U.S. Liquid Embolic Agent Market Size, Share, Trends, & Industry Analysis Report

By Product Type (Ethylene Vinyl Alcohol Copolymer (EVOH), Cyanoacrylates, Others), By Application, By End User– Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6329

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

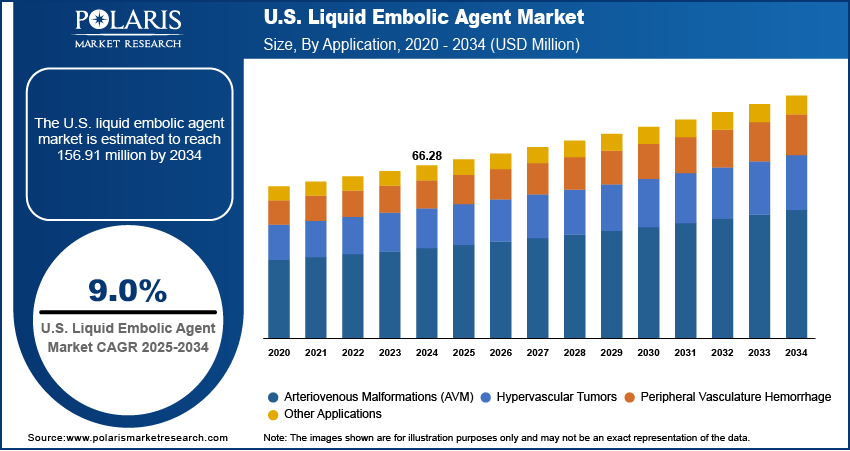

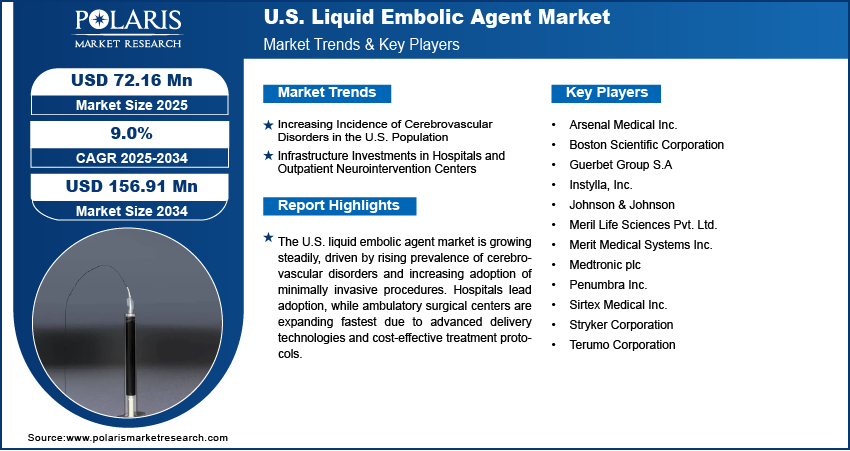

The U.S. liquid embolic agent market size was valued at USD 66.28 million in 2024, growing at a CAGR of 9.0% during 2025–2034. Rising incidence of cerebrovascular disorders in the U.S. coupled with infrastructure investments in hospitals and outpatient neurointervention centers is driving the growth of neurovascular interventions.

Key Insights

- The ethylene vinyl alcohol (EVOH) segment dominated the U.S. liquid embolic agent market in 2024, driven by its proven efficacy in treating arteriovenous malformations (AVMs) and favorable procedural outcomes.

- The ambulatory surgical centers are projected to grow at the fastest CAGR during the forecast period, fueled by increasing outpatient procedures, cost-efficient and minimally invasive treatments.

Industry Dynamics

- Rising incidence of cerebrovascular disorders in the U.S. population, including arteriovenous malformations (AVMs) and aneurysms is driving demand for liquid embolic agents.

- Growing infrastructure investments in hospitals and outpatient neurointervention centers are fueling broader adoption and market growth.

- Integration of advanced polymer formulations, radiopaque visibility and microcatheter delivery systems is creating opportunities in minimally invasive interventions.

