U.S. Marble Market Size, Share, Trends, & Industry Analysis Report

By Color (White, Black, Yellow, Red), By Product, By Application, and By Country – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 130

- Format: PDF

- Report ID: PM5894

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

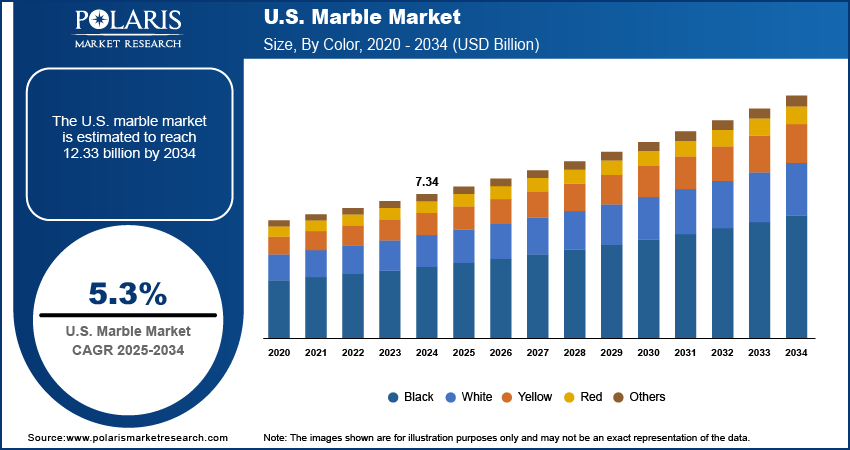

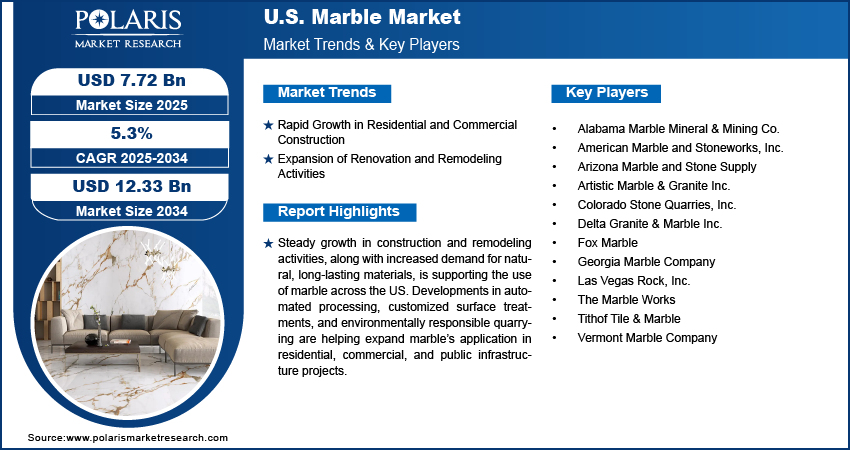

The U.S. marble market size was valued at USD 7.34 billion in 2024, growing at a CAGR of 5.3% from 2025–2034. Increasing residential and commercial construction along with renovation and remodeling activities fuels the market.

Marble is a smooth, durable metamorphic rock made mostly of calcite or dolomite, commonly used across the U.S. in flooring, countertops, wall cladding, and architectural details. Its natural patterns, clean finish, and strength make it a preferred material in both residential and commercial spaces. Manufacturers are using automated machinery such as waterjet cutting machine and digital shaping tools to improve production efficiency and reduce material waste. There is growing interest in customized marble products, which led to wider use of precision-based equipment and digital fabrication systems.

Many marble processing units are now installing water recycling systems, dust control equipment, and energy-saving machines to reduce environmental impact. Companies are also following updated safety and environmental regulations by modernizing their quarrying and cutting methods. Surface treatments, slip-resistant textures, and protective coatings are helping expand the use of marble in high-use areas such as public buildings and hotels. These changes are allowing U.S. marble producers to meet modern design standards while managing production costs and improving overall quality.

