiency.

December 2023: ABB announced the acquisition of Eve Systems GmbH, a Munich-based leader in smart home products with operations in the U.S.

U.S. Intelligent Building Automation Technologies Market Segmentation

By Component Outlook (Revenue, USD Billion, Volume 2020–2034)

- Hardware

- Sensors

- Controllers

- Actuators

- Networking Devices

- Others

- Software

- Building Management Systems (BMS)

- Energy Management Software

- Lighting Control Software

- HVAC Control Software

- Fire, Life & Safety and Security

- Others

- Services

- Professional Services

- Managed Services

By End User Outlook (Revenue, USD Billion, Volume, 2020–2034)

- Commercial

- Residential

- Industrial

U.S. Intelligent Building Automation Technologies Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 28.90 billion |

|

Market Size in 2025 |

USD 31.64 billion |

|

Revenue Forecast by 2034 |

USD 75.44 billion |

|

CAGR |

10.14% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The U.S. market size was valued at USD 28.90 billion in 2024 and is projected to grow to USD 75.44 billion by 2034.

The U.S. market is projected to register a CAGR of 10.14% during the forecast period.

A few of the key players in the market are ABB Limited; Azbil Corporation; Carrier Global Corporation; Daikin Industries, Ltd.; Delta Controls; Distech Controls; Eaton Corporation; Emerson Electric Co.; Johnson Controls, Inc.; Mitsubishi Electric Corporation; Robert Bosch GmbH; Rockwell Automation, Inc.; and Schneider Electric.

The hardware segment accounted for ~48% of revenue share in 2024 due to widespread deployment of physical devices such as sensors, controllers, switches, and smart thermostats across commercial properties.

The commercial segment accounted for ~58% of the revenue share in 2024 due to large-scale adoption of intelligent automation systems across office buildings, airports, hospitals, and retail complexes.