- High procedural costs and technical complexity are limiting adoption and constraining market expansion.

Market Statistics

- 2024 Market Size: USD 66.28 Million

- 2034 Projected Market Size: USD 156.91 Million

- CAGR (2025–2034): 9.0%

The U.S. liquid embolic agent industry is driven by the rising incidence of cerebrovascular disorders, including arteriovenous malformations (AVMs), aneurysms, and peripheral vascular abnormalities. Liquid embolic agents, such as ethylene vinyl alcohol (EVOH)-based copolymers, n-butyl cyanoacrylate (NBCA), and newer polymer formulations, enable controlled occlusion of blood vessels with precision. Manufacturers are investing in advanced delivery systems, microcatheters, and radiopaque formulations to improve procedural accuracy and enhance patient safety. Regulatory approvals, including FDA clearance, ensure product quality and clinical reliability, supporting adoption across hospitals, neurointervention centers, and specialty clinics.

Increasing preference for minimally invasive procedures and targeted vascular therapies is expanding applications in AVM treatment, aneurysm embolization, and peripheral vascular occlusions. Innovations, including improved polymer biocompatibility, enhanced visibility under imaging, and flow-control systems, are optimizing treatment outcomes and reducing procedural risks. Hospitals and outpatient intervention centers are integrating digital planning tools and microcatheter navigation systems to streamline procedure workflow, enhance precision, and manage operational costs effectively. For instance, in July 2025, Arsenal Medical’s NeoCast liquid embolic showed strong results in the EMBO-02 trial for chronic subdural hematoma. The study reported complete vessel blockage, high hematoma resolution, and no injection-related pain, suggesting it could be a safe, pain-free alternative to surgery.

Rapidly increasing govenrment healthcare programs and infrastructure development are contributing to broader access to embolization services. Rising awareness of early intervention, preventive care, and minimally invasive surgery options is supporting hospital adoption of liquid embolic agents. In addition, growing focus on cost-effective and efficient treatment protocols is promoting the use of durable, controlled, and predictable embolic agents. Rising adoption of precision medicine and adherence to clinical guidelines is reinforcing the role of liquid embolic agents in modern cerebrovascular care.

Drivers & Opportunities

Increasing Incidence of Cerebrovascular Disorders in the U.S. Population: The rising prevalence of cerebrovascular disorders, including arteriovenous malformations (AVMs), intracranial aneurysms, and peripheral vascular abnormalities, is driving demand for liquid embolic agents in the U.S. Increasing cases of stroke and vascular malformations create a greater need for precise and minimally invasive embolization procedures. As per the U.S. Centers for Disease Control and Prevention (CDC), approximately 7.8 million U.S. adults (3.1%) experienced a stroke. In 2023, stroke was the fourth leading cause of death in the U.S., with 162,639 deaths, equating to a rate of 48.6 per 100,000 population. Moreover, advancements in polymer formulations and radiopaque visibility enhance procedural accuracy, supporting adoption among neurointervention specialists. In addition, growing awareness among clinicians and patients about early intervention and minimally invasive therapies is promoting frequent use of liquid embolic agents, further expanding the market.

Infrastructure Investments in Hospitals and Outpatient Neurointervention Centers: Rising investments in hospitals and outpatient neurointervention centers in the U.S. are supporting wider adoption of liquid embolic agents. Expansion of advanced imaging facilities, catheterization labs, and minimally invasive procedure suites enables hospitals and clinics to perform complex embolization procedures with higher precision and efficiency. For instance, in September 2024, the U.S. Department of Health and Human Services (HHS) announced a USD 75 million investment to enhance healthcare services in rural communities. The funding, administered by the Health Resources and Services Administration (HRSA) is expected to support substance use disorder treatment, expand maternal healthcare services in the South, and assist rural hospitals in maintaining operations. Moreover, investments in digital planning tools, microcatheter navigation systems, and staff training enhance procedural safety and workflow optimization. In addition, government healthcare programs and public-private partnerships are funding infrastructure upgrades, increasing patient access to neurointervention services and driving the overall growth of the liquid embolic agent market.