To Understand More About this Research: Request a Free Sample Report

Rising urbanization across major U.S. cities and the growing preference for long-lasting, low-maintenance building materials are contributing to the use of marble in architectural and interior design applications. As urban areas expand and infrastructure systems modernize, the need for premium materials that combine durability with visual appeal continues to grow. Marble is increasingly selected for public and private developments due to its ability to deliver a clean, refined appearance while offering long service life. In high-end commercial settings such as hotels, museums, and government buildings, marble is used to enhance aesthetics without compromising on strength or maintenance efficiency.

Investments in smart cities and large-scale public infrastructure projects are creating new opportunities for marble integration in the U.S. Municipal planners and architects are using marble in public squares, transit terminals, and civic buildings where material integrity and timeless design are key considerations. Higher disposable income levels among U.S. consumers are also contributing to the growing demand for premium surface materials in urban developments. As per the U.S. Energy Information Administration (EIA), U.S. per-capita disposable income is projected to rise from USD 49,193 in 2025 to USD 51,549 by 2030. This reflects a growth of approximately 4.8% over the five-year period. On the production side, advancements in cutting precision and automation are improving fabrication speed and material utilization. These trends combined with regulations that support sustainable construction are promoting marble as a reliable choice for large-scale, design-driven infrastructure and urban development projects.

Industry Dynamics

Rapid Growth in Residential and Commercial Construction

The rise in residential and commercial construction across the US is contributing to the steady demand for marble as a preferred surface and structural material. New housing developments, office buildings, and mixed-use spaces are incorporating marble in flooring, wall cladding, countertops, and staircases due to its visual appeal and durability. According to FRED, U.S. public construction spending grew from about USD 360.88 billion in March 2021 to USD 511.12 billion in March 2025, marking a 41.6% increase over four years. Moreover, architects and developers are opting for marble to meet design preferences that focus on natural materials, long-lasting finishes, and low maintenance requirements. As construction activities expand in both urban and suburban areas, marble continues to find broader application across interiors and exteriors that require both function and style.

The shift toward premium building materials in commercial projects, such as hotels, hospitals, educational institutions, and cultural centers, is further supporting the use of marble. Its ability to enhance design aesthetics while offering resilience against wear and moisture makes it suitable for high-traffic areas. The demand for consistency in color, texture, and finish is driving investment in advanced fabrication tools that improve product quality and customization. These developments are helping marble maintain a steady presence in new construction projects, with growing preference among builders and designers aiming for modern yet natural design outcomes.

Expansion of Renovation and Remodeling Activities

The remodeling segment in the US experienced consistent growth, with homeowners and commercial property owners focusing on upgrading spaces for improved utility and appearance. Marble is widely used in kitchen countertops, bathroom vanities, flooring, and fireplace surrounds during renovation projects due to its ability to enhance the visual appeal and value of a property. Demand is further driven by rising consumer interest in timeless materials that blend well with both contemporary and traditional interiors. This shift toward personalized and high-end finishes is boosting the use of marble across a wider range of remodeling applications.

Commercial renovations in hospitality, retail, and office spaces are also contributing to the increasing use of marble. For instance, in April 2025, Marble Systems introduced 10 new tile and stone lines at Coverings 2025, featuring modern marble mosaics, reimagined terra cotta, and textured natural stone collections in Orlando, Florida. Additionally, businesses are investing in interior upgrades to improve customer experience to meet evolving design standards. Marble’s ability to offer clean finishes, smooth textures, and a wide range of patterns makes it suitable for creating distinct design features in modern refurbishments. The availability of advanced tools that support custom sizing, edge profiling, and surface treatments is making it easier for contractors to integrate marble into renovation projects while maintaining consistency and cost efficiency.

Segmental Insights

Color Analysis

The segmentation, based on color includes, white, black, yellow, red, and other colors. The white segment is projected to reach substantial revenue share by 2034. This growth is due to its clean appearance, timeless appeal, and versatility across architectural and interior design settings. In July 2022, M S International, Inc. (MSI) expanded its Q Premium Quartz line by adding four new marble-look quartz colors. The new designs feature stylish white tones with soft grey or bold gold veining, offering a range of modern, elegant options. It is widely used in residential and commercial applications including flooring, countertops, staircases, and wall cladding, where a bright, spacious, and elegant aesthetic is desired. Designers and homeowners prefer white marble to create modern yet classic spaces that remain visually balanced. Its compatibility with various design themes and lighting conditions further enhances its appeal. The availability of various white marble types such as Carrara, Calacatta, and Statuario ensures demand remains consistent across both new construction and remodeling activities.

