U.S. Laminar Airflow Cabinet Market Size, Share, Trends, Industry Analysis Report

By Size (2x2 Feet, 3x2 Feet, 4x2 Feet, 6x2 Feet, and 8x2 Feet), By Product, By Class, By End Use – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 128

- Format: PDF

- Report ID: PM6317

- Base Year: 2024

- Historical Data: 2020-2023

Overview

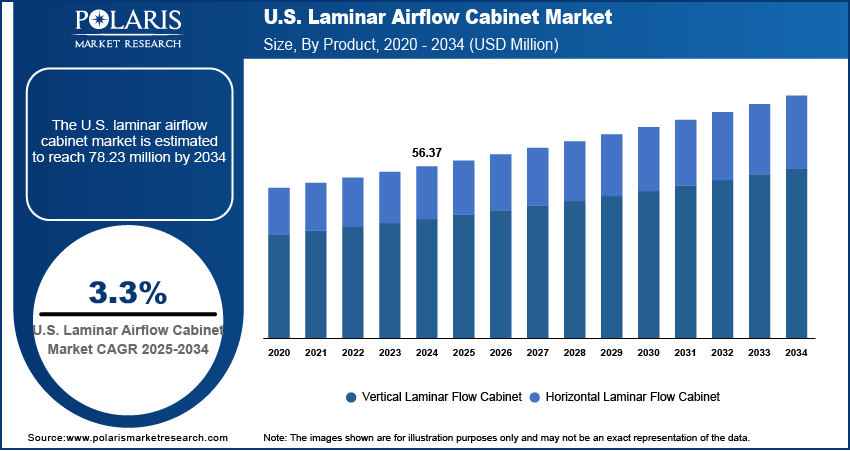

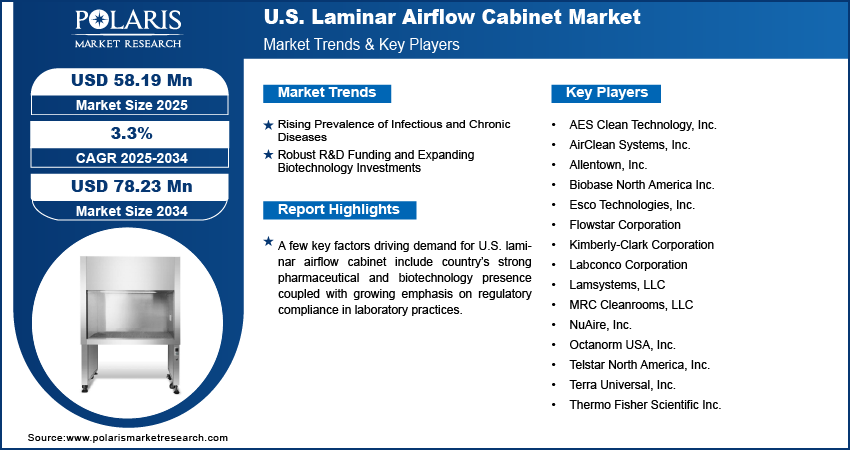

The U.S. laminar airflow cabinet market size was valued at USD 56.37 million in 2024, growing at a CAGR of 3.3% from 2025 to 2034. Key factors driving demand for U.S. laminar airflow cabinet include rising prevalence of infectious and chronic diseases coupled with robust R&D funding and expanding biotechnology investments.

Key Insights

- The 4x2 feet segment held the largest market share in 2024, attributed to optimized design, affordability, and adaptability for medium-volume laboratory operations.

- The vertical laminar flow cabinets segment accounted for the largest share in 2024, due to efficient airflow distribution, improved contamination control, and effectiveness in applications that demand sterile environments.

Industry Dynamics

- Rising prevalence of infectious and chronic diseases is driving demand for sterile laboratory environments, increasing the adoption of laminar airflow cabinets across U.S. hospitals, diagnostic centers, and pharmaceutical research facilities to ensure safe handling of samples and improved biosafety.

- Robust R&D funding and expanding biotechnology investments are strengthening the market outlook, supported by significant federal allocations and private sector spending that boosts laboratory modernization and the use of advanced airflow systems for contamination control.