Segmental Insights

Product Type Analysis

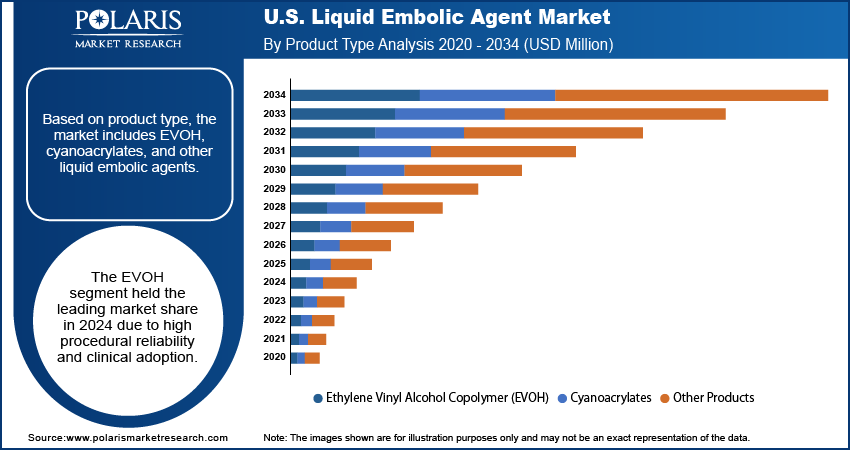

Based on product type, the segmentation includes ethylene vinyl alcohol copolymer (EVOH), cyanoacrylates, and other products. The ethylene vinyl alcohol copolymer (EVOH) segment dominated the market in 2024, driven by its high efficacy in treating arteriovenous malformations and aneurysms. EVOH agents provide controlled vessel occlusion and improved procedural precision. Moreover, their biocompatible polymer formulations reduce the risk of adverse events. In addition, hospitals and outpatient neurointervention centers prefer EVOH due to ease of delivery, enhanced imaging visibility, and consistent clinical outcomes across complex cerebrovascular interventions.

The cyanoacrylates segment is projected to grow at the fastest CAGR during the forecast period, due to its rapid polymerization and effective occlusion of AVMs and aneurysms. Moreover, cyanoacrylate formulations are increasingly used in peripheral vascular procedures, expanding their clinical applications. In addition, advancements in catheter-based delivery and enhanced radiopacity improve procedural safety and physician confidence, supporting market growth. Also, rising awareness of early intervention is boosting adoption rates.

Application Analysis

Based on application, the segmentation includes arteriovenous malformations (AVM), hypervascular tumors, peripheral vasculature hemorrhage, and other applications. The arteriovenous malformations (AVM) segment dominated the liquid embolic agent market in 2024, driven by increasing prevalence of intracranial and spinal AVMs in the U.S. These procedures require precise embolic agents for safe vessel occlusion. Moreover, technological advancements in polymer formulations and delivery systems improve treatment outcomes. In addition, rising adoption of minimally invasive neurointervention techniques and hospital infrastructure expansion further support market dominance. Also, regulatory approvals increase physician confidence in AVM treatments.

The hypervascular tumors segment is projected to grow at the fastest CAGR during the forecast period, due to the increasing demand for embolization in liver, kidney, and bone tumors. Moreover, advanced liquid embolic agents allow targeted therapy and reduced intraoperative bleeding. In addition, integration of imaging guidance and catheter navigation improves procedural precision. Also, growing awareness of minimally invasive treatment benefits among clinicians and patients is accelerating adoption in oncology interventions.

End User Analysis

Based on end user, the segmentation includes hospitals, specialty clinics, ambulatory surgical centers (ASCs), and other end users. The hospitals segment dominated the market in 2024, driven by higher procedure volumes and availability of advanced neurointervention infrastructure. Moreover, hospitals offer trained specialists and integrated imaging facilities that enhance procedural accuracy. In addition, federal healthcare initiatives and investments in outpatient and inpatient facilities support adoption. Also, growing patient preference for minimally invasive interventions and expanding neurointervention programs strengthen hospitals as the primary end user for liquid embolic agents.