The black segment is projected to grow at a robust pace in the coming years, driven by increasing demand in luxury interiors and high-end commercial spaces. Its rich tone and striking appearance make it a favored choice for accent walls, reception counters, bathroom vanities, and upscale flooring designs. As design preferences shift toward bold contrasts and minimalist elegance, black marble is incorporated into modern spaces to achieve a premium, sophisticated look. The stone's ability to serve as both a focal point and a complementary background makes it suitable for a variety of applications. Enhanced surface treatments are also improving durability, expanding usage in wet and high-traffic areas.

Product Analysis

The segmentation, based on product includes, tiles or slabs, blocks, and other products. The tiles or slabs segment accounted for significant market share in 2024, driven by their broad application in residential and commercial construction. These products are extensively used in flooring, countertops, wall panels, and staircases due to their standardized sizing, ease of installation, and adaptability to various design themes. Slabs offer seamless surface coverage, while tiles provide design flexibility for different room layouts. Increased adoption in home improvement projects and institutional buildings is sustaining demand. Advancements in cutting and polishing technologies are also helping fabricators produce tiles and slabs with higher precision, smoother finishes, and improved surface protection.

The blocks segment is projected to grow at a significant pace during the assessment phase, due to its custom fabrication and large-scale commercial projects where unique dimensions and custom designs are required. These raw blocks are commonly used by specialized fabricators and artists to produce custom sculptures, bespoke installations, and large-format slabs tailored to specific projects. Growth in demand from art studios, cultural institutions, and luxury developers is supporting this segment. The flexibility in shaping and surface finishing allows for a broader range of creative applications. Additionally, increased domestic extraction and the availability of imported blocks from diverse geological sources are improving supply reliability across the U.S.

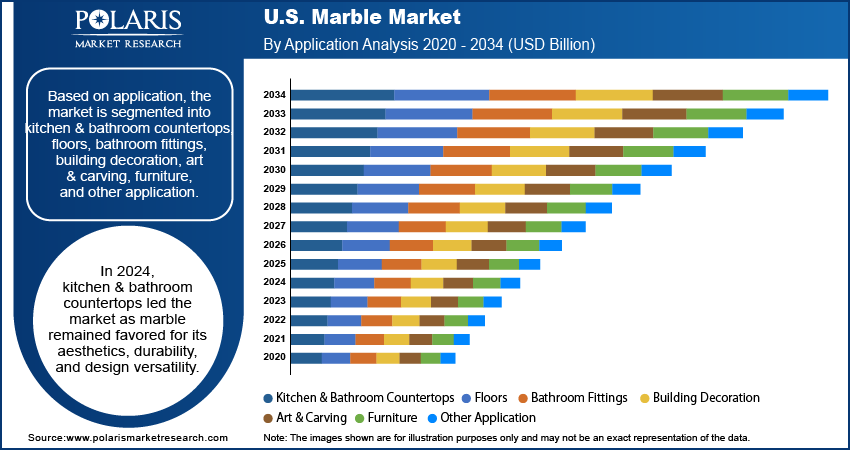

Application Analysis

The segmentation, based on application includes, kitchen & bathroom countertops, floors, bathroom fittings, building decoration, art & carving, furniture, and other application. The kitchen & bathroom countertops segment dominated the market, in 2024, as homeowners, builders, and designers continue to prefer marble for its aesthetic value, durability, and ability to elevate the appearance of both traditional and modern kitchens and bathrooms. For instance, in February 2025, Brizo introduced new marble-accented handles in its Odin Kitchen Collection, adding a touch of luxury to its kitchen and bath designs. Its natural patterns, smooth finish, and resistance to moderate heat make it ideal for these areas. High consumer interest in remodeling and customization further supports the use of marble countertops. Fabricators are offering pre-cut and sealed options to improve convenience and reduce maintenance concerns, while expanded design choices are enhancing consumer confidence in long-term usage.