- High initial investment costs and ongoing maintenance requirements restraining the market growth, limiting widespread adoption among smaller laboratories, academic institutions, and resource-constrained healthcare facilities that face budget challenges.

- Integration of smart monitoring systems presents strong opportunities for market growth, enabling real-time airflow and particulate monitoring, enhanced filter performance tracking, and improved compliance with stringent FDA and OSHA laboratory safety standards.

Market Statistics

- 2024 Market Size: USD 56.37 Million

- 2034 Projected Market Size: USD 78.23 Million

- CAGR (2025–2034): 3.3%

The U.S. laminar airflow cabinet market comprises advanced containment systems engineered to deliver sterile, particle-free working environments by maintaining consistent airflow across the workspace. These cabinets are extensively utilized in pharmaceutical manufacturing facilities, biotechnology research centers, clinical laboratories, and healthcare institutions to safeguard sensitive samples, cell cultures, and drug formulations from contamination. Continuous advancements in high-efficiency particulate air (HEPA) and ultra-low penetration air (ULPA) filtration, real-time airflow monitoring, and ergonomically optimized designs increases the safety, energy efficiency, and reliability of these systems.

The adoption of laminar airflow cabinets in the U.S. is increasing due to the country’s strong pharmaceutical and biotechnology presence coupled with growing emphasis on regulatory compliance in laboratory practices. The growing demand for sterile environments in drug manufacturing, biologics development, and diagnostic laboratories is fueling market growth. These systems integrate advanced airflow management technologies, next-generation HEPA/ULPA filters, and operator-friendly configurations to improve contamination control, minimize occupational hazards, and enhance workflow efficiency.

The growing expansion of healthcare services and pharmaceutical manufacturing is fueling the demand for sterile and contamination-free laboratory environments. U.S. laminar airflow cabinets are essential in maintaining product integrity and protecting sensitive samples during drug formulation, clinical testing, and advanced research activities. As per the Kaiser Family Foundation (KFF) data, health spending in the U.S. is expected to reach USD 5.6 trillion by the end of 2025, with hospitals contributing the largest portion at USD 1.8 trillion. Increasing healthcare expenditures at domestic and global levels are strengthening the need for advanced laboratory safety solutions, such as laminar airflow cabinets, to support stringent quality control measures and safeguard patient health outcomes.

Drivers & Opportunities

Rising Prevalence of Infectious and Chronic Diseases: The growing burden of infectious and chronic diseases across the U.S. is driving the demand for safe diagnostic testing and sterile laboratory environments. According to the U.S. Centers for Disease Control and Prevention (CDC), 6 out of 10 U.S. citizen live with at least one chronic disease, while 4 in 10 are affected by two or more chronic conditions. This rising disease prevalence is creating strong demand for contamination-free laboratory infrastructure to ensure accurate diagnostics, effective drug development, and safe clinical testing. As a result, the adoption of U.S. laminar airflow cabinets is expanding across research institutions, diagnostic laboratories, and pharmaceutical companies to maintain sterility, minimize contamination risks, and comply with stringent biosafety standards.

Robust R&D Funding and Expanding Biotechnology Investments: The strong presence of pharmaceutical and biotechnology companies making substantial investments in research and development activities, is propelling the market growth. As per the Public Spend Forum, the U.S. federal government allocated more than USD 3.13 trillion toward biotechnology and medical technology R&D between FY2018 and FY2022, reflecting a 62% increase over the period. This robust funding, along with continuous advancements in life sciences, is driving the adoption of laminar airflow cabinets to ensure sterile environments across laboratories, cleanrooms, and production facilities.

Segmental Insights

By Size

Based on size, the U.S. laminar airflow cabinet market is segmented into 2x2 feet, 3x2 feet, 4x2 feet, 6x2 feet, and 8x2 feet units. The 4x2 feet cabinets accounted for the largest share in 2024, driven by balanced design, suitability for medium-volume laboratory operations, and cost efficiency. These units are widely adopted across pharmaceutical, biotechnology, and academic laboratories for providing contamination-free work environments.