The ambulatory surgical centers (ASCs) segment is projected to grow at the fastest CAGR during the forecast period, due to increasing outpatient procedures for AVMs, aneurysms, and peripheral vascular conditions. Moreover, ASCs provide cost-efficient and convenient treatment options, attracting patient preference. In addition, adoption of portable imaging systems and minimally invasive techniques enhances procedural safety. Also, growing investments in specialized neurointervention outpatient centers are boosting market penetration and driving segment growth.

Key Players & Competitive Analysis Report

The U.S. liquid embolic agent industry is moderately fragmented, driven by rising demand for AVM, aneurysm, and peripheral vascular embolization procedures. Leading manufacturers are investing in advanced polymer formulations, enhanced radiopacity, and efficient microcatheter delivery systems to meet hospital and outpatient center requirements. Competitive positioning is influenced by innovations in minimally invasive embolization techniques and improved procedural safety. Companies are enhancing operational efficiency through digital planning tools, training programs, and streamlined device workflows. Strategic partnerships with hospitals and neurointervention specialists are expanding market access, while regulatory compliance and product safety innovations support clinical adoption.

Key companies in the U.S. liquid embolic agent industry include Medtronic plc, Johnson & Johnson, Stryker Corporation, Terumo Corporation, Sirtex Medical Inc., Boston Scientific Corporation, Instylla, Inc., Penumbra Inc., Merit Medical Systems Inc., Guerbet Group S.A, Arsenal Medical Inc., and Meril Life Sciences Pvt. Ltd.

Key Players

- Arsenal Medical Inc.

- Boston Scientific Corporation

- Guerbet Group S.A

- Instylla, Inc.

- Johnson & Johnson

- Meril Life Sciences Pvt. Ltd.

- Merit Medical Systems Inc.

- Medtronic plc

- Penumbra Inc.

- Sirtex Medical Inc.

- Stryker Corporation

- Terumo Corporation

Industry Developments

August 2025: Instylla received FDA premarket approval for its Embrace Hydrogel Embolic System, the first liquid embolic in the U.S. approved to treat hypervascular tumors in peripheral arteries up to 5 mm.

July 2025: Medtronic launched the PELE pivotal study to assess the Onyx Liquid Embolic System in peripheral vascular applications. The study aims to evaluate the system’s safety and effectiveness in treating peripheral blood vessels.

U.S. Liquid Embolic Agent Market Segmentation

By Product Type Outlook (Revenue, USD Million, 2020–2034)

- Ethylene Vinyl Alcohol Copolymer (EVOH)

- Cyanoacrylates

- N-BCA (n-Butyl Cyanoacrylate)

- N-HCA (n-Hexyl Cyanoacrylate)

- Other Products

By Application Outlook (Revenue, USD Million, 2020–2034)

- Arteriovenous Malformations (AVM)

- Hypervascular Tumors

- Peripheral Vasculature Hemorrhage

- Other Applications

By End User Outlook (Revenue, USD Million, 2020–2034)

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers (ASCs)

- Other End Users

U.S. Liquid Embolic Agent Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 66.28 million |

|

Market Size in 2025 |

USD 72.16 million |

|

Revenue Forecast by 2034 |

USD 156.91 million |

|

CAGR |

9.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The U.S. market size was valued at USD 66.28 million in 2024 and is projected to grow to USD 156.91 million by 2034.

The U.S. market is projected to register a CAGR of 9.0% during the forecast period.

A few of the key players in the market are Medtronic plc, Johnson & Johnson, Stryker Corporation, Terumo Corporation, Sirtex Medical Inc., Boston Scientific Corporation, Instylla, Inc., Penumbra Inc., Merit Medical Systems Inc., Guerbet Group S.A, Arsenal Medical Inc., and Meril Life Sciences Pvt. Ltd.

The ethylene vinyl alcohol (EVOH) segment dominated the market in 2024, driven by proven clinical efficacy, physician preference, and favorable procedural outcomes.

The ambulatory surgical centers are projected to grow at the fastest CAGR, fueled by minimally invasive procedures, shorter patient recovery times, and integration of advanced embolic delivery technologies.