The building decoration segment is estimated to hold a substantial market share in 2034, due to increasing use of marble in public, commercial, and luxury residential buildings for interior and exterior design. Marble is used for wall panels, pillars, columns, façade accents, and staircases in projects seeking to achieve a refined and enduring visual appeal. Demand is rising in government buildings, hotels, and cultural institutions where high-quality natural materials are favored. Improved processing methods and lightweight backing systems are enabling more efficient installation, while enhanced sealants are making marble more resistant to wear and environmental exposure in decorative structural applications.

Key Players & Competitive Analysis Report

The U.S. marble industry is moderately consolidated, with competition shaped by evolving architectural preferences, demand for premium natural materials, and the steady pace of construction and renovation projects. Leading companies are focusing on improving extraction efficiency, expanding domestic and imported marble inventories, and offering value-added fabrication services. Investment in advanced machinery, digital design tools, and automated cutting solutions is helping manufacturers deliver consistent quality, faster lead times, and customized surface finishes tailored to individual project requirements. Product differentiation through expanded color options, finishes, and sustainable processing techniques is enabling firms to cater to both modern and traditional design segments.

Key companies in the U.S. marble industry include Alabama Marble Mineral & Mining Co., American Marble and Stoneworks, Inc., Arizona Marble and Stone Supply, Artistic Marble & Granite Inc., Colorado Stone Quarries, Inc., Delta Granite & Marble Inc., Fox Marble, Georgia Marble Company, Las Vegas Rock, Inc., The Marble Works, Tithof Tile & Marble, Vermont Marble Company.

Key Players

- Alabama Marble Mineral & Mining Co.

- American Marble and Stoneworks, Inc.

- Arizona Marble and Stone Supply

- Artistic Marble & Granite Inc.

- Colorado Stone Quarries, Inc.

- Delta Granite & Marble Inc.

- Fox Marble

- Georgia Marble Company

- Las Vegas Rock, Inc.

- The Marble Works

- Tithof Tile & Marble

- Vermont Marble Company

Industry Developments

March 2025: Daltile showcased new quartz slabs with marble-inspired designs, offering a blend of luxury look and durable, low-maintenance performance.

February 2025: Nemo Tile + Stone opened a new gallery in New Jersey showcasing premium marble and stone slabs, making it easier for designers to explore and select materials.

February 2024: Xtone launched new large-format porcelain slabs in North America with marble-like designs such as Bianco Lasa and Calacatta Antico, offering a durable and stylish option for modern spaces.

U.S. Marble Market Segmentation

By Color Outlook (Revenue, USD Billion, 2020–2034)

- White

- Black

- Yellow

- Red

- Other Colors

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Tiles or Slabs

- Blocks

- Other Products

By Application Type Outlook (Revenue, USD Billion, 2020–2034)

- Kitchen & Bathroom Countertops

- Floors

- Bathroom Fittings

- Building Decoration

- Art & Carving

- Furniture

- Other Application

U.S. Marble Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 7.34 Billion |

|

Market Size in 2025 |

USD 7.72 Billion |

|

Revenue Forecast by 2034 |

USD 12.33 Billion |

|

CAGR |

5.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The U.S. market size was valued at USD 7.34 billion in 2024 and is projected to grow to USD 12.33 billion by 2034.

The U.S. market is projected to register a CAGR of 5.3% during the forecast period.

A few of the key players in the market are Alabama Marble Mineral & Mining Co., American Marble & Stone, Arizona Marble and Stone Supply, Artistic Marble & Granite Inc., Colorado Stone Quarries, Inc., Delta Granite & Marble Inc., Fox Marble Holdings, Georgia Marble Company, Las Vegas Rock, Inc., The Marble Works, Tithof Tile & Marble, Vermont Marble Company.

The kitchen & bathroom countertops segment dominated the market share in 2024.

The black segment is projected to grow at a robust pace during the forecast period.