The 6x2 feet and 8x2 feet cabinets are projected to witness significant growth during the forecast period, fueled by its capacity to handle large-scale operations, high-throughput testing, and bulk sample processing requirements across cleanrooms and semiconductor facilities.

By Product

Based on product, the U.S. laminar airflow cabinet market is categorized into vertical laminar flow cabinets and horizontal laminar flow cabinets. Vertical laminar flow cabinets accounted for the largest share in 2024, due to superior airflow pattern, enhanced contamination control, and suitability for applications requiring sterile conditions such as pharmaceutical manufacturing, microbiology, and clinical research.

Horizontal laminar flow cabinets are projected to register the fastest growth over the forecast period, due to its ability to deliver consistent and uniform airflow across the workspace, minimize turbulence, and create highly stable environments. These cabinets are increasingly preferred in sensitive applications such as electronic assembly, diagnostic testing, and food quality control, where contamination control and precision handling are essential.

By Class

Based on class, the U.S. laminar airflow cabinet market is segmented into Class 1, Class 2, and Class 3 systems. Class 2 cabinets held the largest share in 2024, driven by advanced biosafety features, ability to safeguard operators and samples simultaneously, and extensive deployment in pharmaceutical production facilities, biotechnology laboratories, and clinical research centers. The growing emphasis on maintaining contamination-free environments during drug discovery services, diagnostic testing, and cell culture processes are further boosting the demand for Class 2 systems.

Class 3 cabinets, are anticipated to record the fastest growth during the forecast period, due to unmatched containment capabilities, absolute sterility, and highly secure design for handling the most hazardous and infectious pathogens. These systems are increasingly used in high-risk laboratory settings such as biosafety level-3 and biosafety level-4 facilities, where high class safety and contamination control are required.

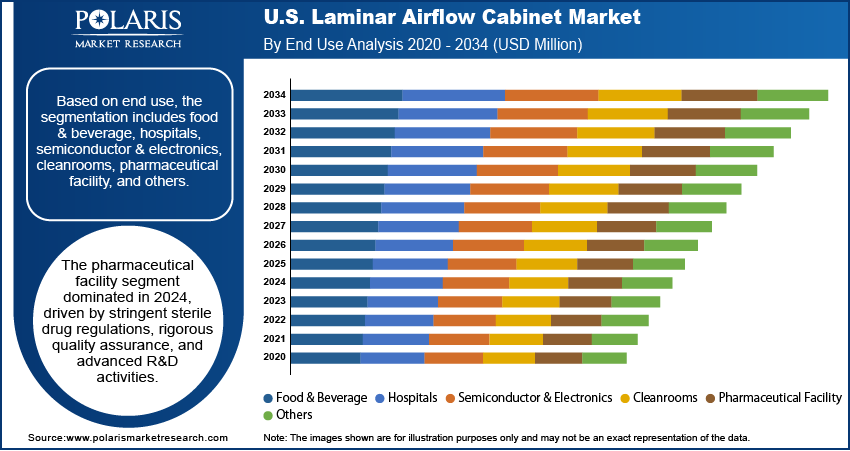

By End-Use

Based on end-use, the U.S. laminar airflow cabinet market is segmented into food & beverage, hospitals, semiconductor & electronics, cleanrooms, pharmaceutical facilities, and others. Pharmaceutical facilities accounted for the largest share in 2024, driven by stringent regulatory requirements for contamination-free drug manufacturing, quality assurance testing, and R&D activities.

Semiconductor & electronics are projected to witness significant growth over the forecast period, owing to the rising demand for particle-free assembly environments, precision manufacturing, and microelectronics production. Hospitals are adopting laminar airflow cabinets to ensure sterile conditions in diagnostic laboratories, surgical setups, and microbiology testing units.

Key Players & Competitive Analysis

The U.S. laminar airflow cabinet market is highly competitive, with key players such as AES Clean Technology, Inc., AirClean Systems, Inc., and Thermo Fisher Scientific Inc. driving growth through advanced product development, regulatory compliance, and extensive nationwide distribution networks. Thermo Fisher Scientific Inc. continues to lead with innovations in contamination-control technologies, incorporating advanced airflow mechanisms, HEPA/ULPA filtration systems, and user-friendly designs tailored for research, clinical, and pharmaceutical applications. Companies such as AES Clean Technology, Inc. and NuAire, Inc. are strengthening their portfolios by focusing on cleanroom infrastructure and biosafety cabinet solutions, supporting the expanding demand from biopharmaceutical manufacturing, healthcare institutions, and academic research centers across the country.

The U.S. market is experiencing rising adoption of laminar airflow cabinets across pharmaceutical laboratories, biotechnology firms, diagnostic centers, and hospitals, owing to growing emphasis on sterile, contamination-free environments for drug discovery, vaccine development, and clinical testing. Manufacturers are introducing next-generation horizontal and vertical cabinets equipped with energy-efficient airflow systems, integrated digital monitoring, and ergonomic designs to improve safety, reduce contamination risks, and enhance operational efficiency. Strategic collaborations with pharmaceutical companies, cleanroom contractors, and federal research organizations are further strengthening the market presence of these players.

Prominent companies operating in the U.S. laminar airflow cabinet market include AES Clean Technology, Inc., AirClean Systems, Inc., Allentown, Inc., Biobase North America Inc., Esco Technologies, Inc., Flowstar Corporation, Kimberly-Clark Corporation, Labconco Corporation, Lamsystems, LLC (U.S. division), MRC Cleanrooms, LLC, NuAire, Inc., Octanorm USA, Inc., Telstar North America, Inc., Terra Universal, Inc., and Thermo Fisher Scientific Inc.

Key Players

- AES Clean Technology, Inc.

- AirClean Systems, Inc.

- Allentown, Inc.

- Biobase North America Inc.

- Esco Technologies, Inc.

- Flowstar Corporation

- Kimberly-Clark Corporation

- Labconco Corporation

- Lamsystems, LLC

- MRC Cleanrooms, LLC

- NuAire, Inc.

- Octanorm USA, Inc.

- Telstar North America, Inc.

- Terra Universal, Inc.

- Thermo Fisher Scientific Inc.

U.S. Laminar Airflow Cabinet Industry Developments

In October 2024: Germfree finalized the acquisition of Arcoplast, enhancing its portfolio of cleanroom and containment facility solutions. The acquisition broadens Germfree’s ability to deliver turnkey projects with advanced architectural finishes, while supporting expansion in biopharmaceutical manufacturing, high-containment laboratory environments, and sterile production facilities.

U.S. Laminar Airflow Cabinet Market Segmentation

By Size Outlook (Revenue, USD Million, 2020–2034)

- 2x2 Feet

- 3x2 Feet

- 4x2 Feet

- 6x2 Feet

- 8x2 Feet

By Product Outlook (Revenue, USD Million, 2020–2034)

- Vertical Laminar Flow Cabinet

- Horizontal Laminar Flow Cabinet

By Class Outlook (Revenue, USD Million, 2020–2034)

- Class 1

- Class 2

- Class 3

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Food & Beverage

- Hospitals

- Semiconductor & Electronics

- Cleanrooms

- Pharmaceutical Facility

- Others

U.S. Laminar Airflow Cabinet Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 56.37 Million |

|

Market Size in 2025 |

USD 58.19 Million |

|

Revenue Forecast by 2034 |

USD 78.23 Million |

|

CAGR |

3.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, and segmentation. |

FAQ's

The market size was valued at USD 56.37 million in 2024 and is projected to grow to USD 78.23 million by 2034.

The market is projected to register a CAGR of 3.3% during the forecast period.

A few of the key players in the market are AES Clean Technology, Inc., AirClean Systems, Inc., Allentown, Inc., Biobase North America Inc., Esco Technologies, Inc., Flowstar Corporation, Kimberly-Clark Corporation, Labconco Corporation, Lamsystems, LLC (U.S. division), MRC Cleanrooms, LLC, NuAire, Inc., Octanorm USA, Inc., Telstar North America, Inc., Terra Universal, Inc., and Thermo Fisher Scientific Inc.

The 4x2 feet segment dominated the market revenue share in 2024.

The horizontal laminar flow cabinets segment is projected to witness the fastest growth during the forecast period.